Answered step by step

Verified Expert Solution

Question

1 Approved Answer

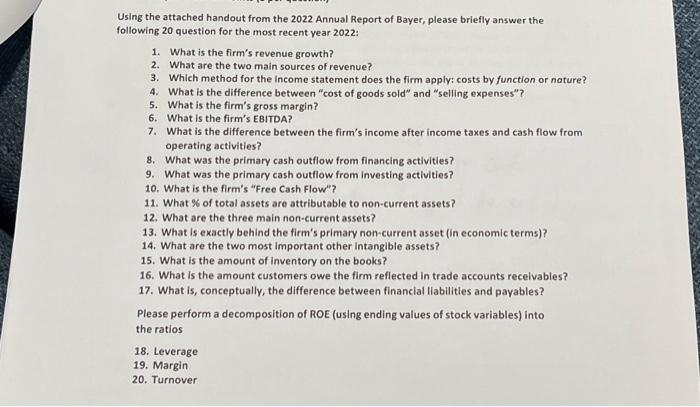

Using the attached handout from the 2022 Annual Report of Bayer, please briefly answer the following 20 question for the most recent year 2022: 1.

Using the attached handout from the 2022 Annual Report of Bayer, please briefly answer the following 20 question for the most recent year 2022: 1. What is the firm's revenue growth? 2. What are the two main sources of revenue? 3. Which method for the income statement does the firm apply: costs by function or nature? 4. What is the difference between "cost of goods sold" and "selling expenses"? 5. What is the firm's gross margin? 6. What is the firm's EBITDA? 7. What is the difference between the firm's income after income taxes and cash flow from operating activities? 8. What was the primary cash outflow from financing activities? 9. What was the primary cash outflow from investing activities? 10. What is the firm's "Free Cash Flow"? 11. What % of total assets are attributable to non-current assets? 12. What are the three main non-current assets? 13. What is exactly behind the firm's primary non-current asset (in economic terms)? 14. What are the two most important other intangible assets? 15. What is the amount of inventory on the books? 16. What is the amount customers owe the firm reflected in trade accounts receivables? 17. What is, conceptually, the difference between financial liabilities and payables? Please perform a decomposition of ROE (using ending values of stock variables) into the ratios 18. Leverage 19. Margin 20. Turnover

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started