using python 3 how can I get the expected output ?

the code used: main.py and loan_calc.py

main.py code :

from loan_calc import apply_payment, total_loan_cost, total_interest_paid, calculate_payment

amount = float(input('Enter the amount of the loan: ')) print() apr = float(input(' Enter the annual percentage rate (APR): ')) print() num_months = int(input(' Enter the number of months for the loan: ')) print()

monthly_payment = calculate_payment(amount, apr, num_months) total_cost = total_loan_cost(amount, apr, num_months) total_interest = total_interest_paid(amount, apr, num_months)

t_payments = 0 t_principal = 0 t_interest = 0 print() print(' E - Z L - O - A - N') print() print('%-10s:%10.2f%26s%20s%10.2f'%(' Loan: $:',amount,'',' Monthly Payment: $',monthly_payment)) print('%-10s: %10.2f%2s%23s%20s%10.2f' %(' APR: :',apr, '%','',' Total Interest: $',total_interest)) print('%-10s: %10d months%18s%20s%10.2f' %(' Term: :',num_months,'',' Total Cost: $',total_cost))

print(' %-17s%-20s%-30s%-15s' %('','Payment','','Total')) print('%-3s | %-10s%-15s%-12s%-10s%-12s%-15s%-10s' %('No','Payment','Principal','Interest','Balance','Payments','Principal','Interest'))

month = 1 while month

loan_calc.py

def round_cents(num): return float(int(num*100 + .5000001))/100 def calculate_payment(amount, apr, num_months): monthly_interest_rate = apr/1200 payment = (amount*monthly_interest_rate)/(1-((1+monthly_interest_rate)**(-num_months))) return round_cents(payment) def total_loan_cost(amount, apr, num_months):

return round_cents(calculate_payment(amount, apr, num_months)*num_months) def total_interest_paid(amount, apr, num_months): return round_cents(total_loan_cost(amount, apr, num_months)-amount)

def apply_payment(payment, balance, apr): interest = (balance*apr)/1200 if payment > balance: payment = balance + interest principal_amount = payment-interest rem_bal = balance-principal_amount if rem_bal

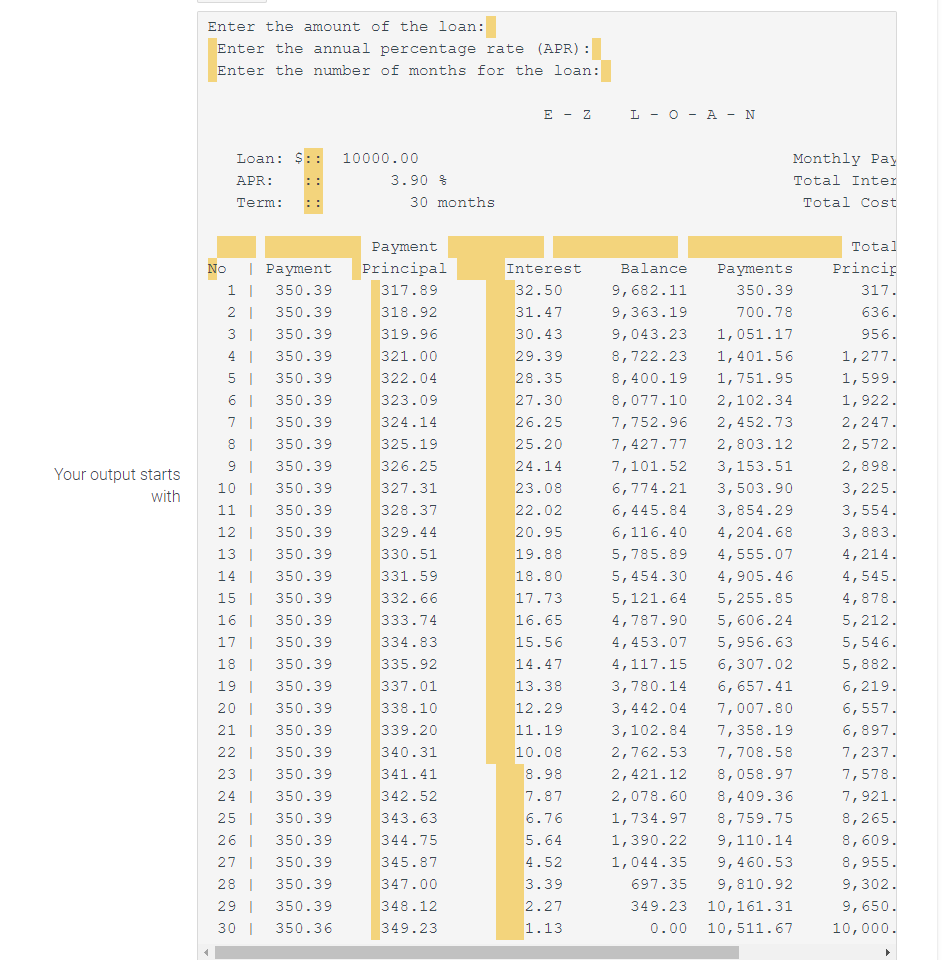

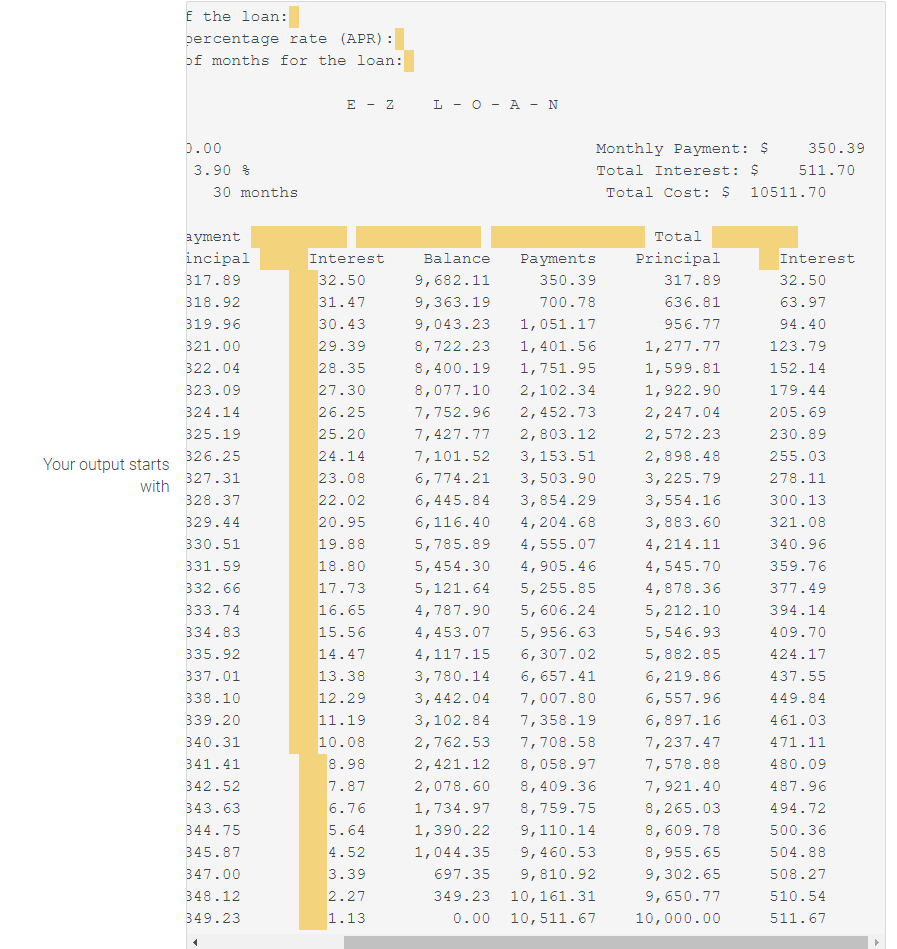

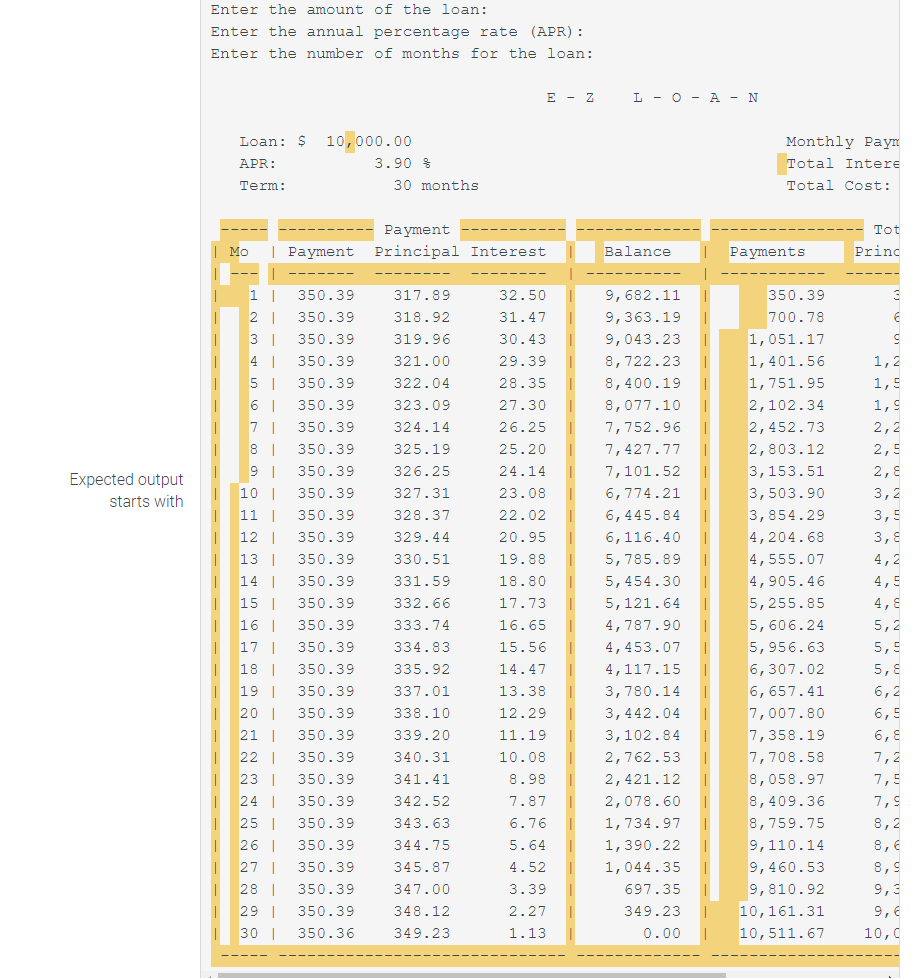

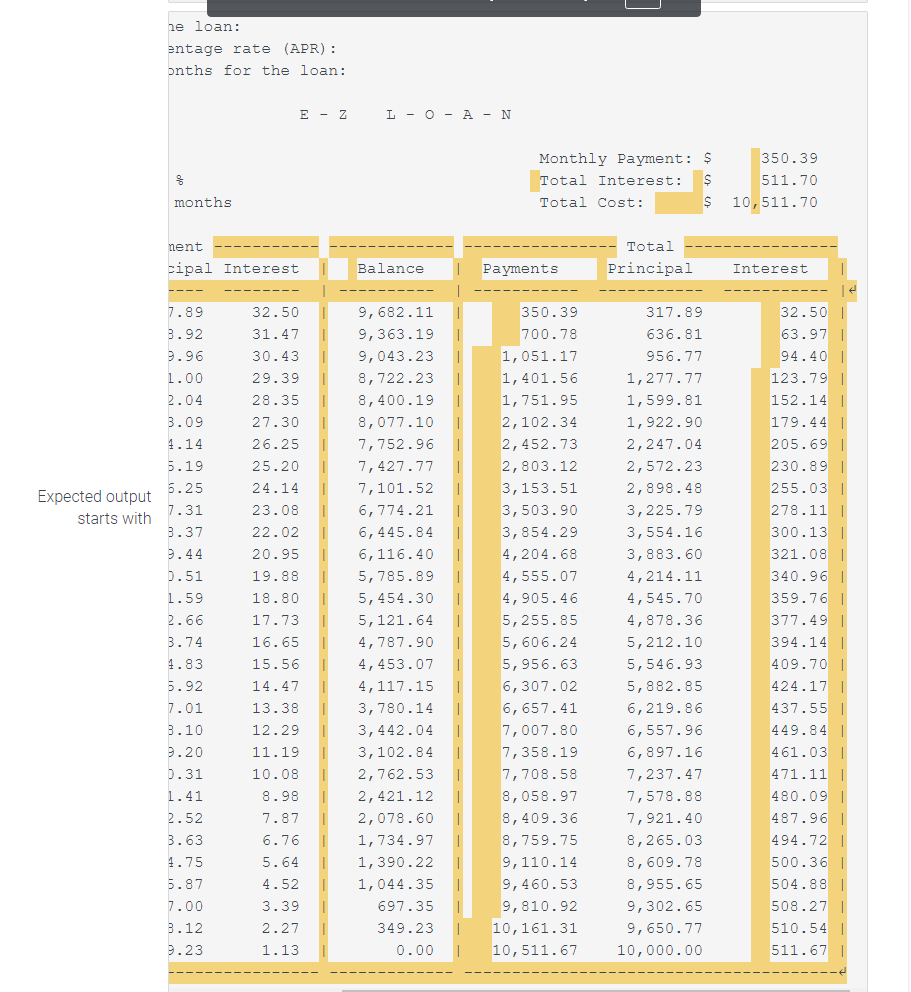

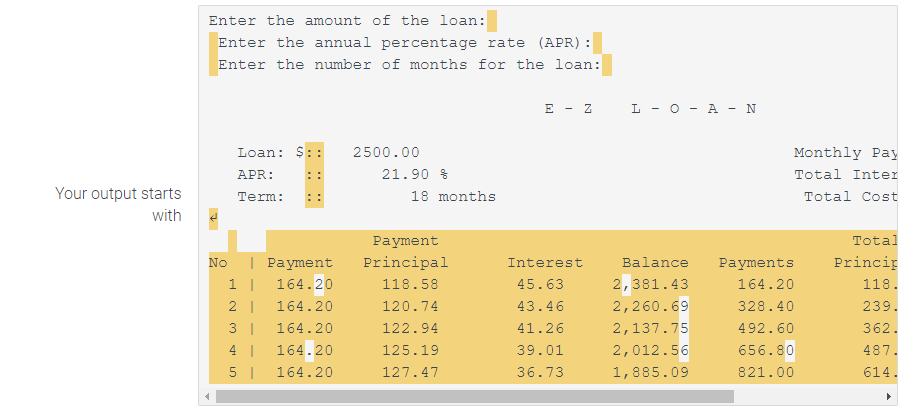

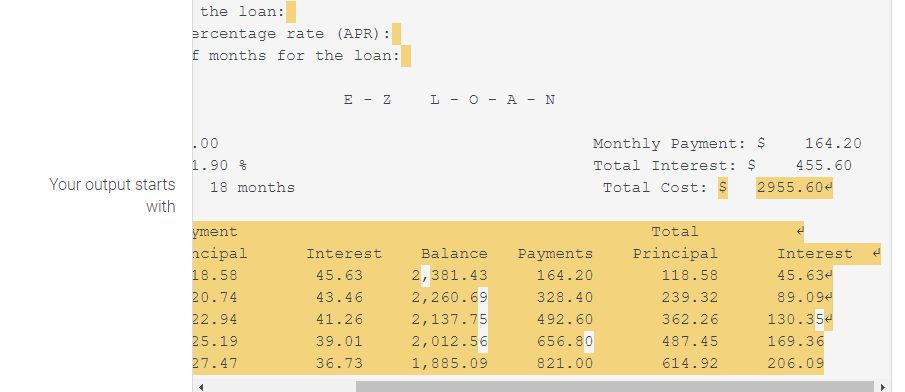

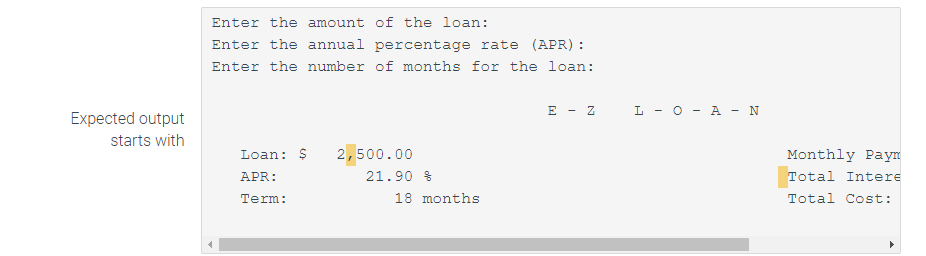

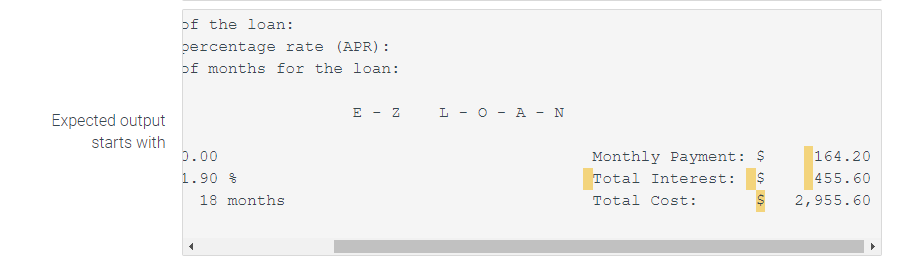

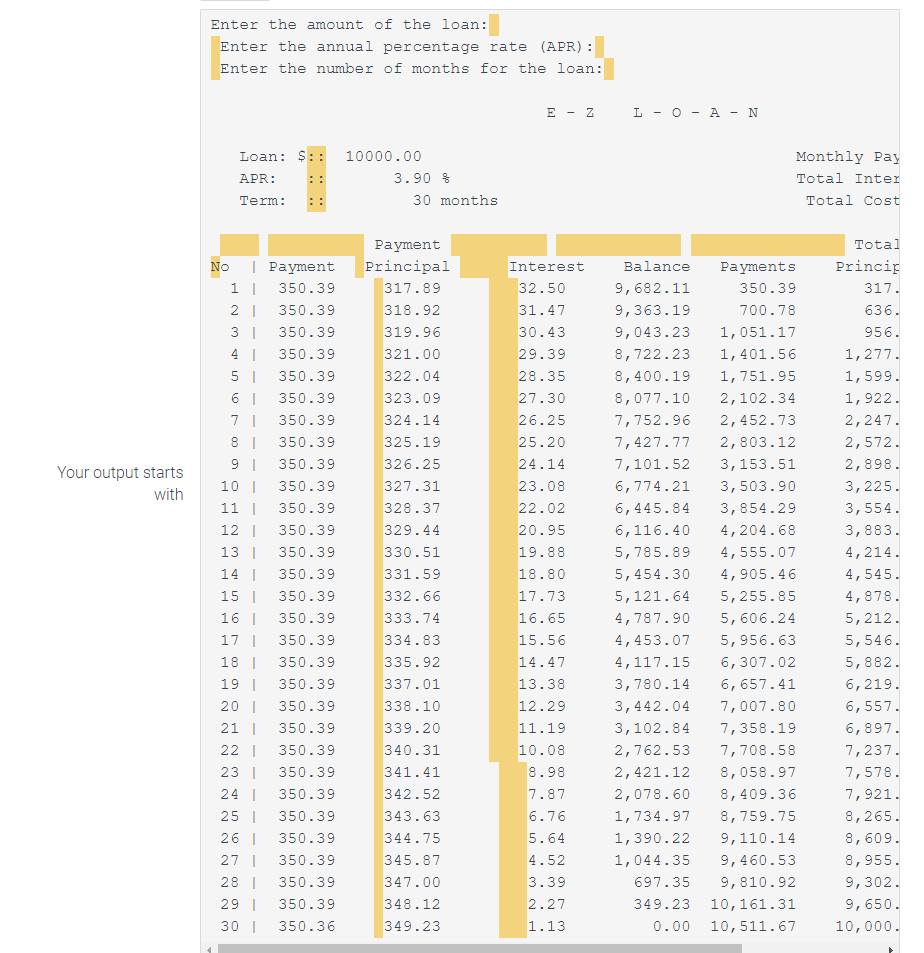

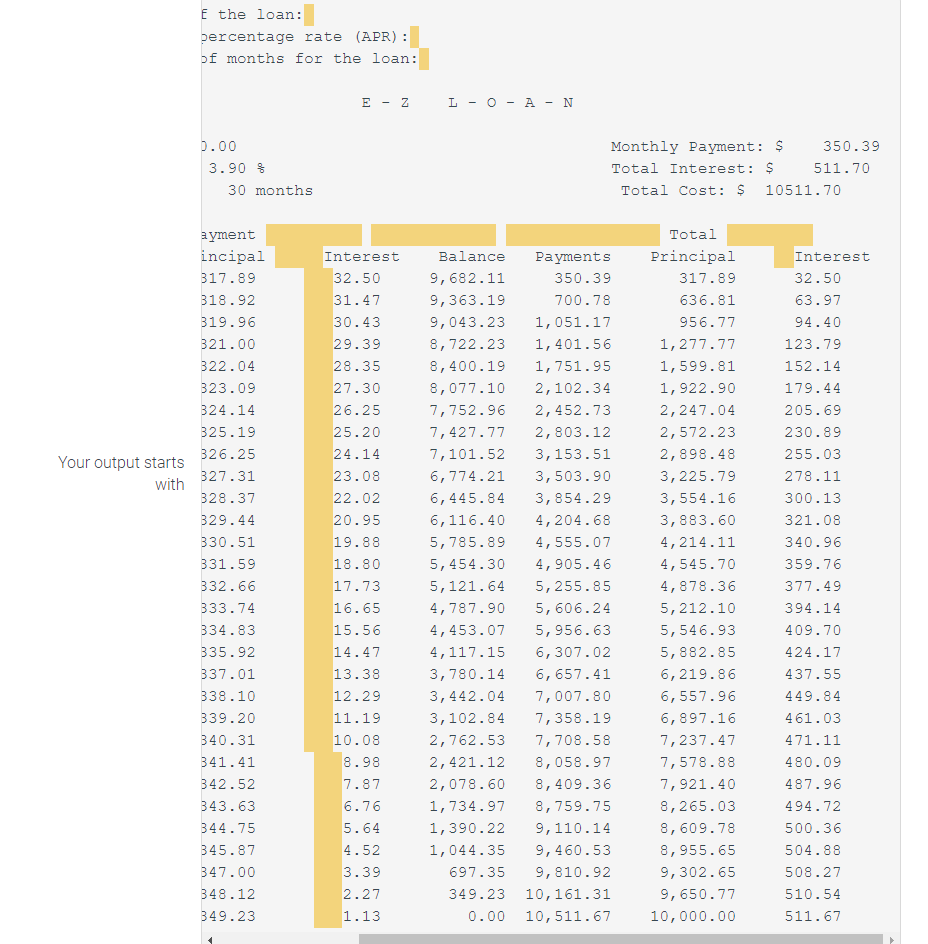

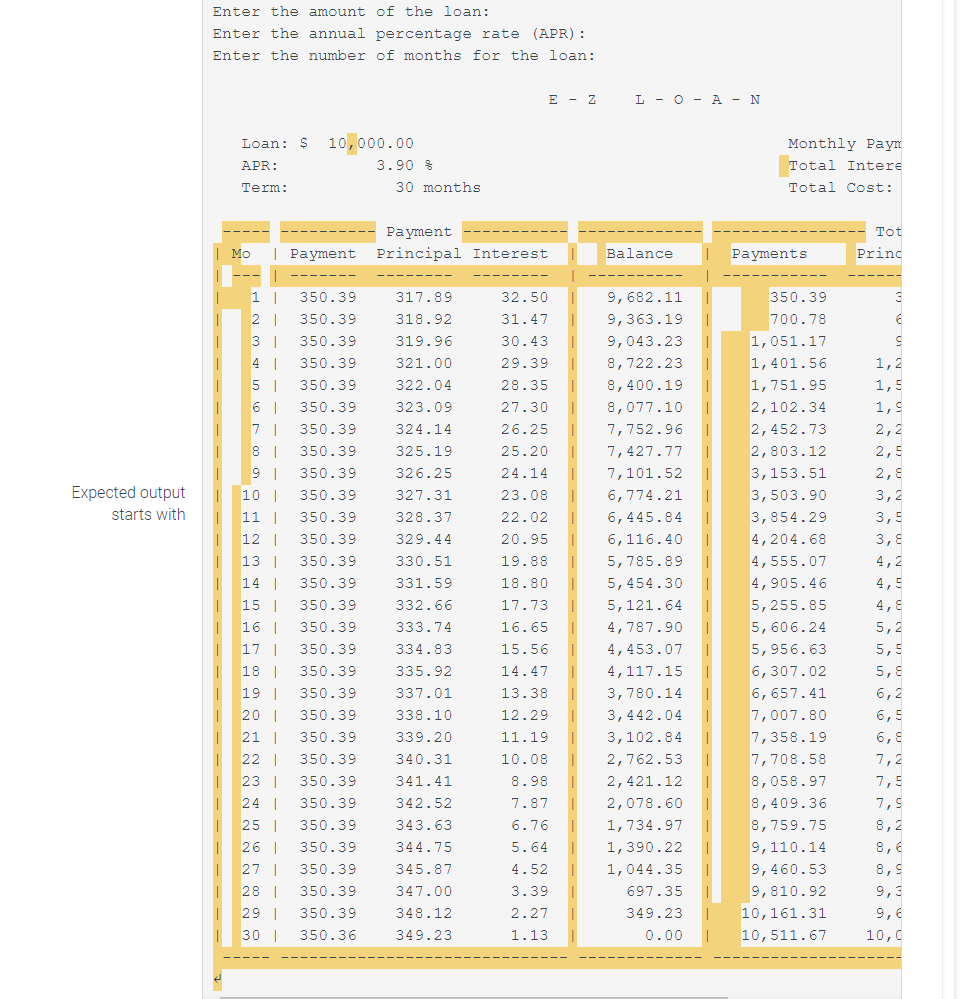

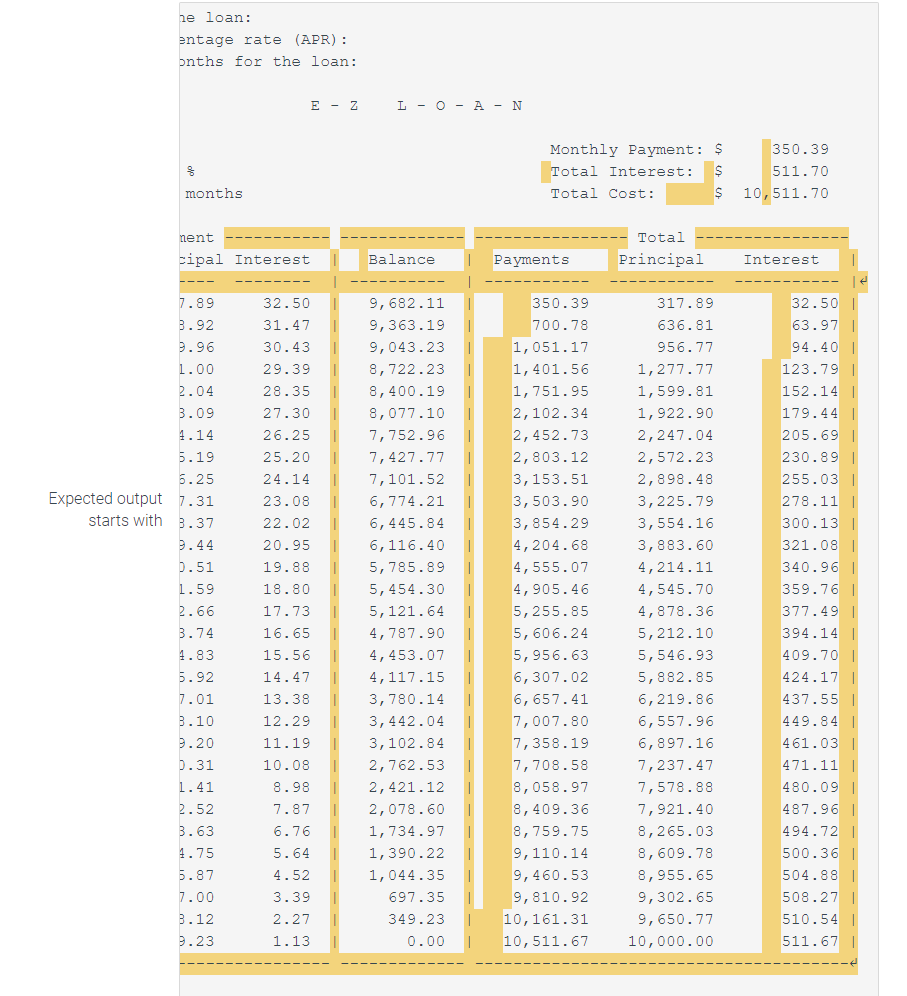

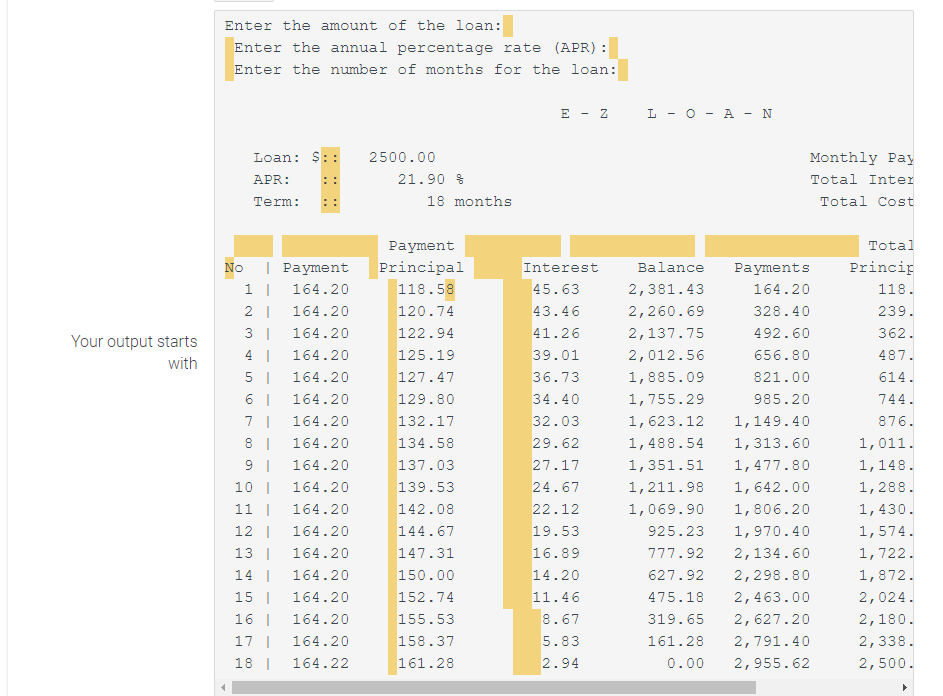

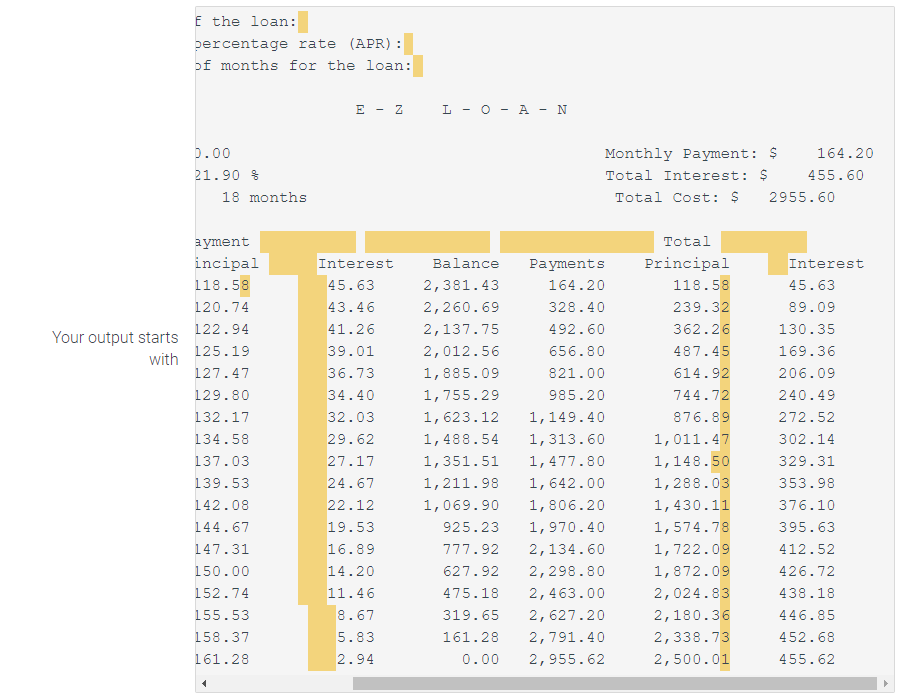

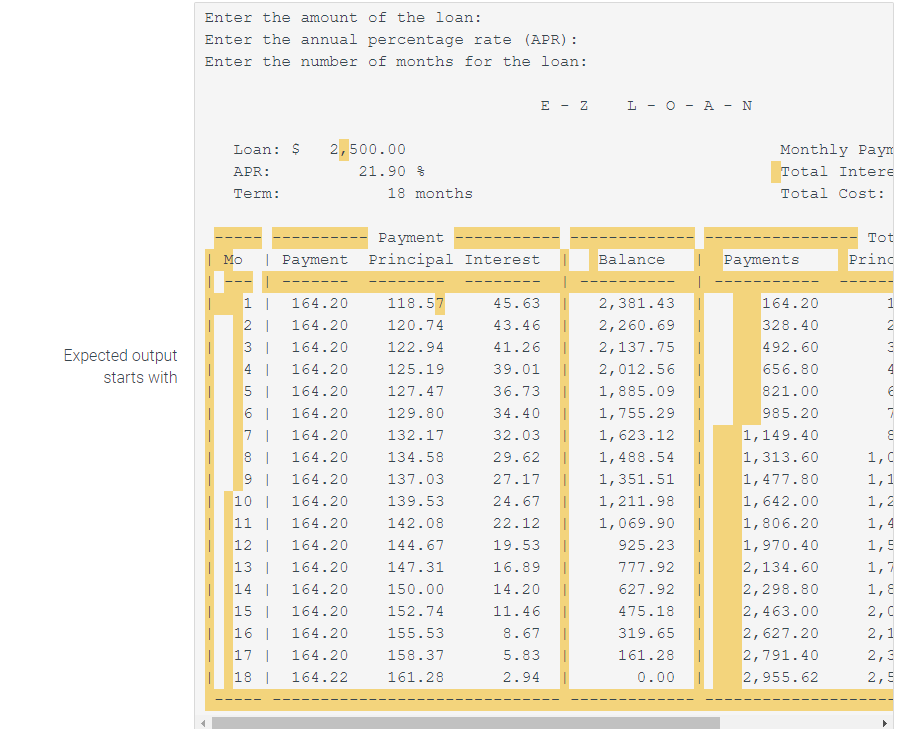

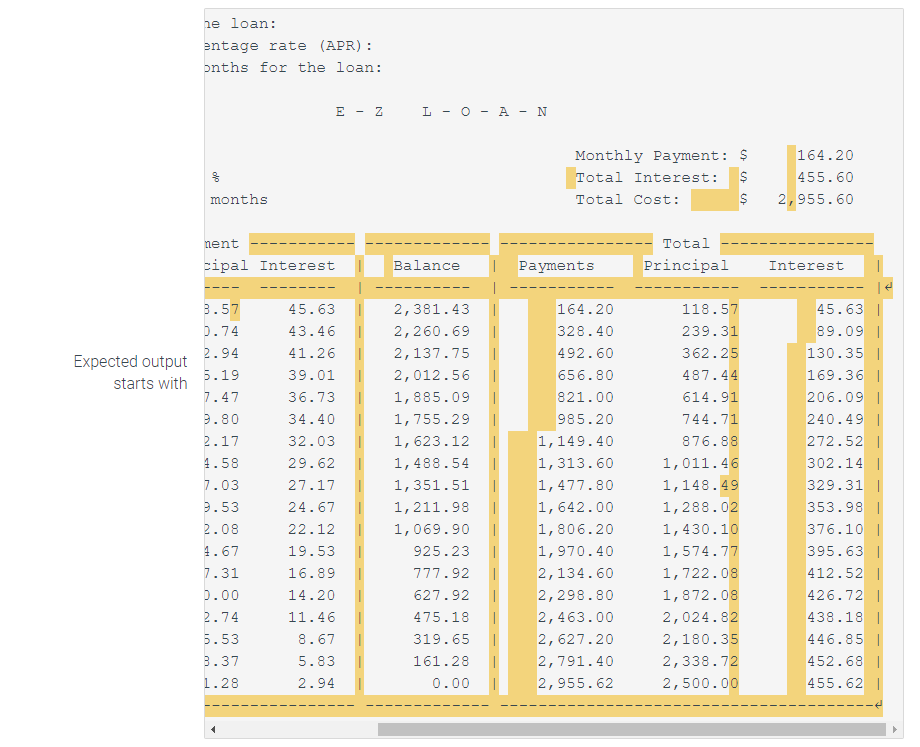

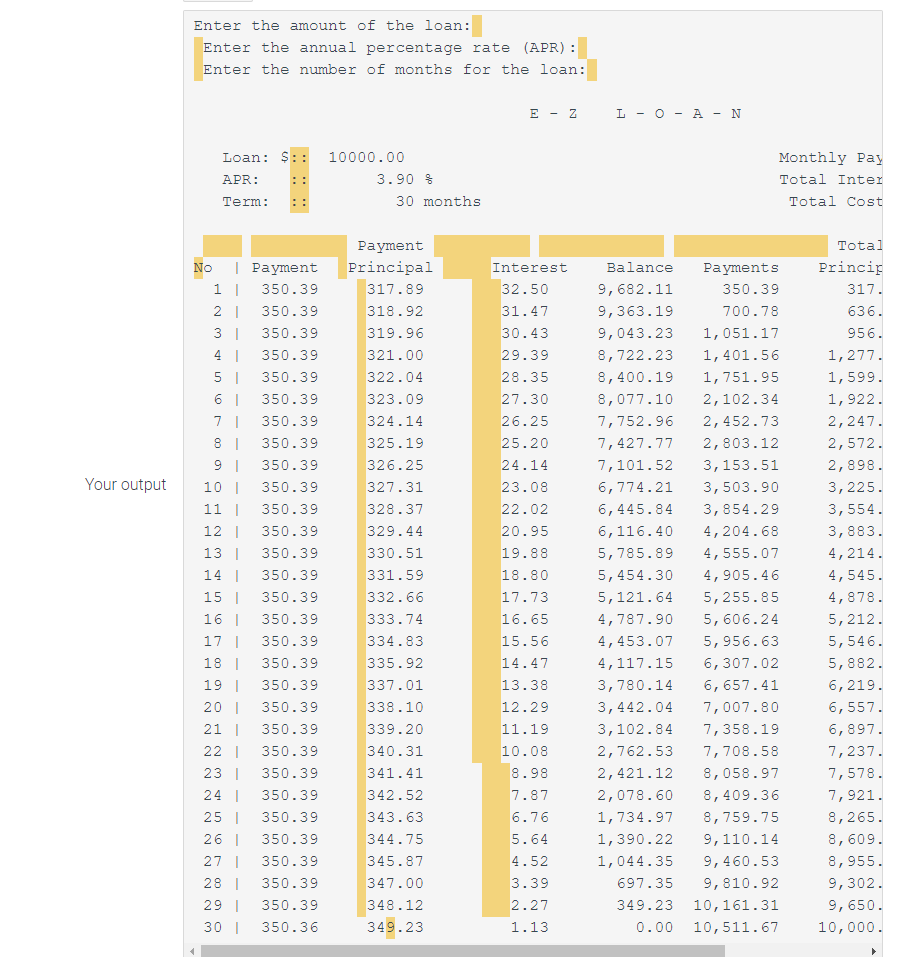

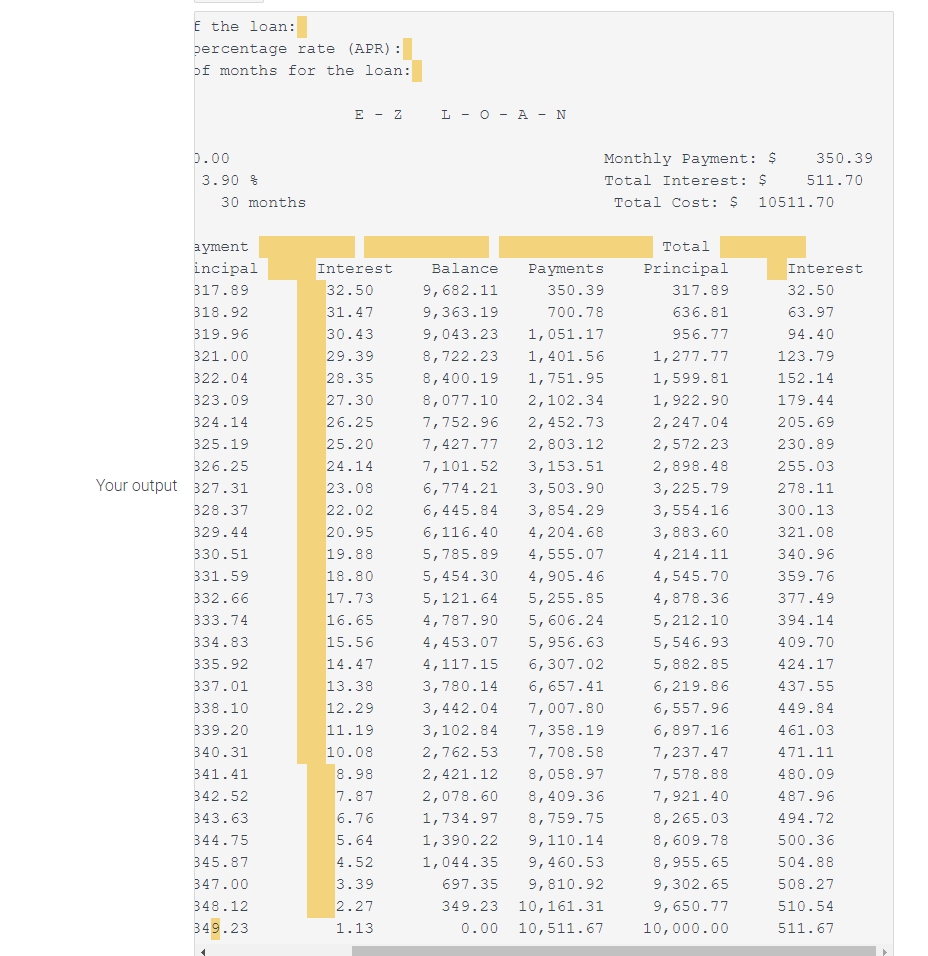

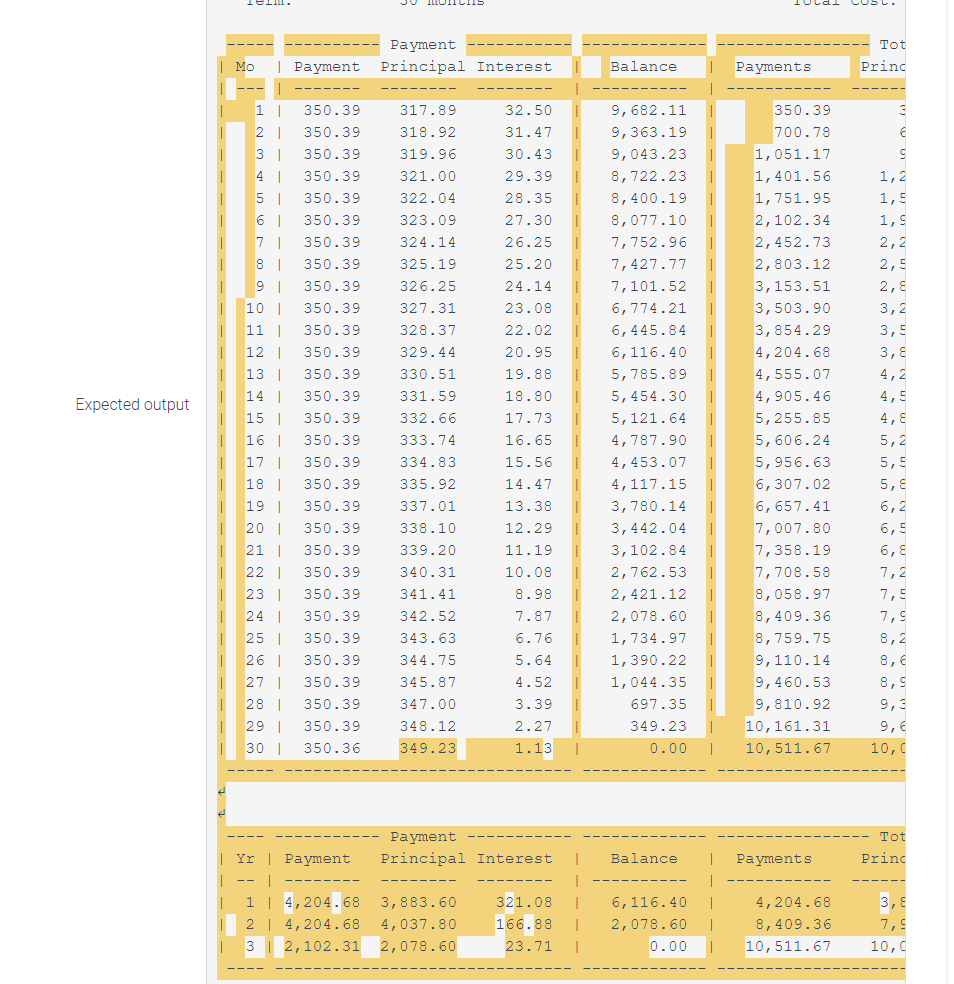

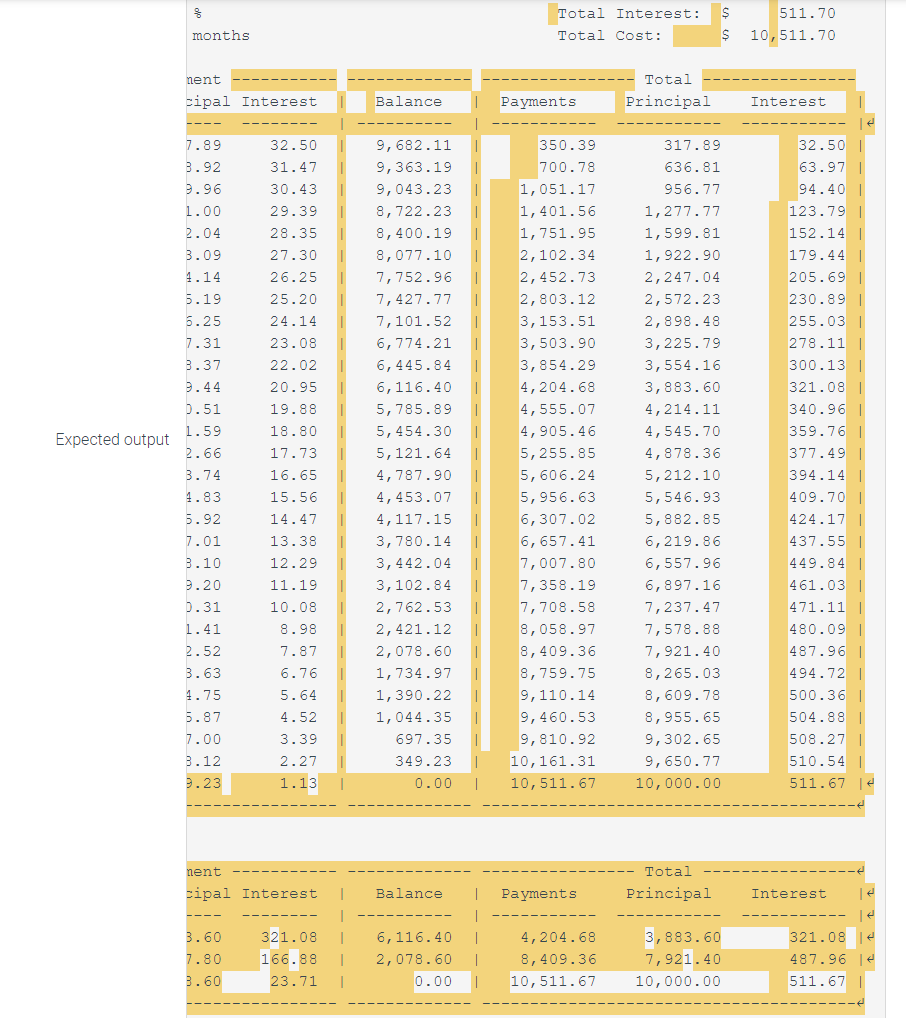

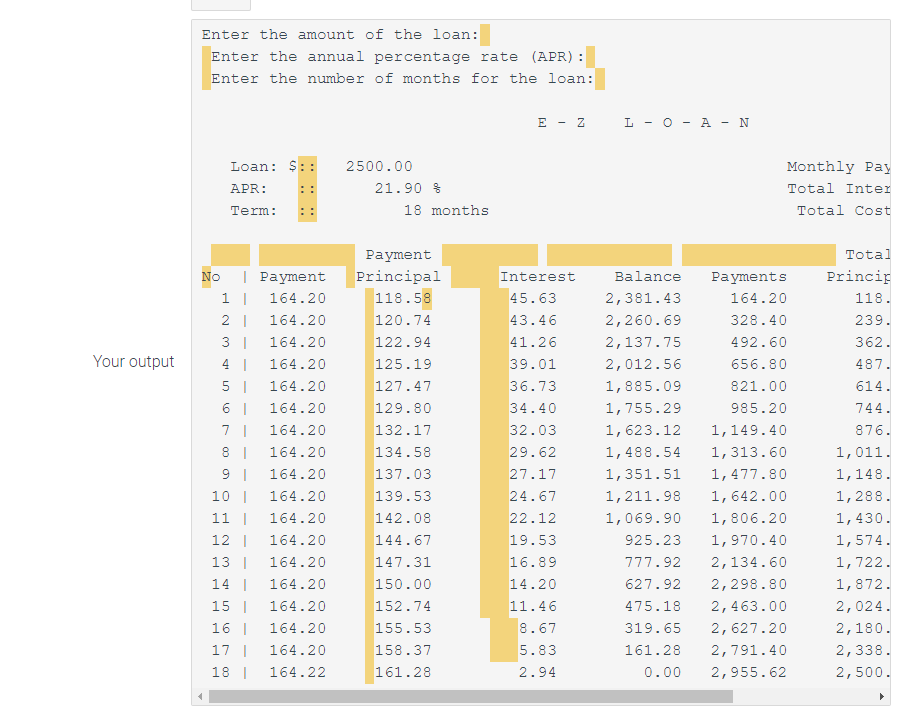

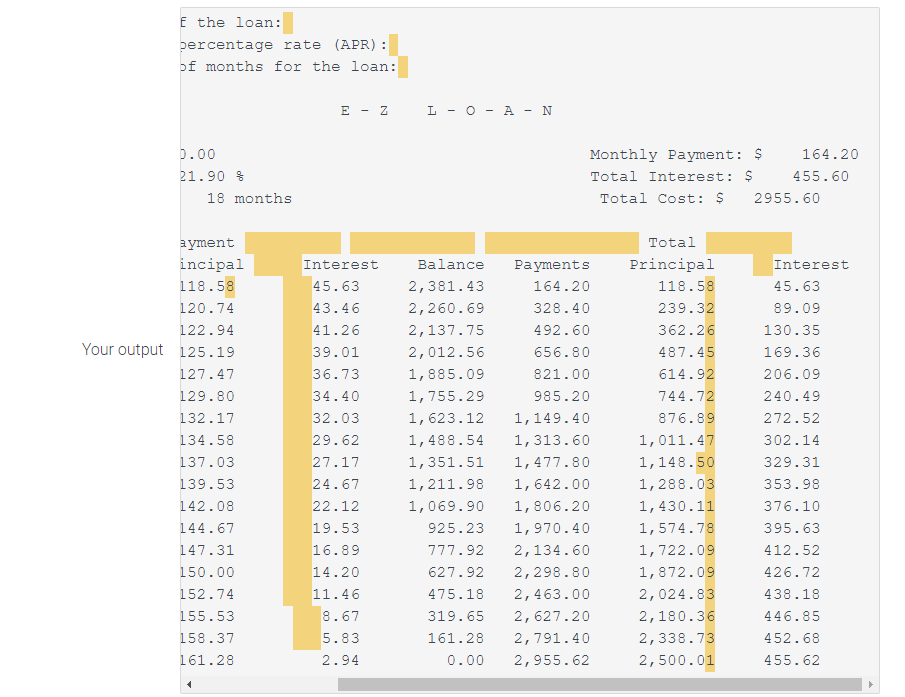

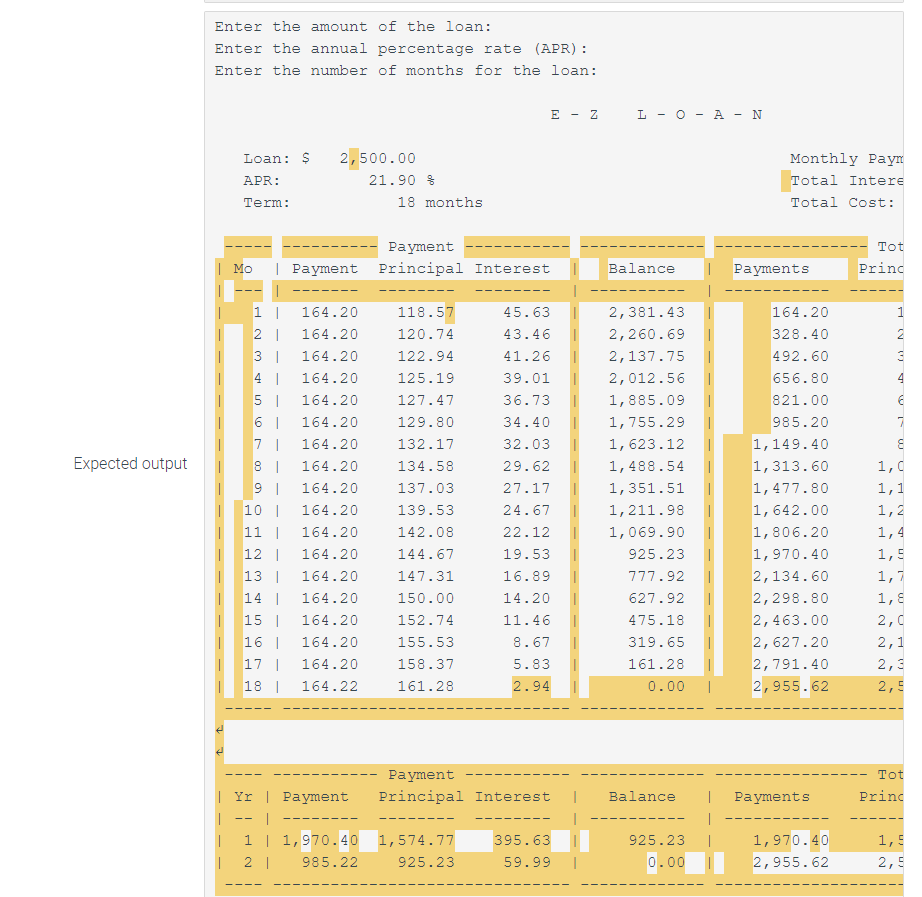

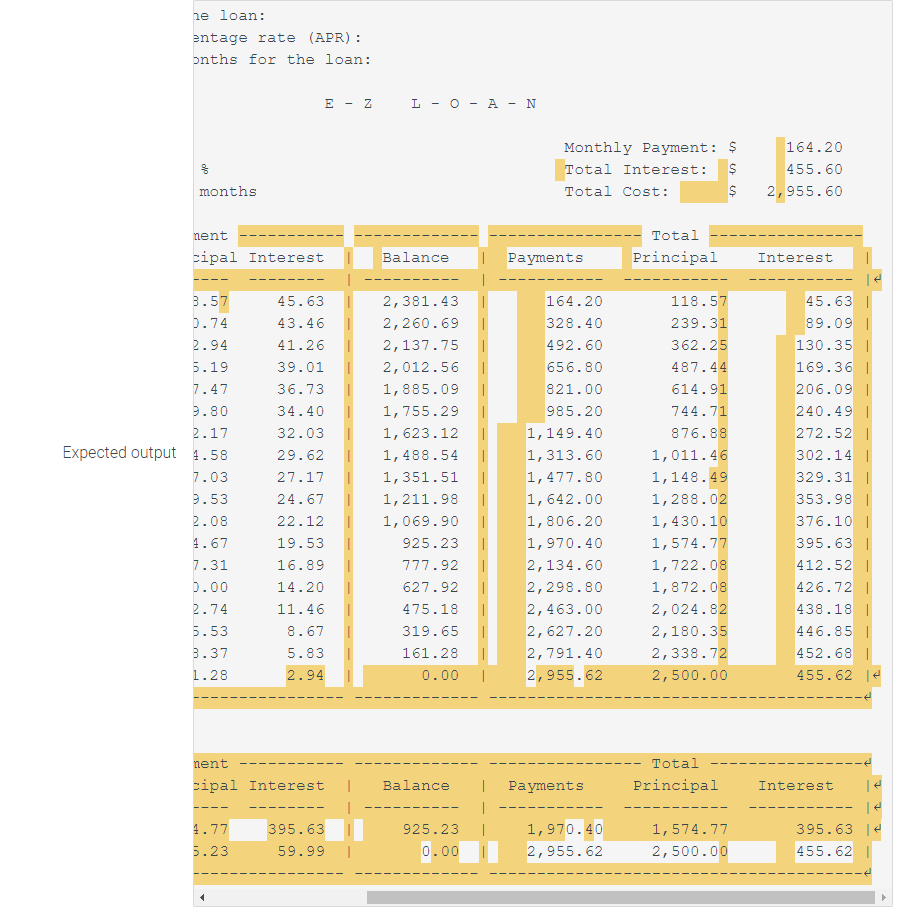

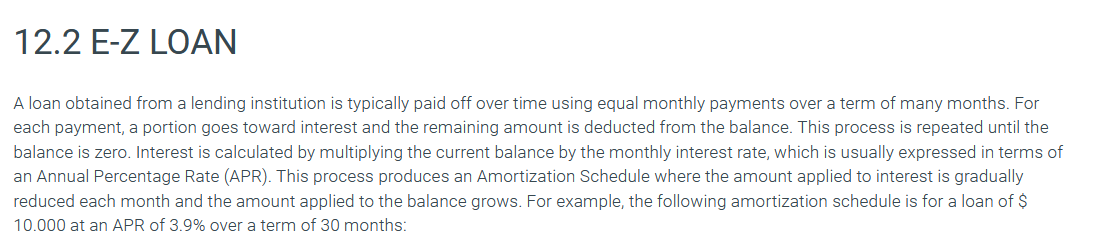

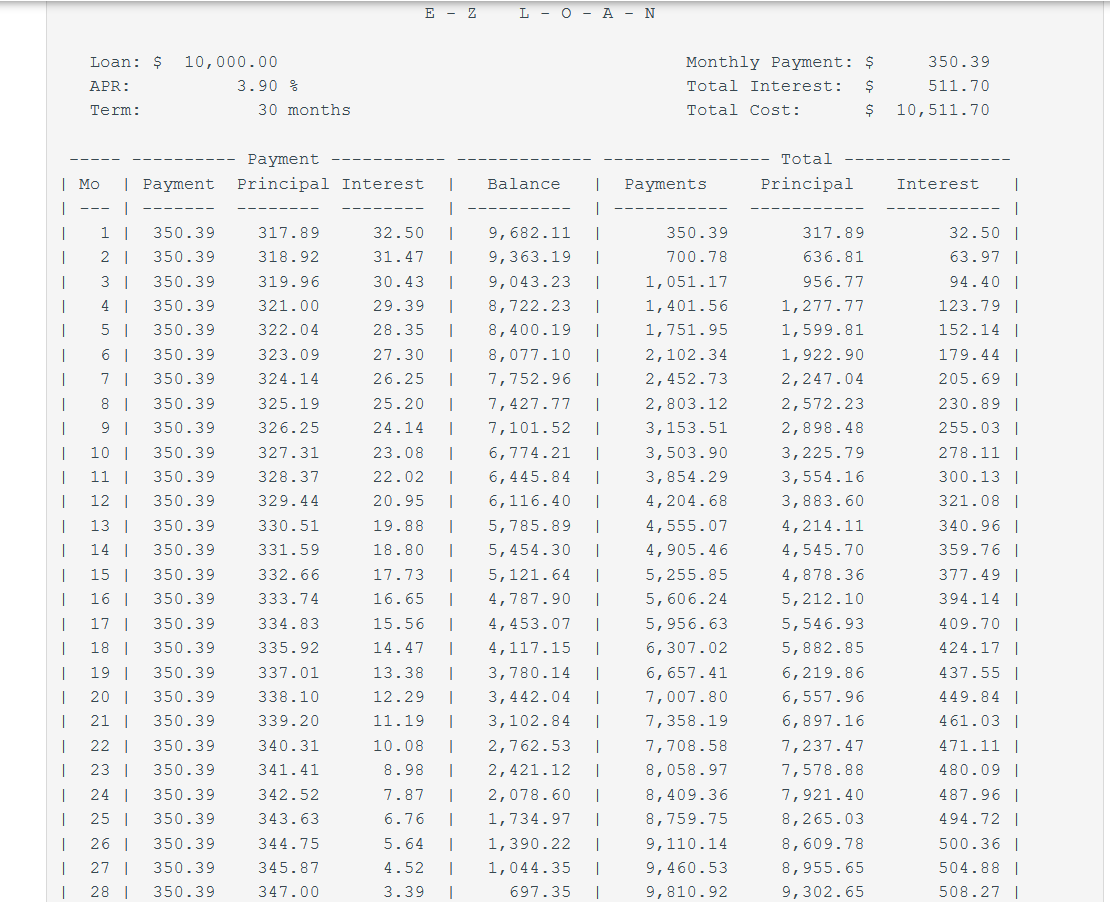

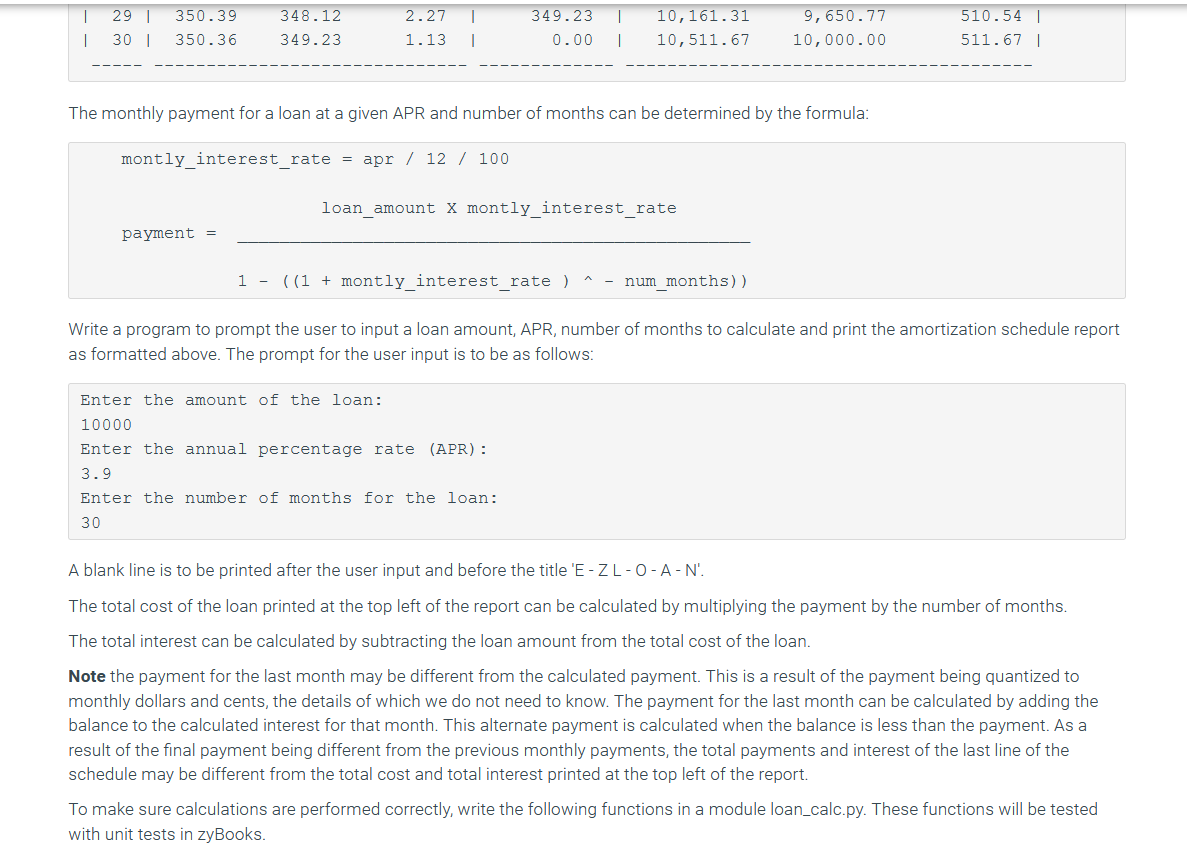

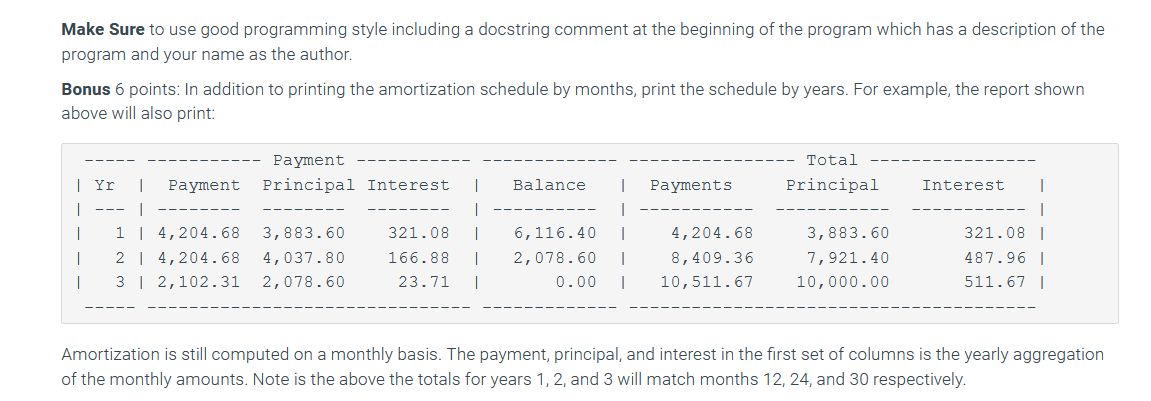

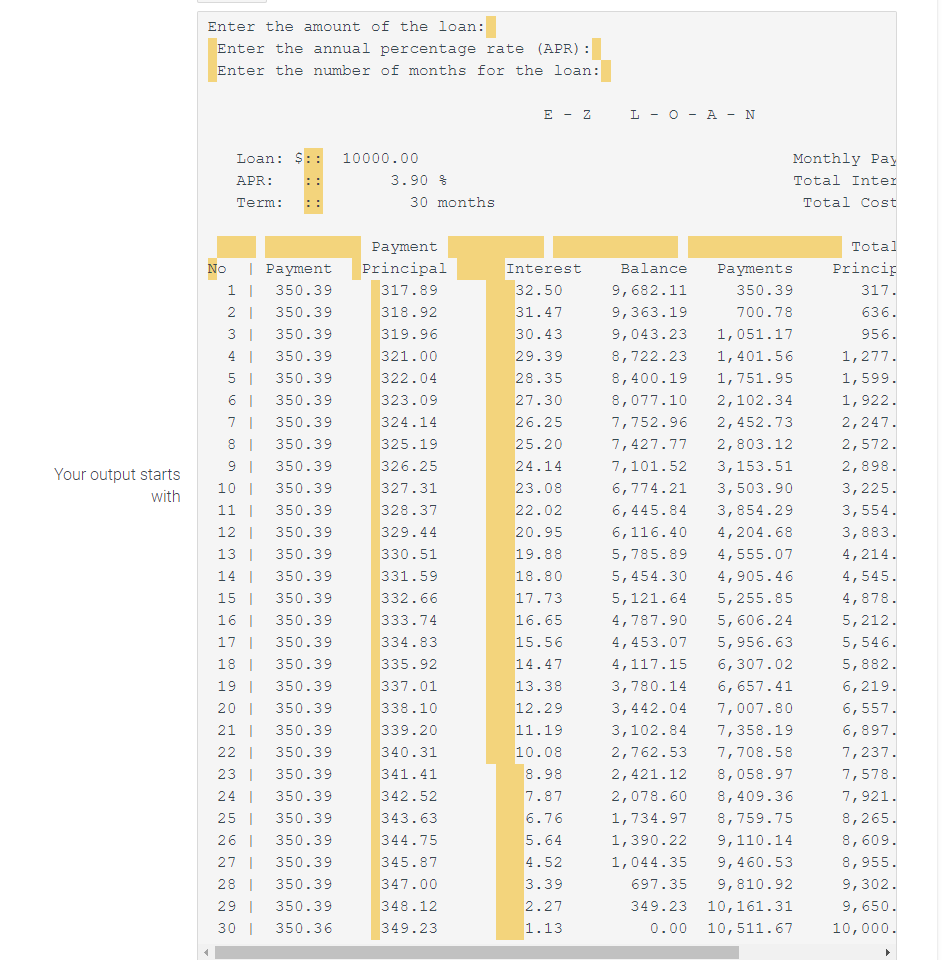

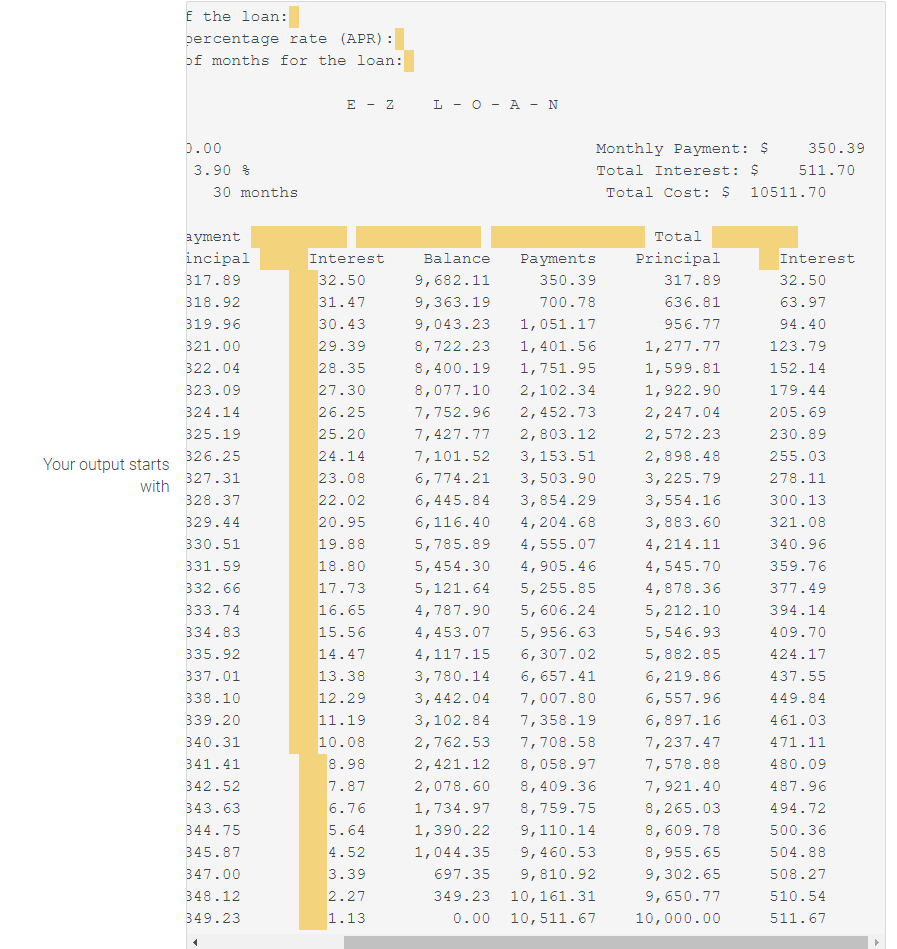

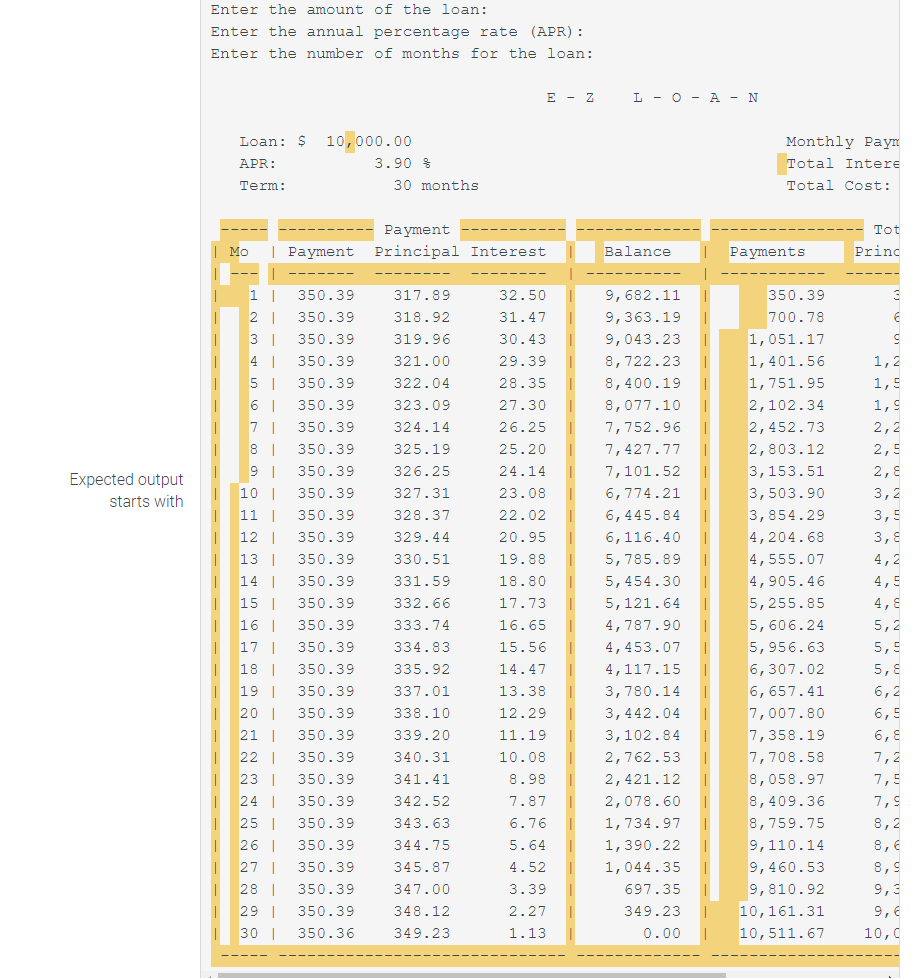

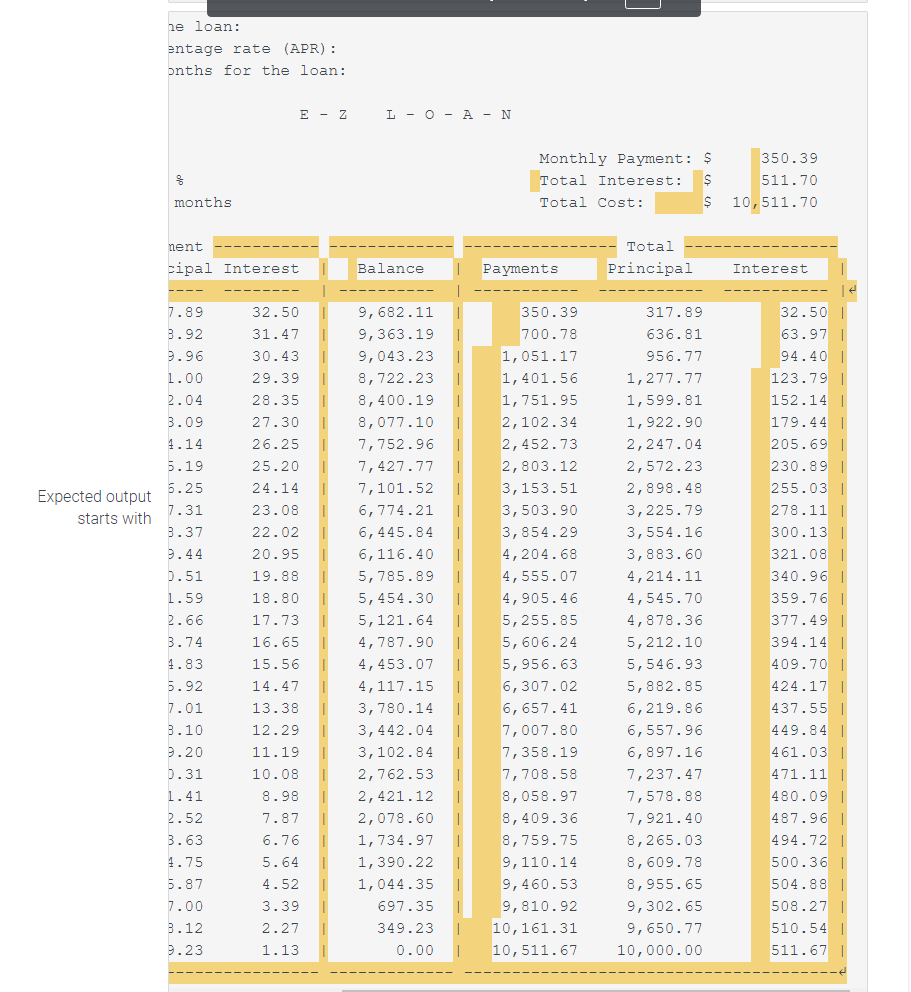

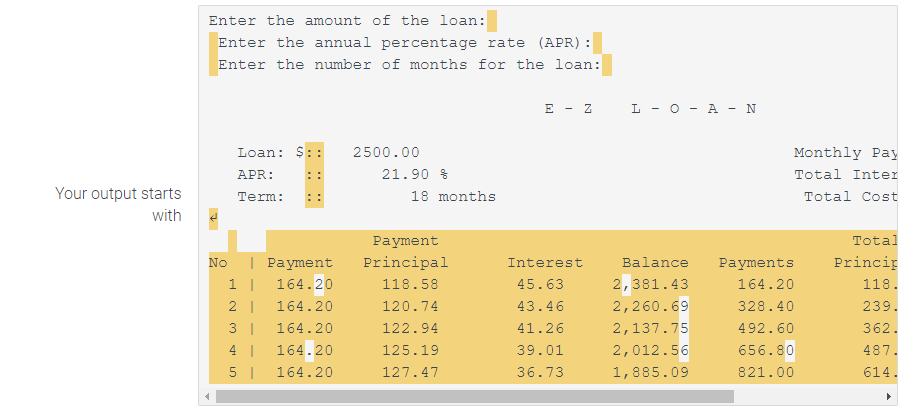

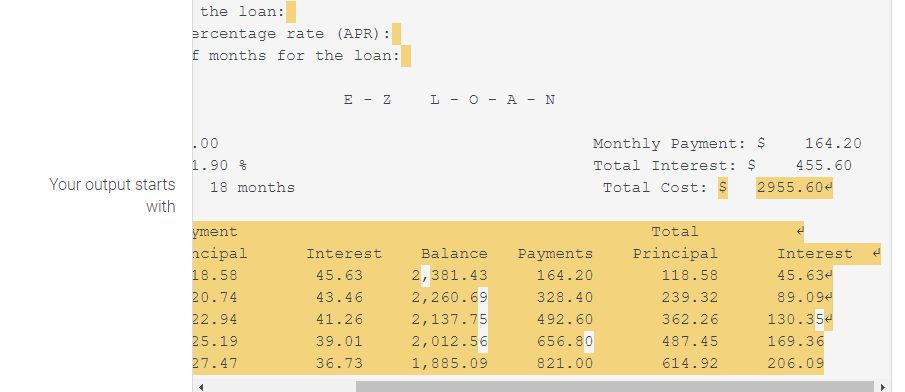

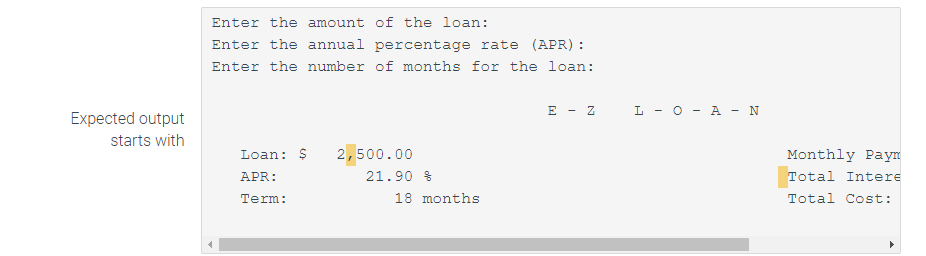

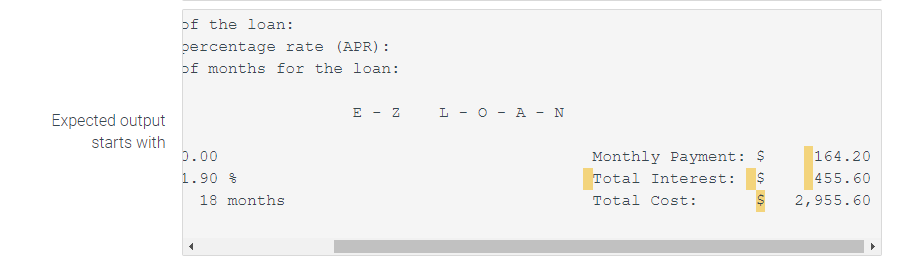

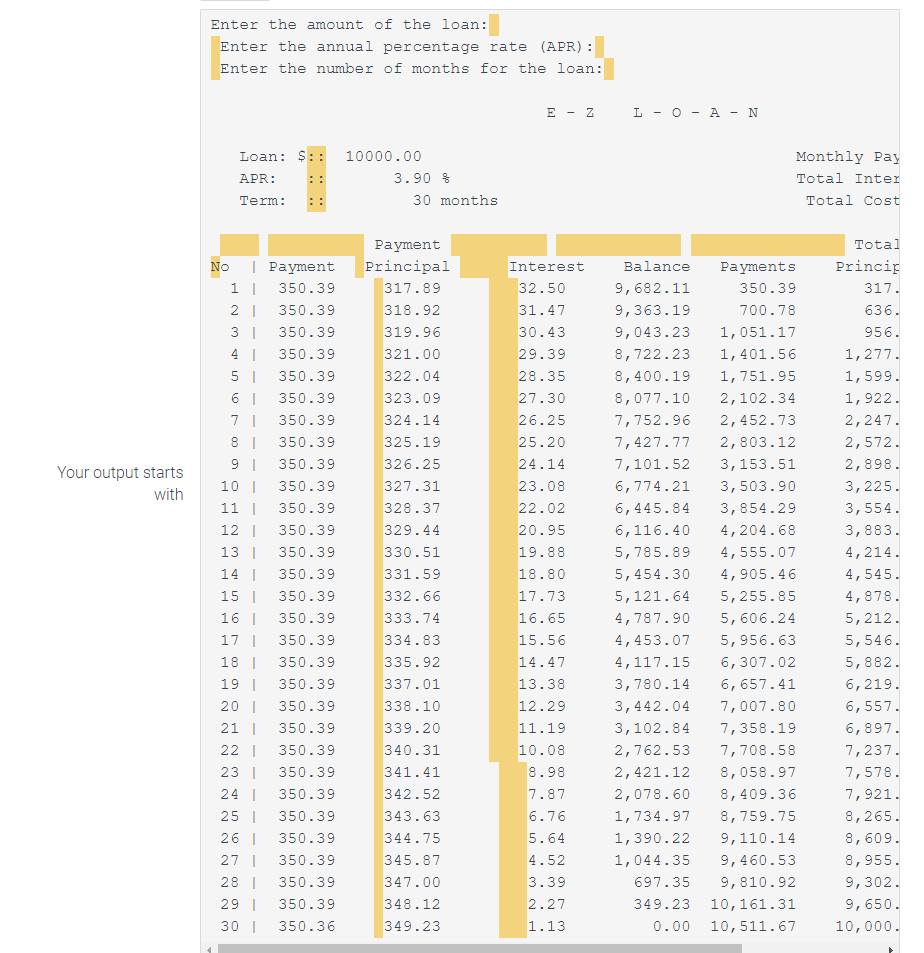

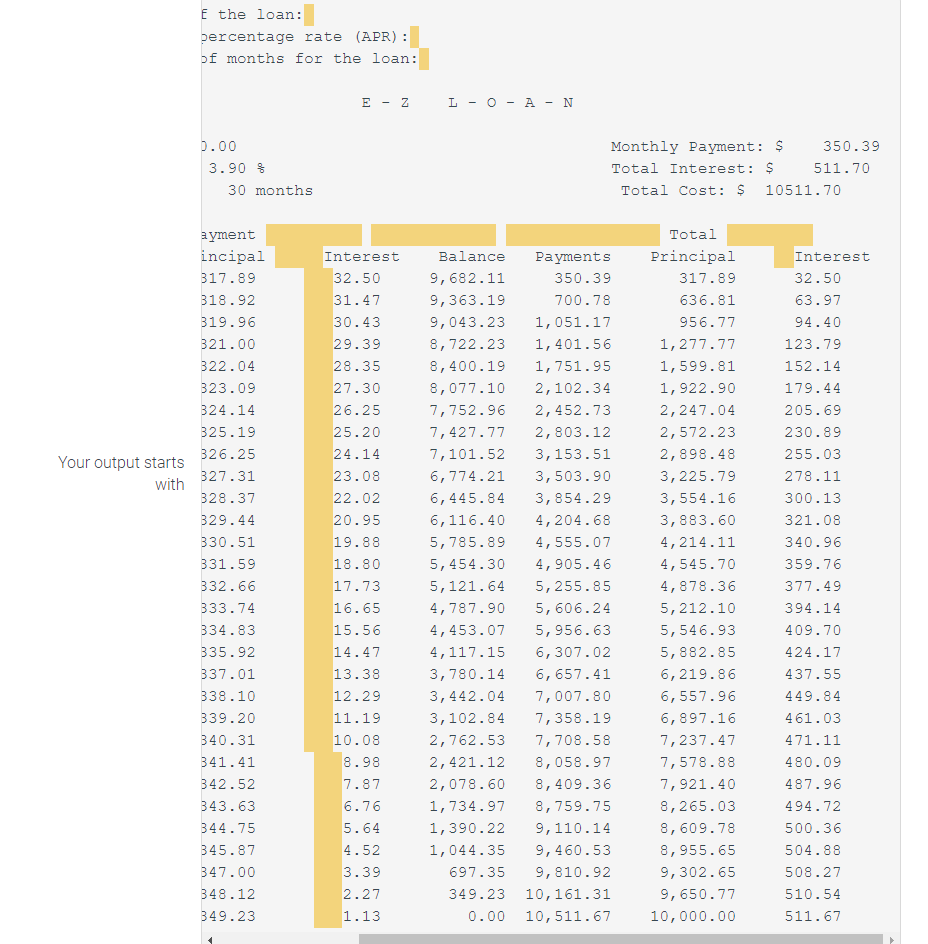

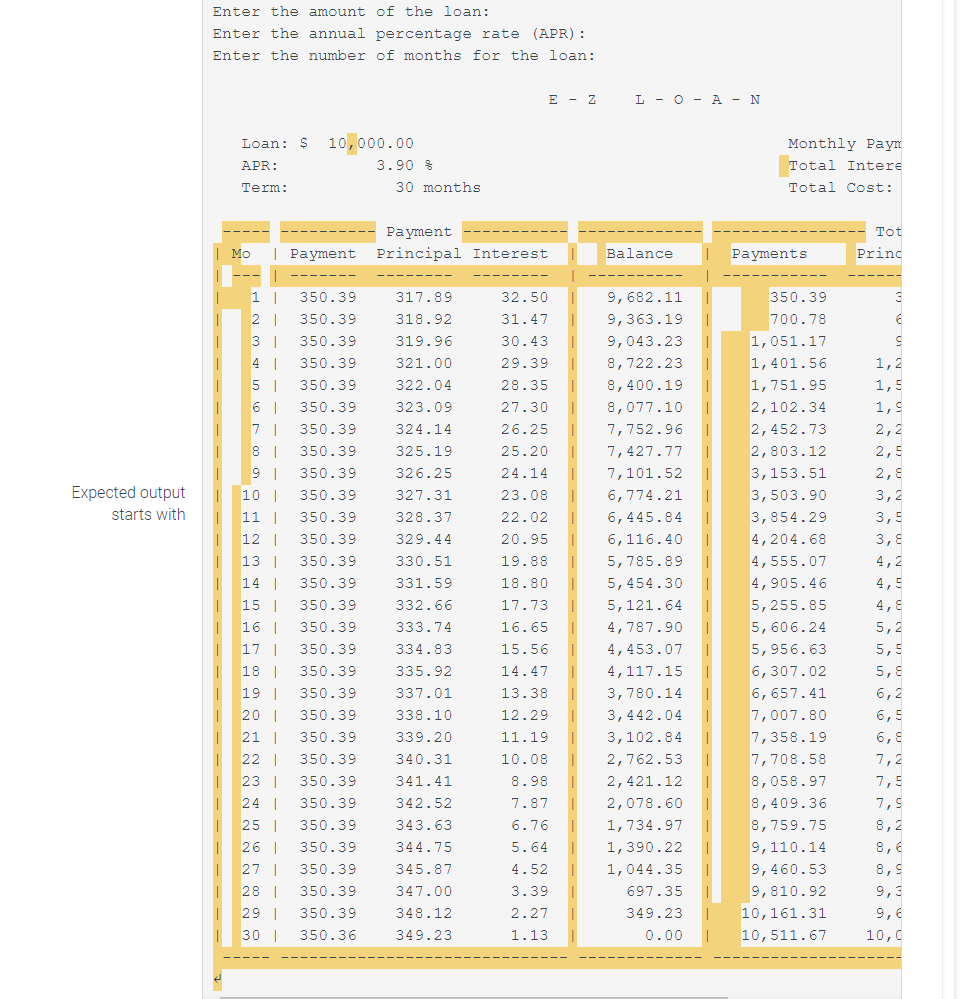

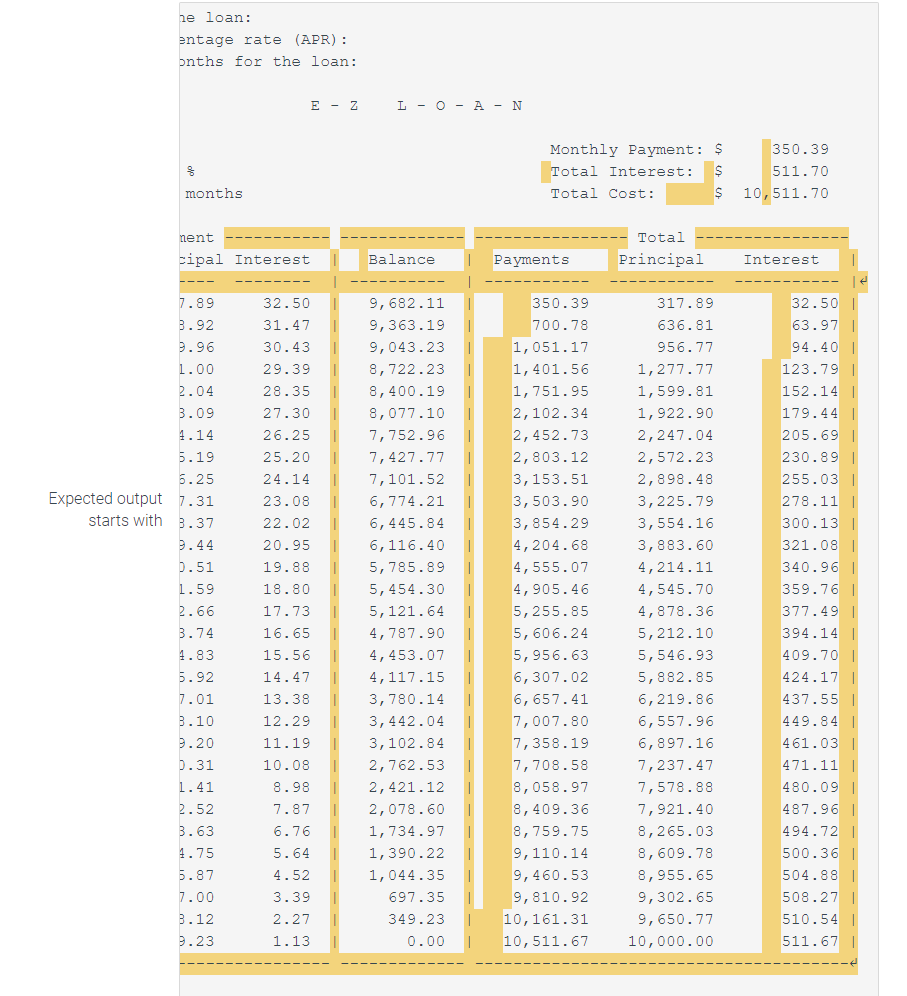

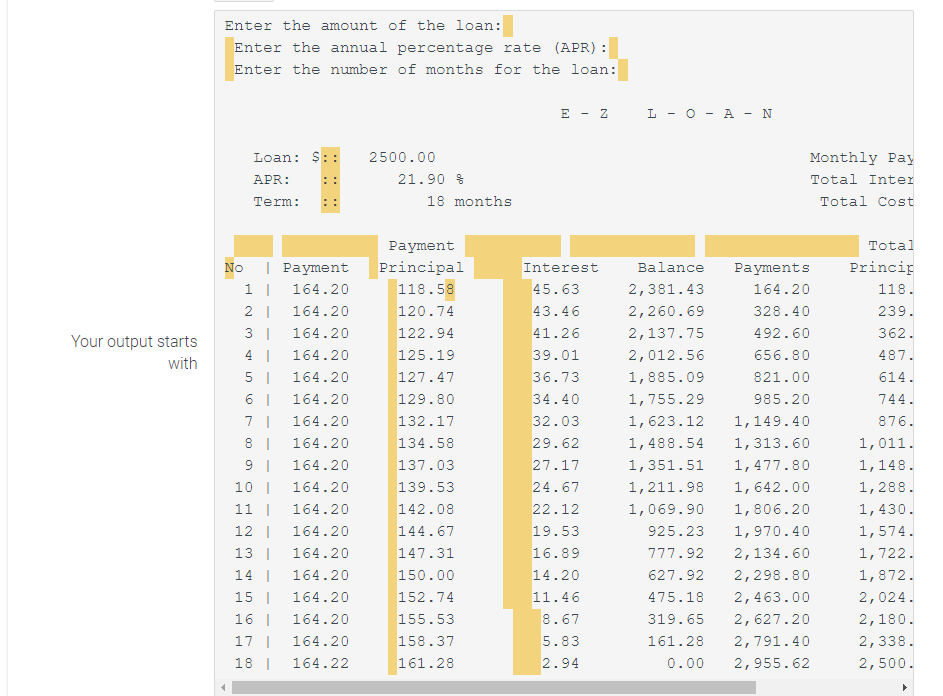

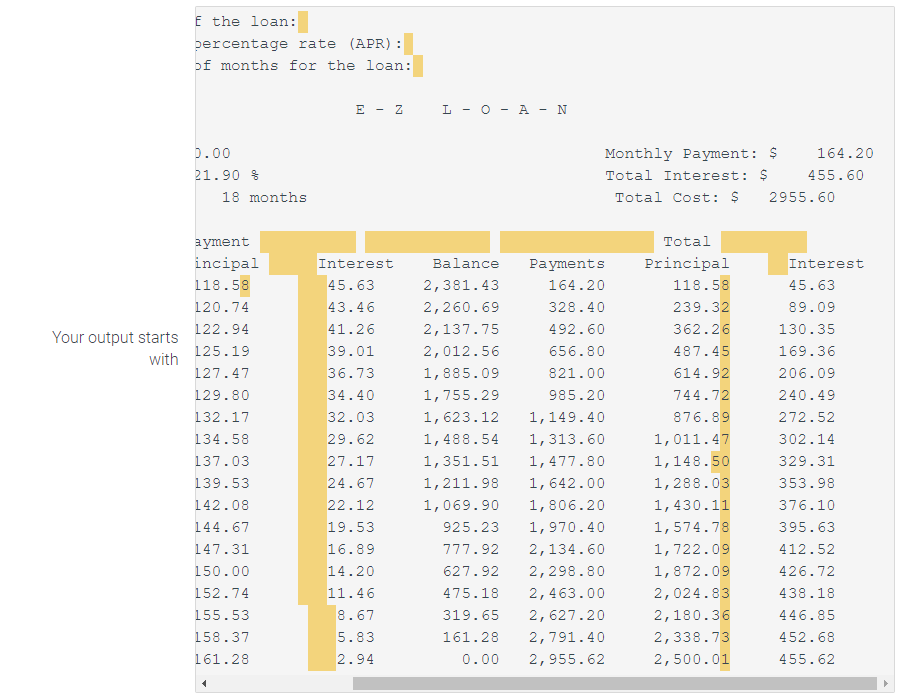

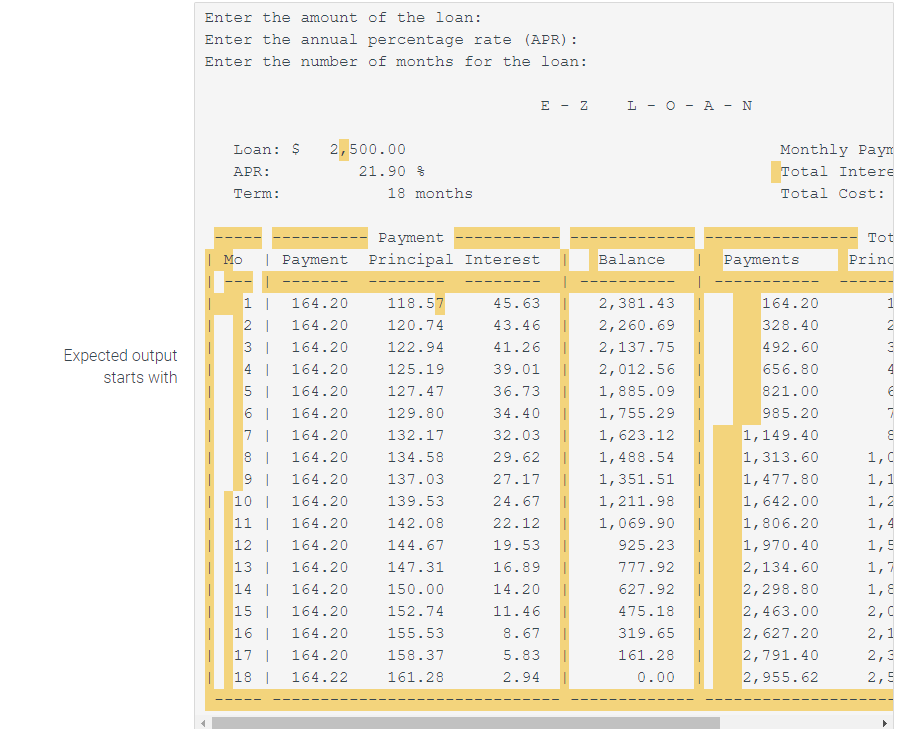

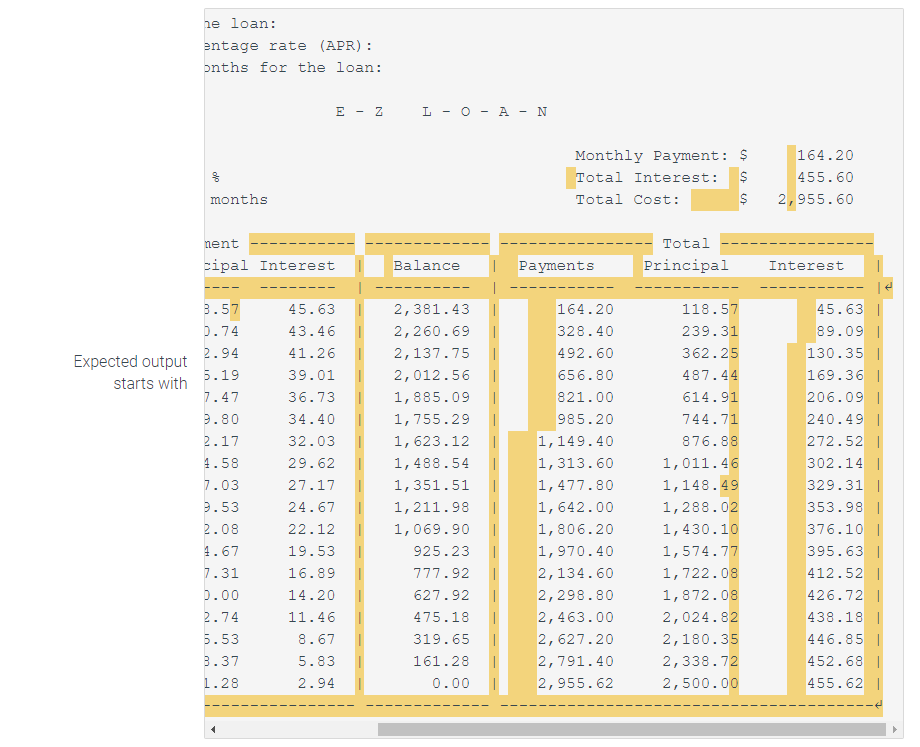

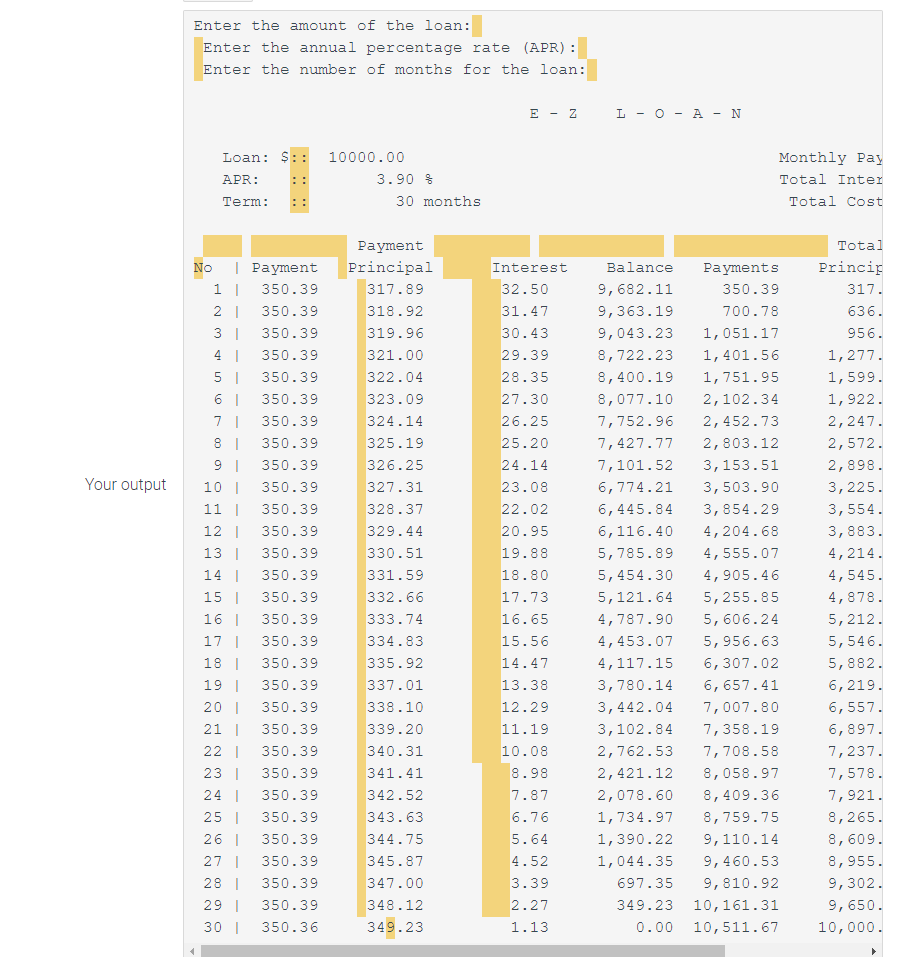

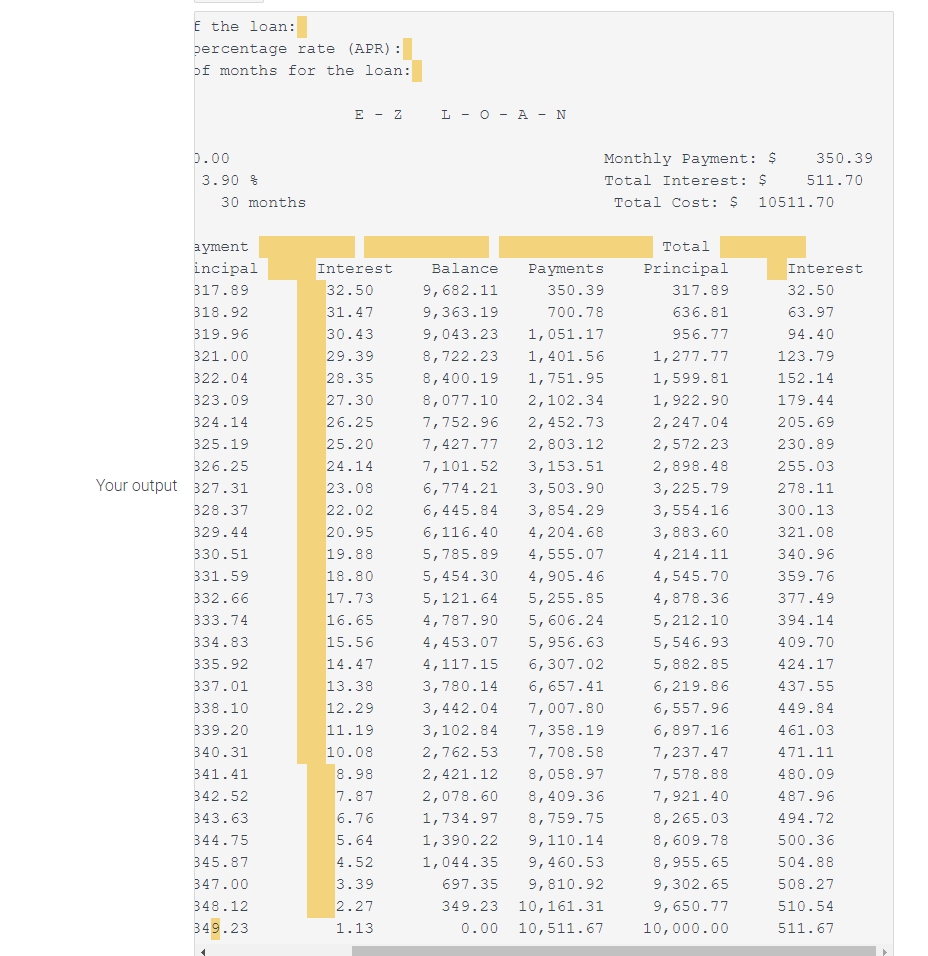

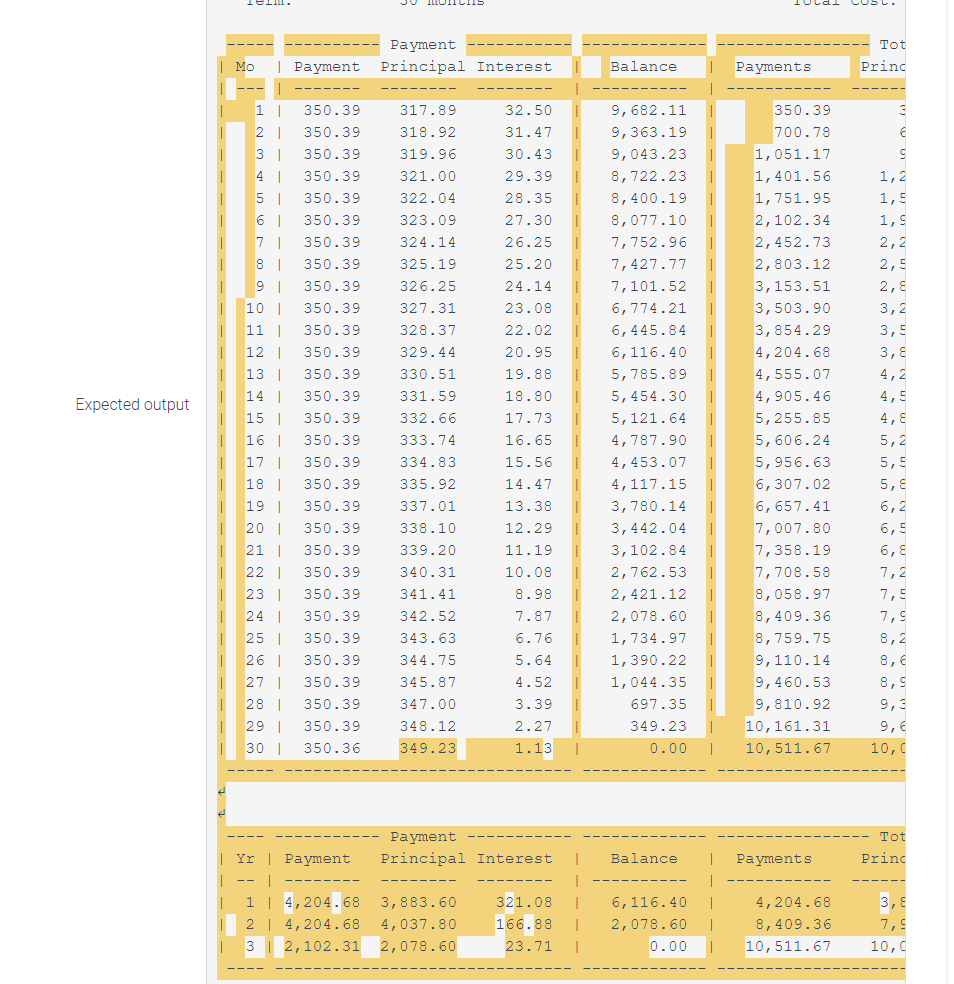

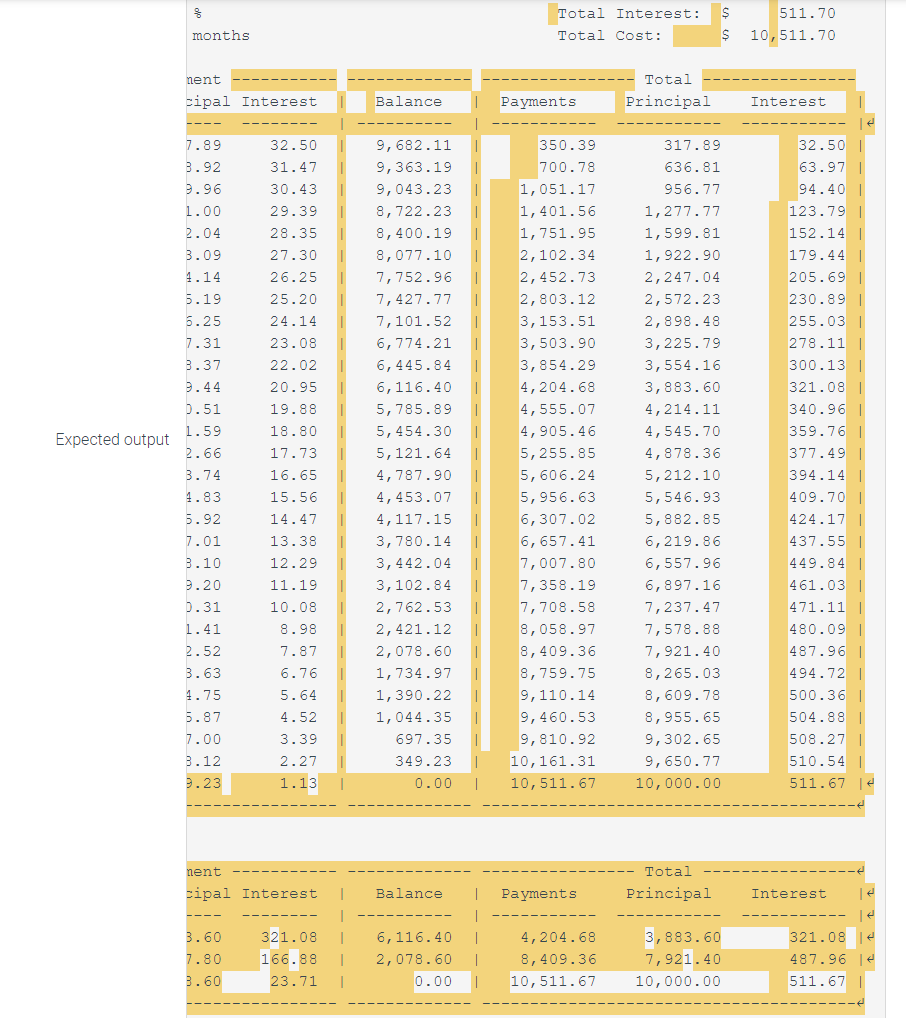

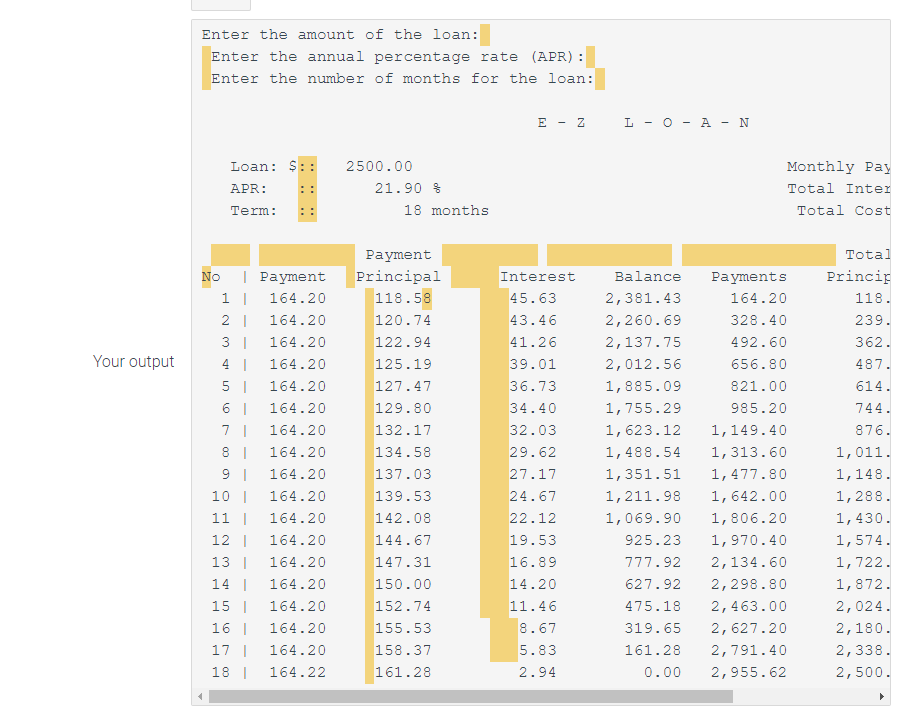

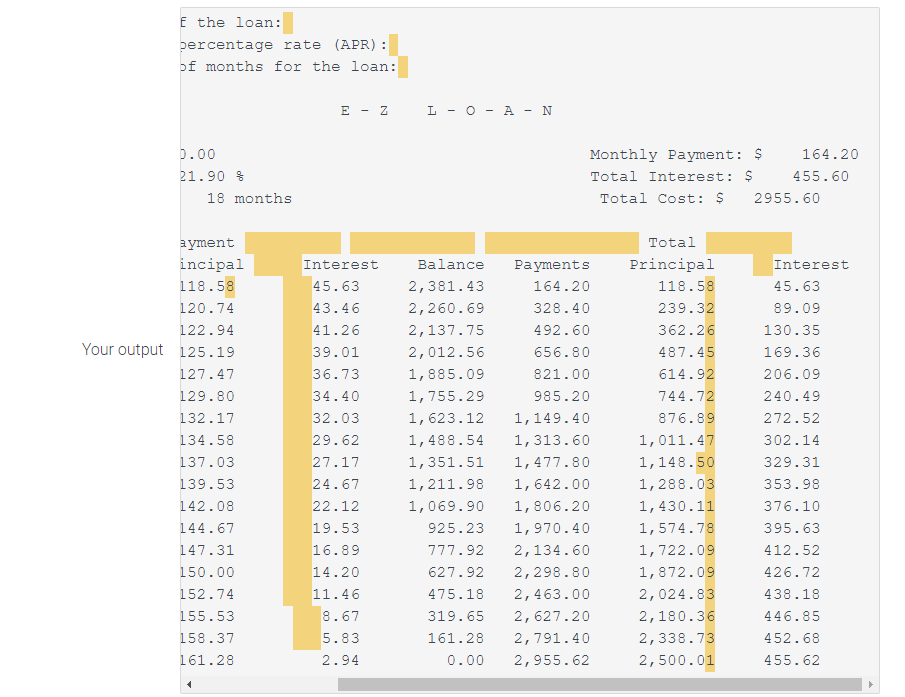

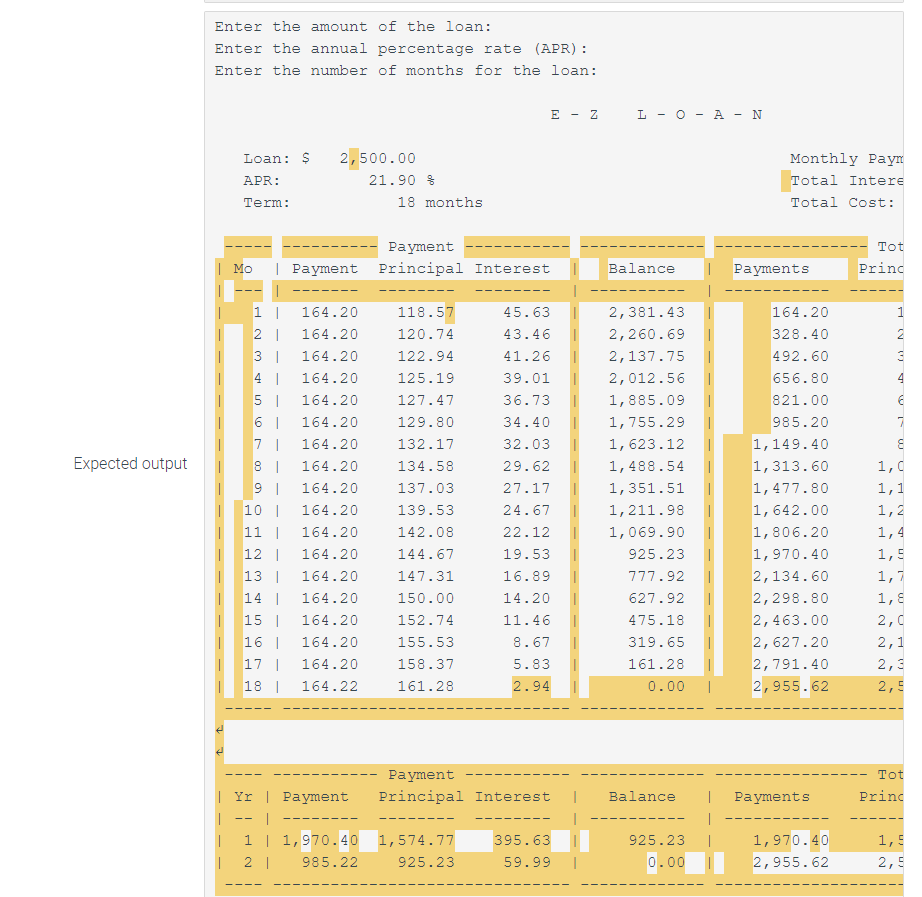

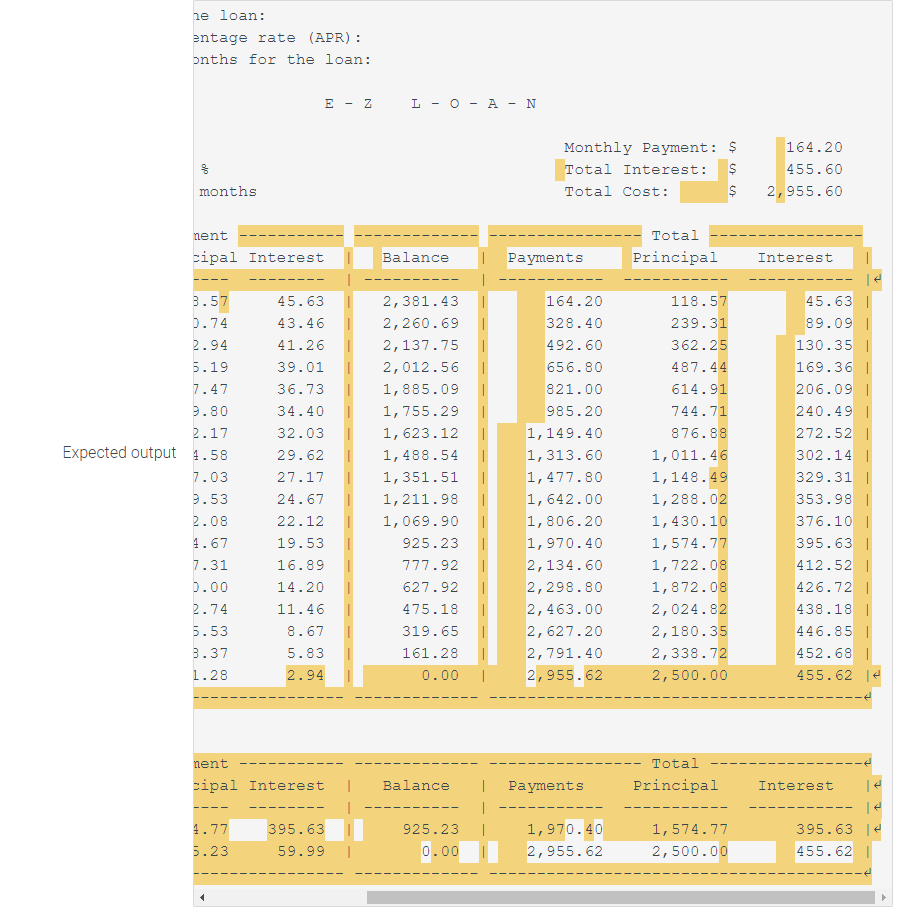

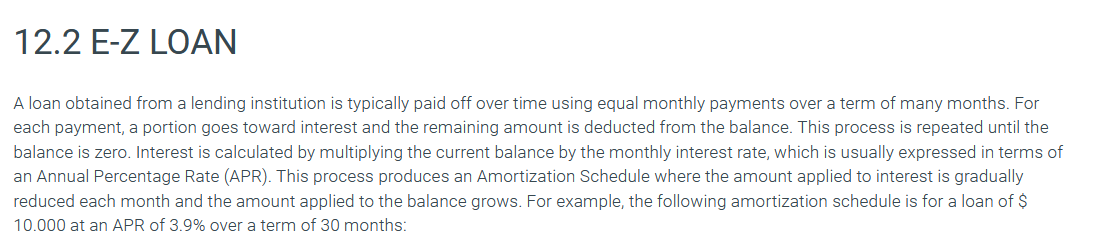

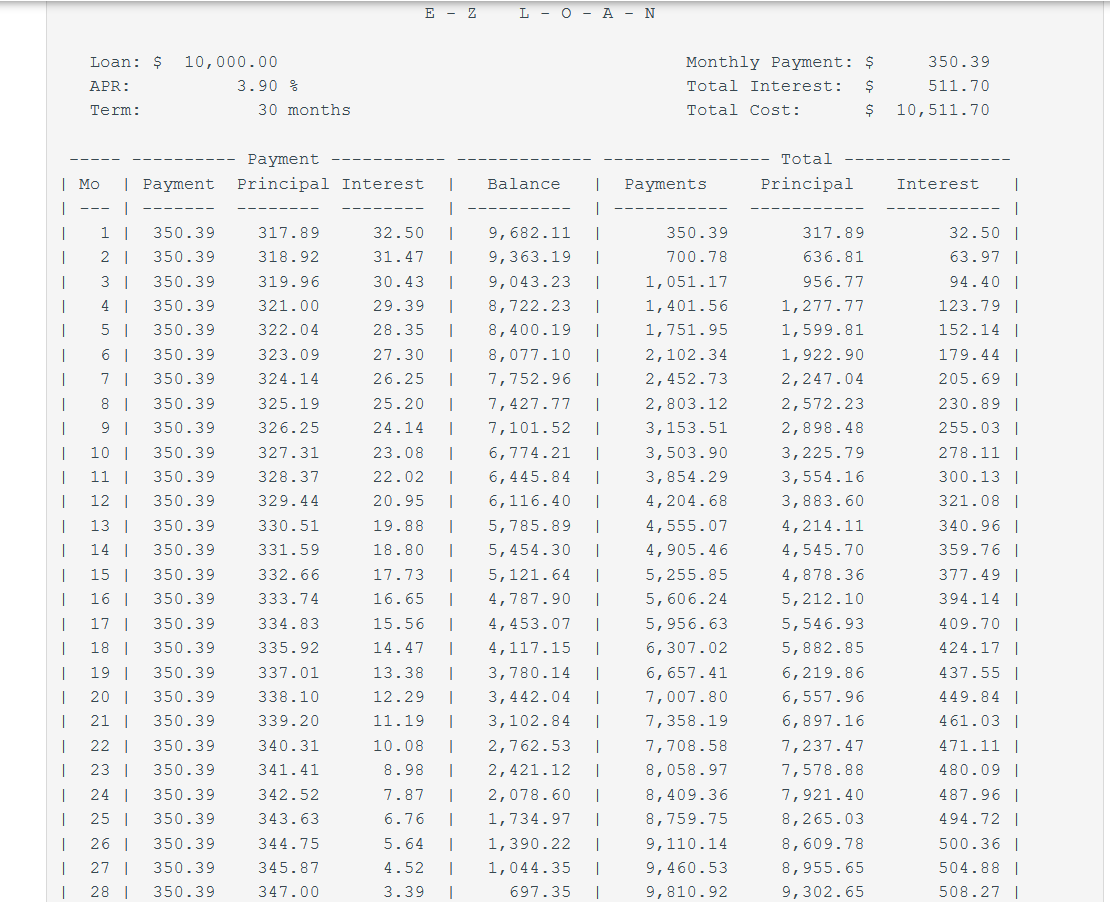

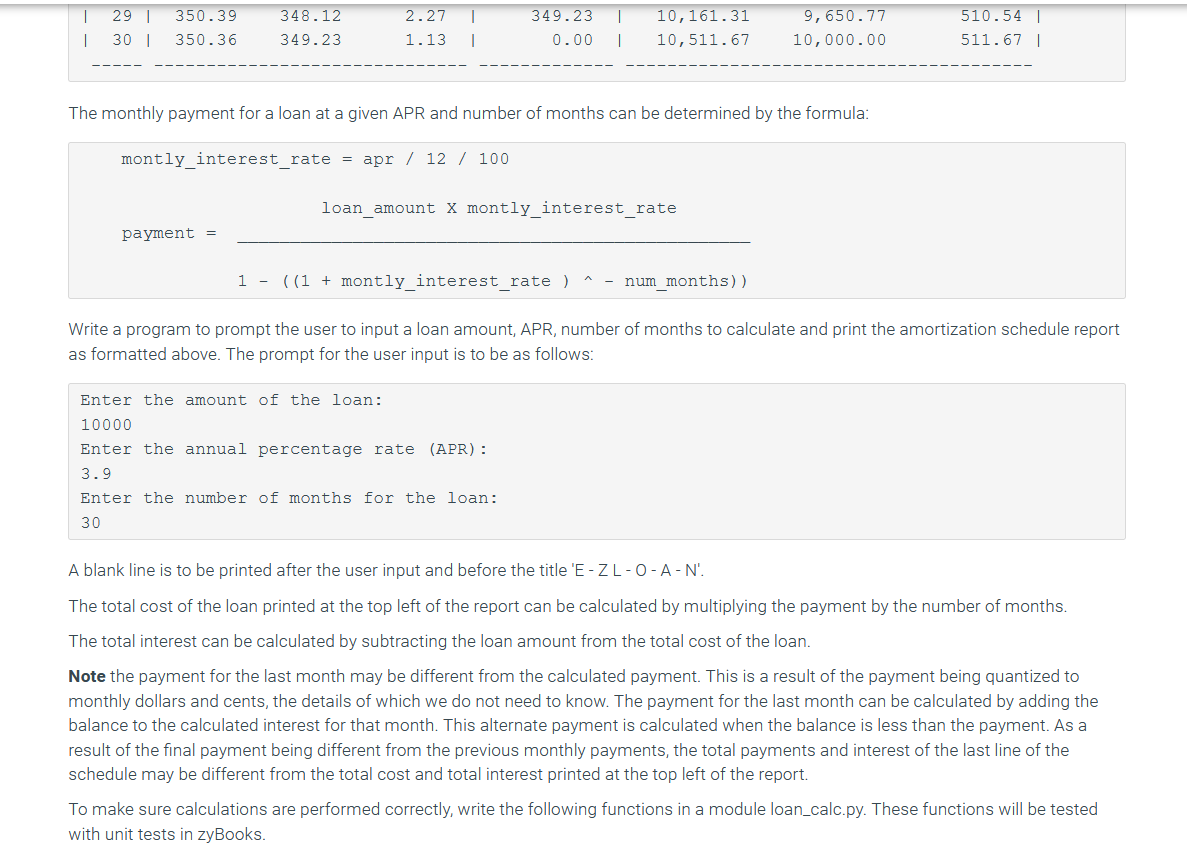

in the pictures is the output that I got and the output that I am supposed to get

((how can I fix it to get the all the Expected output ))?

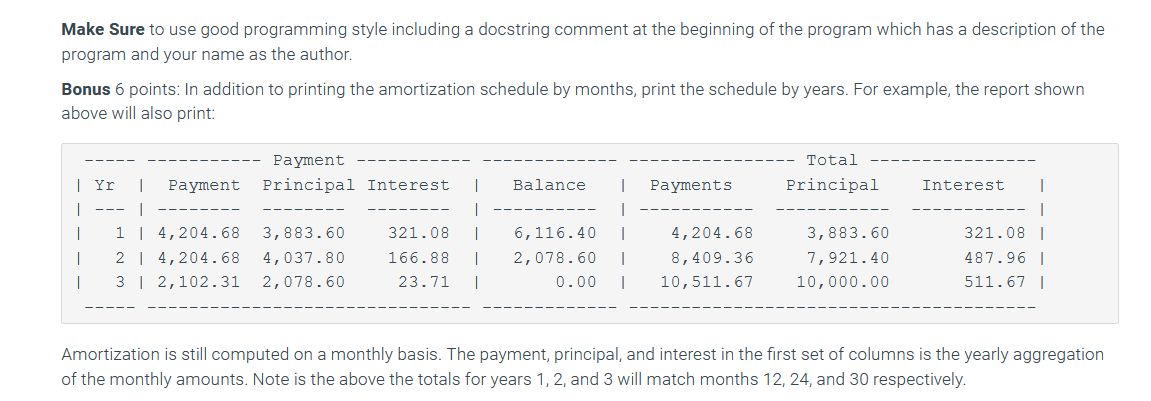

Enter the amount of the loan: Enter the annual percentage rate (APR) : Enter the number of months for the loan: E - Z L - O - A - N Loan: $ : : APR: Term: 10000.00 3.90 % 30 months Monthly Pay Total Inter Total Cost Your output starts with NO | Payment 1 350.39 1 350.39 31 350.39 41 350.39 5 350.39 6 350.39 7 350.39 8 350.39 9 350.39 10 | 350.39 11 350.39 12 l 350.39 13 350.39 14 | 350.39 15 l 350.39 16 | 350.39 17 | 350.39 18 | 350.39 19 350.39 20 350.39 21 | 350.39 22 350.39 23 | 350.39 24 ] 350.39 25 l 350.39 26 350.39 27 350.39 28 | 350.39 29 | 350.39 30 | 350.36 Payment Principal 317.89 318.92 319.96 321.00 322.04 323.09 324.14 325.19 326.25 327.31 328.37 329.44 330.51 331.59 332.66 333.74 334.83 335.92 337.01 338.10 339.20 340.31 341.41 342.52 343.63 344.75 345.87 347.00 348.12 349.23 Interest 32.50 31.47 30.43 29.39 28.35 27.30 26.25 25.20 24.14 23.08 22.02 20.95 19.88 18.80 17.73 16.65 15.56 14.47 13.38 12.29 11.19 10.08 8.98 7.87 6.76 5.64 4.52 3.39 2.27 1.13 Balance 9,682.11 9,363.19 9,043.23 8,722.23 8, 400.19 8,077.10 7,752.96 7,427.77 7,101.52 6,774.21 6,445.84 6,116.40 5,785.89 5, 454.30 5, 121.64 4,787.90 4,453.07 4,117.15 3,780.14 3,442.04 3,102.84 2,762.53 2,421.12 2,078.60 1,734.97 1,390.22 1,044.35 697.35 349.23 0.00 Payments 350.39 700.78 1,051.17 1,401.56 1,751.95 2,102.34 2,452.73 2,803.12 3,153.51 3,503.90 3,854.29 4,204.68 4,555.07 4,905.46 5,255.85 5, 606.24 5,956.63 6, 307.02 6, 657.41 7,007.80 7,358.19 7,708.58 8,058.97 8,409.36 8,759.75 9, 110.14 9,460.53 9,810.92 10,161.31 10,511.67 Total Princir 317. 636. 956. 1,277. 1,599. 1,922. 2,247. 2,572. 2,898. 3, 225. 3,554. 3,883. 4,214. 4,545. 4,878. 5,212 5,546. 5,882. 6,219. 6,557. 6,897. 7,237. 7,578. 7,921. 8, 265. 8, 609. 8, 955. 9,302. 9,650. 10,000. E the loan: percentage rate (APR) : of months for the loan: E - Z L - O - A - N 0.00 3.90 $ 30 months Monthly Payment: $ 350.39 Total Interest: $ 511.70 Total Cost: $ 10511.70 Your output starts with ayment incipal 317.89 318.92 319.96 321.00 B22.04 323.09 B24.14 325.19 326.25 B27.31 328.37 B29.44 330.51 B31.59 332.66 333.74 B34.83 335.92 337.01 338.10 339.20 340.31 B41.41 B42.52 B43.63 B44.75 B45.87 B47.00 348.12 349.23 Interest 32.50 31.47 30.43 29.39 28.35 27.30 26.25 25.20 24.14 23.08 22.02 20.95 19.88 18.80 17.73 16.65 15.56 14.47 13.38 12.29 11.19 10.08 8.98 7.87 6.76 5.64 4.52 3.39 2.27 1.13 Balance 9,682.11 9,363.19 9,043.23 8,722.23 8,400.19 8,077.10 7,752.96 7,427.77 7,101.52 6,774.21 6,445.84 6,116.40 5,785.89 5, 454.30 5, 121.64 4,787.90 4,453.07 4,117.15 3,780.14 3, 442.04 3,102.84 2,762.53 2, 421.12 2,078.60 1,734.97 1,390.22 1,044.35 697.35 349.23 0.00 Payments 350.39 700.78 1,051.17 1,401.56 1, 751.95 2,102.34 2,452.73 2,803.12 3,153.51 3,503.90 3,854.29 4,204.68 4,555.07 4,905.46 5,255.85 5, 606.24 5,956.63 6, 307.02 6, 657.41 7,007.80 7,358.19 7,708.58 8,058.97 8, 409.36 8,759.75 9, 110.14 9, 460.53 9,810.92 10,161.31 10,511.67 Total Principal 317.89 636.81 956.77 1,277.77 1,599.81 1,922.90 2,247.04 2,572.23 2,898.48 3,225.79 3,554.16 3,883.60 4,214.11 4,545.70 4,878.36 5, 212.10 5,546.93 5,882.85 6,219.86 6,557.96 6,897.16 7,237.47 7,578.88 7,921.40 8, 265.03 8,609.78 8,955.65 9,302.65 9,650.77 10,000.00 Interest 32.50 63.97 94.40 123.79 152.14 179.44 205.69 230.89 255.03 278.11 300.13 321.08 340.96 359.76 377.49 394.14 409.70 424.17 437.55 449.84 461.03 471.11 480.09 487.96 494.72 500.36 504.88 508.27 510.54 511.67 Enter the amount of the loan: Enter the annual percentage rate (APR): Enter the number of months for the loan: E - Z L - O - A - N Loan: $ 10,000.00 APR: 3.90 $ Term: 30 months Monthly Payr Total Intere Total Cost: Tot Payment Payment Principal Interest Balance Payments Princ ------- -------- -------- ---- |--- 1 21 3 4 | 5 6 1 1 1 Expected output starts with 1 1 1 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.36 317.89 318.92 319.96 321.00 322.04 323.09 324.14 325.19 326.25 327.31 328.37 329.44 330.51 331.59 332.66 333.74 334.83 335.92 337.01 338.10 339.20 340.31 341.41 342.52 343.63 344.75 345.87 347.00 348.12 349.23 81 9 | 10 1 11 1 12 13 14 151 16 | 17 18 19 20 21 1 22 | 23 24 | 25 | 261 27 1 281 29 | 30 ] 32.50 31.47 30.43 29.39 28.35 27.30 26.25 25.20 24.14 23.08 22.02 20.95 19.88 18.80 17.73 16.65 15.56 14.47 13.38 12.29 11.19 10.08 8.98 7.87 6.76 5.64 4.52 3.39 2.27 1.13 1,2 1,5 1,9 2,2 2,5 2,8 3,2 3,5 3,8 4,2 4,5 4,8 5,2 5,5 5,8 9,682.11 9,363.19 9,043.23 8,722.23 8, 400.19 8,077.10 7,752.96 7,427.77 7,101.52 6,774.21 6,445.84 6,116.40 5,785.89 5,454.30 5, 121.64 4,787.90 4,453.07 4,117.15 3,780.14 3,442.04 3,102.84 2,762.53 2,421.12 2,078.60 1,734.97 1,390.22 1,044.35 697.35 349.23 0.00 350.39 700.78 1,051.17 1,401.56 1,751.95 2,102.34 2,452.73 2,803.12 3,153.51 3,503.90 3,854.29 4, 204.68 4,555.07 4,905.46 5, 255.85 5, 606.24 5,956.63 6,307.02 6,657.41 7,007.80 7,358.19 7,708.58 8,058.97 8,409.36 8,759.75 9, 110.14 9, 460.53 9,810.92 10,161.31 10, 511.67 1 1 1 6,5 1 7,2 7,5 7,9 8,6 8,9 9,6 10,0 | ne loan: entage rate (APR) : onths for the loan: E - Z L - O - A - N Monthly Payment: $ Total Interest: S Total Cost: S 350.39 511.70 10,511.70 months nent cipal Interest Total Principal Balance Payments Interest ---- -------- Expected output starts with 7.89 8.92 9.96 1.00 2.04 3.09 4.14 5.19 5.25 7.31 3.37 9.44 0.51 1.59 2.66 3.74 1.83 5.92 7.01 3.10 9.20 0.31 1.41 2.52 3.63 1.75 5.87 7.00 3.12 9.23 32.50 31.47 30.43 29.39 28.35 27.30 26.25 25.20 24.14 23.08 22.02 20.95 19.88 18.80 17.73 16.65 15.56 14.47 13.38 12.29 11.19 10.08 8.98 7.87 6.76 5.64 4.52 3.39 2.27 1.13 9,682.11 9,363.19 9,043.23 8,722.23 8,400.19 8,077.10 7,752.96 7,427.77 7,101.52 6,774.21 6,445.84 6,116.40 5,785.89 5,454.30 5,121.64 4,787.90 4,453.07 4,117.15 3,780.14 3, 442.04 3,102.84 2,762.53 2,421.12 2,078.60 1,734.97 1,390.22 1,044.35 697.35 349.23 0.00 350.39 700.78 1,051.17 1,401.56 1,751.95 2,102.34 2,452.73 2,803.12 3,153.51 3,503.90 3,854.29 4,204.68 4,555.07 4,905.46 5,255.85 5, 606.24 5,956.63 6,307.02 6,657.41 7,007.80 7,358.19 7,708.58 8,058.97 8,409.36 8,759.75 9, 110.14 9,460.53 9,810.92 10,161.31 10, 511.67 317.89 636.81 956.77 1,277.77 1,599.81 1,922.90 2,247.04 2,572.23 2,898.48 3,225.79 3,554.16 3,883.60 4,214.11 4,545.70 4,878.36 5, 212.10 5,546.93 5,882.85 6,219.86 6,557.96 6,897.16 7, 237.47 7,578.88 7,921.40 8, 265.03 8,609.78 8, 955.65 9,302.65 9,650.77 10,000.00 32.50 63.97 94.40 123.79 152.14 179.44 205.69 230.89 255.03 278.11 300.13 321.08 340.96 359.76 377.49 394.14 409.70 424.17 437.55 449.84 461.03 471.11 480.09 487.96 494.72 500.36 504.88 508.27 510.54 511.67 Enter the amount of the loan: Enter the annual percentage rate (APR): Enter the number of months for the loan: E - Z L - O - A - N Loan: $:: APR: Term: 2500.00 21.90 $ 18 months Monthly Pay Total Inter Total Cost Your output starts with No | Payment 1 ] 164.20 2 164.20 3 164.20 4 l 164.20 5 164.20 Payment Principal 118.58 120.74 122.94 125.19 127.47 Interest 45.63 43.46 41.26 39.01 36.73 Balance 2,381.43 2,260.69 2,137.75 2,012.56 1,885.09 Payments 164.20 328.40 492.60 656.80 821.00 Total Princig 118. 239. 362. 487. 614. the loan: ercentage rate (APR) : f months for the loan: E - Z L - O - A - N .00 1.90 $ 18 months Monthly Payment: $ 164.20 Total Interest: $ 455.60 Total Cost: $ 2955.60 Your output starts with yment ncipal 18.58 20.74 22.94 25.19 27.47 Interest 45.63 43.46 41.26 39.01 36.73 Balance 2,381.43 2,260.69 2,137.75 2,012.56 1,885.09 Payments 164.20 328.40 492.60 656.80 821.00 Tot Principal 118.58 239.32 362.26 487.45 614.92 Interest 45.63 89.09 130.35 169.36 206.09 Enter the amount of the loan: Enter the annual percentage rate (APR) : Enter the number of months for the loan: E - Z L - O - A - N Expected output starts with Loan: $ APR: 2,500.00 21.908 18 months Monthly Payn Total Inters Total Cost: Term: of the loan: percentage rate (APR): of months for the loan: E - Z L - O - A - N Expected output starts with 0.00 1.90 18 months Monthly Payment: $ Total Interest: $ Total Cost: 164.20 455.60 2,955.60 Enter the amount of the loan: Enter the annual percentage rate (APR) : Enter the number of months for the loan: E - Z L - O - A - N Loan: $: : APR: Term: 10000.00 3.90 $ 30 months Monthly Pay Total Inter Total Cost Your output starts with No | Payment 1 350.39 I 350.39 3 350.39 4 350.39 5 350.39 350.39 7 | 350.39 8 | 350.39 9 | 350.39 10 | 350.39 11 | 350.39 12 | 350.39 13 | 350.39 14 | 350.39 15 | 350.39 16 | 350.39 17 | 350.39 18 | 350.39 19 | 350.39 20 | 350.39 21 | 350.39 22 | 350.39 23 | 350.39 24 | 350.39 25 | 350.39 26 | 350.39 27 | 350.39 28 | 350.39 29 | 350.39 30 350.36 Payment Principal 317.89 318.92 319.96 321.00 322.04 323.09 324.14 325.19 326.25 327.31 328.37 329.44 330.51 331.59 332.66 333.74 334.83 335.92 337.01 338.10 339.20 340.31 341.41 342.52 343.63 344.75 345.87 347.00 348.12 349.23 Interest 32.50 31.47 30.43 29.39 28.35 27.30 26.25 25.20 24.14 23.08 22.02 20.95 19.88 18.80 17.73 16.65 15.56 14.47 13.38 12.29 11.19 10.08 8.98 7.87 6.76 5.64 4.52 3.39 2.27 1.13 Balance 9,682.11 9,363.19 9,043.23 8,722.23 8, 400.19 8,077.10 7,752.96 7,427.77 7,101.52 6,774.21 6,445.84 6,116.40 5,785.89 5,454.30 5, 121.64 4,787.90 4,453.07 4,117.15 3,780.14 3, 442.04 3,102.84 2,762.53 2,421.12 2,078.60 1,734.97 1,390.22 1,044.35 697.35 349.23 0.00 Payments 350.39 700.78 1,051.17 1,401.56 1,751.95 2,102.34 2,452.73 2,803.12 3,153.51 3,503.90 3,854.29 4,204.68 4,555.07 4,905.46 5,255.85 5, 606.24 5,956.63 6,307.02 6,657.41 7,007.80 7,358.19 7,708.58 8,058.97 8, 409.36 8,759.75 9, 110.14 9,460.53 9,810.92 10,161.31 10, 511.67 Total Princir 317. 636. 956. 1,277. 1,599. 1,922. 2,247. 2,572. 2,898. 3,225. 3,554. 3,883. 4,214. 4,545. 4,878. 5, 212. 5,546. 5,882. 6,219. 6,557. 6,897. 7,237. 7,578. 7,921. 8, 265. 8,609. 8, 955. 9, 302. 9,650. 10,000. E the loan: percentage rate (APR) : of months for the loan: E - Z L - O - A - N 0.00 3.90 $ 30 months Monthly Payment: $ 350.39 Total Interest: $ 511.70 Total Cost: $ 10511.70 Your output starts with ayment incipal 317.89 318.92 319.96 B21.00 B22.04 B23.09 B24.14 B25.19 B26.25 327.31 B28.37 B29.44 B30.51 331.59 332.66 333.74 B34.83 B35.92 337.01 338.10 339.20 B40.31 B41.41 B42.52 343.63 B44.75 B45.87 347.00 B48.12 B49.23 Interest 32.50 31.47 30.43 29.39 28.35 27.30 26.25 25.20 24.14 23.08 22.02 20.95 19.88 18.80 17.73 16.65 15.56 14.47 13.38 12.29 11.19 10.08 8.98 7.87 6.76 5.64 4.52 3.39 2.27 1.13 Balance 9,682.11 9, 363.19 9,043.23 8,722.23 8, 400.19 8,077.10 7,752.96 7,427.77 7,101.52 6,774.21 6,445.84 6,116.40 5,785.89 5, 454.30 5, 121.64 4,787.90 4,453.07 4,117.15 3,780.14 3,442.04 3,102.84 2,762.53 2, 421.12 2,078.60 1,734.97 1,390.22 1,044.35 697.35 349.23 0.00 Payments 350.39 700.78 1,051.17 1,401.56 1,751.95 2,102.34 2,452.73 2,803.12 3,153.51 3,503.90 3,854.29 4,204.68 4,555.07 4,905.46 5,255.85 5, 606.24 5,956.63 6, 307.02 6,657.41 7,007.80 7,358.19 7,708.58 8,058.97 8, 409.36 8,759.75 9, 110.14 9,460.53 9,810.92 10,161.31 10,511.67 Total Principal 317.89 636.81 956.77 1,277.77 1,599.81 1,922.90 2,247.04 2,572.23 2,898.48 3, 225.79 3,554.16 3,883.60 4,214.11 4,545.70 4,878.36 5, 212.10 5,546.93 5,882.85 6,219.86 6,557.96 6,897.16 7,237.47 7,578.88 7,921.40 8, 265.03 8, 609.78 8,955.65 9,302.65 9,650.77 10,000.00 Interest 32.50 63.97 94.40 123.79 152.14 179.44 205.69 230.89 255.03 278.11 300.13 321.08 340.96 359.76 377.49 394.14 409.70 424.17 437.55 449.84 461.03 471.11 480.09 487.96 494.72 500.36 504.88 508.27 510.54 511.67 Enter the amount of the loan: Enter the annual percentage rate (APR): Enter the number of months for the loan: E - Z L - O - A - N Loan: $ 10,000.00 APR: 3.90 $ Term: 30 months Monthly Paym Total Intere Total Cost: Tot Balance Payments Princ 1 Expected output starts with Payment | Mo | Payment Principal Interest --- 1 350.39 317.89 32.50 2 1 350.39 318.92 31.47 3 350.39 319.96 30.43 4 1 350.39 321.00 29.39 51 350.39 322.04 28.35 350.39 323.09 27.30 71 350.39 324.14 26.25 350.39 325.19 25.20 91 350.39 326.25 24.14 10 ] 350.39 327.31 23.08 11 | 350.39 328.37 22.02 12 350.39 329.44 20.95 13 | 350.39 330.51 19.88 14 350.39 331.59 18.80 15 350.39 332.66 17.73 16 350.39 333.74 16.65 1 17 | 350.39 334.83 15.56 1 18 350.39 335.92 14.47 191 350.39 337.01 13.38 20 | 350.39 338.10 12.29 21 | 350.39 339.20 11.19 22 350.39 340.31 10.08 231 350.39 341.41 8.98 24 1 350.39 342.52 7.87 25 350.39 343.63 6.76 26 350.39 344.75 5.64 27 350.39 345.87 4.52 28 350.39 347.00 3.39 29 350.39 348.12 2.27 30 350.36 349.23 1.13 9,682.11 9,363.19 9,043.23 8,722.23 8,400.19 8,077.10 7,752.96 7, 427.77 7,101.52 6,774.21 6,445.84 6, 116.40 5,785.89 5, 454.30 5, 121.64 4,787.90 4,453.07 4,117.15 3,780.14 3,442.04 3, 102.84 2,762.53 2,421.12 2,078.60 1,734.97 1,390.22 1,044.35 697.35 349.23 0.00 350.39 700.78 1,051.17 1,401.56 1,751.95 2,102.34 2, 452.73 2,803.12 3,153.51 3, 503.90 3,854.29 4,204.68 4,555.07 4,905.46 5,255.85 5,606.24 5,956.63 6,307.02 6,657.41 7,007.80 7,358.19 7, 708.58 8,058.97 8,409.36 8, 759.75 9, 110.14 9,460.53 9,810.92 10,161.31 10,511.67 1,2 1,5 1,9 2,2 2,5 2,8 3,2 3,5 3,8 4,2 4,5 4,8 5,2 5,5 5,8 6,2 7,2 7,5 7,9 8,2 8,6 8,9 9,3 9,6 10,0 ne loan: ntage rate (APR) : onths for the loan: E - Z L - O - A - N Monthly Payment: $ Total Interest: S Total Cost: 350.39 511.70 10,511.70 months nent Total Principal cipal Interest Balance Payments Interest 32.50 7.89 3.92 9.96 1.00 2.04 3.09 1.14 5.19 6.25 Expected output 7.31 starts with 3.37 3.44 0.51 1.59 2.66 3.74 4.83 31.47 30.43 29.39 28.35 27.30 26.25 25.20 24.14 23.08 22.02 20.95 19.88 18.80 17.73 16.65 15.56 14.47 13.38 12.29 11.19 10.08 8.98 7.87 6.76 5.64 4.52 3.39 2.27 1.13 9,682.11 9,363.19 9,043.23 8,722.23 8,400.19 8,077.10 7,752.96 7,427.77 7,101.52 6, 774.21 6,445.84 6,116.40 5,785.89 5,454.30 5, 121.64 4,787.90 4,453.07 4,117.15 3,780.14 3,442.04 3,102.84 2,762.53 2,421.12 2,078.60 1,734.97 1,390.22 1,044.35 697.35 349.23 0.00 350.39 700.78 1,051.17 1,401.56 1,751.95 2,102.34 2,452.73 2,803.12 3,153.51 3,503.90 3,854.29 4,204.68 4,555.07 4,905.46 5, 255.85 5, 606.24 5,956.63 6,307.02 6,657.41 7,007.80 7,358.19 7,708.58 8,058.97 8,409.36 8,759.75 9, 110.14 9, 460.53 9,810.92 10,161.31 10,511.67 317.89 636.81 956.77 1,277.77 1,599.81 1,922.90 2,247.04 2,572.23 2,898.48 3,225.79 3,554.16 3,883.60 4,214.11 4,545.70 4,878.36 5, 212.10 5, 546.93 5,882.85 6,219.86 6,557.96 6,897.16 7,237.47 7,578.88 7,921.40 8, 265.03 8,609.78 8, 955.65 9,302.65 9,650.77 10,000.00 32.50 63.97 | 94.40 | 123.79 | 152.14 | 179.44 | 205.691 230.89 255.03 | 278.11 | 300.13 321.08 | 340.96 | 359.76 | 377.491 394.14 | 409.70 | 424.17 437.55 | 449.84 | 461.03 471.11 | 480.09 | 487.96 | 494.72 | 500.36 | 504.88 | 508.27 | 510.54 511.67 5.92 1 7.01 3.10 9.20 0.31 1.41 2.52 3.63 1.75 5.87 7.00 3.12 9.23 1 Enter the amount of the loan: Enter the annual percentage rate (APR): Enter the number of months for the loan: E - Z L - O - A - N Loan: $: APR: Term: 2500.00 21.90 % 18 months Monthly Pay Total Inter Total Cost Your output starts with No | Payment 1 164.20 2 164.20 3 164.20 4 164.20 5 164.20 6 164.20 7 164.20 8 ] 164.20 9 | 164.20 10 | 164.20 11 | 164.20 121 164.20 13] 164.20 14 164.20 15 | 164.20 16 | 164.20 17 | 164.20 18 ] 164.22 Payment Principal 118.58 120.74 122.94 125.19 127.47 129.80 132.17 134.58 137.03 139.53 142.08 144.67 147.31 150.00 152.74 155.53 158.37 161.28 Interest 45.63 43.46 41.26 39.01 36.73 34.40 32.03 29.62 27.17 24.67 22.12 19.53 16.89 14.20 11.46 8.67 5.83 2.94 Balance 2,381.43 2,260.69 2,137.75 2,012.56 1,885.09 1,755.29 1,623.12 1,488.54 1,351.51 1,211.98 1,069.90 925.23 777.92 627.92 475.18 319.65 161.28 0.00 Payments 164.20 328.40 492.60 656.80 821.00 985.20 1,149.40 1, 313.60 1,477.80 1,642.00 1,806.20 1,970.40 2,134.60 2,298.80 2,463.00 2,627.20 2,791.40 2,955.62 Total Princip 118. 239. 362. 487. 614. 744. 876. 1,011. 1,148. 1,288. 1,430. 1,574. 1,722. 1,872 2,024. 2,180. 2,338. 2,500. E the loan: percentage rate (APR) : of months for the loan: E - Z L - O - A - N 0.00 21.90 % 18 months Monthly Payment: $ 164.20 Total Interest: $ 455.60 Total Cost: $ 2955.60 Your output starts with ayment incipal 118.58 120.74 122.94 125.19 127.47 129.80 132.17 134.58 137.03 139.53 142.08 144.67 147.31 150.00 152.74 155.53 158.37 161.28 Interest 45.63 43.46 41.26 39.01 36.73 34.40 32.03 29.62 27.17 24.67 22.12 19.53 16.89 14.20 11.46 8.67 5.83 2.94 Balance 2,381.43 2,260.69 2,137.75 2,012.56 1,885.09 1,755.29 1,623.12 1,488.54 1,351.51 1,211.98 1,069.90 925.23 777.92 627.92 475.18 319.65 161.28 0.00 Payments 164.20 328.40 492.60 656.80 821.00 985.20 1,149.40 1, 313.60 1,477.80 1,642.00 1,806.20 1,970.40 2,134.60 2,298.80 2,463.00 2,627.20 2,791.40 2,955.62 Total Principal 118.58 239.32 362.26 487.45 614.92 744.72 876.89 1,011.47 1,148.50 1,288.03 1,430.11 1,574.78 1,722.09 1,872.09 2,024.83 2,180.36 2,338.73 2,500.01 Interest 45.63 89.09 130.35 169.36 206.09 240.49 272.52 302.14 329.31 353.98 376.10 395.63 412.52 426.72 438.18 446.85 452.68 455.62 Enter the amount of the loan: Enter the annual percentage rate (APR): Enter the number of months for the loan: E - Z L - O - A - N Loan: $ APR: Term: 2,500.00 21.90 $ 18 months Monthly Payn Total Intere Total Cost: - - - Payment | Payment Principal Interest Tot Princ Mo Balance Payments ---- 1 2 3 Expected output starts with 1 l 21 3 4 51 6 7 4 7 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.22 91 10 11 1 12 13 14 | 15 16 17 18 ] 118.57 120.74 122.94 125.19 127.47 129.80 132.17 134.58 137.03 139.53 142.08 144.67 147.31 150.00 152.74 155.53 158.37 161.28 45.63 43.46 41.26 39.01 36.73 34.40 32.03 29.62 27.17 24.67 22.12 19.53 16.89 14.20 11.46 8.67 5.83 2.94 2,381.43 2,260.69 2,137.75 2,012.56 1,885.09 1,755.29 1,623.12 1,488.54 1,351.51 1,211.98 1,069.90 925.23 777.92 627.92 475.18 319.65 161.28 0.00 164.20 328.40 492.60 656.80 821.00 985.20 1,149.40 1,313.60 1,477.80 1,642.00 1,806.20 1,970.40 2,134.60 2,298.80 2,463.00 2,627.20 2,791.40 2,955.62 | & 1, 1,1 1,2 1,4 1,5 1,7 1,8 2,0 2,1 2,3 2,5 | I ne loan: ntage rate (APR) : onths for the loan: E - Z L - O - A - N Monthly Payment: $ Total Interest: $ Total Cost: $ 164.20 455.60 2,955.60 months - - - - - - - nent cipal Interest Total Principal Balance Payments Interest - - - -- Expected output starts with 3.57 0.74 2.94 5.19 7.47 9.80 2.17 1.58 7.03 9.53 2.08 1.67 7.31 0.00 2.74 5.53 3.37 1.28 1 45.63 43.46 41.26 39.01 36.73 34.40 32.03 29.62 27.17 24.67 22.12 19.53 16.89 14.20 11.46 8.67 5.83 2.94 2,381.43 2,260.69 2,137.75 2,012.56 1,885.09 1,755.29 1,623.12 1,488.54 1,351.51 1,211.98 1,069.90 925.23 777.92 627.92 164.20 328.40 492.60 656.80 821.00 985.20 1,149.40 1,313.60 1,477.80 1,642.00 1,806.20 1,970.40 2,134.60 2,298.80 2,463.00 2,627.20 2,791.40 2,955.62 118.57 239.31 362.25 487.44 614.91 744.71 876.88 1,011.46 1,148.49 1,288.02 1,430.10 1,574.77 1,722.08 1,872.08 2,024.82 2,180.35 2,338.72 2,500.00 45.63 | 89.09 | 130.35 | 169.36 | 206.09 | 240.49 | 272.52 302.14 | 329.31 | 353.98 376.10 | 395.63 412.52 | 426.72 438.18 | 446.85 | 452.68 455.62 | 1 1 1 475.18 319.65 161.28 0.00 | 1 1 - - - - - Enter the amount of the loan: Enter the annual percentage rate (APR) : Enter the number of months for the loan: E - Z L - O - A - N Loan: $: : APR: Term: 10000.00 3.90 % 30 months Monthly Pay Total Inter Total Cost Your output No | Payment 1 350.39 2 L 350.39 3 1 350.39 4 350.39 5 350.39 6 | 350.39 7 | 350.39 8L 350.39 9 350.39 10 | 350.39 11 | 350.39 12 ] 350.39 13 | 350.39 14 350.39 15 350.39 16 350.39 17 350.39 18 350.39 191 350.39 20 350.39 21 | 350.39 22 350.39 23 350.39 24 | 350.39 25 l 350.39 261 350.39 27 350.39 28 | 350.39 29 | 350.39 30 350.36 Payment Principal 317.89 318.92 319.96 321.00 322.04 323.09 324.14 325.19 326.25 327.31 328.37 329.44 330.51 331.59 332.66 333.74 334.83 335.92 337.01 338.10 339.20 340.31 341.41 342.52 343.63 344.75 345.87 347.00 348.12 349.23 Interest 32.50 31.47 30.43 29.39 28.35 27.30 26.25 25.20 24.14 23.08 22.02 20.95 19.88 18.80 17.73 16.65 15.56 14.47 13.38 12.29 11.19 10.08 8.98 7.87 6.76 5.64 4.52 3.39 2.27 1.13 Balance 9,682.11 9,363.19 9,043.23 8,722.23 8, 400.19 8,077.10 7,752.96 7,427.77 7,101.52 6,774.21 6,445.84 6,116.40 5,785.89 5, 454.30 5, 121.64 4,787.90 4,453.07 4,117.15 3,780.14 3,442.04 3,102.84 2,762.53 2,421.12 2,078.60 1,734.97 1,390.22 1,044.35 697.35 349.23 0.00 Payments 350.39 700.78 1,051.17 1,401.56 1, 751.95 2,102.34 2,452.73 2,803.12 3,153.51 3,503.90 3,854.29 4,204.68 4,555.07 4,905.46 5, 255.85 5, 606.24 5,956.63 6, 307.02 6,657.41 7,007.80 7,358.19 7,708.58 8,058.97 8,409.36 8,759.75 9, 110.14 9, 460.53 9,810.92 10,161.31 10,511.67 Total Princir 317. 636. 956. 1,277. 1,599. 1,922. 2,247. 2,572. 2,898. 3,225. 3,554. 3,883. 4,214. 4,545. 4,878. 5, 212. 5,546. 5,882. 6,219. 6,557. 6,897. 7,237. 7,578. 7,921. 8, 265. 8,609. 8, 955. 9,302. 9,650. 10,000. E the loan: percentage rate (APR): of months for the loan: E - Z L - O - A - N 0.00 3.90 % 30 months Monthly Payment: $ 350.39 Total Interest: $ 511.70 Total Cost: $ 10511.70 ayment incipal 317.89 B18.92 319.96 321.00 322.04 B23.09 B24.14 325.19 B26.25 Your output 327.31 B28.37 329.44 330.51 331.59 B32.66 333.74 334.83 B35.92 B37.01 338.10 339.20 B40.31 B41.41 B42.52 B43.63 B44.75 B45.87 347.00 B48.12 B49.23 Interest 32.50 31.47 30.43 29.39 28.35 27.30 26.25 25.20 24.14 23.08 22.02 20.95 19.88 18.80 17.73 16.65 15.56 14.47 13.38 12.29 11.19 10.08 8.98 7.87 6.76 5.64 4.52 3.39 2.27 1.13 Balance 9,682.11 9,363.19 9,043.23 8,722.23 8, 400.19 8,077.10 7,752.96 7,427.77 7,101.52 6,774.21 6,445.84 6,116.40 5,785.89 5,454.30 5, 121.64 4,787.90 4,453.07 4,117.15 3,780.14 3, 442.04 3,102.84 2,762.53 2,421.12 2,078.60 1,734.97 1,390.22 1,044.35 697.35 349.23 0.00 Payments 350.39 700.78 1,051.17 1,401.56 1,751.95 2,102.34 2,452.73 2,803.12 3,153.51 3,503.90 3,854.29 4,204.68 4,555.07 4,905.46 5, 255.85 5, 606.24 5,956.63 6, 307.02 6,657.41 7,007.80 7,358.19 7,708.58 8,058.97 8,409.36 8,759.75 9, 110.14 9,460.53 9,810.92 10,161.31 10,511.67 Total Principal 317.89 636.81 956.77 1,277.77 1,599.81 1,922.90 2,247.04 2,572.23 2,898.48 3, 225.79 3,554.16 3,883.60 4,214.11 4,545.70 4,878.36 5,212.10 5,546.93 5,882.85 6,219.86 6,557.96 6,897.16 7, 237.47 7,578.88 7,921.40 8,265.03 8,609.78 8, 955.65 9,302.65 9,650.77 10,000.00 Interest 32.50 63.97 94.40 123.79 152.14 179.44 205.69 230.89 255.03 278.11 300.13 321.08 340.96 359.76 377.49 394.14 409.70 424.17 437.55 449.84 461.03 471.11 480.09 487.96 494.72 500.36 504.88 508.27 510.54 511.67 IELILL JOITLIIS Payment | Payment Principal Interest Tot Princ Balance Payments 1 2 3 C 9 1,2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 | 17 18 1 19 20 21 22 23 24 25 261 27 28 291 30 Expected output 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.39 350.36 317.89 318.92 319.96 321.00 322.04 323.09 324.14 325.19 326.25 327.31 328.37 329.44 330.51 331.59 332.66 333.74 334.83 335.92 337.01 338.10 339.20 340.31 341.41 342.52 343.63 344.75 345.87 347.00 348.12 349.23 32.50 31.47 30.43 29.39 28.35 27.30 26.25 25.20 24.14 23.08 22.02 20.95 19.88 18.80 17.73 16.65 15.56 14.47 13.38 12.29 11.19 10.08 8.98 7.87 6.76 5.64 4.52 3.39 2.27 1.13 9,682.11 9,363.19 9,043.23 8,722.23 8,400.19 8,077.10 7,752.96 7,427.77 7, 101.52 6,774.21 6,445.84 6,116.40 5,785.89 5, 454.30 5, 121.64 4,787.90 4,453.07 4,117.15 3,780.14 3,442.04 3,102.84 2,762.53 2,421.12 2,078.60 1,734.97 1,390.22 1,044.35 697.35 349.23 0.00 350.39 700.78 1,051.17 1,401.56 1,751.95 2,102.34 2,452.73 2,803.12 3,153.51 3, 503.90 3,854.29 4,204.68 4,555.07 4,905.46 5, 255.85 5,606.24 5,956.63 6, 307.02 6,657.41 7,007.80 7,358.19 7,708.58 8,058.97 8, 409.36 8,759.75 9, 110.14 9,460.53 9,810.92 10,161.31 10,511.67 1,5 1,9 2,2 2,5 2,8 3,2 3,5 3,8 4,2 4,9 4,8 5,2 5,5 5,8 6,5 6,8 7,2 7,5 7,9 8,2 8,9 9,3 9,6 10,6 Yr | Payment Payment Principal Interest Balance Payments Princ -- 1 1 | 4,204.68 2 / 4,204.68 3 2,102.31 3,883.60 4,037.80 2,078.60 321.08 166.88 23.71 1 1 6,116.40 2,078.60 0.00 4,204.68 8,409.36 10, 511.67 3,& 7,5 10,0 $ S Total Interest: Total Cost: 511.70 10,511.70 months nent cipal Interest Total Principal Balance Payments Interest ---- Expected output 7.89 3.92 9.96 1.00 2.04 3.09 1.14 5.19 5.25 7.31 3.37 9.44 0.51 1.59 2.66 3.74 4.83 5.92 7.01 3.10 9.20 0.31 1.41 2.52 3.63 1.75 5.87 7.00 3.12 9.23 32.50 31.47 30.43 29.39 28.35 27.30 26.25 25.20 24.14 23.08 22.02 20.95 19.88 18.80 17.73 16.65 15.56 14.47 13.38 12.29 11.19 10.08 8.98 7.87 6.76 5.64 4.52 3.39 2.27 1.13 9,682.11 9,363.19 9,043.23 8,722.23 8,400.19 8,077.10 7,752.96 7,427.77 7,101.52 6,774.21 6,445.84 6,116.40 5,785.89 5, 454.30 5, 121.64 4,787.90 4,453.07 4,117.15 3,780.14 3,442.04 3,102.84 2, 762.53 2,421.12 2,078.60 1,734.97 1,390.22 1,044.35 697.35 349.23 0.00 350.39 700.78 1,051.17 1,401.56 1,751.95 2,102.34 2,452.73 2,803.12 3,153.51 3,503.90 3,854.29 4,204.68 4,555.07 4,905.46 5, 255.85 5, 606.24 5,956.63 6, 307.02 6,657.41 7,007.80 7,358.19 7,708.58 8,058.97 8, 409.36 8,759.75 9, 110.14 9,460.53 9,810.92 10,161.31 10,511.67 317.89 636.81 956.77 1,277.77 1,599.81 1,922.90 2,247.04 2,572.23 2,898.48 3, 225.79 3,554.16 3,883.60 4,214.11 4,545.70 4,878.36 5, 212.10 5,546.93 5,882.85 6,219.86 6,557.96 6,897.16 7,237.47 7,578.88 7,921.40 8, 265.03 8,609.78 8,955.65 9,302.65 9,650.77 10,000.00 32.50 63.97 94.40 123.79 152.14 | 179.44 205.69 230.89 | 255.03 278.11 300.13 321.08 340.96 | 359.76 377.49 394.14 409.70 424.17 437.55 449.84 461.03 471.11 480.09 | 487.96 494.72 500.36 504.88 508.27 510.54 511.67 nent cipal Interest Total Principal 1 Balance Payments Interest 3.60 7.80 3.60 321.08 166.88 23.71 1 1 6,116.40 2,078.60 0.00 4,204.68 8,409.36 10, 511.67 3,883.60 7,921.40 10,000.00 321.08 487.96 511.67 T Enter the amount of the loan: Enter the annual percentage rate (APR) : Enter the number of months for the loan: E - Z L - O - A - N Loan: S :: APR: 2500.00 21.90 % 18 months Monthly Pay Total Inter Total Cost Term: Your output NO | Payment 1 ] 164.20 2 164.20 3 164.20 4 164.20 5 ] 164.20 6 164.20 7 | 164.20 8 ] 164.20 9 164.20 10 | 164.20 11 | 164.20 12 164.20 13 164.20 14 | 164.20 15 l 164.20 16 164.20 17 | 164.20 18 ] 164.22 Payment Principal 118.58 120.74 122.94 125.19 127.47 129.80 132.17 134.58 137.03 139.53 142.08 144.67 147.31 150.00 152.74 155.53 158.37 161.28 Interest 45.63 43.46 41.26 39.01 36.73 34.40 32.03 29.62 27.17 24.67 22.12 19.53 16.89 14.20 11.46 8.67 5.83 2.94 Balance 2,381.43 2,260.69 2,137.75 2,012.56 1,885.09 1,755.29 1,623.12 1,488.54 1,351.51 1,211.98 1,069.90 925.23 777.92 627.92 475.18 319.65 161.28 0.00 Payments 164.20 328.40 492.60 656.80 821.00 985.20 1,149.40 1, 313.60 1,477.80 1,642.00 1,806.20 1,970.40 2,134.60 2,298.80 2,463.00 2,627.20 2,791.40 2,955.62 Total Princip 118. 239. 362. 487. 614. 744. 876. 1,011. 1,148. 1,288. 1,430. 1,574. 1,722. 1,872. 2,024. 2,180. 2,338. 2,500. E the loan: percentage rate (APR) : of months for the loan: E - Z L - O - A - N 0.00 21.90 $ 18 months Monthly Payment: $ 164.20 Total Interest: $ 455.60 Total Cost: $ 2955.60 Interest ayment incipal 118.58 120.74 122.94 Your output 125.19 127.47 129.80 132.17 134.58 137.03 139.53 142.08 144.67 147.31 150.00 152.74 155.53 158.37 161.28 45.63 43.46 41.26 39.01 36.73 34.40 32.03 29.62 27.17 24.67 22.12 19.53 16.89 14.20 11.46 8.67 5.83 2.94 Balance 2,381.43 2,260.69 2,137.75 2,012.56 1,885.09 1,755.29 1,623.12 1,488.54 1,351.51 1,211.98 1,069.90 925.23 777.92 627.92 475.18 319.65 161.28 0.00 Payments 164.20 328.40 492.60 656.80 821.00 985.20 1,149.40 1,313.60 1,477.80 1,642.00 1,806.20 1,970.40 2,134.60 2,298.80 2,463.00 2,627.20 2,791.40 2,955.62 Total Principal 118.58 239.32 362.26 487.45 614.92 744.72 876.89 1,011.47 1,148.50 1,288.03 1,430.11 1,574.78 1,722.09 1,872.09 2,024.83 2,180.36 2,338.73 2,500.01 Interest 45.63 89.09 130.35 169.36 206.09 240.49 272.52 302.14 329.31 353.98 376.10 395.63 412.52 426.72 438.18 446.85 452.68 455.62 Enter the amount of the loan: Enter the annual percentage rate (APR) : Enter the number of months for the loan: E - Z L - O - A - N Loan: $ APR: Term: 2,500.00 21.90 % 18 months Monthly Payn Total Intere Total Cost: - - - - - _ - - - - - - - - ! 1 1 i ! Payment Principal Interest Tot Princ Mo | Payment Balance Payments - - - - - - --- - - ! - - - 1 N 6 Expected output 1 2 3 | 4 5 1 71 8 91 10 11 121 13 14 1 15 | 16 l 17 | 18 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.20 164.22 118.57 120.74 122.94 125.19 127.47 129.80 132.17 134.58 137.03 139.53 142.08 144.67 147.31 150.00 152.74 155.53 158.37 161.28 45.63 43.46 41.26 39.01 36.73 34.40 32.03 29.62 27.17 24.67 22.12 19.53 16.89 14.20 11.46 8.67 5.83 2.94 2,381.43 2,260.69 2,137.75 2,012.56 1,885.09 1,755.29 1,623.12 1,488.54 1,351.51 1,211.98 1,069.90 925.23 777.92 627.92 475.18 319.65 161.28 0.00 164.20 328.40 492.60 656.80 821.00 985.20 1,149.40 1,313.60 1,477.80 1,642.00 1,806.20 1,970.40 2,134.60 2,298.80 2,463.00 2,627.20 2,791.40 2,955.62 1 4 C 7 & 1,0 1,1 1,2 1,4 1,5 1,7 1,8 2,0 2,1 2,3 2,5 1 1 Payment Principal Interest Tot Princ | Yr | Payment Balance Payments - - - - - - 1 1 | 1,970.40 2 | 985.22 1,574.77 925.23 395.63 59.99 925.23 0.00 1,970.40 2,955.62 1,5 2,9 ne loan: entage rate (APR) : onths for the loan: E - Z L - O - A - N months Monthly Payment: $ Total Interest: $ Total Cost: $ 164.20 455.60 2,955.60 nent - - Total Principal cipal Interest Balance Payments Interest - - - - - ! I | I 1 3.57 0.74 2.94 5.19 7.47 9.80 2.17 Expected output 1.58 7.03 9.53 2.08 4.67 7.31 0.00 2.74 5.53 3.37 1.28 45.63 43.46 41.26 39.01 36.73 34.40 32.03 29.62 27.17 24.67 22.12 19.53 16.89 14.20 11.46 8.67 5.83 2.94 2,381.43 2,260.69 2,137.75 2,012.56 1,885.09 1,755.29 1,623.12 1,488.54 1,351.51 1,211.98 1,069.90 925.23 777.92 627.92 475.18 319.65 161.28 0.00 164.20 328.40 492.60 656.80 821.00 985.20 1,149.40 1,313.60 1,477.80 1,642.00 1,806.20 1,970.40 2,134.60 2,298.80 2,463.00 2,627.20 2,791.40 2,955.62 118.57 239.31 362.25 487.44 614.91 744.71 876.88 1,011.46 1,148.49 1,288.02 1,430.10 1,574.77 1,722.08 1,872.08 2,024.82 2,180.35 2,338.72 2,500.00 45.63 89.09 | 130.35 169.36 | 206.09 | 240.49 | 272.521 302.14 | 329.31 | 353.98 376.10 | 395.63 412.52 426.72 438.18 | 446.85 | 452.68 455.62 I 1 - - - - - - --- - - - - - - - - - - - - - - - - - ! T nent cipal Interest Total Principal | Balance | Payments Interest le -- - - - ! - t 1.77 5.23 395.63 59.99 925.23 0.00 1,970.40 2,955.62 1,574.77 2,500.00 395.63 16 455.62 - - - - - - - 12.2 E-Z LOAN A loan obtained from a lending institution is typically paid off over time using equal monthly payments over a term of many months. For each payment, a portion goes toward interest and the remaining amount is deducted from the balance. This process is repeated until the balance is zero. Interest is calculated by multiplying the current balance by the monthly interest rate, which is usually expressed in terms of an Annual Percentage Rate (APR). This process produces an Amortization Schedule where the amount applied to interest is gradually reduced each month and the amount applied to the balance grows. For example, the following amortization schedule is for a loan of $ 10.000 at an APR of 3.9% over a term of 30 months: E - Z L - O - A - N Loan: $ APR: 10,000.00 3.90 % 30 months Monthly Payment: $ Total Interest: $ Total Cost: $ 350.39 511.70 10,511.70 Term: Payment Principal Interest Total Principal Balance Payments Interest | 1 1 1 | | | | | 32.50 31.47 30.43 29.39 28.35 27.30 26.25 25.20 24.14 23.08 22.02 20.95 19.88 18.80 | | | | | | MO | Payment | | | 1 350.39 | 21 350.39 3 350.39 41 350.39 5 350.39 350.39 71 350.39 1 81 350.39 | 9 350.39 1 101 350.39 11 | 350.39 121 350.39 131 350.39 1 14 350.39 151 350.39 16 350.39 17 1 350.39 1 18 ] 350.39 19 350.39 20 350.39 1 21 350.39 22 | 350.39 | 23 350.39 | 24 ] 350.39 | 25 350.39 26 | 350.39 27 350.39 28 1 350.39 | | 1 | | 317.89 318.92 319.96 321.00 322.04 323.09 324.14 325.19 326.25 327.31 328.37 329.44 330.51 331.59 332.66 333.74 334.83 335.92 337.01 338.10 339.20 340.31 341.41 342.52 343.63 344.75 345.87 347.00 9,682.11 9,363.19 9,043.23 8,722.23 8,400.19 8,077.10 7,752.96 7,427.77 7,101.52 6,774.21 6,445.84 6, 116.40 5,785.89 5,454.30 5, 121.64 4,787.90 4,453.07 4,117.15 3,780.14 3,442.04 3,102.84 2,762.53 2,421.12 2,078.60 1,734.97 1,390.22 1,044.35 697.35 350.39 700.78 1,051.17 1,401.56 1,751.95 2,102.34 2,452.73 2,803.12 3,153.51 3,503.90 3,854.29 4,204.68 4,555.07 4,905.46 5, 255.85 5,606.24 5,956.63 6, 307.02 6, 657.41 7,007.80 7,358.19 7,708.58 8,058.97 8,409.36 8,759.75 9, 110.14 9,460.53 9,810.92 317.89 636.81 956.77 1,277.77 1,599.81 1,922.90 2,247.04 2,572.23 2,898.48 3,225.79 3,554.16 3,883.60 4,214.11 4,545.70 4,878.36 5, 212.10 5,546.93 5,882.85 6,219.86 6,557.96 6,897.16 7,237.47 7,578.88 7,921.40 8, 265.03 8,609.78 8, 955.65 9,302.65 32.50 63.97 94.40 123.79 | 152.14 | 179.44 | 205.691 230.891 255.031 278.11 | 300.13 321.08 | 340.96 | 359.76 | 377.491 394.14 409.70 424.17 | 437.55 449.84 461.03 471.11 | 480.09 487.961 494.72 500.36 504.88 508.27 1 17.73 16.65 | | | | | | | | | 15.56 14.47 13.38 12.29 11.19 10.08 8.98 7.87 6.76 5.64 4.52 3.39 1 1 - - - - - -- --- | 29 30 350.39 350.36 348.12 349.23 2.27 1.13 1 1 349.23 0.00 10,161.31 10,511.67 9, 650.77 10,000.00 510.54 | 511.67 1 The monthly payment for a loan at a given APR and number of months can be determined by the formula: montly_interest rate = apr / 12 / 100 loan_amount X montly_interest rate payment = 1 - ((1 + montly_interest rate ) num_months)) Write a program to prompt the user to input a loan amount, APR, number of months to calculate and print the amortization schedule report as formatted above. The prompt for the user input is to be as follows: Enter the amount of the loan: 10000 Enter the annual percentage rate 3.9 (APR) : Enter the number of months for the loan: 30 A blank line is to be printed after the user input and before the title 'E-ZL-O-A-N'. The total cost of the loan printed at the top left of the report can be calculated by multiplying the payment by the number of months. The total interest can be calculated by subtracting the loan amount from the total cost of the loan. Note the payment for the last month may be different from the calculated payment. This is a result of the payment being quantized to monthly dollars and cents, the details of which we do not need to know. The payment for the last month can be calculated by adding the balance to the calculated interest for that month. This alternate payment is calculated when the balance is less than the payment. As a result of the final payment being different from the previous monthly payments, the total payments and interest of the last line of the schedule may be different from the total cost and total interest printed at the top left of the report. To make sure calculations are performed correctly, write the following functions in a module loan_calc.py. These functions will be tested with unit tests in zyBooks. Make Sure to use good programming style including a docstring comment at the beginning of the program which has a description of the program and your name as the author. Bonus 6 points: In addition to printing the amortization schedule by months, print the schedule by years. For example, the report shown above will also print: Total Principal Balance Payments Interest Payment | Yr Payment Principal Interest I | 1 | 4,204.68 3,883.60 321.08 24,204.68 4,037.80 166.88 3 | 2,102.31 2,078.60 23.71 1 6,116.40 2,078.60 0.00 | | 4,204.68 8,409.36 10,511.67 3,883.60 7,921.40 10,000.00 321.08 487.96 | 511.67 | 1 Amortization is still computed on a monthly basis. The payment, principal, and interest in the first set of columns is the yearly aggregation of the monthly amounts. Note is the above the totals for years 1, 2, and 3 will match months 12, 24, and 30 respectively