Using information from the statement of cash flows, answer the following questions for Yahoo:

Which method, direct or indirect, was used to prepare the companys Statement of Cash Flows? How can you tell? How much cash and cash equivalents did the company have on hand at the end of its most recent fiscal year? What is the trend in the companys net cash from operations over the past three years? What were the significant cash flows from or used by financing activities during its most recent fiscal year? What were the significant cash flows from or used by investing activities during its most recent fiscal year?

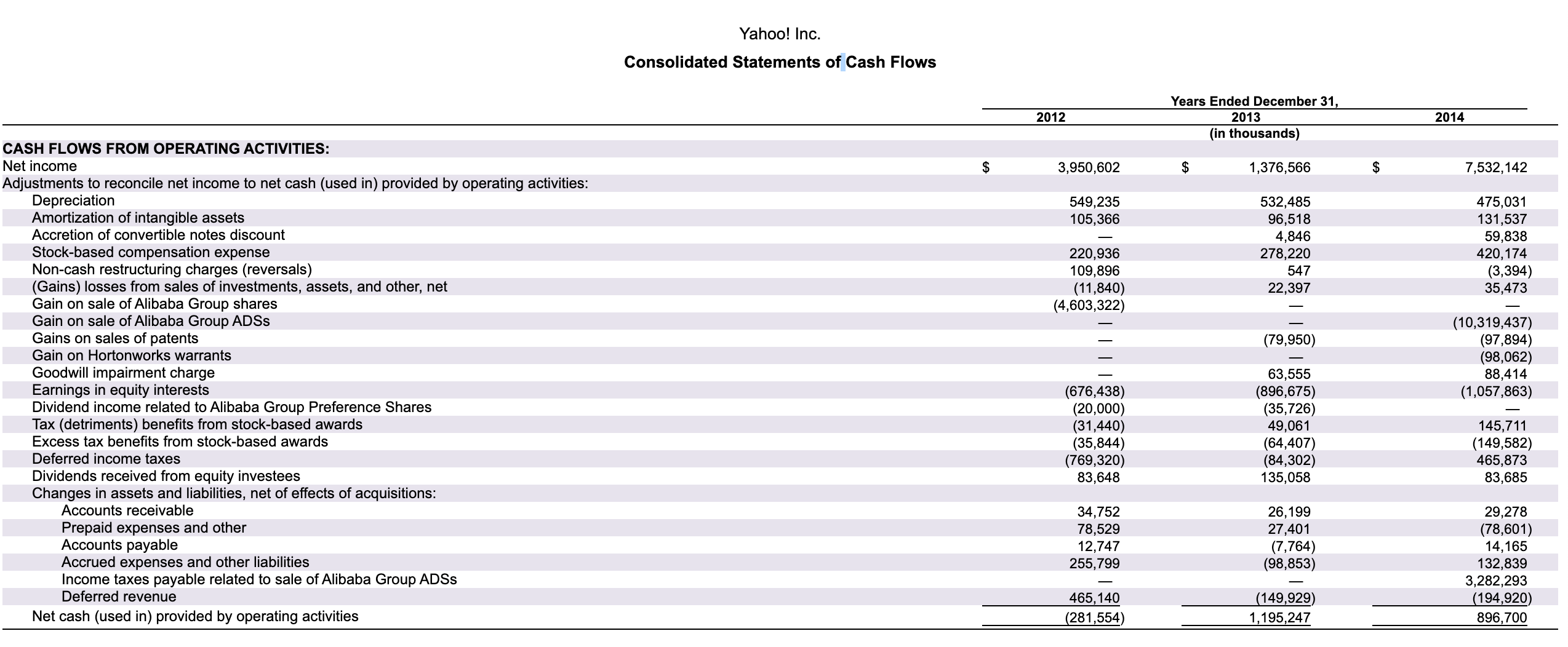

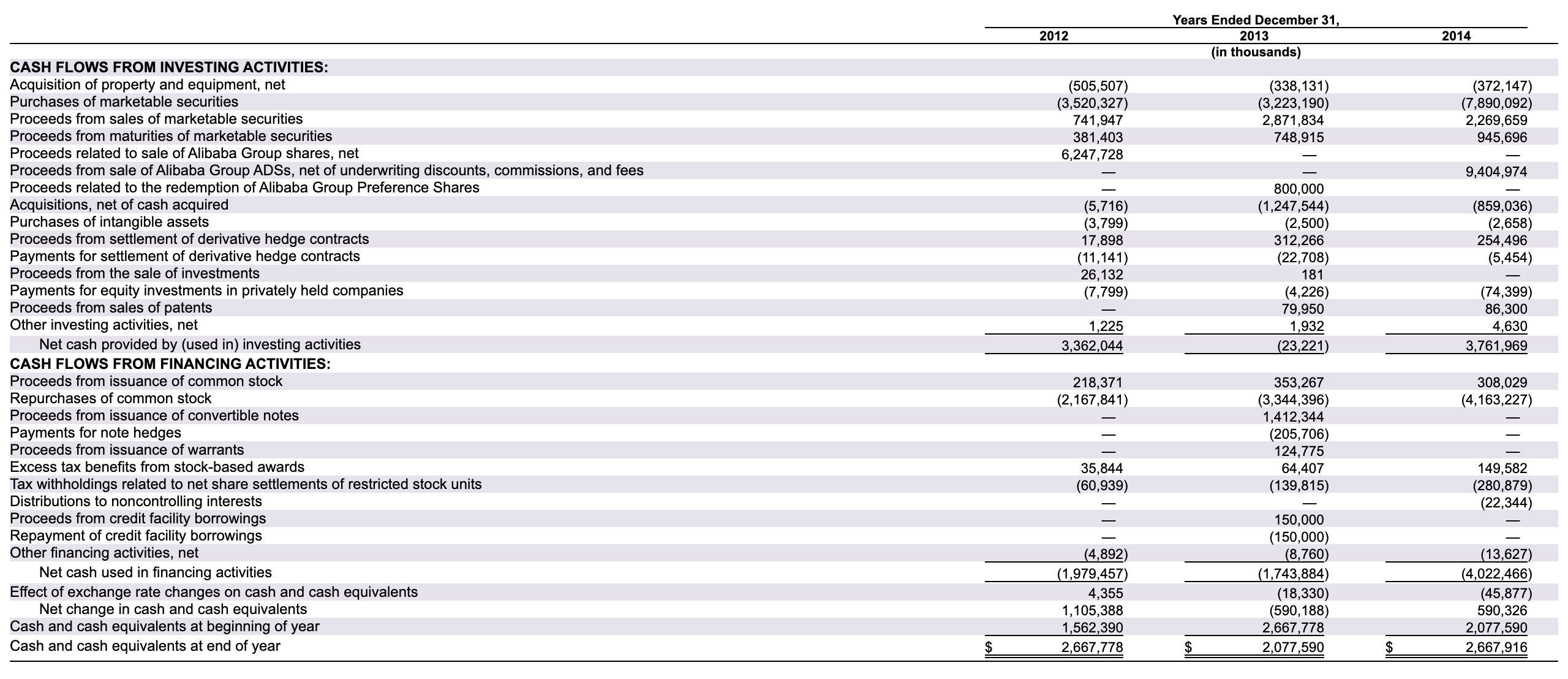

Yahoo! Inc. Consolidated Statements of Cash Flows 2012 Years Ended December 31, 2013 (in thousands) 2014 $ 3,950,602 $ 1,376,566 $ 7,532,142 549,235 105,366 532,485 96,518 4,846 278,220 547 22,397 475,031 131,537 59,838 420,174 (3,394) 35,473 220,936 109,896 (11,840) (4,603,322) (79,950) CASH FLOWS FROM OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to net cash (used in) provided by operating activities: Depreciation Amortization of intangible assets Accretion of convertible notes discount Stock-based compensation expense Non-cash restructuring charges (reversals) (Gains) losses from sales of investments, assets, and other, net Gain on sale of Alibaba Group shares Gain on sale of Alibaba Group ADSs Gains on sales of patents Gain on Hortonworks warrants Goodwill impairment charge Earnings in equity interests Dividend income related to Alibaba Group Preference Shares Tax (detriments) benefits from stock-based awards Excess tax benefits from stock-based awards Deferred income taxes Dividends received from equity investees Changes in assets and liabilities, net of effects of acquisitions: Accounts receivable Prepaid expenses and other Accounts payable Accrued expenses and other liabilities Income taxes payable related to sale of Alibaba Group ADSs Deferred revenue Net cash (used in) provided by operating activities (10,319,437) (97,894) (98,062) 88,414 (1,057,863) (676,438) (20,000) (31,440) (35,844) (769,320) 83,648 63,555 (896,675) (35,726) 49,061 (64,407) (84,302) 135,058 145,711 (149,582) 465,873 83,685 34,752 78,529 12,747 255,799 26,199 27,401 (7,764) (98,853) 29,278 (78,601) 14,165 132,839 3,282,293 (194,920) 896,700 465, 140 (281,554) (149,929) 1,195,247 2012 Years Ended December 31, 2013 (in thousands) 2014 (505,507) (3,520,327) 741,947 381,403 6,247,728 (338,131) (3,223,190) 2,871,834 748,915 (372,147) (7,890,092) 2,269,659 945,696 9,404,974 (5,716) (3,799) 17,898 (11,141) 26,132 (7,799) (859,036) (2,658) 254,496 (5,454) 800,000 (1,247,544) (2,500) 312,266 (22,708) 181 (4,226) 79,950 1,932 (23,221) 1,225 3,362,044 (74,399) 86,300 4,630 3,761,969 CASH FLOWS FROM INVESTING ACTIVITIES: Acquisition of property and equipment, net Purchases of marketable securities Proceeds from sales of marketable securities Proceeds from maturities of marketable securities Proceeds related to sale of Alibaba Group shares, net Proceeds from sale of Alibaba Group ADSs, net of underwriting discounts, commissions, and fees Proceeds related to the redemption of Alibaba Group Preference Shares Acquisitions, net of cash acquired Purchases of intangible assets Proceeds from settlement of derivative hedge contracts Payments for settlement of derivative hedge contracts Proceeds from the sale of investments Payments for equity investments in privately held companies Proceeds from sales of patents Other investing activities, net Net cash provided by (used in) investing activities CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from issuance of common stock Repurchases of common stock Proceeds from issuance of convertible notes Payments for note hedges Proceeds from issuance of warrants Excess tax benefits from stock-based awards Tax withholdings related to net share settlements of restricted stock units Distributions to noncontrolling interests Proceeds from credit facility borrowings Repayment of credit facility borrowings Other financing activities, net Net cash used in financing activities Effect of exchange rate changes on cash and cash equivalents Net change in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year 218,371 (2,167,841) 308,029 (4,163,227) 353,267 (3,344,396) 1,412,344 (205,706) 124,775 64,407 (139,815) - 35,844 (60,939) 149,582 (280,879) (22,344) (4,892) (1,979,457) 4,355 1,105,388 1,562,390 2,667,778 150,000 (150,000) (8,760) (1,743,884) (18,330) (590,188) 2,667,778 2,077,590 (13,627) (4,022,466) (45,877) 590,326 2,077,590 2,667,916 $ $ $ Yahoo! Inc. Consolidated Statements of Cash Flows 2012 Years Ended December 31, 2013 (in thousands) 2014 $ 3,950,602 $ 1,376,566 $ 7,532,142 549,235 105,366 532,485 96,518 4,846 278,220 547 22,397 475,031 131,537 59,838 420,174 (3,394) 35,473 220,936 109,896 (11,840) (4,603,322) (79,950) CASH FLOWS FROM OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to net cash (used in) provided by operating activities: Depreciation Amortization of intangible assets Accretion of convertible notes discount Stock-based compensation expense Non-cash restructuring charges (reversals) (Gains) losses from sales of investments, assets, and other, net Gain on sale of Alibaba Group shares Gain on sale of Alibaba Group ADSs Gains on sales of patents Gain on Hortonworks warrants Goodwill impairment charge Earnings in equity interests Dividend income related to Alibaba Group Preference Shares Tax (detriments) benefits from stock-based awards Excess tax benefits from stock-based awards Deferred income taxes Dividends received from equity investees Changes in assets and liabilities, net of effects of acquisitions: Accounts receivable Prepaid expenses and other Accounts payable Accrued expenses and other liabilities Income taxes payable related to sale of Alibaba Group ADSs Deferred revenue Net cash (used in) provided by operating activities (10,319,437) (97,894) (98,062) 88,414 (1,057,863) (676,438) (20,000) (31,440) (35,844) (769,320) 83,648 63,555 (896,675) (35,726) 49,061 (64,407) (84,302) 135,058 145,711 (149,582) 465,873 83,685 34,752 78,529 12,747 255,799 26,199 27,401 (7,764) (98,853) 29,278 (78,601) 14,165 132,839 3,282,293 (194,920) 896,700 465, 140 (281,554) (149,929) 1,195,247 2012 Years Ended December 31, 2013 (in thousands) 2014 (505,507) (3,520,327) 741,947 381,403 6,247,728 (338,131) (3,223,190) 2,871,834 748,915 (372,147) (7,890,092) 2,269,659 945,696 9,404,974 (5,716) (3,799) 17,898 (11,141) 26,132 (7,799) (859,036) (2,658) 254,496 (5,454) 800,000 (1,247,544) (2,500) 312,266 (22,708) 181 (4,226) 79,950 1,932 (23,221) 1,225 3,362,044 (74,399) 86,300 4,630 3,761,969 CASH FLOWS FROM INVESTING ACTIVITIES: Acquisition of property and equipment, net Purchases of marketable securities Proceeds from sales of marketable securities Proceeds from maturities of marketable securities Proceeds related to sale of Alibaba Group shares, net Proceeds from sale of Alibaba Group ADSs, net of underwriting discounts, commissions, and fees Proceeds related to the redemption of Alibaba Group Preference Shares Acquisitions, net of cash acquired Purchases of intangible assets Proceeds from settlement of derivative hedge contracts Payments for settlement of derivative hedge contracts Proceeds from the sale of investments Payments for equity investments in privately held companies Proceeds from sales of patents Other investing activities, net Net cash provided by (used in) investing activities CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from issuance of common stock Repurchases of common stock Proceeds from issuance of convertible notes Payments for note hedges Proceeds from issuance of warrants Excess tax benefits from stock-based awards Tax withholdings related to net share settlements of restricted stock units Distributions to noncontrolling interests Proceeds from credit facility borrowings Repayment of credit facility borrowings Other financing activities, net Net cash used in financing activities Effect of exchange rate changes on cash and cash equivalents Net change in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year 218,371 (2,167,841) 308,029 (4,163,227) 353,267 (3,344,396) 1,412,344 (205,706) 124,775 64,407 (139,815) - 35,844 (60,939) 149,582 (280,879) (22,344) (4,892) (1,979,457) 4,355 1,105,388 1,562,390 2,667,778 150,000 (150,000) (8,760) (1,743,884) (18,330) (590,188) 2,667,778 2,077,590 (13,627) (4,022,466) (45,877) 590,326 2,077,590 2,667,916 $ $ $