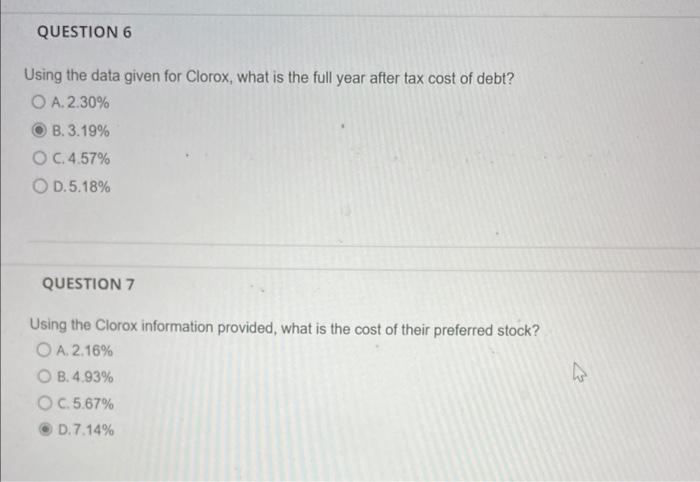

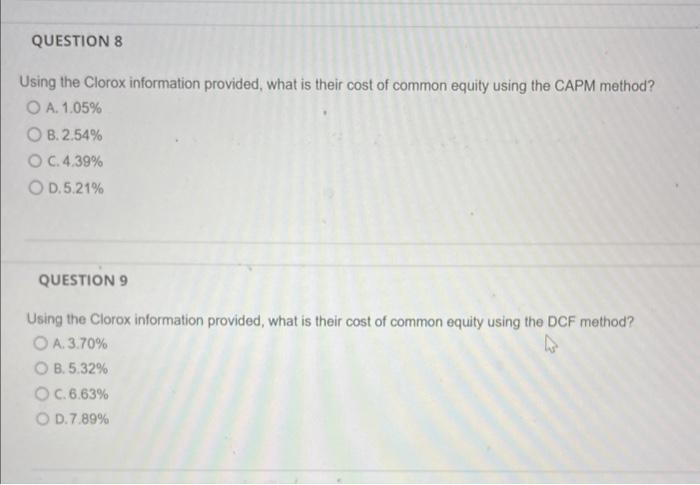

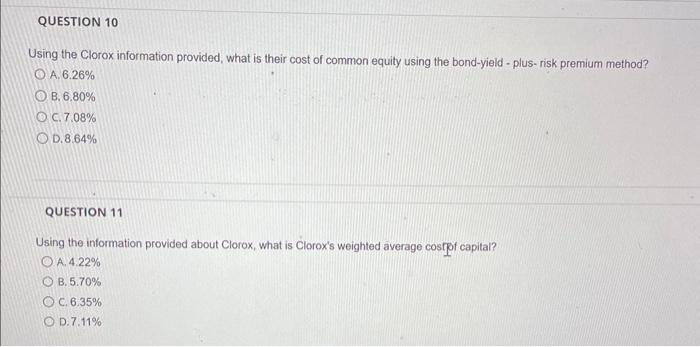

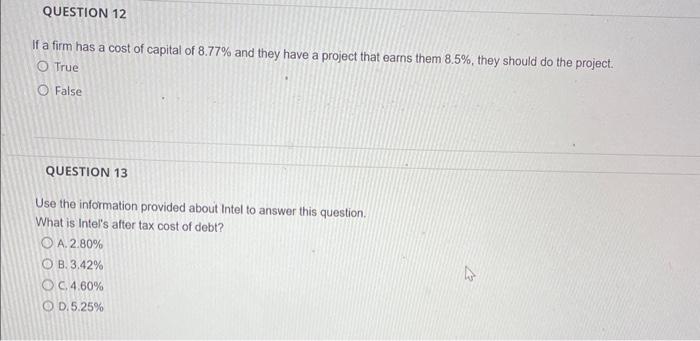

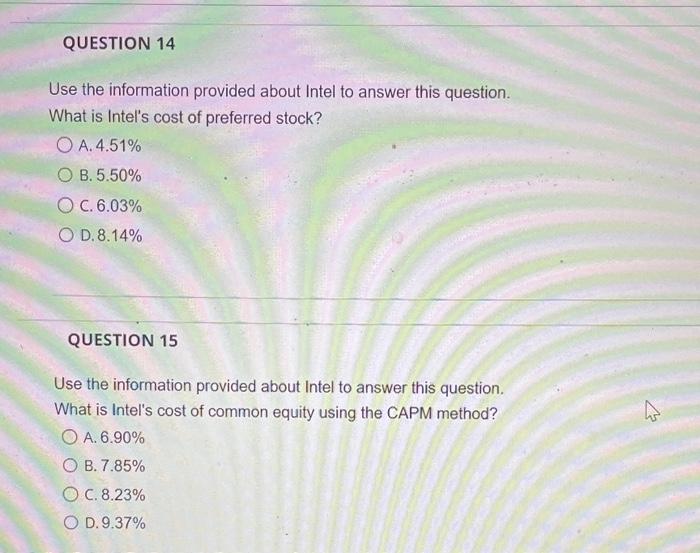

Using the data given for Clorox, what is the full year after tax cost of debt? A. 2.30% B. 3.19% C. 4.57% D. 5.18% QUESTION 7 Using the Clorox information provided, what is the cost of their preferred stock? A. 2.16% B. 4.93% C. 5.67% D. 7.14% Using the Clorox information provided, what is their cost of common equity using the CAPM method? A. 1.05% B. 2.54% C. 4.39% D. 5.21% QUESTION 9 Using the Clorox information provided, what is their cost of common equity using the DCF method? A. 3.70% B. 5.32% C. 6.63% D. 7.89% Using the Clorox information provided, what is their cost of common equity using the bond-yield - plus-risk premium method? A. 6.26% B. 6.80% C. 7.08% D. 8.64% QUESTION 11 Using the information provided about Clorox, what is Clorox's weighted average costpof capital? A. 4.22% B. 5.70% C. 6.35% D. 7.11% If a firm has a cost of capital of 8.77% and they have a project that earns them 8.5%, they should do the project. True False QUESTION 13 Use the information provided about Intel to answer this question. What is Intel's after tax cost of debt? A. 2.80% B. 3.42% C. 4.60% D. 5.25% Use the information provided about Intel to answer this question. What is Intel's cost of preferred stock? A. 4.51% B. 5.50% C. 6.03% D. 8.14% QUESTION 15 Use the information provided about Intel to answer this question. What is Intel's cost of common equity using the CAPM method? A. 6.90% B. 7.85% C. 8.23% D. 9.37% Using the data given for Clorox, what is the full year after tax cost of debt? A. 2.30% B. 3.19% C. 4.57% D. 5.18% QUESTION 7 Using the Clorox information provided, what is the cost of their preferred stock? A. 2.16% B. 4.93% C. 5.67% D. 7.14% Using the Clorox information provided, what is their cost of common equity using the CAPM method? A. 1.05% B. 2.54% C. 4.39% D. 5.21% QUESTION 9 Using the Clorox information provided, what is their cost of common equity using the DCF method? A. 3.70% B. 5.32% C. 6.63% D. 7.89% Using the Clorox information provided, what is their cost of common equity using the bond-yield - plus-risk premium method? A. 6.26% B. 6.80% C. 7.08% D. 8.64% QUESTION 11 Using the information provided about Clorox, what is Clorox's weighted average costpof capital? A. 4.22% B. 5.70% C. 6.35% D. 7.11% If a firm has a cost of capital of 8.77% and they have a project that earns them 8.5%, they should do the project. True False QUESTION 13 Use the information provided about Intel to answer this question. What is Intel's after tax cost of debt? A. 2.80% B. 3.42% C. 4.60% D. 5.25% Use the information provided about Intel to answer this question. What is Intel's cost of preferred stock? A. 4.51% B. 5.50% C. 6.03% D. 8.14% QUESTION 15 Use the information provided about Intel to answer this question. What is Intel's cost of common equity using the CAPM method? A. 6.90% B. 7.85% C. 8.23% D. 9.37%