Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) The IAASB has published the Exposure Draft, Proposed ISA 540 (Revised) Auditing Accounting Estimates and Related Disclosures (ED-540) stating The objective of ED-540

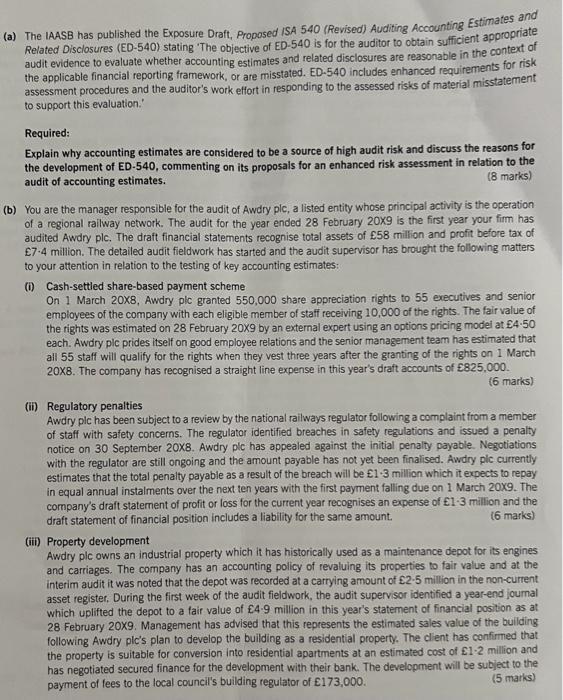

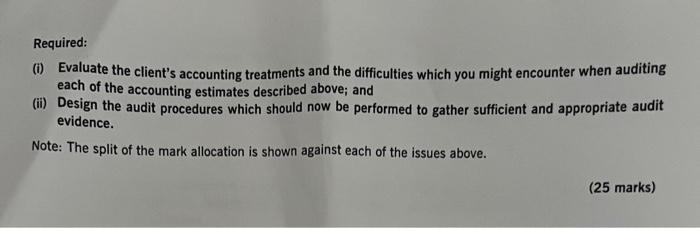

(a) The IAASB has published the Exposure Draft, Proposed ISA 540 (Revised) Auditing Accounting Estimates and Related Disclosures (ED-540) stating The objective of ED-540 is for the auditor to obtain sufficient appropriate audit evidence to evaluate whether accounting estimates and related disclosures are reasonable in the context of the applicable financial reporting framework, or are misstated. ED-540 includes enhanced requirements for risk assessment procedures and the auditor's work effort in responding to the assessed risks of material misstatement to support this evaluation. Required: Explain why accounting estimates are considered to be a source of high audit risk and discuss the reasons for the development of ED-540, commenting on its proposals for an enhanced risk assessment in relation to the (8 marks) audit of accounting estimates. (b) You are the manager responsible for the audit of Awdry plc, a listed entity whose principal activity is the operation of a regional railway network. The audit for the year ended 28 February 20X9 is the first year your firm has audited Awdry plc. The draft financial statements recognise total assets of 58 million and profit before tax of 7-4 million. The detailed audit fieldwork has started and the audit supervisor has brought the following matters to your attention in relation to the testing of key accounting estimates: (i) Cash-settled share-based payment scheme On 1 March 20X8, Awdry plc granted 550,000 share appreciation rights to 55 executives and senior employees of the company with each eligible member of staff receiving 10,000 of the rights. The fair value of the rights was estimated on 28 February 20X9 by an external expert using an options pricing model at 4-50 each. Awdry plc prides itself on good employee relations and the senior management team has estimated that all 55 staff will qualify for the rights when they vest three years after the granting of the rights on 1 March 20X8. The company has recognised a straight line expense in this year's draft accounts of 825,000. (6 marks) (ii) Regulatory penalties Awdry plc has been subject to a review by the national railways regulator following a complaint from a member of staff with safety concerns. The regulator identified breaches in safety regulations and issued a penalty notice on 30 September 20X8. Awdry plc has appealed against the initial penalty payable. Negotiations with the regulator are still ongoing and the amount payable has not yet been finalised. Awdry plc currently estimates that the total penalty payable as a result of the breach will be 1-3 million which it expects to repay in equal annual instalments over the next ten years with the first payment falling due on 1 March 20X9. The company's draft statement of profit or loss for the current year recognises an expense of 1-3 million and the draft statement of financial position includes a liability for the same amount. (6 marks) (iii) Property development Awdry plc owns an industrial property which it has historically used as a maintenance depot for its engines and carriages. The company has an accounting policy of revaluing its properties to fair value and at the interim audit it was noted that the depot was recorded at a carrying amount of 2-5 million in the non-current asset register. During the first week of the audit fieldwork, the audit supervisor identified a year-end journal which uplifted the depot to a fair value of 4-9 million in this year's statement of financial position as at 28 February 20X9. Management has advised that this represents the estimated sales value of the building following Awdry plc's plan to develop the building as a residential property. The client has confirmed that the property is suitable for conversion into residential apartments at an estimated cost of 1-2 million and has negotiated secured finance for the development with their bank. The development will be subject to the (5 marks) payment of fees to the local council's building regulator of 173,000. Required: (i) Evaluate the client's accounting treatments and the difficulties which you might encounter when auditing each of the accounting estimates described above; and (ii) Design the audit procedures which should now be performed to gather sufficient and appropriate audit evidence. Note: The split of the mark allocation is shown against each of the issues above. (25 marks)

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a Accounting estimates are considered to be a source of high audit risk because they are inherently subjective and are subject to the judgement of management Accounting estimates can be used to manipu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started