Answered step by step

Verified Expert Solution

Question

1 Approved Answer

USING JOURNAL ENTRIES ANSWER: a . Magann General Contractors enters into a contract to build customized equipment for Barraza Inc. The contact price is $

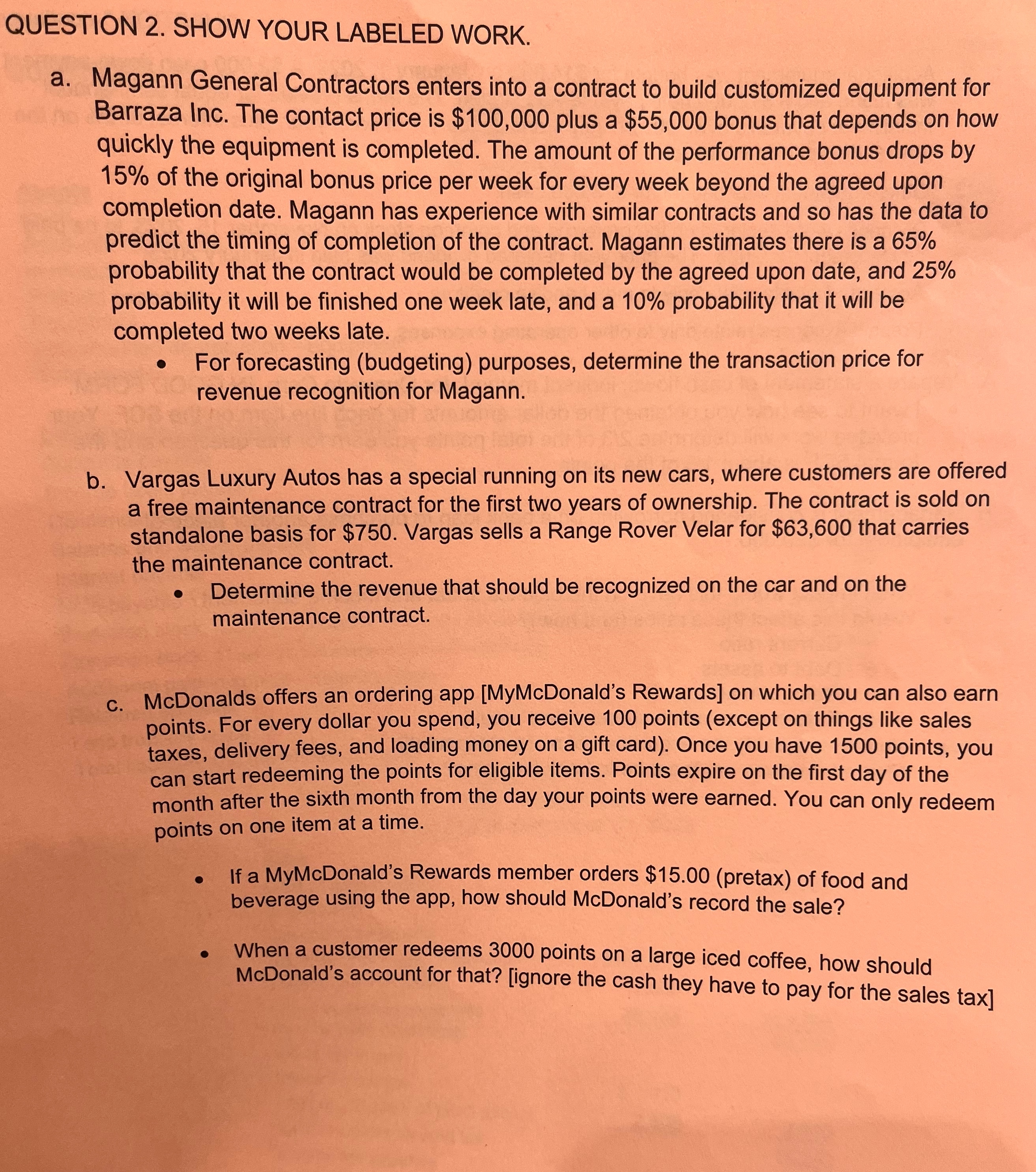

USING JOURNAL ENTRIES ANSWER: a Magann General Contractors enters into a contract to build customized equipment for Barraza Inc. The contact price is $ plus a $ bonus that depends on how quickly the equipment is completed. The amount of the performance bonus drops by of the original bonus price per week for every week beyond the agreed upon completion date. Magann has experience with similar contracts and so has the data to predict the timing of completion of the contract. Magann estimates there is a probability that the contract would be completed by the agreed upon date, and probability it will be finished one week late, and a probability that it will be completed two weeks late. For forecasting budgeting purposes, determine the transaction price for revenue recognition for Magann. b Vargas Luxury Autos has a special running on its new cars, where customers are offered a free maintenance contract for the first two years of ownership. The contract is sold on standalone basis for $ Vargas sells a Range Rover Velar for $ that carries the maintenance contract. Determine the revenue that should be recognized on the car and on the maintenance contract. c McDonalds offers an ordering app MyMcDonalds Rewards on which you can also earn points. For every dollar you spend, you receive points except on things like sales taxes, delivery fees, and loading money on a gift card Once you have points, you can start redeeming the points for eligible items. Points expire on the first day of the month after the sixth month from the day your points were earned. You can only redeem points on one item at a time. If a MyMcDonald's Rewards member orders $pretax of food and beverage using the app, how should McDonald's record the sale? When a customer redeems points on a large iced coffee, how should McDonald's account for that? ignore the cash they have to pay for the sales taxQUESTION SHOW YOUR LABELED WORK.

a Magann General Contractors enters into a contract to build customized equipment for Barraza Inc. The contact price is $ plus a $ bonus that depends on how quickly the equipment is completed. The amount of the performance bonus drops by of the original bonus price per week for every week beyond the agreed upon completion date. Magann has experience with similar contracts and so has the data to predict the timing of completion of the contract. Magann estimates there is a probability that the contract would be completed by the agreed upon date, and probability it will be finished one week late, and a probability that it will be completed two weeks late.

For forecasting budgeting purposes, determine the transaction price for revenue recognition for Magann.

b Vargas Luxury Autos has a special running on its new cars, where customers are offered a free maintenance contract for the first two years of ownership. The contract is sold on standalone basis for $ Vargas sells a Range Rover Velar for $ that carries the maintenance contract.

Determine the revenue that should be recognized on the car and on the maintenance contract.

c McDonalds offers an ordering app MyMcDonalds Rewards on which you can also earn points. For every dollar you spend, you receive points except on things like sales taxes, delivery fees, and loading money on a gift card Once you have points, you can start redeeming the points for eligible items. Points expire on the first day of the month after the sixth month from the day your points were earned. You can only redeem points on one item at a time.

If a MyMcDonald's Rewards member orders $pretax of food and beverage using the app, how should McDonald's record the sale?

When a customer redeems points on a large iced coffee, how should McDonald's account for that? ignore the cash they have to pay for the sales tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started