Question

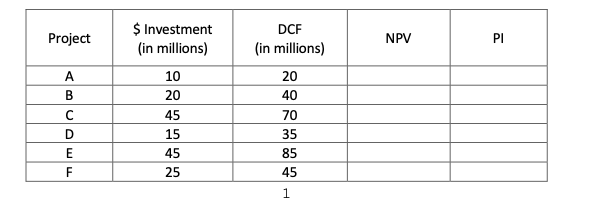

Using NPV and PI to rank investments can give different rankings. Below, first calculate the NPV and the PI for each project; then rank order

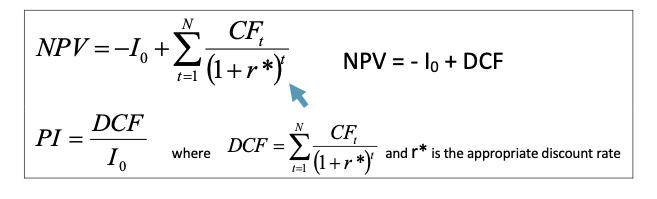

Using NPV and PI to rank investments can give different rankings. Below, first calculate the NPV and the PI for each project; then rank order the investments by each of the criteria. Finally, choose the projects you would invest in strictly using the ranking criteria and assuming that you have only $90 million to invest.

Note: The amount in the $ Investment column represents the amount of capital that must be invested at time 0 (now) to generate the cash inflows in the future. The amount designated DCF represents the Discounted Cash Flow (which is the present value of the future cash inflows, beginning one period after the investment, and lasting through the end of the project). All DCF calculations have used an appropriate discount rate and cover the life of the investment beginning at time 1 and going forward.

(Rank order of the investments by each criteria and circle the ones you would choose using the NPV and PI criteria, recognizing that you can only invest $90 million)

NPV: PI: Which criteria works better with the limitation of a $90 million capital budget?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started