Question

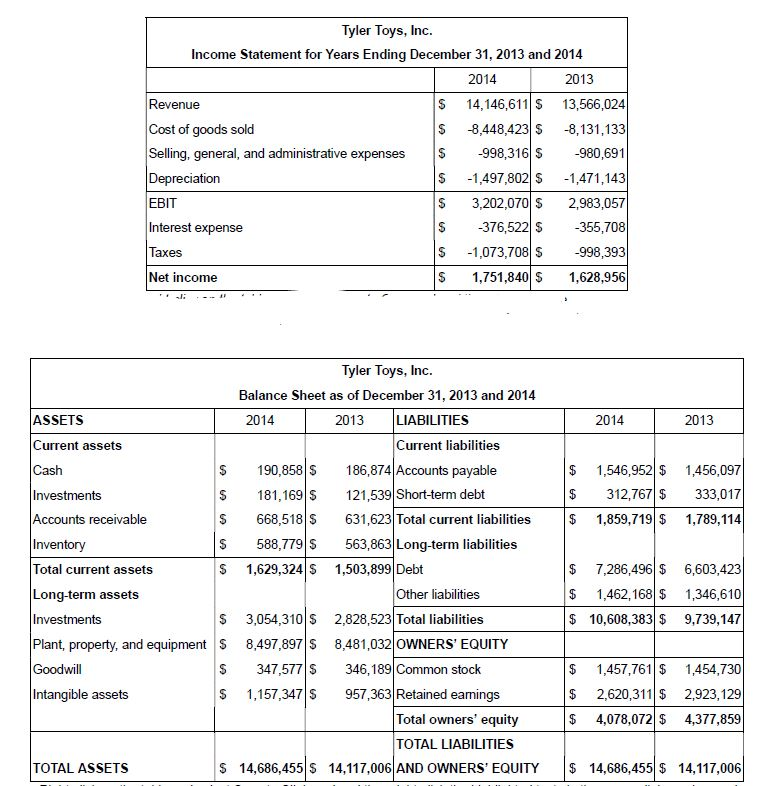

Using the attached statements, fill in the following blanks. Enter three decimal places. The total asset turnover for 2014 is _______ and for 2013 is

Using the attached statements, fill in the following blanks. Enter three decimal places.

The total asset turnover for 2014 is _______ and for 2013 is _________ . Turnover has (enter increased, decreased or stayed constant).

The net profit margin for 2014 is___________ and for 2013 is___________ . Margin has (enter increased, decreased or stayed constant).

Return on Assets (ROA) for 2014 is___________ and for 2013 is__________ . Profitability has (enter increased, decreased or stayed constant).

Which change is more likely to explain the change in ROA, the change in turnover or margin? (enter turnover, margin or both).

Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue $ 14,146,611 S 13,566,024 Cost of goods sold $ -8,448,423 S -8,131,133 Selling, general, and administrative expenses $ -998,316 $ -980,691 Depreciation $ -1,497,802 $ -1,471,143 EBIT $ 3,202,070 S 2,983,057 Interest expense $ -376,522 $ -355,708 Taxes $ -1,073,708 $ -998,393 Net income 1,751,840 $ 1,628,956 $ 2014 2013 69 A A $ 1,546,952 $ 312,767 $ 1,859,719 $ 1,456,097 333,017 1,789,114 $ Tyler Toys, Inc. Balance Sheet as of December 31, 2013 and 2014 ASSETS 2014 2013 LIABILITIES Current assets Current liabilities Cash $ 190,858 S 186,874 Accounts payable Investments $ 181,169 $ 121,539 Short-term debt Accounts receivable $ 668,518$ 631,623 Total current liabilities Inventory $ 588,779 $ 563,863 Long-term liabilities Total current assets $ 1,629,324 S 1,503,899 Debt Long-term assets Other liabilities Investments 3,054,310 $ 2,828,523 Total liabilities Plant, property, and equipment S 8,497,897 $ 8,481,032 OWNERS' EQUITY Goodwill $ 347,577 $ 346,189 Common stock Intangible assets $ 1,157,347 S 957,363 Retained earnings Total owners' equity TOTAL LIABILITIES TOTAL ASSETS $ 14,686,455 S 14,117,006 AND OWNERS' EQUITY 62 $ 7,286,496 $ 6,603,423 $ 1,462,168 $ 1,346,610 $ 10,608,383 $ 9,739,147 $ $ 1,457,761 $ 1,454,730 $ 2,620,311 $ 2,923,129 $ 4,078,072 $ 4,377,859 $ 14,686,455 $ 14,117,006Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started