Question

Using only the information provided in the table, you decide to value JetBlues IPO using either a P/EBIT or P/E multiple. Based on this decision,

Using only the information provided in the table, you decide to value JetBlue’s IPO using either a P/EBIT or P/E multiple. Based on this decision, which comparable company would you be most likely excludefrom your analysis?

A. AirTran, because it is valued at a discount to Frontier, Ryanair, and Southwest on a leading multiple basis

B. ATA, because it would produce an irrational share price for JetBlue

C. Frontier, because it is an airline major, not a low cost provider

D. Rynair, because it is bigger and more established than JetBlue

E.Southwest, because it is a low cost provider, not an airline major

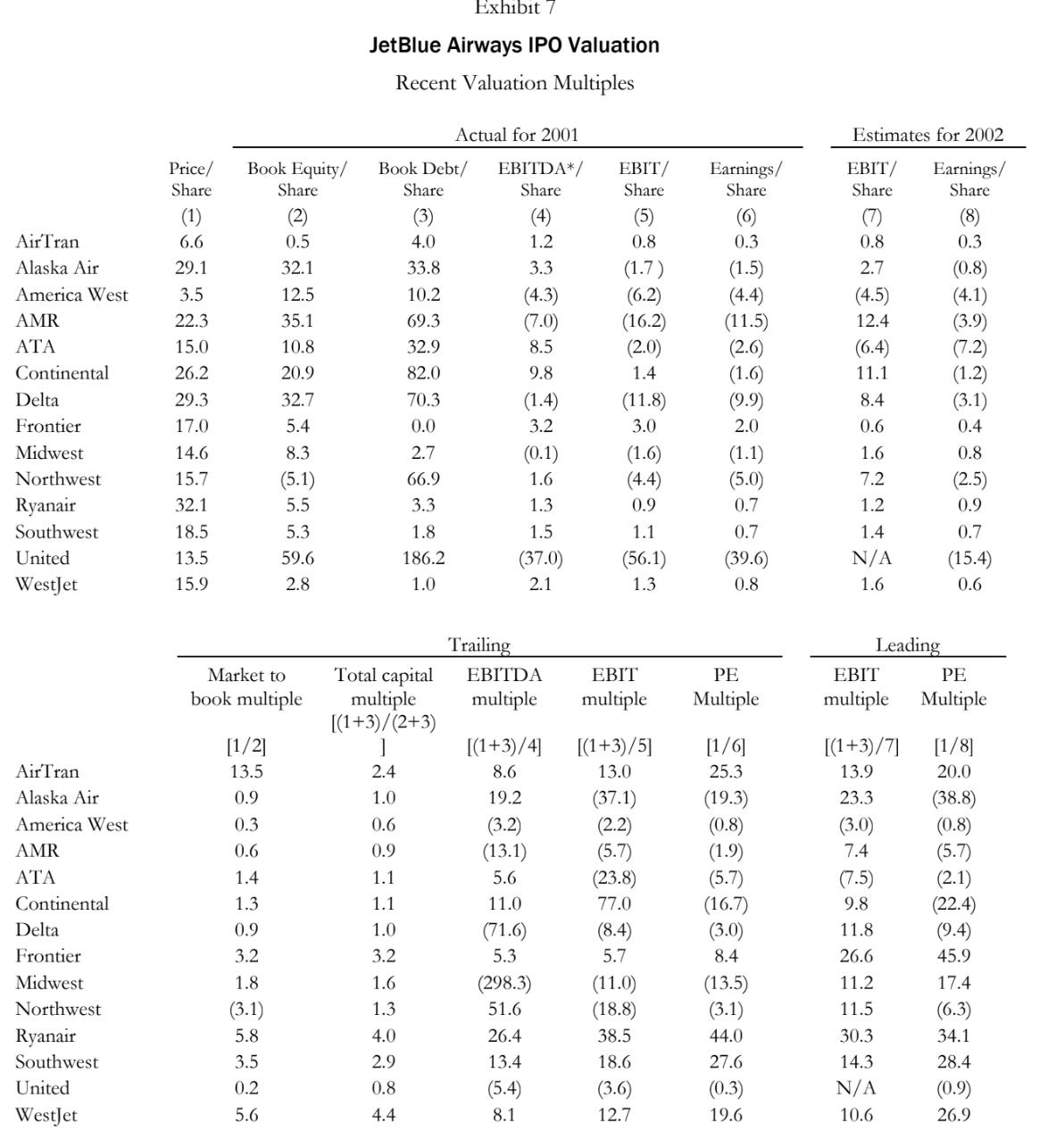

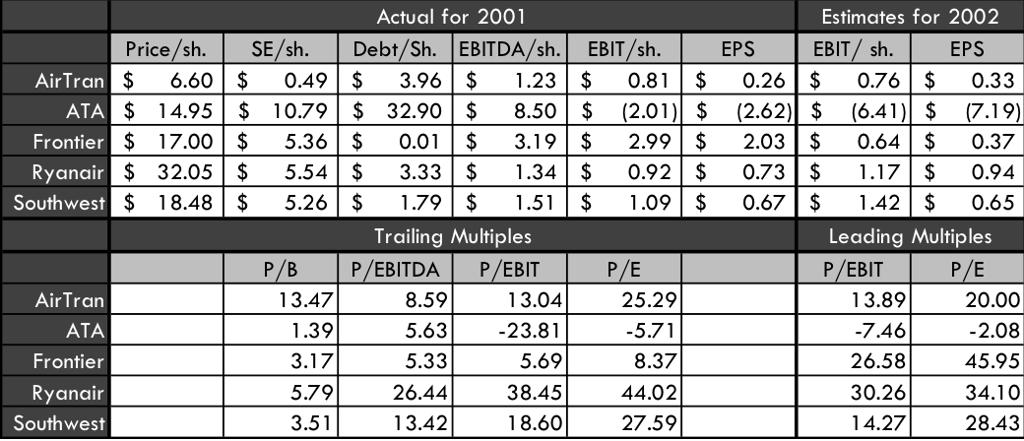

Exhibit 7 JetBlue Airways IPO Valuation Recent Valuation Multiples Actual for 2001 Estimates for 2002 Price/ Share Book Equity/ Book Debt/ EBITDA*/ EBIT/ Earnings/ EBIT/ Share Share Share Share Share Share Earnings/ Share (2) (4) (5) (6) (7) (8) AirTran 6.6 0.5 4.0 1.2 0.8 0.3 0.8 0.3 Alaska Air 29.1 32.1 33.8 3.3 (1.7) (1.5) 2.7 (0.8) America West 3.5 12.5 10.2 (4.3) (6.2) (4.4) (4.5) (4.1) AMR 22.3 35.1 69.3 (7.0) (16.2) (11.5) 12.4 (3.9) 15.0 10.8 32.9 8.5 (2.0) (2.6) (6.4) (7.2) Continental 26.2 20.9 82.0 9.8 1.4 (1.6) 11.1 (1.2) Delta 29.3 32.7 70.3 (1.4) (11.8) (9.9) 8.4 (3.1) Frontier 17.0 5.4 0.0 3.2 3.0 2.0 0.6 0.4 Midwest 14.6 8.3 2.7 (0.1) (1.6) (1.1) 1.6 0.8 Northwest 15.7 (5.1) 66.9 1.6 (4.4) (5.0) 7.2 (2.5) Ryanair 32.1 5.5 3.3 1.3. 0.9 0.7 1.2 0.9 Southwest 18.5 5.3 1.8 1.5 1.1 0.7 1.4 0.7 United 13.5 59.6 186.2 (37.0) (56.1) (39.6) N/A (15.4) WestJet 15.9 2.8 1.0 2.1 1.3 0.8 1.6 0.6 Trailing Leading Market to Total capital EBITDA EBIT PE EBIT PE book multiple multiple multiple multiple Multiple multiple Multiple [(1+3)/(2+3) [1/2] ] [(1+3)/4] [(1+3)/5] [1/6] [(1+3)/7] [1/8] AirTran 13.5 2.4 8.6 13.0 25.3 13.9 20.0 Alaska Air 0.9 1.0 19.2 (37.1) (19.3) 23.3 (38.8) America West 0.3 0.6 (3.2) (2.2) (0.8) (3.0) (0.8) AMR 0.6 0.9 (13.1) (5.7) (1.9) 7.4 (5.7) 1.4 1.1 5.6 (23.8) (5.7) (7.5) (2.1) Continental 1.3 1.1 11.0 77.0 (16.7) 9.8 (22.4) Delta 0.9 1.0 (71.6) (8.4) (3.0) 11.8 (9.4) Frontier 3.2 3.2 5.3 5.7 8.4 26.6 45.9 Midwest 1.8 1.6 (298.3) (11.0) (13.5) 11.2 17.4 Northwest (3.1) 1.3 51.6 (18.8) (3.1) 11.5 (6.3) Ryanair 5.8 4.0 26.4 38.5 44.0 30.3 34.1 Southwest 3.5 2.9 13.4 18.6 27.6 14.3 28.4 United 0.2 0.8 (5.4) (3.6) (0.3) N/A (0.9) WestJet 5.6 4.4 8.1 12.7 19.6 10.6 26.9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

First lets find the necessary financial metrics for JetBlue Airways Unfortunately the table does not provide specific numbers for JetBlue however we c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started