Using five-year financial summary and the prior weeks Chipotle readings for ideas please discuss the fixed and variable costs related to opening a new store. Please list one item and discuss the behavior of the cost (is it variable, fixed, mixed what amount variable what amount fixed, or a stepped cost). A SAMPLE POSTING the opening of the new store will enable additional sales these additional sales will require additional food, beverage and packaging expenses I believe that the expense will be variable and vary as a percentage of sales meaning as sales increase these will increase proportionately.

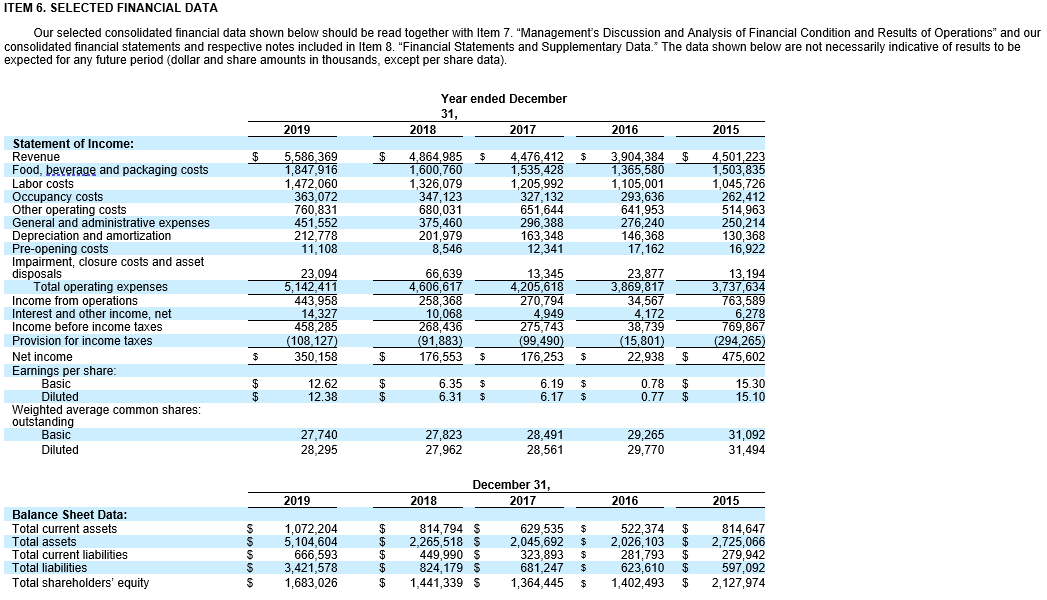

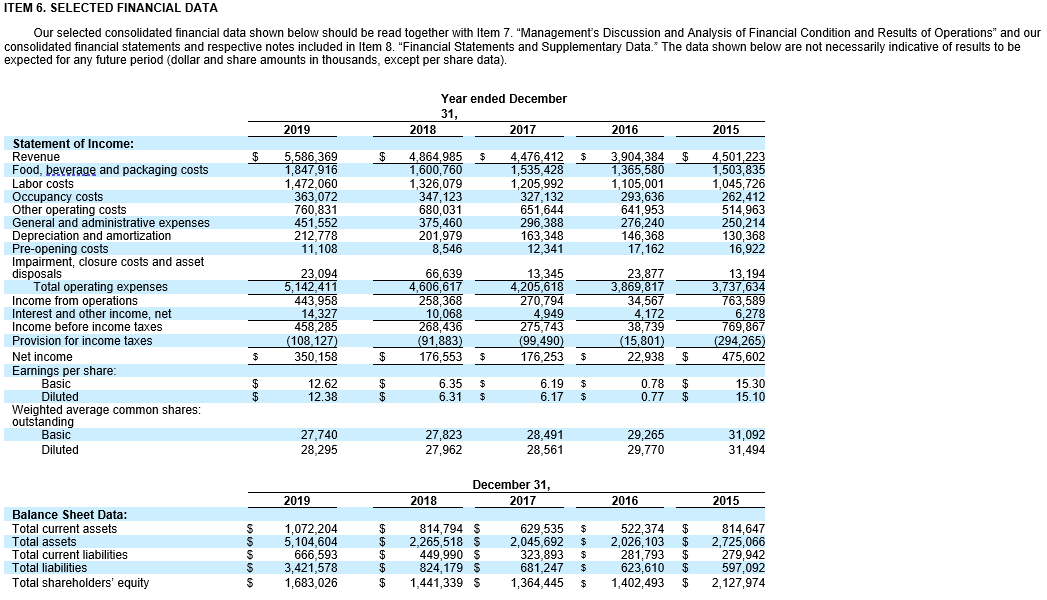

ITEM 6. SELECTED FINANCIAL DATA Our selected consolidated financial data shown below should be read together with Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and respective notes included in Item 8. "Financial Statements and Supplementary Data. The data shown below are not necessarily indicative of results to be expected for any future period (dollar and share amounts in thousands, except per share data). Year ended December 31, 2018 2017 2019 2016 2015 $ $ 5,586,369 1,847,916 1,472,060 363,072 760,831 451,552 212,778 11,108 4,476,412 1,535,428 1,205,992 327 132 651,644 296,388 163,348 12.341 Statement of Income: Revenue Food, beverage and packaging costs Labor costs Occupancy costs Other operating costs General and administrative expenses Depreciation and amortization Pre-opening costs Impairment, closure costs and asset disposals Total operating expenses Income from operations Interest and other income, net Income before income taxes Provision for income taxes Net income Earnings per share Basic Diluted Weighted average common shares: outstanding Basic Diluted 4,864,985 1,600,760 1,326,079 347 123 680.031 375,460 201,979 8,546 66,639 4,606,617 258,368 10,068 268,436 (91,883) 176,553 3,904,384 $ 1,365,580 1,105,001 293,636 641,953 276,240 146,368 17,162 23,877 3,869,817 34,567 4,501,223 1,503,835 1,045,726 262,412 514,963 250,214 130,368 16,922 23,094 5,142,411 443,958 14,327 458,285 (109127) 350,158 13,345 4,205,618 270,794 4,949 275, 743 (99.490) 176,253 4,172 13,194 3,737,634 763,589 6,278 769,867 (294,265) 475,602 38,739 (15,801) 22,938 $ $ $ $ $ $ $ 12.62 12.38 $ $ 6.35 6.31 $ $ 6.19 6.17 $ $ 0.78 0.77 A CA 15.30 15.10 27,740 28,295 27,823 27,962 28,491 28,561 29,265 29,770 31,092 31,494 December 31, 2017 2019 2018 2016 2015 Balance Sheet Data: Total current assets Total assets Total current liabilities Total liabilities Total shareholders' equity S S S S 1,072,204 5,104,604 666,593 3,421,578 1,683,026 $ $ $ $ $ 814,794 $ 2,265,518 S 449,990 $ 824,179 $ 1,441,339 $ 629,535 2,045,692 323,893 681,247 1,364,445 $ $ $ $ 522,374 2,026,103 281,793 623,610 1,402,493 $ $ $ $ $ 814,647 2,725,066 279.942 597,092 2,127,974 ITEM 6. SELECTED FINANCIAL DATA Our selected consolidated financial data shown below should be read together with Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and respective notes included in Item 8. "Financial Statements and Supplementary Data. The data shown below are not necessarily indicative of results to be expected for any future period (dollar and share amounts in thousands, except per share data). Year ended December 31, 2018 2017 2019 2016 2015 $ $ 5,586,369 1,847,916 1,472,060 363,072 760,831 451,552 212,778 11,108 4,476,412 1,535,428 1,205,992 327 132 651,644 296,388 163,348 12.341 Statement of Income: Revenue Food, beverage and packaging costs Labor costs Occupancy costs Other operating costs General and administrative expenses Depreciation and amortization Pre-opening costs Impairment, closure costs and asset disposals Total operating expenses Income from operations Interest and other income, net Income before income taxes Provision for income taxes Net income Earnings per share Basic Diluted Weighted average common shares: outstanding Basic Diluted 4,864,985 1,600,760 1,326,079 347 123 680.031 375,460 201,979 8,546 66,639 4,606,617 258,368 10,068 268,436 (91,883) 176,553 3,904,384 $ 1,365,580 1,105,001 293,636 641,953 276,240 146,368 17,162 23,877 3,869,817 34,567 4,501,223 1,503,835 1,045,726 262,412 514,963 250,214 130,368 16,922 23,094 5,142,411 443,958 14,327 458,285 (109127) 350,158 13,345 4,205,618 270,794 4,949 275, 743 (99.490) 176,253 4,172 13,194 3,737,634 763,589 6,278 769,867 (294,265) 475,602 38,739 (15,801) 22,938 $ $ $ $ $ $ $ 12.62 12.38 $ $ 6.35 6.31 $ $ 6.19 6.17 $ $ 0.78 0.77 A CA 15.30 15.10 27,740 28,295 27,823 27,962 28,491 28,561 29,265 29,770 31,092 31,494 December 31, 2017 2019 2018 2016 2015 Balance Sheet Data: Total current assets Total assets Total current liabilities Total liabilities Total shareholders' equity S S S S 1,072,204 5,104,604 666,593 3,421,578 1,683,026 $ $ $ $ $ 814,794 $ 2,265,518 S 449,990 $ 824,179 $ 1,441,339 $ 629,535 2,045,692 323,893 681,247 1,364,445 $ $ $ $ 522,374 2,026,103 281,793 623,610 1,402,493 $ $ $ $ $ 814,647 2,725,066 279.942 597,092 2,127,974