Question

Using the Black-Scholes excel file posted, calculate the value of the call and put option for each of the followings: a. Time to expiration =

Using the Black-Scholes excel file posted, calculate the value of the call and put option for each of the followings:

a. Time to expiration = 3 months Standard deviation = 50% per year Exercise price = $50 Stock price = $50 Interest rate = 3%

Call value = ?

Put value = ?

b. Time to expiration = 6 months Standard deviation = 25% per year Exercise price = $50 Stock price = $50 Interest rate = 3%

Call value = ?

Put value = ?

c. Time to expiration = 6 months

Standard deviation = 50% per year Exercise price = $55 Stock price = $50 Interest rate = 3%

Call value =

Put value =

d. Time to expiration = 6 months Standard deviation = 50% per year Exercise price = $50 Stock price = $55 Interest rate = 3%

Call value =

Put value =

e. Time to expiration = 6 months Standard deviation = 50% per year Exercise price = $50 Stock price = $50 Interest rate = 5%

Call value =

Put value =

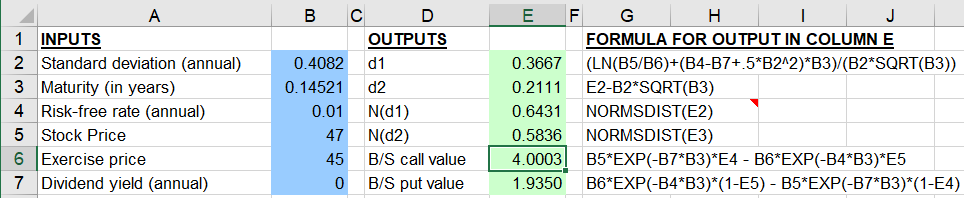

B C E F 1 INPUTS 2 Standard deviation (annual) 3 Maturity (in years) 4Risk-free rate (annual) 5 Stock Price 6 Exercise price 7 Dividend yield (annual) OUTPUTS FORMULA FOR OUTPUT IN COLUMN E 0.4082 d1 0.14521 d2 0.3667 (LN(B5/B6)t(B487+5*B2/'2)"B3)/(B2"SQRT(B3)) 0.2111E2-B2*SQRT(B3) 0.6431NORMSDIST(E2) 0.5836 NORMSDIST(E3) 4.00031 1.9350 B6*EXP(-B4*B3)*(1-E5) - B5 EXP(-BT B3)*(1-E4) 0.01 N(d1) 47 45 0 N(d2) B/S Call value B/S put value | B5EXP(-B7"B3)"E4-B6"EXP(-B4"B3YE5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started