Answered step by step

Verified Expert Solution

Question

1 Approved Answer

using financial ratios to improve working capital accounts. Bobs accountant found ways that ABC company could generate more cash by improving two areas. Average content/564779/viewContent/2022696/View

using financial ratios to improve working capital accounts.

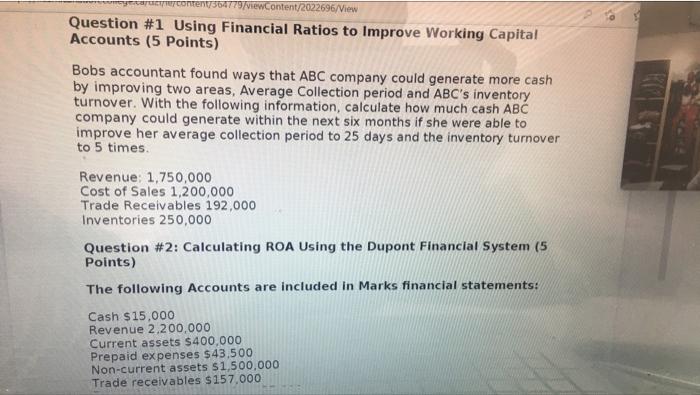

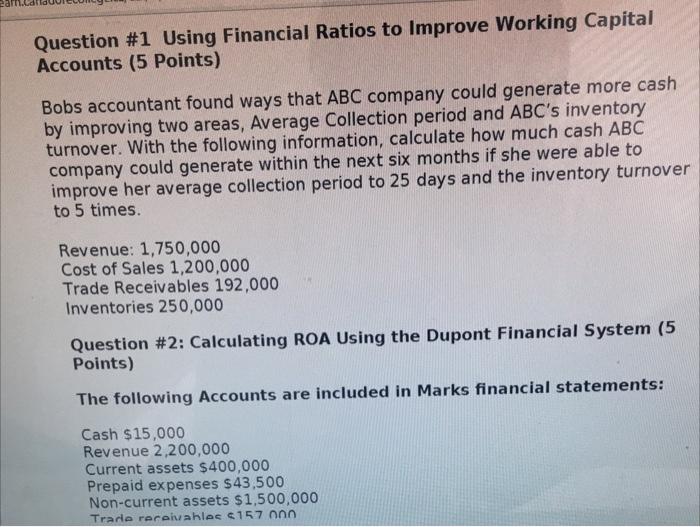

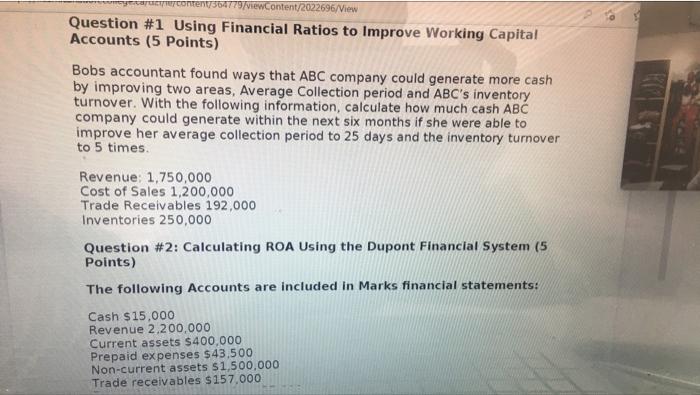

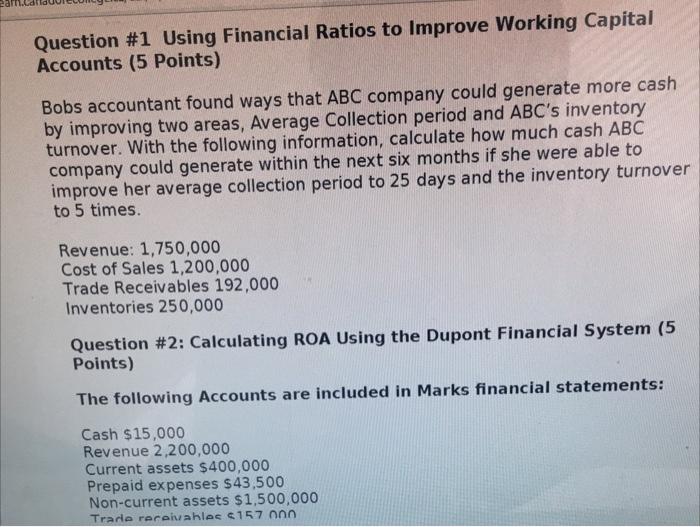

content/564779/viewContent/2022696/View Question #1 Using Financial Ratios to Improve Working Capital Accounts (5 Points) Bobs accountant found ways that ABC company could generate more cash by improving two areas, Average Collection period and ABC's inventory turnover. With the following information, calculate how much cash ABC company could generate within the next six months if she were able to improve her average collection period to 25 days and the inventory turnover to 5 times. Revenue: 1.750,000 Cost of Sales 1,200,000 Trade Receivables 192,000 Inventories 250,000 Question #2: Calculating ROA Using the Dupont Financial System (5 Points) The following Accounts are included in Marks financial statements: Cash $15,000 Revenue 2.200.000 Current assets $400,000 Prepaid expenses $43.500 Non-current assets $1,500,000 Trade receivables $157,000 Question #1 Using Financial Ratios to Improve Working Capital Accounts (5 Points) Bobs accountant found ways that ABC company could generate more cash by improving two areas, Average Collection period and ABC's inventory turnover. With the following information, calculate how much cash ABC company could generate within the next six months if she were able to improve her average collection period to 25 days and the inventory turnover to 5 times. Revenue: 1,750,000 Cost of Sales 1,200,000 Trade Receivables 192,000 Inventories 250,000 Question #2: Calculating ROA Using the Dupont Financial System (5 Points) The following Accounts are included in Marks financial statements: Cash $15,000 Revenue 2,200,000 Current assets $400,000 Prepaid expenses $43,500 Non-current assets $1,500,000 Trade receivables 157 On Bobs accountant found ways that ABC company could generate more cash by improving two areas. Average

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started