Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the background information and transaction history, please record the journal entries, t accounts and trial balance in excel. Please use graphs and templates below

Using the background information and transaction history, please record the journal entries, t accounts and trial balance in excel. Please use graphs and templates below for reference. Thank you.

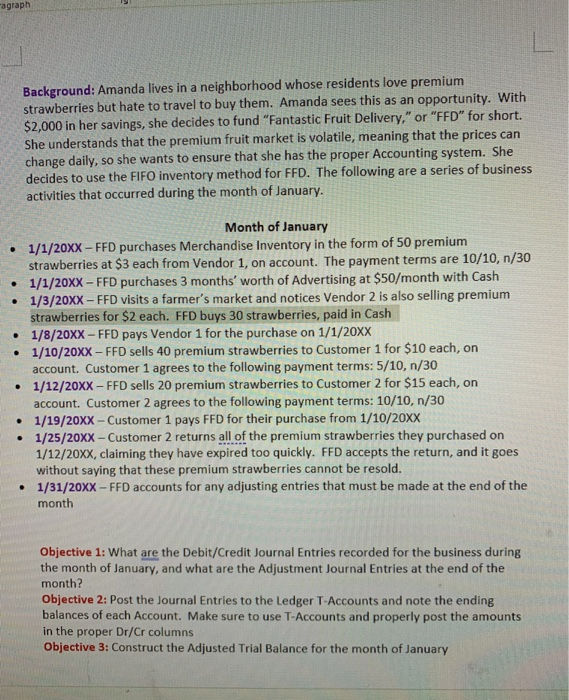

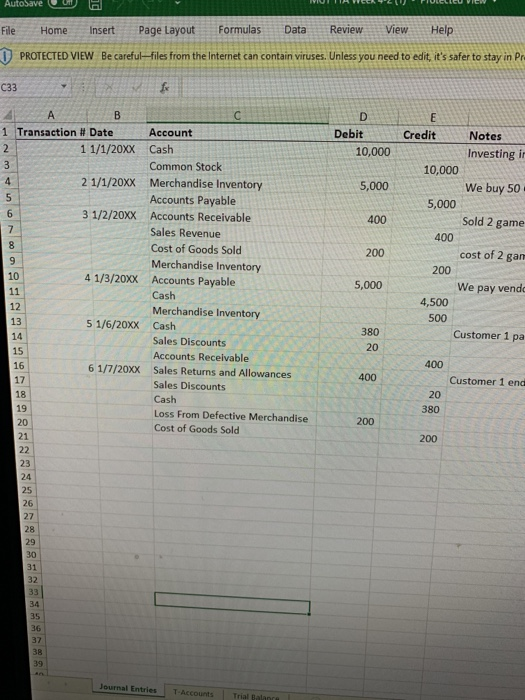

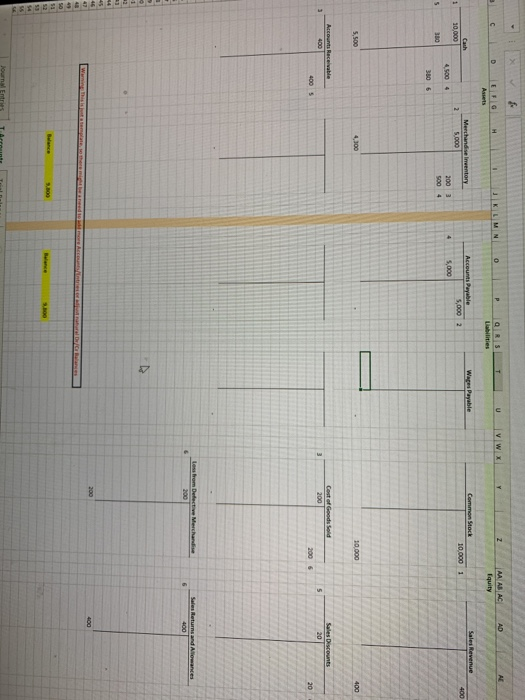

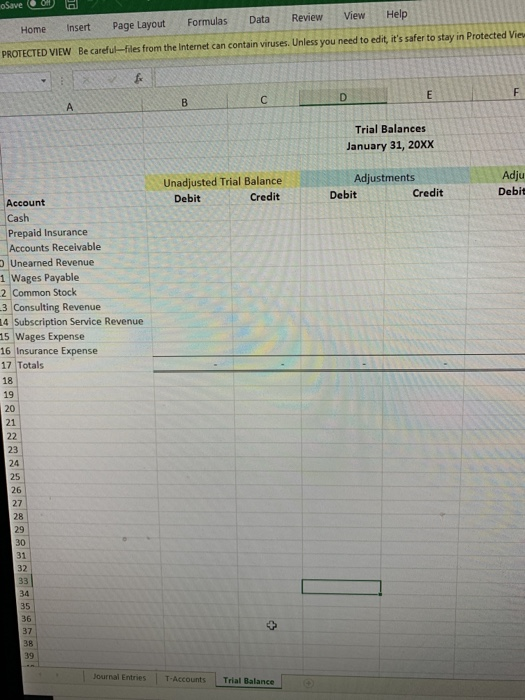

Fagraph Background: Amanda lives in a neighborhood whose residents love premium strawberries but hate to travel to buy them. Amanda sees this as an opportunity. With $2,000 in her savings, she decides to fund "Fantastic Fruit Delivery," or "FFD" for short. She understands that the premium fruit market is volatile, meaning that the prices can change daily, so she wants to ensure that she has the proper Accounting system. She decides to use the FIFO inventory method for FFD. The following are a series of business activities that occurred during the month of January. Month of January 1/1/20XX-FFD purchases Merchandise Inventory in the form of 50 premium strawberries at $3 each from Vendor 1, on account. The payment terms are 10/10, n/30 1/1/20XX - FFD purchases 3 months' worth of Advertising at $50/month with Cash 1/3/20XX - FFD visits a farmer's market and notices Vendor 2 is also selling premium strawberries for $2 each. FFD buys 30 strawberries, paid in Cash 1/8/20XX - FFD pays Vendor 1 for the purchase on 1/1/20XX 1/10/20XX - FFD sells 40 premium strawberries to Customer 1 for $10 each, on account. Customer 1 agrees to the following payment terms: 5/10, n/30 1/12/20XX - FFD sells 20 premium strawberries to Customer 2 for $15 each, on account. Customer 2 agrees to the following payment terms: 10/10, n/30 1/19/20XX - Customer 1 pays FFD for their purchase from 1/10/20XX 1/25/20XX - Customer 2 returns all of the premium strawberries they purchased on 1/12/20XX, claiming they have expired too quickly. FFD accepts the return, and it goes without saying that these premium strawberries cannot be resold. 1/31/20XX - FFD accounts for any adjusting entries that must be made at the end of the month Objective 1: What are the Debit/Credit Journal Entries recorded for the business during the month of January, and what are the Adjustment Journal Entries at the end of the month? Objective 2: Post the Journal Entries to the Ledger T-Accounts and note the ending balances of each Account. Make sure to use T-Accounts and properly post the amounts in the proper Dr/Cr columns Objective 3: Construct the Adjusted Trial Balance for the month of January AutoSave a File Home Insert Page Layout Formulas Data Review View Help 1) PROTECTED VIEW Be careful-Files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Pa C33 Debit 10,000 5,000 400 1 Transaction # Date Account 1 1/1/20XX Cash Common Stock 2 1/1/20xx Merchandise Inventory Accounts Payable 3 1/2/20XX Accounts Receivable Sales Revenue Cost of Goods Sold Merchandise Inventory 4 1/3/20XX Accounts Payable Cash Merchandise Inventory 5 1/6/20XX Cash Sales Discounts Accounts Receivable 6 1/7/20XX Sales Returns and Allowances Sales Discounts Cash Loss From Defective Merchandise Cost of Goods Sold Credit Notes Investing it 10,000 We buy 50 5,000 Sold 2 game 400 cost of 2 gan 200 We pay vendi 4,500 500 Customer 1 pa 200 5,000 380 20 400 Customer 1 end 200 Journal Entries Tra AA AB AC AD AE oSave H D Home Insert Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful--files from the Internet can contain viruses. Unless you need to edit it's safer to stay in Protected View Trial Balances January 31, 20XX Unadjusted Trial Balance Debit Credit Adjustments Debit Credit Adju Debit Account Cash Prepaid Insurance Accounts Receivable Unearned Revenue 1 Wages Payable 2 Common Stock 3 Consulting Revenue 14 Subscription Service Revenue 15 Wages Expense 16 Insurance Expense 17 Totals Journal Entries T-Accounts Trial Balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started