Using the Article! from Marketing Research!

Is there a relationship between the importance variables considered individually (Q1_a through Q1_I) and the recoded demographic characteristics (Q9 through Q15)?

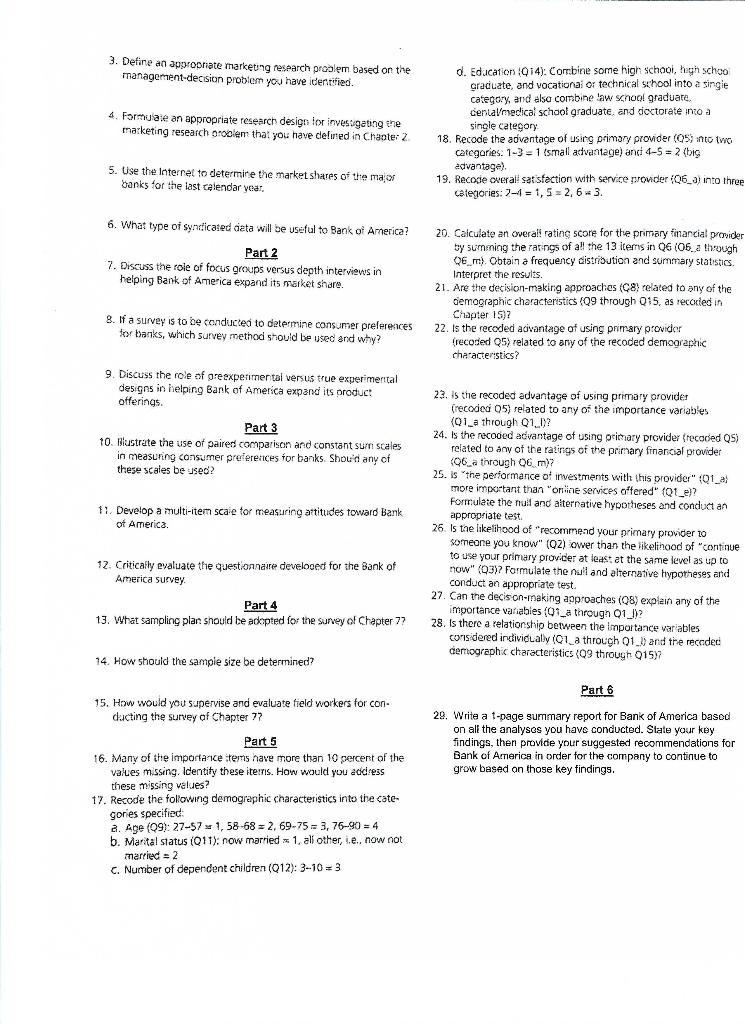

COMPREHENSIVE CASES WITH REAL DATA CASE 3.1 BANK OF AMERICA SPSS has Leading the American Way Bank of America, headquartered in Charlotte, North Carolina, is the largest bank holding company in the United States, by assets, and the second largest bank by market capitalization. BankAmerica began as the American Bank of Italy, which was founded in 1904 by Amadeo Giannini , and Bank of America still operates under Federal Charter 13044, which was granted to Giannini on March 1, 1927. The bank its roots in two former banks: NationsBank and the San francisco-based BankAmerica. The two merged in 1998 and assumed the name Bank of America. At the time, the merger was the largest bank acquisition in history. Bank of America acquired Countrywide Financial in 2008, oving the bank a substantial market share of the mortgage business. Bank of America acquired Merrill Lynch & Co. in 2009. This acquisition made Bank of America the largest financial services company in the world. Bank of America caters its services to individual consumers, small and midsize businesses, and large corporations with a full range of banking, investment, asset t management, and other financial products and services. As of 2011, Bank of America serves clients in more than 150 countries and has relationships with 99 percent of the U.S. Fortune 500 companies and 83 percent of the Fortune Global 500 companies. This publicly traded corporation provides a diversified range financial and risk-management products and services both domestically and internationally through four market segments: Global Consumer & Small Business Banking, Global Corporate & Investment Banking, Global Wealth & Investment Management, and International. Global Consumer and Small Business Banking Global Consumer and Small Business Banking (GC&SBB) is the largest division in the company, it deals primarily with consumer banking and credit card issuance. The acquisition of FleetBoston and MBNA significantly expanded its size and range of services, generating about 50 percent of the company's total revenue in 2007. It competes directly with the retail banking divisions of Citigroup and JPMorgan Chase. As of 2011, the GC&SBB organization includes more than 6,100 retali branches and more than 18,700 ATMs across the United States. Global Corporate and Investment Banking The bank's investment banking activities operate under the Merrill Lynch subsidiary and provide mergers and acquisitions advisory. underwriting, capital markets, as well as sales and trading in fixed income and equities markets. Its strongest groups include Leveraged Finance, Syndicated Loans, and Mortgage Backed Securities. It has one of the largest research tears on Wall Street, Global Wealth and Investment Management Global Wealth and Investment Management (GWIM) manages assets of institutions and individuals. It is among the 10 largest U.S. wealth managers (ranked by private banking assets under management in accounts of $1 million or more as of June 30, 2010). GWIM has five Primary lines of business: Premier Banking & Investments (including SPSS Data File Excel Data File Banc of America Investment Services, Inc.). The Private Bank, Family Wealth Advisors, Columbia Management Group, and Banc of America Specialist Bank of America has recently spent $675 million building its U.S. investment banking business and is looking to become one of the top five investment banks worldwide. Bank of America already has excellent relationships with the corporate and financial institutions world. These relationships, as well as a balance sheet that most banks would kill for are the foundations for a lofty ambition. International Operations Bank of America's Global Corporate and investment Banking spans the globe with divisions in the United States, Europe, and Asia. The U.S. headquarters are located in New York, European headquarters are based in London, UK and Asia's headquarters are based in Hong Kong. Bank of America generates 90 percent of its revenues in its domestic market and continues to buy businesses in the United States. The core of Bank of America's strategy is to be the number one bank in its domestic market. It has achieved this through key acquisitions. As a result of its mergers and acquisitions, Bank of America is now the largest issuer of credit, debit, and prepaid cards in the world based on total purchase volume, as well as the largest consumer and small business bank in the United States Competition On a national and international level. Bank of America's main compe tition consists of Citigroup, Wells Fargo, and JPMorgan Chase & Company. However, Bank of America also encounters fierce competi- tion from regional and local banks all over the country. Marketing Issue and Marketing Research With Bank of Amenca representing so many customers, it needed to provide a wider range of services to meet their needs. Bank of America's Innovation and Development Team (80 Team) realized that the customers wanted different things when it came to banking other than the "traditionally designed bank branch. Therefore, Bank of America conducted a study to understand its consumers, their lifestyles, and potential for customer segmentation in terms of invest- ment products and service needs. The questionnaire used follows and the data file is provided on the Web site for this book. The outputs and the analyses of this study should help Bank of America carve its growth plan and its successful implementation Questions Part 1 1. Discuss the role that marketing research can play in helping Bank of America formulate sound marketing strategies. 2. Management would like to further expand Bank of America's market share in the consumer market. Detine the management- decision problem. 3. Define an appropriate marketing research problem based on the management decision problem you have identified. 4. Formulate an appropriate research design for investigating the marketing research problem that you have defined in Chapter 2 d. Education (914): Combine some high school, high school Graduate, and vocational or technical school into a single category, and also combine law school graduate centa medical school graduate and doctorate into a single category 18. Recode the advantage of using primary provider (5) into lvio categories: 1-3 = 1 (small advantage) and 4-5 = 2 (big advantage). 19. Recode overall satisfaction with service provider (06_3) into three categories: 2-4 = 1,5 = 2,6 3. 5. Use the Internet to determine the market shares of the mos banks for the last calendar year, 6. What type of syndicated data will be useful to Bank of America? Part 2 7. Discuss the role of focus groups versus depth interviews in helping Bank of America expand its market share 20. Calculate an overall rating score for the primary Financial provider by sumning the ratings of all the 13 items in 06 (06_ a though Q6 m). Obtain a frequency distribution and summary statistics. Interpret the results 21. Are the decision-making approaches (Carelated to any of the Gemographic characteristics (Q9 through Q15, as recorded in Chapter 15)? 22. is the recoded advantage of using primary provider recoded 05) related to any of the recoded demographic characteristics? 8. If a survey is to be conducted to determine consumer preferences for banks, which survey method should be used and why? 9 Discuss the role of greexperimental versus true experimental designs in helping Bank of America expand its product offerings. Part 3 10. Wustrate the use of paired comparison and constant sur scales in measuring consumer preferences for banks Shou's any of these scales be used? 11. Develop a multi-item scale tor measuring attitudes toward Bank a - of America. 23. Is the recoded advantage of using primary provider (recoded 05) related to any of the importance variables (Q1_a through 01.1)? 24. Is the recoded advantage of using primary provider (tecoded QS) related to any of the ratings of the primary financial provider (96_a through 26 m)? 25. is the performance of investments with this provider" (Q1_a more important than "online services offered" (Que)? Formulate the null and alternative hypotheses and conduct an appropriate test 26. Is the likelihood of recommend your primary provider 10 someone you know" (02) ower than the likelihood of "continue to use your primary provider at least at the same level as up to DOW" (03)7 Formulate the nail and alternative hypotheses and conduct an appropriate test. 27. Can the decison-making approaches (98) explain any of the importance vanabies (01_a through 01_1? 28. Is there a relationship between the importance variables considered individually (Q1_a through 013) and the recoded demographic characteristics (Q9 through 0157 12. Critically evaluate the questionnaire developed for the Bank of America survey Part 4 13. What sampling plan should be adopted for the survey of Chapter 77 14. How should the sample size be determined? Part 6 15. How would you supervise and evaluate field workers for con- ducting the survey of Chapter 77 20. Write a t-page summary report for Bank of America based on all the analyses you have conducted. State your key findings, then provide your suggested recommendations for Bank of America in order for the company to continue to grow based on those key findings. Part 5 16. Many of the importance tems have more than 10 percent of the values missing, Identity these iters. How would you address these missing values? 17. Recode the following demographic characteristics into the cate gories specified 2. Age (09): 27-571, 58-68 = 2,69-75= 3, 76-90 = 4 b. Marital status (Q11): now married 1. all other, i.e., now not married = 2 C. Number of dependent children (012): 3-10 = 3 COMPREHENSIVE CASES WITH REAL DATA CASE 3.1 BANK OF AMERICA SPSS has Leading the American Way Bank of America, headquartered in Charlotte, North Carolina, is the largest bank holding company in the United States, by assets, and the second largest bank by market capitalization. BankAmerica began as the American Bank of Italy, which was founded in 1904 by Amadeo Giannini , and Bank of America still operates under Federal Charter 13044, which was granted to Giannini on March 1, 1927. The bank its roots in two former banks: NationsBank and the San francisco-based BankAmerica. The two merged in 1998 and assumed the name Bank of America. At the time, the merger was the largest bank acquisition in history. Bank of America acquired Countrywide Financial in 2008, oving the bank a substantial market share of the mortgage business. Bank of America acquired Merrill Lynch & Co. in 2009. This acquisition made Bank of America the largest financial services company in the world. Bank of America caters its services to individual consumers, small and midsize businesses, and large corporations with a full range of banking, investment, asset t management, and other financial products and services. As of 2011, Bank of America serves clients in more than 150 countries and has relationships with 99 percent of the U.S. Fortune 500 companies and 83 percent of the Fortune Global 500 companies. This publicly traded corporation provides a diversified range financial and risk-management products and services both domestically and internationally through four market segments: Global Consumer & Small Business Banking, Global Corporate & Investment Banking, Global Wealth & Investment Management, and International. Global Consumer and Small Business Banking Global Consumer and Small Business Banking (GC&SBB) is the largest division in the company, it deals primarily with consumer banking and credit card issuance. The acquisition of FleetBoston and MBNA significantly expanded its size and range of services, generating about 50 percent of the company's total revenue in 2007. It competes directly with the retail banking divisions of Citigroup and JPMorgan Chase. As of 2011, the GC&SBB organization includes more than 6,100 retali branches and more than 18,700 ATMs across the United States. Global Corporate and Investment Banking The bank's investment banking activities operate under the Merrill Lynch subsidiary and provide mergers and acquisitions advisory. underwriting, capital markets, as well as sales and trading in fixed income and equities markets. Its strongest groups include Leveraged Finance, Syndicated Loans, and Mortgage Backed Securities. It has one of the largest research tears on Wall Street, Global Wealth and Investment Management Global Wealth and Investment Management (GWIM) manages assets of institutions and individuals. It is among the 10 largest U.S. wealth managers (ranked by private banking assets under management in accounts of $1 million or more as of June 30, 2010). GWIM has five Primary lines of business: Premier Banking & Investments (including SPSS Data File Excel Data File Banc of America Investment Services, Inc.). The Private Bank, Family Wealth Advisors, Columbia Management Group, and Banc of America Specialist Bank of America has recently spent $675 million building its U.S. investment banking business and is looking to become one of the top five investment banks worldwide. Bank of America already has excellent relationships with the corporate and financial institutions world. These relationships, as well as a balance sheet that most banks would kill for are the foundations for a lofty ambition. International Operations Bank of America's Global Corporate and investment Banking spans the globe with divisions in the United States, Europe, and Asia. The U.S. headquarters are located in New York, European headquarters are based in London, UK and Asia's headquarters are based in Hong Kong. Bank of America generates 90 percent of its revenues in its domestic market and continues to buy businesses in the United States. The core of Bank of America's strategy is to be the number one bank in its domestic market. It has achieved this through key acquisitions. As a result of its mergers and acquisitions, Bank of America is now the largest issuer of credit, debit, and prepaid cards in the world based on total purchase volume, as well as the largest consumer and small business bank in the United States Competition On a national and international level. Bank of America's main compe tition consists of Citigroup, Wells Fargo, and JPMorgan Chase & Company. However, Bank of America also encounters fierce competi- tion from regional and local banks all over the country. Marketing Issue and Marketing Research With Bank of Amenca representing so many customers, it needed to provide a wider range of services to meet their needs. Bank of America's Innovation and Development Team (80 Team) realized that the customers wanted different things when it came to banking other than the "traditionally designed bank branch. Therefore, Bank of America conducted a study to understand its consumers, their lifestyles, and potential for customer segmentation in terms of invest- ment products and service needs. The questionnaire used follows and the data file is provided on the Web site for this book. The outputs and the analyses of this study should help Bank of America carve its growth plan and its successful implementation Questions Part 1 1. Discuss the role that marketing research can play in helping Bank of America formulate sound marketing strategies. 2. Management would like to further expand Bank of America's market share in the consumer market. Detine the management- decision problem. 3. Define an appropriate marketing research problem based on the management decision problem you have identified. 4. Formulate an appropriate research design for investigating the marketing research problem that you have defined in Chapter 2 d. Education (914): Combine some high school, high school Graduate, and vocational or technical school into a single category, and also combine law school graduate centa medical school graduate and doctorate into a single category 18. Recode the advantage of using primary provider (5) into lvio categories: 1-3 = 1 (small advantage) and 4-5 = 2 (big advantage). 19. Recode overall satisfaction with service provider (06_3) into three categories: 2-4 = 1,5 = 2,6 3. 5. Use the Internet to determine the market shares of the mos banks for the last calendar year, 6. What type of syndicated data will be useful to Bank of America? Part 2 7. Discuss the role of focus groups versus depth interviews in helping Bank of America expand its market share 20. Calculate an overall rating score for the primary Financial provider by sumning the ratings of all the 13 items in 06 (06_ a though Q6 m). Obtain a frequency distribution and summary statistics. Interpret the results 21. Are the decision-making approaches (Carelated to any of the Gemographic characteristics (Q9 through Q15, as recorded in Chapter 15)? 22. is the recoded advantage of using primary provider recoded 05) related to any of the recoded demographic characteristics? 8. If a survey is to be conducted to determine consumer preferences for banks, which survey method should be used and why? 9 Discuss the role of greexperimental versus true experimental designs in helping Bank of America expand its product offerings. Part 3 10. Wustrate the use of paired comparison and constant sur scales in measuring consumer preferences for banks Shou's any of these scales be used? 11. Develop a multi-item scale tor measuring attitudes toward Bank a - of America. 23. Is the recoded advantage of using primary provider (recoded 05) related to any of the importance variables (Q1_a through 01.1)? 24. Is the recoded advantage of using primary provider (tecoded QS) related to any of the ratings of the primary financial provider (96_a through 26 m)? 25. is the performance of investments with this provider" (Q1_a more important than "online services offered" (Que)? Formulate the null and alternative hypotheses and conduct an appropriate test 26. Is the likelihood of recommend your primary provider 10 someone you know" (02) ower than the likelihood of "continue to use your primary provider at least at the same level as up to DOW" (03)7 Formulate the nail and alternative hypotheses and conduct an appropriate test. 27. Can the decison-making approaches (98) explain any of the importance vanabies (01_a through 01_1? 28. Is there a relationship between the importance variables considered individually (Q1_a through 013) and the recoded demographic characteristics (Q9 through 0157 12. Critically evaluate the questionnaire developed for the Bank of America survey Part 4 13. What sampling plan should be adopted for the survey of Chapter 77 14. How should the sample size be determined? Part 6 15. How would you supervise and evaluate field workers for con- ducting the survey of Chapter 77 20. Write a t-page summary report for Bank of America based on all the analyses you have conducted. State your key findings, then provide your suggested recommendations for Bank of America in order for the company to continue to grow based on those key findings. Part 5 16. Many of the importance tems have more than 10 percent of the values missing, Identity these iters. How would you address these missing values? 17. Recode the following demographic characteristics into the cate gories specified 2. Age (09): 27-571, 58-68 = 2,69-75= 3, 76-90 = 4 b. Marital status (Q11): now married 1. all other, i.e., now not married = 2 C. Number of dependent children (012): 3-10 = 3