Answered step by step

Verified Expert Solution

Question

1 Approved Answer

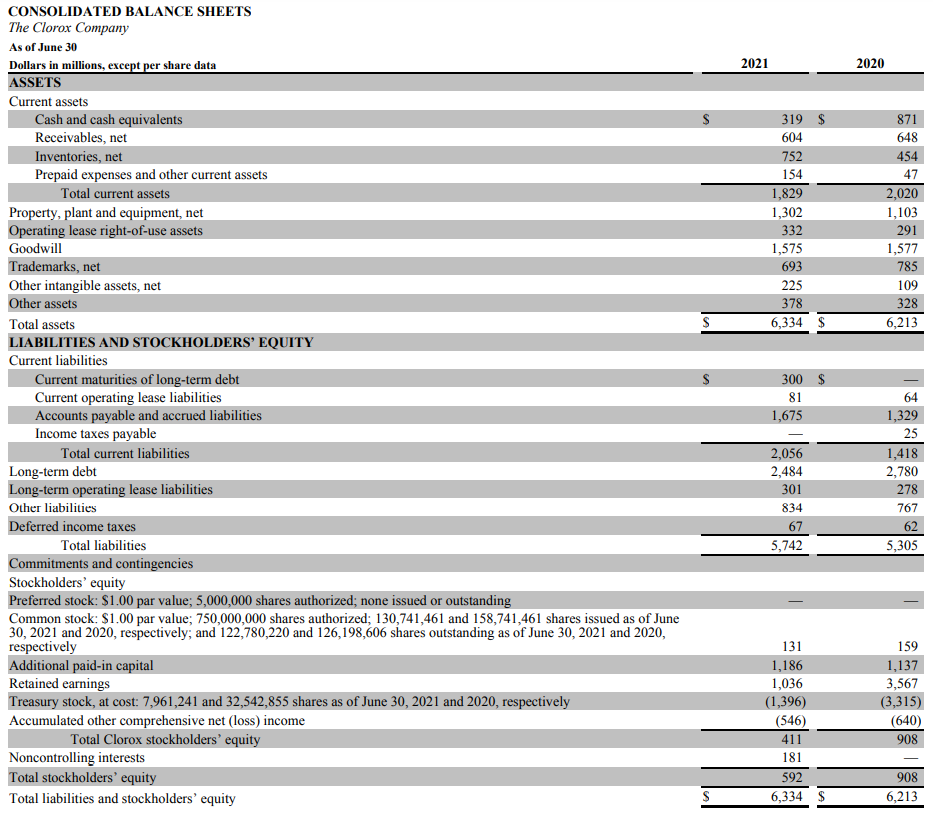

Using information in the revenue footnote for Clorox on page 7, and the balance sheet, what is the gross amount of accounts receivable that Clorox

| Using information in the revenue footnote for Clorox on page 7, and the balance sheet, what is the gross amount of accounts receivable that Clorox is owed. | |||||

| Gross A/R | - | Allowance for uncollectible Accounts | = | Net A/R | |

| ?? | |||||

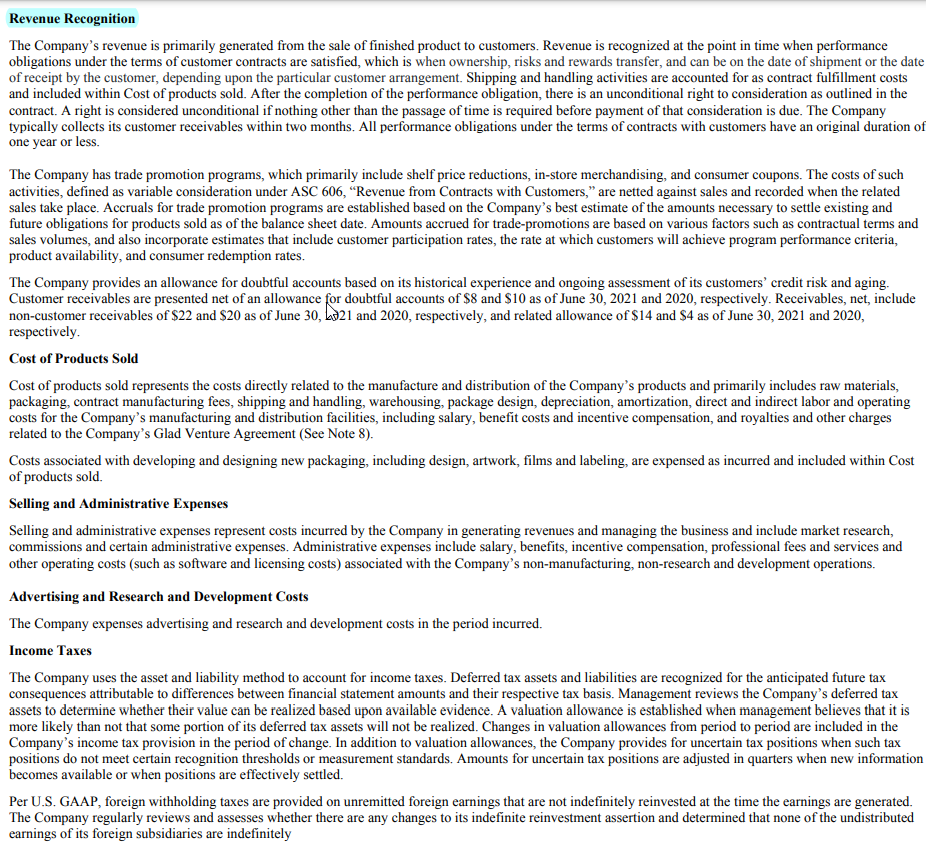

CONSOLIDATED BALANCE SHEETS The Clorox Company As of June 30 Commitments and contingencies Stockholders' equity Preferred stock: $1.00 par value; 5,000,000 shares authorized; none issued or outstanding Common stock: $1.00 par value; 750,000,000 shares authorized; 130,741,461 and 158,741,461 shares issued as of June 30,2021 and 2020, respectively; and 122,780,220 and 126,198,606 shares outstanding as of June 30,2021 and 2020 , Revenue Recognition The Company's revenue is primarily generated from the sale of finished product to customers. Revenue is recognized at the point in time when performance obligations under the terms of customer contracts are satisfied, which is when ownership, risks and rewards transfer, and can be on the date of shipment or the date of receipt by the customer, depending upon the particular customer arrangement. Shipping and handling activities are accounted for as contract fulfillment costs and included within Cost of products sold. After the completion of the performance obligation, there is an unconditional right to consideration as outlined in the contract. A right is considered unconditional if nothing other than the passage of time is required before payment of that consideration is due. The Company typically collects its customer receivables within two months. All performance obligations under the terms of contracts with customers have an original duration of one year or less. The Company has trade promotion programs, which primarily include shelf price reductions, in-store merchandising, and consumer coupons. The costs of such activities, defined as variable consideration under ASC 606, "Revenue from Contracts with Customers," are netted against sales and recorded when the related sales take place. Accruals for trade promotion programs are established based on the Company's best estimate of the amounts necessary to settle existing and future obligations for products sold as of the balance sheet date. Amounts accrued for trade-promotions are based on various factors such as contractual terms and sales volumes, and also incorporate estimates that include customer participation rates, the rate at which customers will achieve program performance criteria, product availability, and consumer redemption rates. The Company provides an allowance for doubtful accounts based on its historical experience and ongoing assessment of its customers' credit risk and aging. Customer receivables are presented net of an allowance for doubtful accounts of $8 and $10 as of June 30,2021 and 2020 , respectively. Receivables, net, include non-customer receivables of $22 and $20 as of June 30 , A21 and 2020 , respectively, and related allowance of $14 and $4 as of June 30,2021 and 2020 , respectively. Cost of Products Sold Cost of products sold represents the costs directly related to the manufacture and distribution of the Company's products and primarily includes raw materials, packaging, contract manufacturing fees, shipping and handling, warehousing, package design, depreciation, amortization, direct and indirect labor and operating costs for the Company's manufacturing and distribution facilities, including salary, benefit costs and incentive compensation, and royalties and other charges related to the Company's Glad Venture Agreement (See Note 8). Costs associated with developing and designing new packaging, including design, artwork, films and labeling, are expensed as incurred and included within Cost of products sold. Selling and Administrative Expenses Selling and administrative expenses represent costs incurred by the Company in generating revenues and managing the business and include market research, commissions and certain administrative expenses. Administrative expenses include salary, benefits, incentive compensation, professional fees and services and other operating costs (such as software and licensing costs) associated with the Company's non-manufacturing, non-research and development operations. Advertising and Research and Development Costs The Company expenses advertising and research and development costs in the period incurred. Income Taxes The Company uses the asset and liability method to account for income taxes. Deferred tax assets and liabilities are recognized for the anticipated future tax consequences attributable to differences between financial statement amounts and their respective tax basis. Management reviews the Company's deferred tax more likely than not that some portion of its deferred tax assets will not be realized. Changes in valuation allowances from period to period are included in the Company's income tax provision in the period of change. In addition to valuation allowances, the Company provides for uncertain tax such tax positions do not meet certain recognition thresholds or measurement standards. Amounts for uncertain tax positions are adjusted in quarters when new information becomes available or when positions are effectively settled. Per U.S. GAAP, foreign withholding taxes are provided on unremitted foreign earnings that are not indefinitely reinvested at the time the earnings are generated. The Company regularly reviews and assesses whether there are any changes to its indefinite reinvestment assertion and determined that none of the undistributed earnings of its foreign subsidiaries are indefinitely

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started