using the data from above how do I solve for the the last 3 pictures?

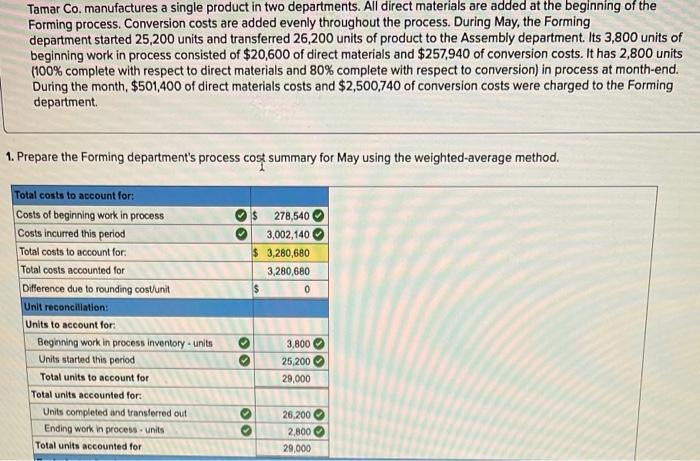

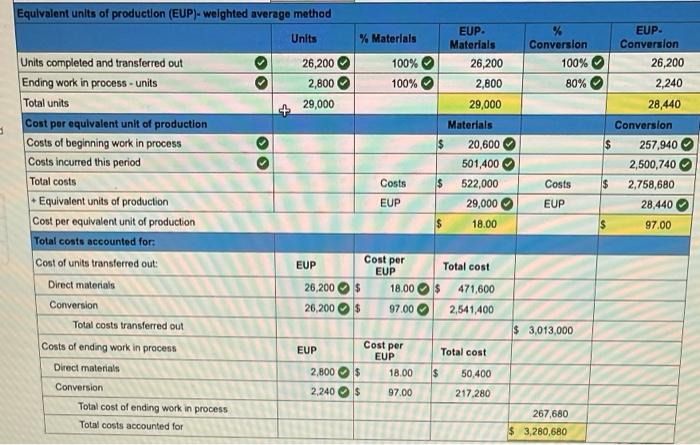

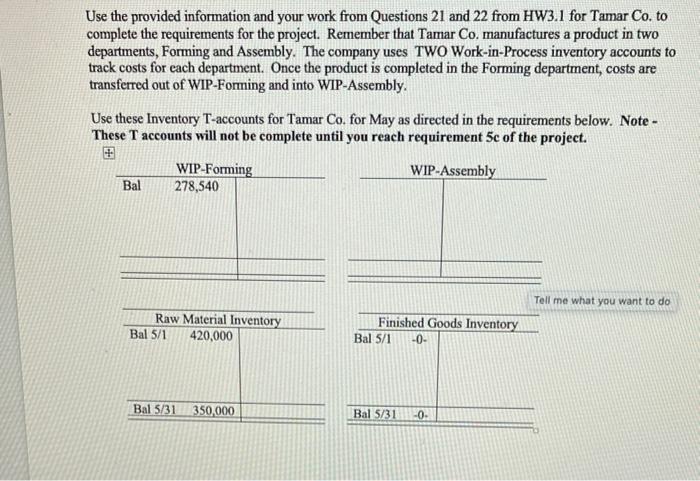

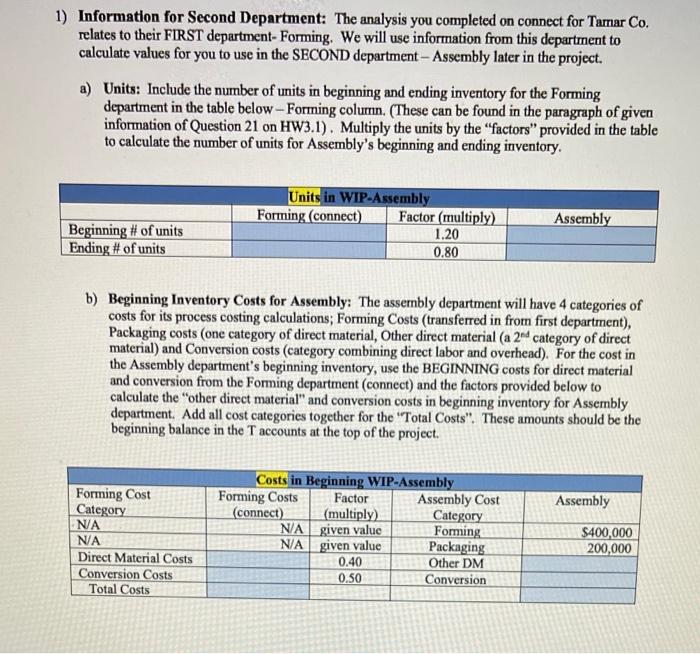

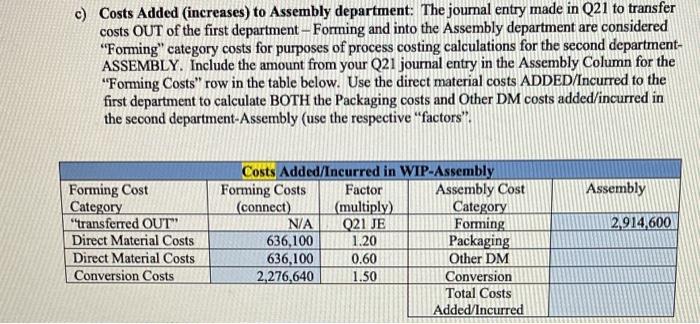

Tamar Co. manufactures a single product in two departments. All direct materials are added at the beginning of the Forming process. Conversion costs are added evenly throughout the process. During May, the Forming department started 25,200 units and transferred 26,200 units of product to the Assembly department. Its 3,800 units of beginning work in process consisted of $20,600 of direct materials and $257,940 of conversion costs. It has 2,800 units (100% complete with respect to direct materials and 80% complete with respect to conversion) in process at month-end. During the month, $501.400 of direct materials costs and $2,500,740 of conversion costs were charged to the Forming department. 1. Prepare the Forming department's process cost summary for May using the weighted average method. OS 278,540 Total costs to account for Costs of beginning work in process Costs incurred this period Total costs to account for Total costs accounted for Difference due to rounding costunit Unit reconciliation: Units to account for: Beginning work in process inventory - units Units started this period 3,002,140 $ 3,280,680 3,280,680 $ 0 3,800 SIS 25,200 Total units to account for 29,000 Total units accounted for: Units completed and transferred out Ending work in process units Total units accounted for SI 26,200 2,800 29,000 Equlvalent units of production (EUP)- weighted average method Units % Materials EUP: Materials EUP- Conversion Conversion SI 26,200 100% 26,200 100% 26,200 2,800 100% 2,800 80% 2,240 29,000 29,000 28,440 Conversion Units completed and transferred out Ending work in process - units Total units Cost por equivalent unit of production Costs of beginning work in process Costs incurred this period Total costs * Equivalent units of production Cost per equivalent unit of production Total costs accounted for: Cost of units transferred out: Materials 20,600 501,400 $ 257,940 2,500,740 Costs 522,000 Costs $ 2,758,680 EUP 29,000 EUP 28,440 $ 18.00 97.00 Cost per EUP Total cost EUP Direct materials 18.00 $ 471,600 26,200 $ 26,200 $ Conversion 97.00 2,541,400 Total costs transferred out $ 3,013,000 Costs of ending work in process EUP Cost per EUP Total cost Direct materials 2,800 $ 18.00 $ 50,400 Conversion 2,240$ 97.00 217,280 Total cost of ending work in process Total costs accounted for 267.680 $ 3,280,680 Use the provided information and your work from Questions 21 and 22 from HW3.1 for Tamar Co. to complete the requirements for the project. Remember that Tamar Co. manufactures a product in two departments, Forming and Assembly. The company uses TWO Work-in-Process inventory accounts to track costs for each department. Once the product is completed in the Forming department, costs are transferred out of WIP-Forming and into WIP-Assembly. Use these Inventory T-accounts for Tamar Co. for May as directed in the requirements below. Note - These T accounts will not be complete until you reach requirement 5c of the project. WIP-Forming 278,540 WIP-Assembly Bal Tell me what you want to do Raw Material Inventory Bal 5/1 420,000 Finished Goods Inventory Bal 5/1 -0- Bal 5/31 350,000 Bal 5/31 -0- 1) Information for Second Department: The analysis you completed on connect for Tamar Co. relates to their FIRST department Forming. We will use information from this department to calculate values for you to use in the SECOND department - Assembly later in the project. a) Units: Include the number of units in beginning and ending inventory for the Forming department in the table below - Forming column. (These can be found in the paragraph of given information of Question 21 on HW3.1). Multiply the units by the "factors provided in the table to calculate the number of units for Assembly's beginning and ending inventory. Units in WIP-Assembly Forming (connect) Factor (multiply) 1.20 Assembly Beginning # of units Ending # of units 0.80 b) Beginning Inventory Costs for Assembly: The assembly department will have 4 categories of costs for its process costing calculations; Forming Costs (transferred in from first department), Packaging costs (one category of direct material, Other direct material (a 2nd category of direct material) and Conversion costs (category combining direct labor and overhead). For the cost in the Assembly department's beginning inventory, use the BEGINNING costs for direct material and conversion from the Forming department (connect) and the factors provided below to calculate the other direct material and conversion costs in beginning inventory for Assembly department. Add all cost categories together for the "Total Costs". These amounts should be the beginning balance in the T accounts at the top of the project. Assembly Forming Cost Category NA NA Direct Material Costs Conversion Costs Total Costs Costs in Beginning WIP-Assembly Forming Costs Factor Assembly Cost (connect) (multiply) Category NA given value Forming NA given value Packaging Other DM 0.50 Conversion $400,000 200,000 0.40 c) Costs Added increases) to Assembly department: The journal entry made in Q21 to transfer costs OUT of the first department - Forming and into the Assembly department are considered "Forming" category costs for purposes of process costing calculations for the second department- ASSEMBLY. Include the amount from your Q21 journal entry in the Assembly Column for the "Forming Costs" row in the table below. Use the direct material costs ADDED/Incurred to the first department to calculate BOTH the Packaging costs and Other DM costs added/incurred in the second department-Assembly (use the respective factors' Assembly 2,914,600 Forming Cost Category "transferred OUT" Direct Material Costs Direct Material Costs Conversion Costs Costs Added/Incurred in WIP-Assembly Forming Costs Factor Assembly Cost (connect) (multiply) Category N/A Q21 JE Foming 636,100 1.20 Packaging 636,100 0.60 Other DM 2,276,640 1.50 Conversion Total Costs Added/Incurred