Answered step by step

Verified Expert Solution

Question

1 Approved Answer

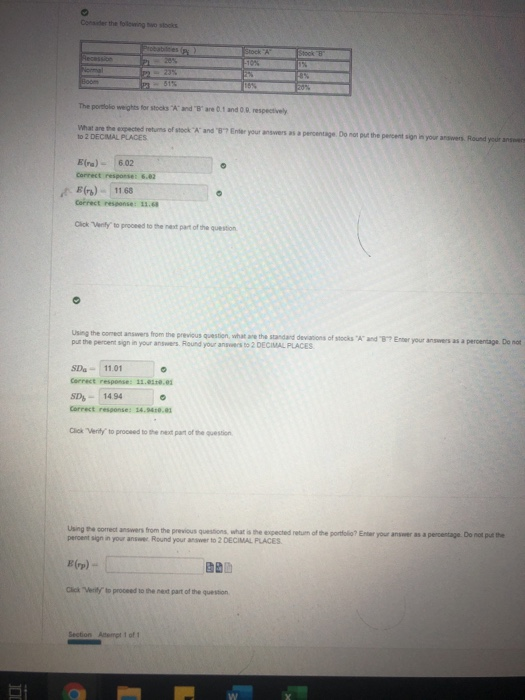

using the correcr answers from the previous questions, what is the expected return of the portfolio? Stock Normal Boo Stock F10% 2% 15% 85 513

using the correcr answers from the previous questions, what is the expected return of the portfolio?

Stock Normal Boo Stock F10% 2% 15% 85 513 The portfolio weights for stocks and are 0.1 and 0.. respectively What are the expected returns of stock "Aand "Enter your answers as a percentage. Do not put the percent sign in your answers. Round your to Z DECIMAL PLACES Bra) 6.02 Correct responses 6.62 () - 1168 Correct conse: 11.6 Click Verily to proceed to the next part of the question Using the correct answers from the previous question, what we the standard deviations of stocks and Emer your answers as a percentage. Do not put the percent sign in your answers. Round your answers to 2 DECIMAL PLACES SD 11.01 Correct response: 11. st.es SD - 1494 Correct resone 14.10.1 Click Verity to proceed to the next part of the question Using the correct answers from the previous questions, what is the expected return of the portfolio? Enter your answer as a percentage. Do not put the percent sign in your answer Round your answer to 2 DECIMAL PLACES () - Click Verly to proceed to the next part of the question Section Attempt 1 of 1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started