Question

Using the annual report, provide and comment on the following based on group (not company): - The performance of the company as compared to previous

Using the annual report, provide and comment on the following based on group (not company):

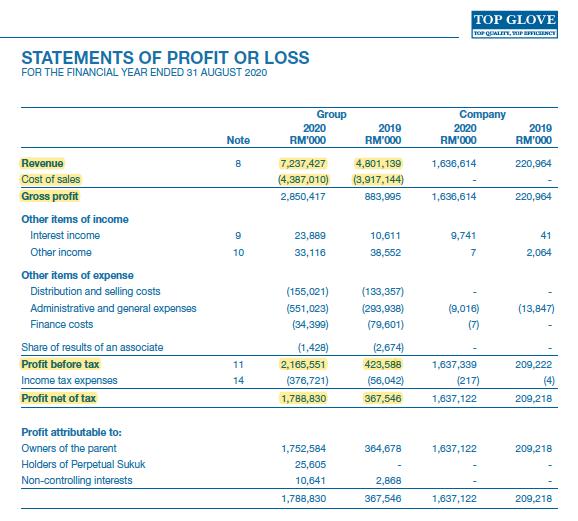

- The performance of the company as compared to previous year. You need to analyse the items under the consolidated statement of profit or loss for both years 2019 and 2020 in order to provide a detailed analysis on this part. - Example, comment on the comparison on revenue, cost of sales, gross profit, distribution and selling costs, Admin and General expenses, finance costs, earnings per share and etc. (Analyse and comment on the individual items inside each category and may refer to notes to financial statements.) - Example, revenue under note to financial statements no (8), explain the increasing and decreasing components. Overall revenue differences figures must be compared.(Explanation must consist of % and figures of comparisons)

- The above applies to other commentaries in the statement of profit and loss too.

- Calculate % cost of sales reduction 2020 and 2019; then compare.

- Gross profit margin differences..etc

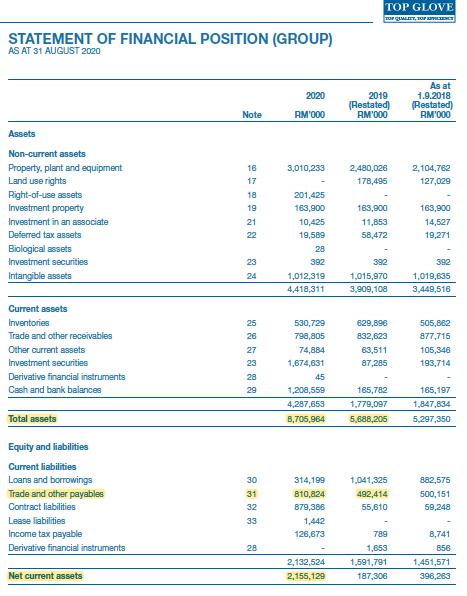

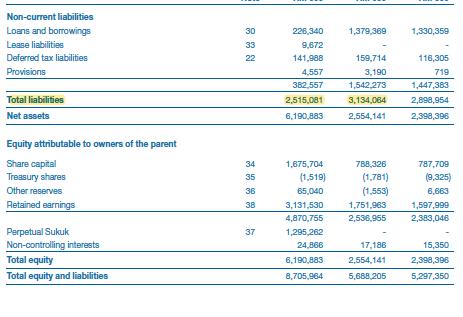

3) Calculate the profitability, liquidity and efficiency ratios of the company (use the following ratios:

1)gross profit margin,

2)net profit margin,

3)return on capital employed,

4) quick ratio,

5) current ratio…for year 2020 and 2019

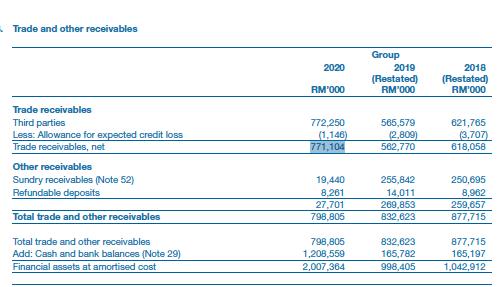

6) accounts receivable turnover,

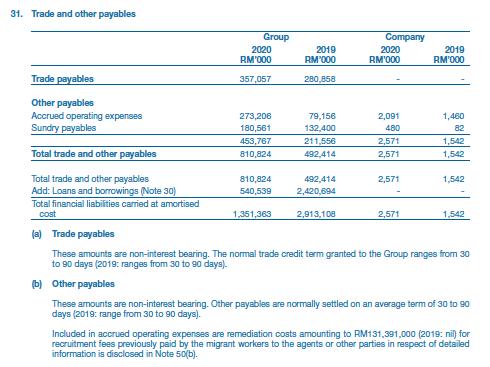

7) accounts payables turnover, 8) inventory turnover) for year 2020 only.

4) Critically evaluate the ratios calculated above, and comment on your analysis. (Points Allocated :- 5 Key Points - 5 Marks; Every key point with 3 or 4 explanations - 3 marks => Total 20 marks) Example; comment between Year 2020 versus Year 2019 that you have calculated.. - i)Gross Profit Margin

- 3 or 4 Comments with proper sentencing.

- % difference

- reason of improvement

- how was it calculated (in theory)

- what illustration does it provide - ii) Net Profit Margin

- 3 Comments with proper sentencing

And this goes on……

5) Provide recommendations to your managing director on whether the company should invest in Top Glove Corporation Berhad based on fundamental analysis (ratios analysis)

- Give the reasons on why you recommend this organization to your managing director.- You need to provide justification and opinions why you choose Top Glove.

a) Management Efficiency (Activity Ratio - Explain the calculated ratio that was previously done; ie Inventory Turnover, Accounts Receivable Turnover, Accounts Payable Turnover, Average payment Period, Average Collection Period)

b) Profitability (Gross Profit Margin , Net Profit Margin, Return on Capital Employed)

c) Liquidity (Current Ratio, Quick Ratio)

d) Leverage (Use Debt Ratio and Asset to Equity Ratio)

TOP GLOVE TOP QEMLEIT, IP EICINCI STATEMENTS OF PROFIT OR LOSS FOR THE FINANCIAL YEAR ENDED 31 AUGUST 2020 Group Company 2020 RM'000 2019 RM'000 2020 RM'000 2019 RM'000 Note Revenue 7,237,427 4,801,139 1,636,614 220,964 Cost of sales Gross profit (4,387,010) (3,917,144) 2,850,417 883,995 1,636,614 220,964 Other items of income Interest income 9 23,889 10,611 9,741 41 Other income 10 33,116 38,552 7 2,064 Other items of expense Distribution and selling costs (155,021) (133,357) Administrative and general expenses (551,023) (293,938) (9,016) (13,847) Finance costs (34,399) (79,601) (7) Share of results of an associate (1,428) (2,674) Profit before tax 11 2,165,551 423,588 1,637,339 209,222 Income tax expenses 14 (376,721) (56,042) (217) (4) Profit net of tax 1,788,830 367,546 1,637,122 209,218 Profit attributable to: Owners of the parent 1,752,584 364,678 1,637,122 209,218 Holders of Perpetual Sukuk 25,605 Non-controlling interests 10,641 2,868 1,788,830 367,546 1,637,122 209,218

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Analysis In 2020 the cost of goods sold is 6062 and the gross profit weightage is 3938while in 2019 cost of goods sold 8159 and gross profit 1841 according to these calculations the weightage o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started