Answered step by step

Verified Expert Solution

Question

1 Approved Answer

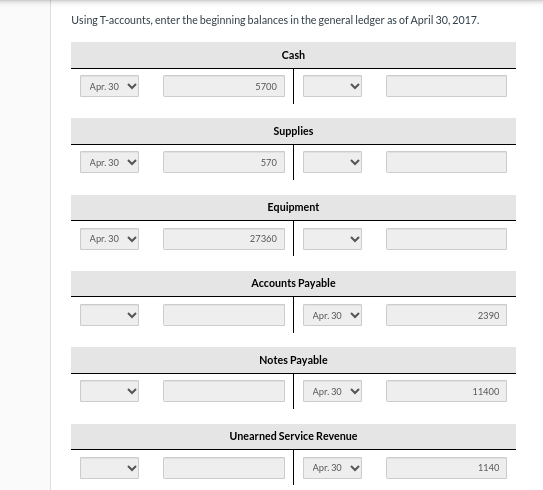

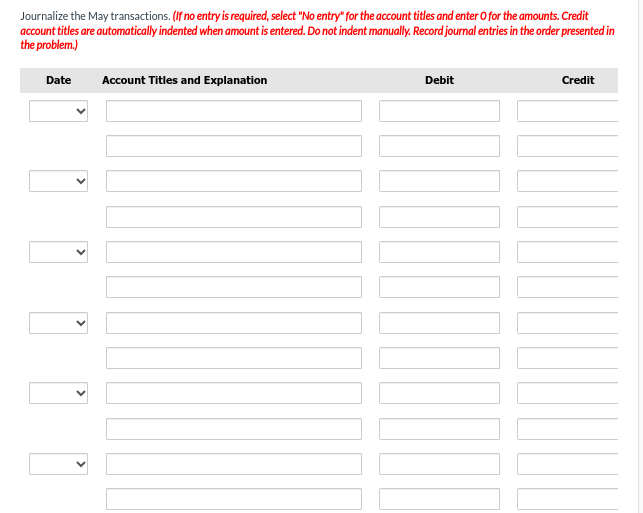

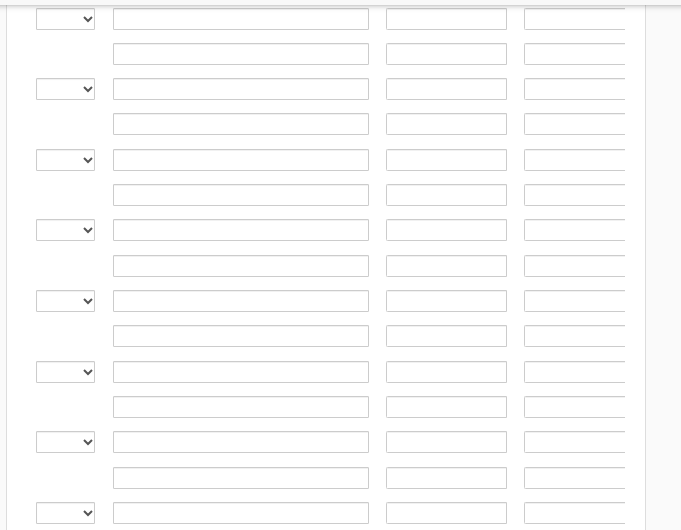

Using T-accounts, enter the beginning balances in the general ledger as of April 30, 2017. Journalize the May transactions. (If no entry is required, select

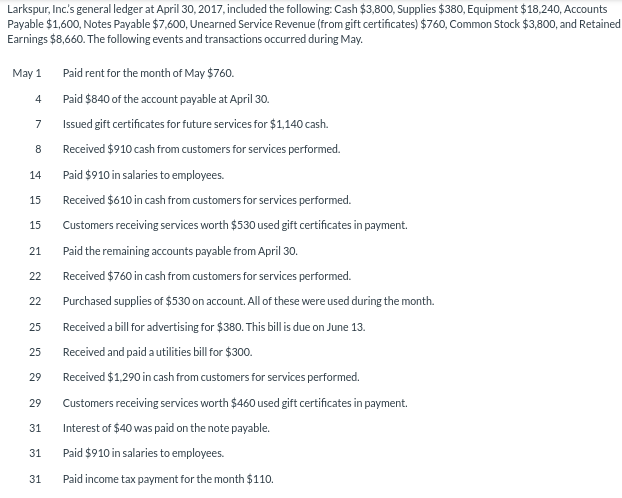

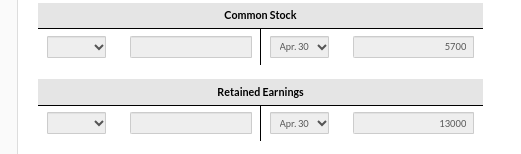

Using T-accounts, enter the beginning balances in the general ledger as of April 30, 2017. Journalize the May transactions. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Larkspur, Inc's general ledger at April 30, 2017, included the following: Cash $3,800, Supplies $380, Equipment $18,240, Accounts Payable $1,600, Notes Payable $7,600, Unearned Service Revenue (from gift certificates) $760, Common Stock $3,800, and Retained Earnings $8,660. The following events and transactions occurred during May. May 1 Paid rent for the month of May $760. 4 Paid $840 of the account payable at April 30. 7 Issued gift certificates for future services for $1,140 cash. 8 Received $910 cash from customers for services performed. 14 Paid $910 in salaries to employees. 15 Received $610 in cash from customers for services performed. 15 Customers receiving services worth $530 used gift certificates in payment. 21 Paid the remaining accounts payable from April 30. 22 Received $760 in cash from customers for services performed. 22 Purchased supplies of $530 on account. All of these were used during the month. 25 Received a bill for advertising for $380. This bill is due on June 13. 25 Received and paid a utilities bill for $300. 29 Received $1,290 in cash from customers for services performed. 29 Customers receiving services worth $460 used gift certificates in payment. 31 Interest of $40 was paid on the note payable. 31 Paid $910 in salaries to employees. 31 Paid income tax payment for the month $110

Using T-accounts, enter the beginning balances in the general ledger as of April 30, 2017. Journalize the May transactions. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Larkspur, Inc's general ledger at April 30, 2017, included the following: Cash $3,800, Supplies $380, Equipment $18,240, Accounts Payable $1,600, Notes Payable $7,600, Unearned Service Revenue (from gift certificates) $760, Common Stock $3,800, and Retained Earnings $8,660. The following events and transactions occurred during May. May 1 Paid rent for the month of May $760. 4 Paid $840 of the account payable at April 30. 7 Issued gift certificates for future services for $1,140 cash. 8 Received $910 cash from customers for services performed. 14 Paid $910 in salaries to employees. 15 Received $610 in cash from customers for services performed. 15 Customers receiving services worth $530 used gift certificates in payment. 21 Paid the remaining accounts payable from April 30. 22 Received $760 in cash from customers for services performed. 22 Purchased supplies of $530 on account. All of these were used during the month. 25 Received a bill for advertising for $380. This bill is due on June 13. 25 Received and paid a utilities bill for $300. 29 Received $1,290 in cash from customers for services performed. 29 Customers receiving services worth $460 used gift certificates in payment. 31 Interest of $40 was paid on the note payable. 31 Paid $910 in salaries to employees. 31 Paid income tax payment for the month $110 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started