Answered step by step

Verified Expert Solution

Question

1 Approved Answer

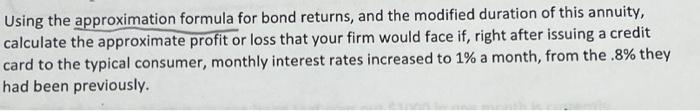

Using the approximation formula for bond returns, and the modified duration of this annuity, calculate the approximate profit or loss that your firm would face

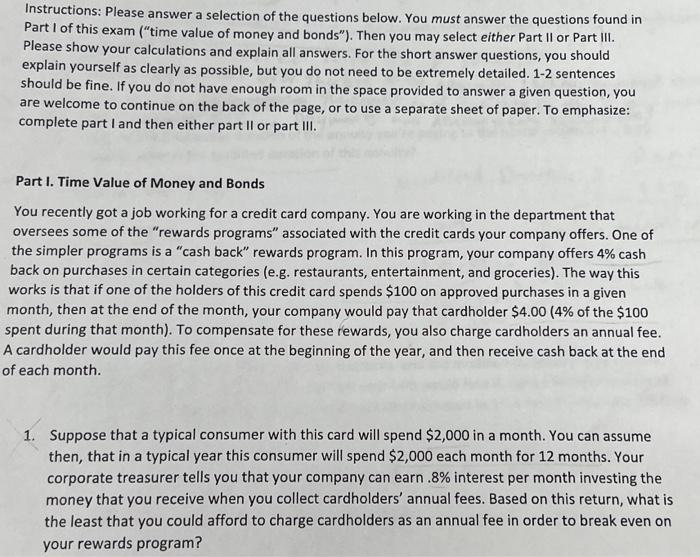

Using the approximation formula for bond returns, and the modified duration of this annuity, calculate the approximate profit or loss that your firm would face if, right after issuing a credit card to the typical consumer, monthly interest rates increased to 1% a month, from the .8% they had been previously.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started