Question

Using Google Sheets, construct a retirement model that calculates the total dollar amount you will have after 30 years when consistently contributing to a retirement

Using Google Sheets, construct a retirement model that calculates the total dollar amount you will have after 30 years when consistently contributing to a retirement plan. You may input any data you want into your model, but make sure it is realistic.

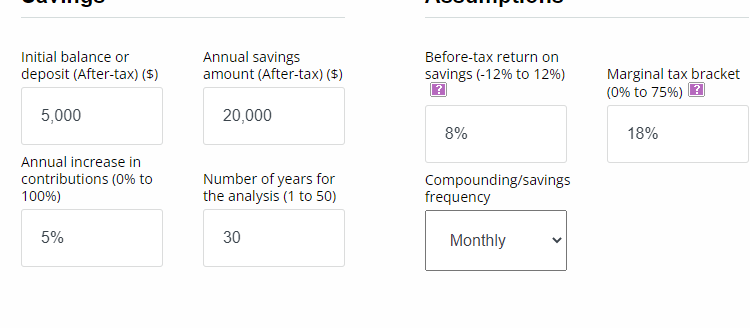

I have no idea how to use google sheets as I am an excel user, if anyone could please provide some type of demonstration in how to put calculations into sheets such as $5,000 for 30 years at a rate of 8% with 5% contributed to yearly , compounded monthly with a 18% tax bracket. I used calcxml website to find the full numbers but I need to display that in a google sheet retirement chart .PLEASE N THANKS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started