Question

Using the data below, calculate the WACC (weighted average cost of capital). You are provided with 2 examples (first 2 rows) and the amount of

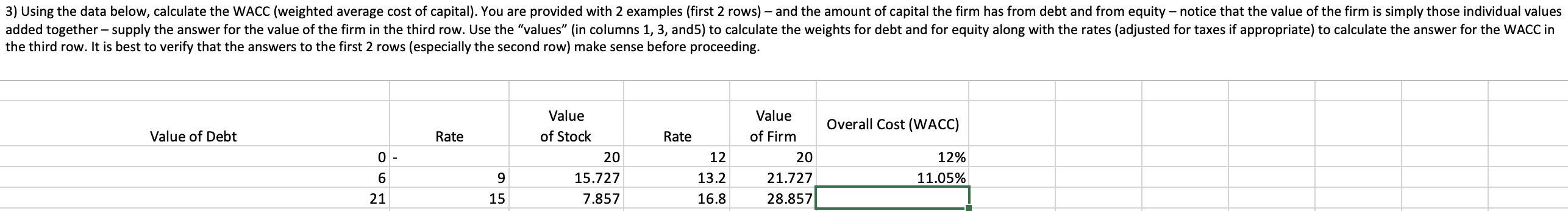

Using the data below, calculate the WACC (weighted average cost of capital). You are provided with 2 examples (first 2 rows) and the amount of capital the firm has from debt and from equity notice that the value of the firm is simply those individual values added together supply the answer for the value of the firm in the third row. Use the values (in columns 1, 3, and5) to calculate the weights for debt and for equity along with the rates (adjusted for taxes if appropriate) to calculate the answer for the WACC in the third row. It is best to verify that the answers to the first 2 rows (especially the second row) make sense before proceeding.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started