Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using Figure 9.1 on page 166, answer the following questions from within the chapter: 1. Accrued Interest Receivable: Your hospital invests in a $60,000 bond

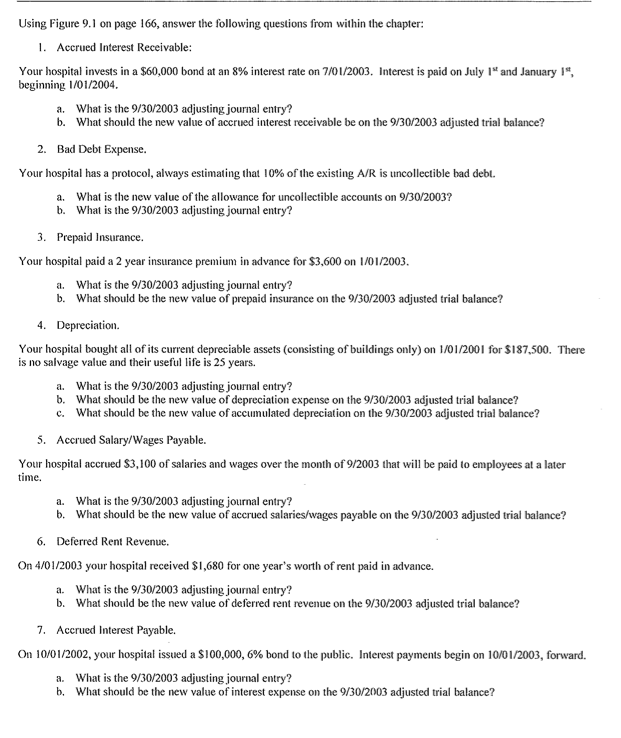

Using Figure 9.1 on page 166, answer the following questions from within the chapter: 1. Accrued Interest Receivable: Your hospital invests in a $60,000 bond at an 8% interest rate on 7/01/2003. Interest is paid on July 1st and January 1t, beginning 1/01/2004. a. What is the 9/30/2003 adjusting journal entry? b. What should the new value of accrued interest receivable be on the 9/30/2003 adjusted trial balance? 2. Bad Debt Expense. Your hospital has a protocol, always estimating that 10% of the existing A/R is uncollectible bad debt. a. What is the new value of the allowance for uncollectible accounts on 9/30/2003? b. What is the 9/30/2003 adjusting journal entry? 3. Prepaid Insurance. Your hospital paid a 2 year insurance premium in advance for $3,600 on 1/01/2003. a. What is the 9/30/2003 adjusting journal entry? b. What should be the new value of prepaid insurance on the 9/30/2003 adjusted trial balance? 4. Depreciation. Your hospital bought all of its current depreciable assets (consisting of buildings only) on 1/01/2001 for $187,500. There is no salvage value and their useful life is 25 years. a. What is the 9/30/2003 adjusting journal entry? b. What should be the new value of depreciation expense on the 9/30/2003 adjusted trial balance? c. What should be the new value of accumulated depreciation on the 9/30/2003 adjusted trial balance? 5. Accrued Salary/Wages Payable. Your hospital accrued $3,100 of salaries and wages over the month of 9/2003 that will be paid to employees at a later time. a. What is the 9/30/2003 adjusting journal entry? b. What should be the new value of accrued salaries/wages payable on the 9/30/2003 adjusted trial balance? 6. Deferred Rent Revenue. On 4/01/2003 your hospital received $1,680 for one year's worth of rent paid in advance. a. What is the 9/30/2003 adjusting journal entry? b. What should be the new value of deferred rent revenue on the 9/30/2003 adjusted trial balance? 7. Accrued Interest Payable. On 10/01/2002, your hospital issued a $100,000,6% bond to the public. Interest payments begin on 10/01/2003, forward. a. What is the 9/30/2003 adjusting journal entry? b. What should be the new value of interest expense on the 9/30/2003 adjusted trial balance

Using Figure 9.1 on page 166, answer the following questions from within the chapter: 1. Accrued Interest Receivable: Your hospital invests in a $60,000 bond at an 8% interest rate on 7/01/2003. Interest is paid on July 1st and January 1t, beginning 1/01/2004. a. What is the 9/30/2003 adjusting journal entry? b. What should the new value of accrued interest receivable be on the 9/30/2003 adjusted trial balance? 2. Bad Debt Expense. Your hospital has a protocol, always estimating that 10% of the existing A/R is uncollectible bad debt. a. What is the new value of the allowance for uncollectible accounts on 9/30/2003? b. What is the 9/30/2003 adjusting journal entry? 3. Prepaid Insurance. Your hospital paid a 2 year insurance premium in advance for $3,600 on 1/01/2003. a. What is the 9/30/2003 adjusting journal entry? b. What should be the new value of prepaid insurance on the 9/30/2003 adjusted trial balance? 4. Depreciation. Your hospital bought all of its current depreciable assets (consisting of buildings only) on 1/01/2001 for $187,500. There is no salvage value and their useful life is 25 years. a. What is the 9/30/2003 adjusting journal entry? b. What should be the new value of depreciation expense on the 9/30/2003 adjusted trial balance? c. What should be the new value of accumulated depreciation on the 9/30/2003 adjusted trial balance? 5. Accrued Salary/Wages Payable. Your hospital accrued $3,100 of salaries and wages over the month of 9/2003 that will be paid to employees at a later time. a. What is the 9/30/2003 adjusting journal entry? b. What should be the new value of accrued salaries/wages payable on the 9/30/2003 adjusted trial balance? 6. Deferred Rent Revenue. On 4/01/2003 your hospital received $1,680 for one year's worth of rent paid in advance. a. What is the 9/30/2003 adjusting journal entry? b. What should be the new value of deferred rent revenue on the 9/30/2003 adjusted trial balance? 7. Accrued Interest Payable. On 10/01/2002, your hospital issued a $100,000,6% bond to the public. Interest payments begin on 10/01/2003, forward. a. What is the 9/30/2003 adjusting journal entry? b. What should be the new value of interest expense on the 9/30/2003 adjusted trial balance Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started