Answered step by step

Verified Expert Solution

Question

1 Approved Answer

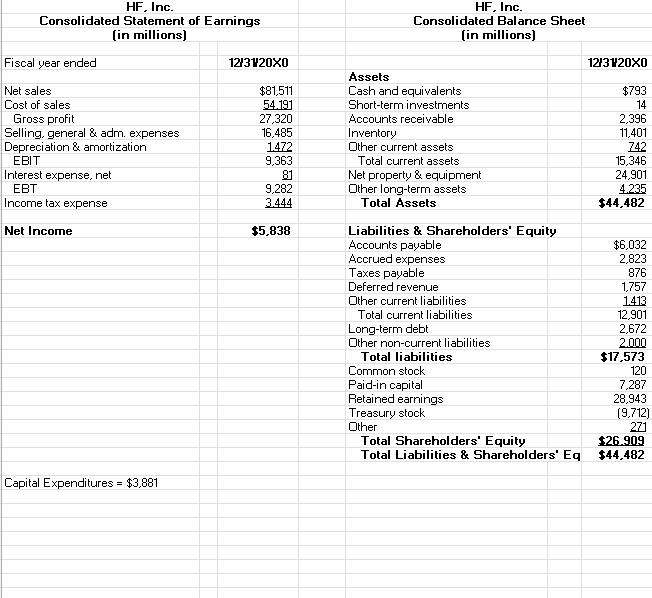

Using the assumptions below, project HFs free cash flow (FCF) for each of the next three years: Sales will increase over the next three years

Using the assumptions below, project HFs free cash flow (FCF) for each of the next three years:

- Sales will increase over the next three years at an annual rate of 10.5 percent.

- Cost of sales for fiscal 20X1 will be 66.5 percent. The ratio of cost of sales to sales is expected to decrease by 0.25 percentage points for each year 20X2 and 20X3.

- Selling, general, and administrative expenses (SG&A) will be 20.2 percent of sales for fiscal 20X1; 20.5 percent for 20X2; and 20.6 percent for 20X3.

- Depreciation expense will be forecasted over the next three years using the historical relation to sales.

- Capital expenditures will be forecasted over the next three years using the historical relation to sales.

- Net working capital will be forecasted over the next three years using the historical relation to sales.

- The tax rate is 37%.

- Free cash flow (FCF) beyond year 3 will grow at 4.0 percent forever.

- WACC is 9.5 percent.

Using the attached forecast assumptions and the Year 3 free cash flow (FCF) forecast, calculate the residual value using the growth perpetuity method

HF, Inc. Consolidated Statement of Earnings (in millions) Fiscal year ended 12/3120X0 HF, Inc. Consolidated Balance Sheet (in millions) Net sales Cost of sales Gross profit Selling, general & adm. expenses Depreciation & amortization EBIT Interest expense, net EBT Income tax expense $81,511 54.191 27,320 16,485 1472 9,363 81 9,282 3.444 Net Income $5,838 123120X0 Assets Cash and equivalents $793 Short-term investments 14 Accounts receivable 2,396 Inventory 11,401 Other current assets 742 Total current assets 15,346 Net property & equipment 24,901 Other long-term assets 4.235 Total Assets $44,482 Liabilities & Shareholders' Equity Accounts payable $6,032 Accrued expenses 2,823 Taxes payable 876 Deferred revenue 1,757 Other current liabilities 1.413 Total current liabilities 12,901 Long-term debt 2,672 Other non-current liabilities 2.000 Total liabilities $17,573 Common stock 120 Paid-in capital 7,287 Retained earnings 28,943 Treasury stock (9,712) Other 271 Total Shareholders' Equity $26.909 Total Liabilities & Shareholders' Eq $44,482 Capital Expenditures = $3,881 HF, Inc. Consolidated Statement of Earnings (in millions) Fiscal year ended 12/3120X0 HF, Inc. Consolidated Balance Sheet (in millions) Net sales Cost of sales Gross profit Selling, general & adm. expenses Depreciation & amortization EBIT Interest expense, net EBT Income tax expense $81,511 54.191 27,320 16,485 1472 9,363 81 9,282 3.444 Net Income $5,838 123120X0 Assets Cash and equivalents $793 Short-term investments 14 Accounts receivable 2,396 Inventory 11,401 Other current assets 742 Total current assets 15,346 Net property & equipment 24,901 Other long-term assets 4.235 Total Assets $44,482 Liabilities & Shareholders' Equity Accounts payable $6,032 Accrued expenses 2,823 Taxes payable 876 Deferred revenue 1,757 Other current liabilities 1.413 Total current liabilities 12,901 Long-term debt 2,672 Other non-current liabilities 2.000 Total liabilities $17,573 Common stock 120 Paid-in capital 7,287 Retained earnings 28,943 Treasury stock (9,712) Other 271 Total Shareholders' Equity $26.909 Total Liabilities & Shareholders' Eq $44,482 Capital Expenditures = $3,881Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started