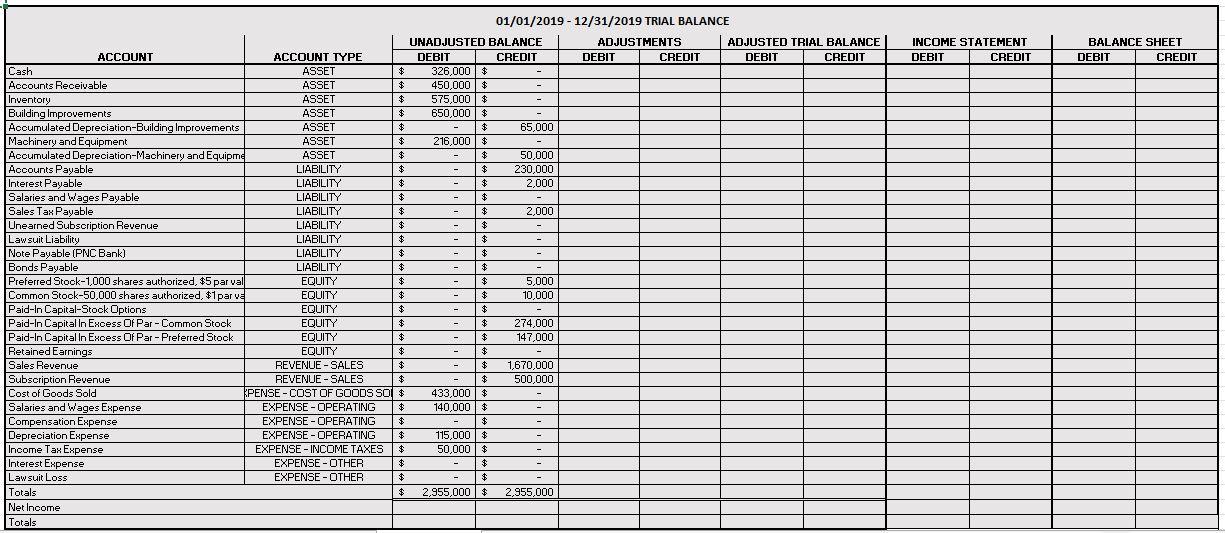

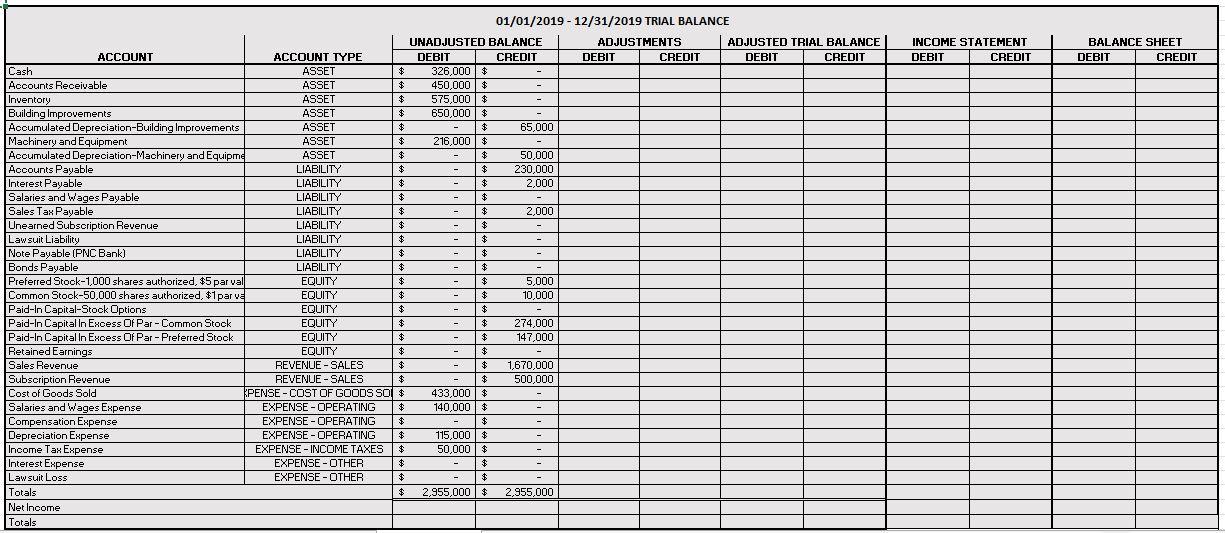

Using the completed journal entries, record the adjusting debits and credits to the corresponding accounts on the trial balance worksheet.

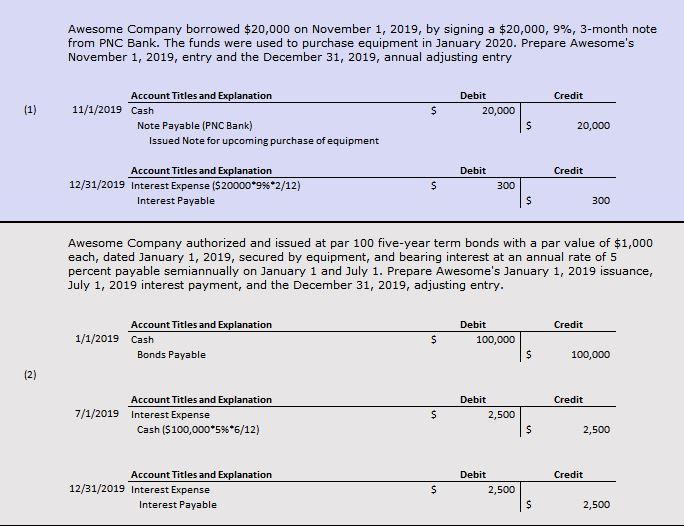

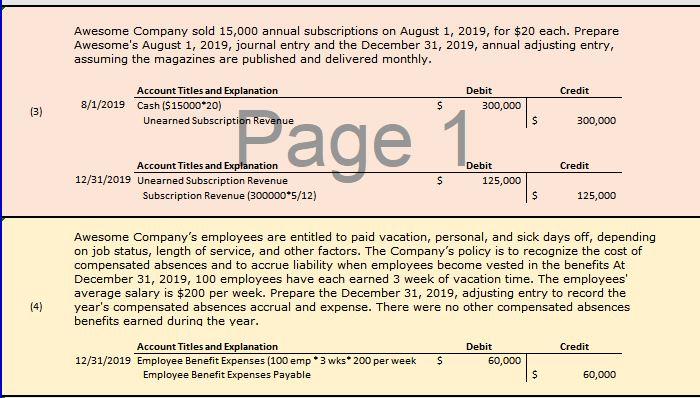

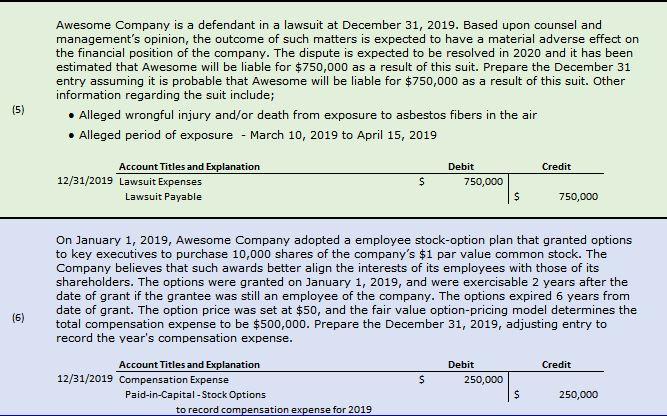

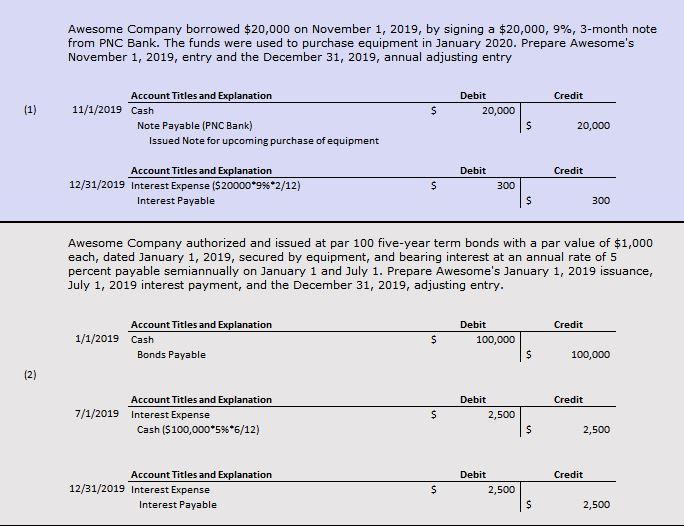

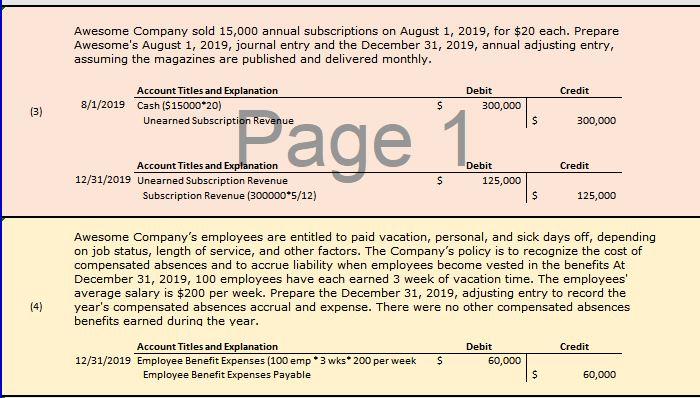

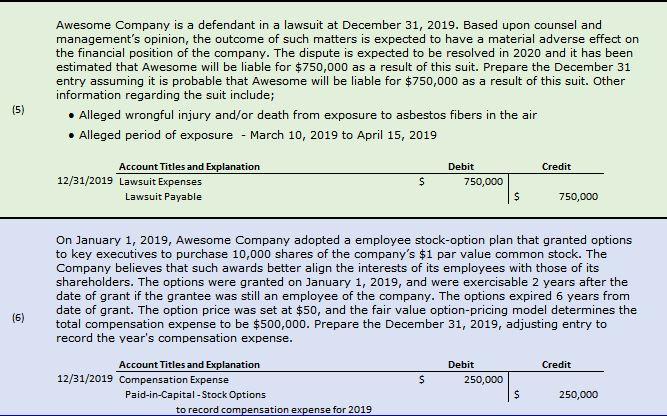

Awesome Company borrowed $20,000 on November 1, 2019, by signing a $20,000, 9%, 3-month note from PNC Bank. The funds were used to purchase equipment in January 2020. Prepare Awesome's November 1, 2019, entry and the December 31, 2019, annual adjusting entry Credit Debit 20,000 (1) $ Account Titles and Explanation 11/1/2019 Cash Note Payable (PNC Bank) Issued Note for upcoming purchase of equipment $ 20,000 Debit Credit Account Titles and Explanation 12/31/2019 Interest Expense ($20000*99*2/12) Interest Payable $ 300 $ 300 Awesome Company authorized and issued at par 100 five-year term bonds with a par value of $1,000 each, dated January 1, 2019, secured by equipment, and bearing interest at an annual rate of 5 percent payable semiannually on January 1 and July 1. Prepare Awesome's January 1, 2019 issuance, July 1, 2019 interest payment, and the December 31, 2019, adjusting entry. Credit Account Titles and Explanation 1/1/2019 Cash Bonds Payable Debit 100,000 $ $ 100,000 2 (2) Credit Account Titles and Explanation 7/1/2019 Interest Expense Cash ($100,000*5**6/12) Debit 2,500 $ $ 2,500 Credit Account Titles and Explanation 12/31/2019 Interest Expense Interest Payable Debit 2,500 $ un 2,500 Awesome Company sold 15,000 annual subscriptions on August 1, 2019, for $20 each. Prepare Awesome's August 1, 2019, journal entry and the December 31, 2019, annual adjusting entry, assuming the magazines are published and delivered monthly. Credit Account Titles and Explanation 8/1/2019 Cash ($15000*20) Unearned Subscription Revenue Debit 300,000 $ (3) 300,000 Page 1 Credit Account Titles and Explanation 12/31/2019 Unearned Subscription Revenue Subscription Revenue (300000*5/12) $ Debit 125,000 $ 125,000 Awesome Company's employees are entitled to paid vacation, personal, and sick days off, depending on job status, length of service, and other factors. The Company's policy is to recognize the cost of compensated absences and to accrue liability when employees become vested in the benefits At December 31, 2019, 100 employees have each earned 3 week of vacation time. The employees' average salary is $200 per week. Prepare the December 31, 2019, adjusting entry to record the year's compensated absences accrual and expense. There were no other compensated absences benefits earned during the year. (4) 4) Credit Account Titles and Explanation 12/31/2019 Employee Benefit Expenses (100 emp3 wks 200 per week Employee Benefit Expenses Payable Debit 60,000 $ $ 60,000 Awesome Company is a defendant in a lawsuit at December 31, 2019. Based upon counsel and management's opinion, the outcome of such matters is expected to have a material adverse effect on the financial position of the company. The dispute is expected to be resolved in 2020 and it has been estimated that Awesome will be liable for $750,000 as a result of this suit. Prepare the December 31 entry assuming it is probable that Awesome will be liable for $750,000 as a result of this suit. Other information regarding the suit include; Alleged wrongful injury and/or death from exposure to asbestos fibers in the air Alleged period of exposure - March 10, 2019 to April 15, 2019 (5) Credit Account Titles and Explanation 12/31/2019 Lawsuit Expenses Lawsuit Payable Debit 750,000 $ $ 750,000 On January 1, 2019, Awesome Company adopted a employee stock-option plan that granted options to key executives to purchase 10,000 shares of the company's $1 par value common stock. The Company believes that such awards better align the interests of its employees with those of its shareholders. The options were granted on January 1, 2019, and were exercisable 2 years after the date of grant if the grantee was still an employee of the company. The options expired 6 years from date of grant. The option price was set at $50, and the fair value option-pricing model determines the total compensation expense to be $500,000. Prepare the December 31, 2019, adjusting entry to record the year's compensation expense. (6) Credit Debit 250,000 $ Account Titles and Explanation 12/31/2019 Compensation Expense Paid-in-Capital - Stock Options to record compensation expense for 2019 $ 250,000 INCOME STATEMENT DEBIT CREDIT BALANCE SHEET DEBIT CREDIT - = = 01/01/2019 - 12/31/2019 TRIAL BALANCE UNADJUSTED BALANCE ADJUSTMENTS ADJUSTED TRIAL BALANCE ACCOUNT ACCOUNT TYPE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT Cash ASSET $ 326,000 $ Accounts Receivable ASSET $ 450,000 $ - Inventory ASSET $ 575,000 $ - Building Improvements ASSET $ 650,000 $ Accumulated Depreciation-Building Improvements ASSET $ - $ 65,000 Machinery and Equipment ASSET $ 216,000 $ - Accumulated Depreciation-Machinery and Equipme ASSET $ $ 50,000 Accounts Payable LIABILITY $ $ $ 230,000 Interest Payable LIABILITY $ $ $ 2,000 Salaries and Wages Payable LIABILITY $ - $ Sales Tax Payable LIABILITY $ - $ 2,000 Unearned Subscription Revenue LIABILITY $ $ $ Lawsuit Liability LIABILITY $ $ $ - Note Payable (PNC Bank) LIABILITY $ $ Bonds Payable LIABILITY $ - $ - Preferred Stook-1,000 shares authorized, $5 par val $ $ 5,000 Common Stock-50,000 shares authorized, $1 par va EQUITY $ $ - $ 10,000 Paid-In Capital-Stock Options EQUITY $ $ $ Paid-In Capital In Excess Of Par - Common Stock EQUITY $ - $ 274,000 Paid-In Capital In Excess Of Par-Preferred Stock EQUITY $ - $ 147,000 Retained Earnings EQUITY $ $ - $ Sales Revenue REVENUE - SALES $ - $ 1,670,000 Subscription Revenue REVENUE - SALES $ $ 500,000 Cost of Goods Sold PENSE - COST OF GOODS SO $ 433,000 $ Salaries and Wages Expense EXPENSE - OPERATING $ 140,000 $ - Compensation Expense EXPENSE - OPERATING $ $ - Depreciation Expense EXPENSE - OPERATING $ 115,000 $ - Income Tax Expense EXPENSE - INCOME TAXES $ 50,000 $ Interest Expense EXPENSE - OTHER $ Lawsuit Loss EXPENSE - OTHER $ $ Totals $ $ 2,955,000 $ 2,955,000 Net Income Totals EQUITY =