Answered step by step

Verified Expert Solution

Question

1 Approved Answer

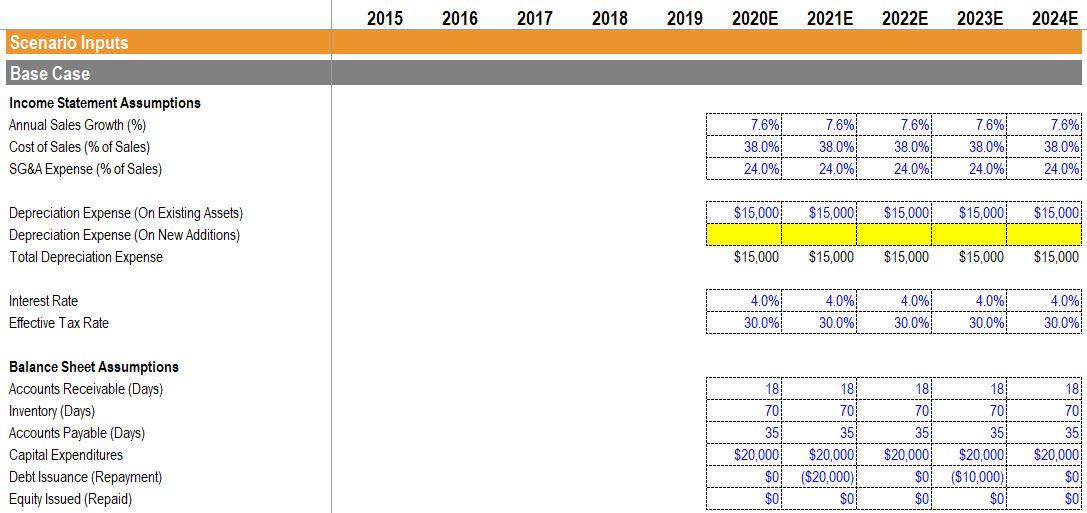

Using the Base Case, calculate total depreciation expense for the year 2023E. Assume that depreciation expense on assets pre-2020E is $15,000 per year. Depreciation on

Using the Base Case, calculate total depreciation expense for the year 2023E. Assume that depreciation expense on assets pre-2020E is $15,000 per year. Depreciation on capital expenditures made from 2020E-2024E assumes a 4-year useful life and a salvage value equal to 10% of the original cost.

| Base Case Capital Assumptions | ||||

| Asset Salvage Value (% of Capital Addition) | 10% | |||

| Asset Useful Life (New Additions) | 4 Years | |||

Answer option:

$19,500

$30,000

$33,000

$20,000

Please help to fill in answer for cell in yellow!

2015 2016 2017 2018 2019 2020E 2021E 2022E 2023E 2024E Scenario Inputs Base Case Income Statement Assumptions Annual Sales Growth (%) Cost of Sales (% of Sales) SG&A Expense (% of Sales) 7.6% 38.0% 24.0% 7.6% 38.0% 24.0% 7.6% 38.0% 24.0% 7.6% 38.0% 24.0% 7.6% --------- 38.0% --------- 24.0% $15,000 $15,000 $15,000 $15,000 $15,000 Depreciation Expense (On Existing Assets) Depreciation Expense (On New Additions) Total Depreciation Expense $15,000 $15,000 $15,000 ----------- $15,000 $15,000 Interest Rate Effective Tax Rate 4.0% 30.0% 4.0% 30.0% 4.0% 30.0% 4.0% 30.0% --------- 4.0% 30.0% ----------- 18 18 Balance Sheet Assumptions Accounts Receivable (Days) Inventory (Days) Accounts Payable (Days) Capital Expenditures Debt Issuance (Repayment) Equity Issued (Repaid) 18 70 35 $20,000 $0 $ 888a 18 70 35 $20,000 ($20,000) $0 70 35 $20,000 $0 70 35 $20,000 ($10,000) SO 70 35 $20,000 $0 $0 $0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started