Question

Using the data from their latest financial reports I have provided, I want you to analyze how taking on debt would affect the return to

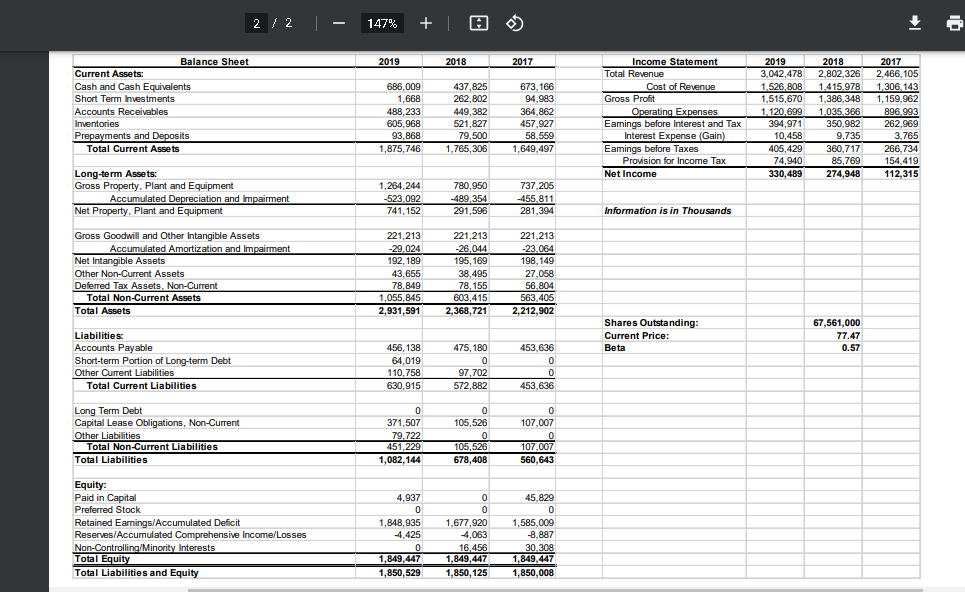

Using the data from their latest financial reports I have provided, I want you to analyze how taking on debt would affect the return to equity holders, the financial ratios of the firm, and other considerations that should go into the decision. Investors in COLM have enjoyed relatively good growth in sales over the last few years, and would like their stock price to increase just as much. Columbias management agrees that a recapitalization has the potential to boost the firms stock price, but are afraid of making a strategic mistake that could affect them permanently in the future. To ensure this is clear, I repeat that none of the debt would be used to buy assets or operate the firm. It will be used entirely to buy back stock at its current market price. To do this analysis, you will need to calculate the value of the firm at various levels of borrowing. After analyzing existing bonds on the market, you expect that the cost of debt will be based on the amount borrowed, and the rates at which you can borrow are given in the table below.

Using the data from their latest financial reports I have provided, I want you to analyze how taking on debt would affect the return to equity holders, the financial ratios of the firm, and other considerations that should go into the decision. Investors in COLM have enjoyed relatively good growth in sales over the last few years, and would like their stock price to increase just as much. Columbias management agrees that a recapitalization has the potential to boost the firms stock price, but are afraid of making a strategic mistake that could affect them permanently in the future. To ensure this is clear, I repeat that none of the debt would be used to buy assets or operate the firm. It will be used entirely to buy back stock at its current market price. To do this analysis, you will need to calculate the value of the firm at various levels of borrowing. After analyzing existing bonds on the market, you expect that the cost of debt will be based on the amount borrowed, and the rates at which you can borrow are given in the table below.

100,000,000 2.850% 200,000,000 2.950% 300,000,000 3.100% 400,000,000 3.250% 500,000,000 3.300% 600,000,000 3.450% 700,000,000 3.650% 800,000,000 3.800% 900,000,000 4.250% 1,000,000,000 4.600%

To get the cost of equity, you will use CAPM, where the current 3-month T-bill rate is 1.1%, and you expect that 7% will be the market return. Also assume that they will keep the same payout ratio regardless of their capital structure, which has historically been 20% of their net income. The stock price is estimated by dividing the expected dividend per share by the firms cost of capital minus an expected growth rate of 2.50%. This is called the dividend growth model, and is commonly used. Stock Price = {Dividend * (1+g)} / (WACC g)

In your write-up, describe what you feel to be the optimal capital structure, and write a one page report justifying your conclusions, as well as making a recommendation to the board. Explain why your answer is correct, and also discuss what impact borrowing might have on other aspects of the firm, such as their return on equity or current operating risk.

2 / 2 - 147% + | G] ) 2019 2018 2017 Balance Sheet Current Assets: Cash and Cash Equivalents Short Term Investments Accounts Receivables Inventories Prepayments and Deposits Total Current Assets 686,009 1,668 488,233 605,968 93,868 1,875,746 437,825 262,802 449,382 521,827 79,500 1,765,306 673,166 94.983 364,862 457,927 58,559 1,649,497 Income Statement Total Revenue Cost of Revenue Gross Profit Operating Expenses Earnings before Interest and Tax Interest Expense (Gain) Earnings before Taxes Provision for Income Tax Net Income 2019 3,042,478 1,526,808 1,515,670 1, 120.699 394,971 10.458 405,429 74,940 330.489 2018 2,802,326 1,415,978 1,386,348 1,035,366 350.982 9,735 360,717 85,769 274,948 2017 2,466,105 1,306,143 1,159,962 896.993 262,969 3.765 266.734 154,419 112,315 Long-term Assets: Gross Property, Plant and Equipment Accumulated Depreciation and Impairment Net Property, Plant and Equipment 1,264,244 -523.092 741, 152 780,950 -489,354 291,596 737,205 -455.811 281,394 Information is in Thousands Gross Goodwill and Other Intangible Assets Accumulated Amortization and Impairment Net Intangible Assets Other Non-Current Assets Deferred Tax Assets. Non-Current Total Non-Current Assets Total Assets 221.213 -29.024 192, 189 43,655 78.849 1,055,845 2,931,591 221,213 -26,044 195, 169 38,495 78,155 603,415 2,368,721 221.213 -23,064 198, 149 27.058 56,804 563,405 2,212,902 Shares Outstanding: Current Price: Beta 67,561,000 77.47 0.57 Liabilities: Accounts Payable Short-term Portion of Long-term Debt Other Current Liabilities Total Current Liabilities 456,138 64,019 110,758 630,915 475, 180 0 97,702 572,882 453,636 0 0 453,636 Long Term Debt Capital Lease Obligations, Non-Current Other Liabilities Total Non-Current Liabilities Total Liabilities 0 371,507 79.722 451,229 1,082,144 0 105,526 0 105,526 678,408 0 107,007 0 107,007 560,643 Equity Paid in Capital Preferred Stock Retained Earnings/Accumulated Deficit Reserves/Accumulated Comprehensive Income/Losses Non-Controlling/Minority Interests Total Equity Total Liabilities and Equity 4,937 0 1,848,935 4.425 0 1,849,447 1,850,529 0 0 1,677,920 4,063 16,456 1,849,447 1,850, 125 45.829 0 1,585,009 -8.887 30.308 1,849,447 1,850,008 2 / 2 - 147% + | G] ) 2019 2018 2017 Balance Sheet Current Assets: Cash and Cash Equivalents Short Term Investments Accounts Receivables Inventories Prepayments and Deposits Total Current Assets 686,009 1,668 488,233 605,968 93,868 1,875,746 437,825 262,802 449,382 521,827 79,500 1,765,306 673,166 94.983 364,862 457,927 58,559 1,649,497 Income Statement Total Revenue Cost of Revenue Gross Profit Operating Expenses Earnings before Interest and Tax Interest Expense (Gain) Earnings before Taxes Provision for Income Tax Net Income 2019 3,042,478 1,526,808 1,515,670 1, 120.699 394,971 10.458 405,429 74,940 330.489 2018 2,802,326 1,415,978 1,386,348 1,035,366 350.982 9,735 360,717 85,769 274,948 2017 2,466,105 1,306,143 1,159,962 896.993 262,969 3.765 266.734 154,419 112,315 Long-term Assets: Gross Property, Plant and Equipment Accumulated Depreciation and Impairment Net Property, Plant and Equipment 1,264,244 -523.092 741, 152 780,950 -489,354 291,596 737,205 -455.811 281,394 Information is in Thousands Gross Goodwill and Other Intangible Assets Accumulated Amortization and Impairment Net Intangible Assets Other Non-Current Assets Deferred Tax Assets. Non-Current Total Non-Current Assets Total Assets 221.213 -29.024 192, 189 43,655 78.849 1,055,845 2,931,591 221,213 -26,044 195, 169 38,495 78,155 603,415 2,368,721 221.213 -23,064 198, 149 27.058 56,804 563,405 2,212,902 Shares Outstanding: Current Price: Beta 67,561,000 77.47 0.57 Liabilities: Accounts Payable Short-term Portion of Long-term Debt Other Current Liabilities Total Current Liabilities 456,138 64,019 110,758 630,915 475, 180 0 97,702 572,882 453,636 0 0 453,636 Long Term Debt Capital Lease Obligations, Non-Current Other Liabilities Total Non-Current Liabilities Total Liabilities 0 371,507 79.722 451,229 1,082,144 0 105,526 0 105,526 678,408 0 107,007 0 107,007 560,643 Equity Paid in Capital Preferred Stock Retained Earnings/Accumulated Deficit Reserves/Accumulated Comprehensive Income/Losses Non-Controlling/Minority Interests Total Equity Total Liabilities and Equity 4,937 0 1,848,935 4.425 0 1,849,447 1,850,529 0 0 1,677,920 4,063 16,456 1,849,447 1,850, 125 45.829 0 1,585,009 -8.887 30.308 1,849,447 1,850,008Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started