Question

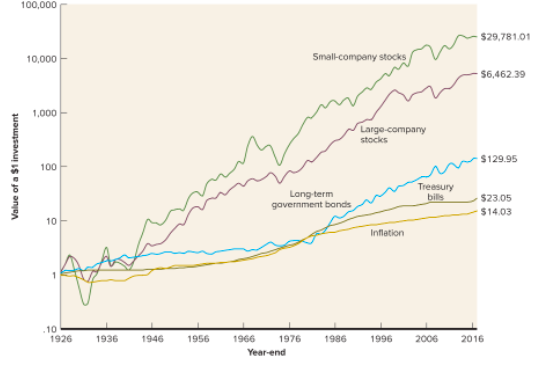

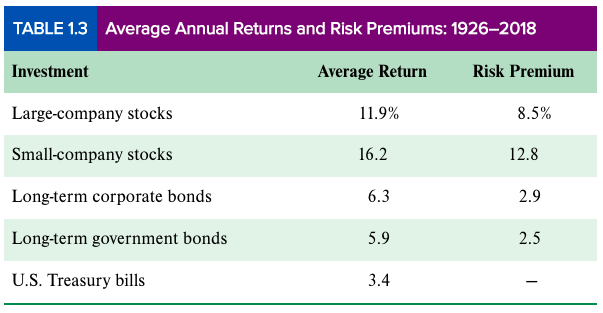

Using the data from Chapter 1 for Large Stocks and Long-term U.S. Government bonds, calculate: 1) The expected return assuming that the past returns represent

Using the data from Chapter 1 for Large Stocks and Long-term U.S. Government bonds, calculate: 1) The expected return assuming that the past returns represent the expected future returns 2) Calculate the standard deviation of each portfolio 3) Calculate the expected return for a portfolio weight 50% in each security 4) Calculate the standard deviation of the portfolio from a combination of the two assets 5) Calculate the minimum variance portfolio for a combination of the two assets 6) Plot the efficient frontier including the minimum variance portfolio

Value of a $1 investment 100,000 10,000 1,000 100 10 .10 1926 1936 1946 1956 1966 Small-company stocks Long-term government bonds 1976 Year-end Large-company stocks Treasury bills Inflation 1986 1996 2006 $29,781.01 $6,462.39 $129.95 $23.05 $14.03 2016 TABLE 1.3 Average Annual Returns and Risk Premiums: 1926-2018 Investment Average Return Risk Premium Large-company stocks 11.9% 8.5% Small-company stocks 16.2 Long-term corporate bonds Long-term government bonds U.S. Treasury bills 6.3 5.9 3.4 12.8 2.9 2.5 Value of a $1 investment 100,000 10,000 1,000 100 10 .10 1926 1936 1946 1956 1966 Small-company stocks Long-term government bonds 1976 Year-end Large-company stocks Treasury bills Inflation 1986 1996 2006 $29,781.01 $6,462.39 $129.95 $23.05 $14.03 2016 TABLE 1.3 Average Annual Returns and Risk Premiums: 1926-2018 Investment Average Return Risk Premium Large-company stocks 11.9% 8.5% Small-company stocks 16.2 Long-term corporate bonds Long-term government bonds U.S. Treasury bills 6.3 5.9 3.4 12.8 2.9 2.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started