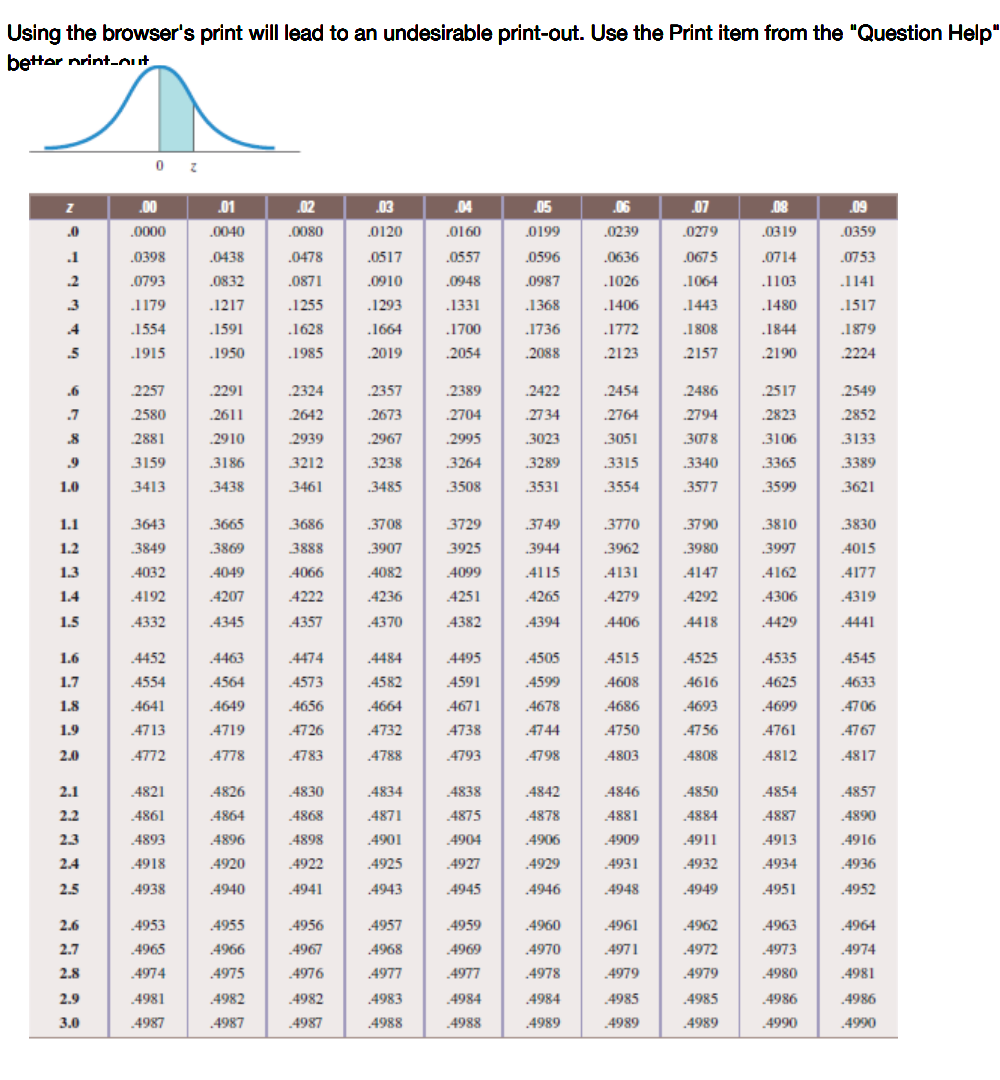

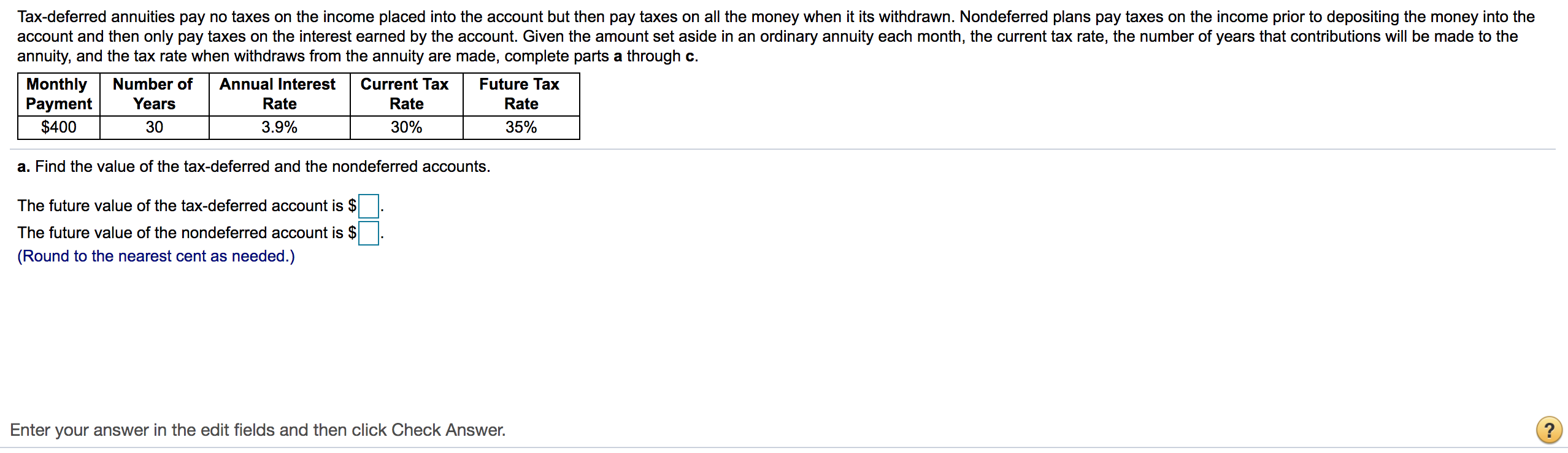

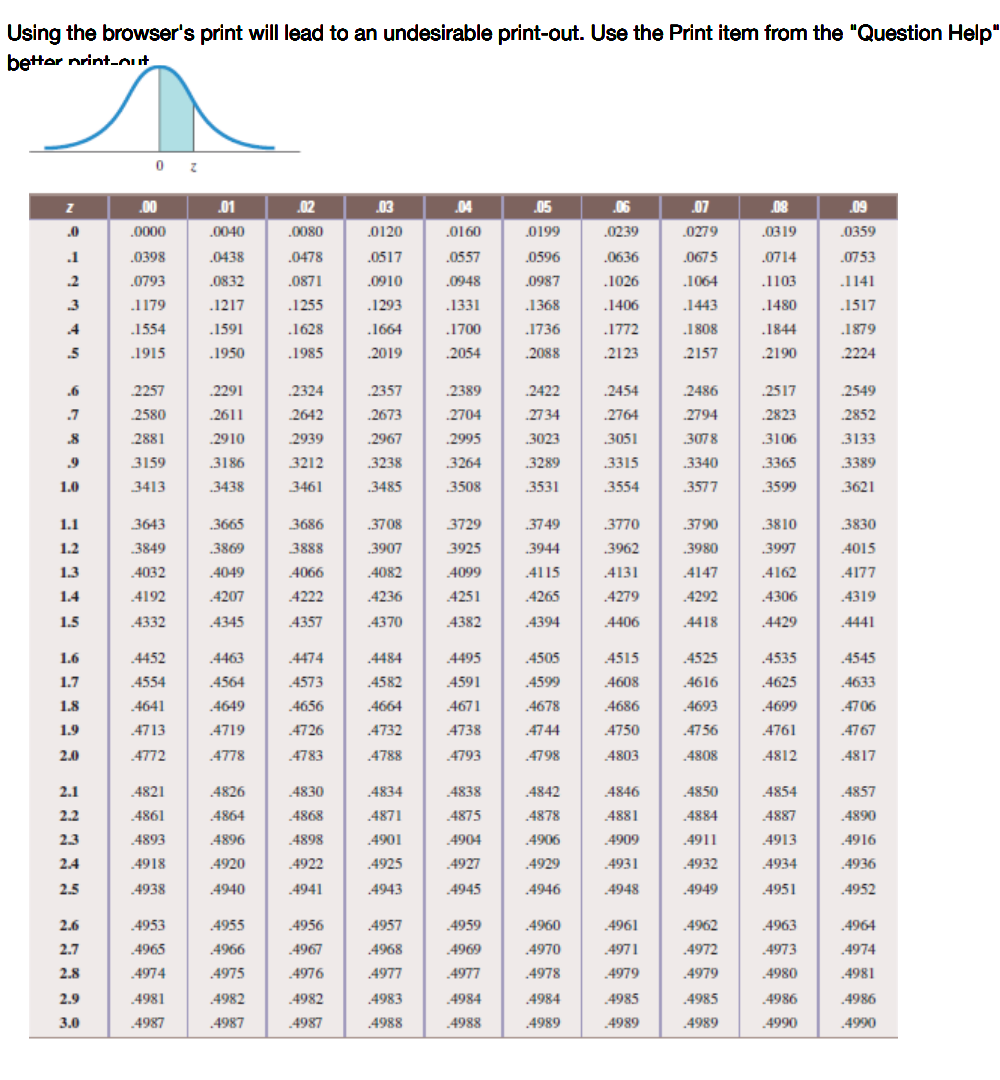

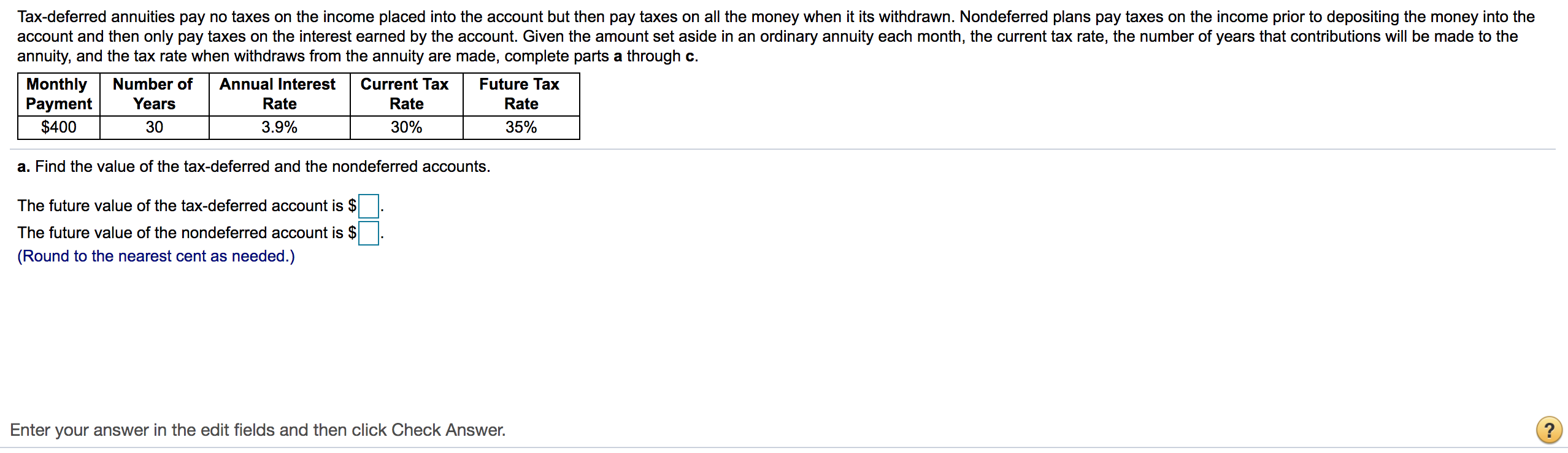

Using the browser's print will lead to an undesirable print-out. Use the Print item from the "Question Help" better nrint-out N .01 .02 .04 .06 .07 09 .0 .0000 .0040 0319 0359 .0398 .0714 Tax-deferred annuities pay no taxes on the income placed into the account but then pay taxes on all the money when it its withdrawn. Nondeferred plans pay taxes on the income prior to depositing the money into the account and then only pay taxes on the interest earned by the account. Given the amount set aside in an ordinary annuity each month, the current tax rate, the number of years that contributions will be made to the annuity, and the tax rate when withdraws from the annuity are made, complete parts a through c. Monthly Number of Annual Interest Current Tax Future Tax Payment Years Rate Rate Rate $400 30 3.9% 30% 35% a. Find the value of the tax-deferred and the nondeferred accounts. The future value of the tax-deferred account is $ The future value of the nondeferred account is $ (Round to the nearest cent as needed.) Enter your answer in the edit fields and then click Check Answer. Using the browser's print will lead to an undesirable print-out. Use the Print item from the "Question Help" better nrint-out N .01 .02 .04 .06 .07 09 .0 .0000 .0040 0319 0359 .0398 .0714 Tax-deferred annuities pay no taxes on the income placed into the account but then pay taxes on all the money when it its withdrawn. Nondeferred plans pay taxes on the income prior to depositing the money into the account and then only pay taxes on the interest earned by the account. Given the amount set aside in an ordinary annuity each month, the current tax rate, the number of years that contributions will be made to the annuity, and the tax rate when withdraws from the annuity are made, complete parts a through c. Monthly Number of Annual Interest Current Tax Future Tax Payment Years Rate Rate Rate $400 30 3.9% 30% 35% a. Find the value of the tax-deferred and the nondeferred accounts. The future value of the tax-deferred account is $ The future value of the nondeferred account is $ (Round to the nearest cent as needed.) Enter your answer in the edit fields and then click Check