Question

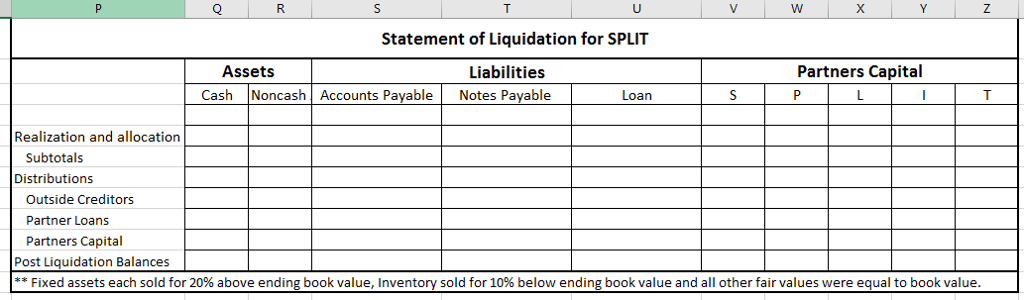

Using the data in the Option 2 Spreadsheet (linked at the bottom of the page), perform the accounting required for the formation, operations, and liquidation

Using the data in the Option 2 Spreadsheet (linked at the bottom of the page), perform the accounting required for the formation, operations, and liquidation of the SPLIT Partnership. Within the worksheet, you are to:

Perform the required journal entries

Update the partnership financials after each set of transactions. There are three setsformation set, operation set, and liquidation set.

Complete all work on the spreadsheet attached to this assignment; it will be your only deliverable.

Part 1: Perform for all partnership formation transactions

Part 2: Perform for all operational and liquidation transactions

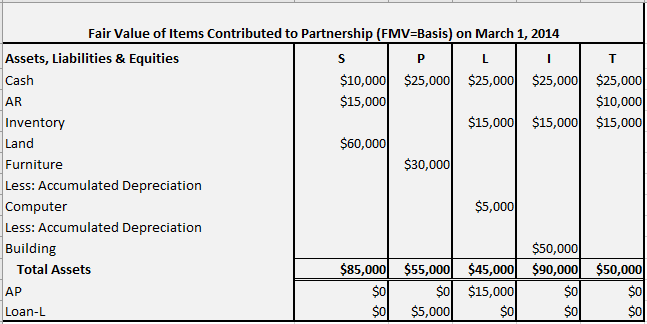

Fair Value of Items Contributed to Partnership (FMV=Basis) on March 1, 2014

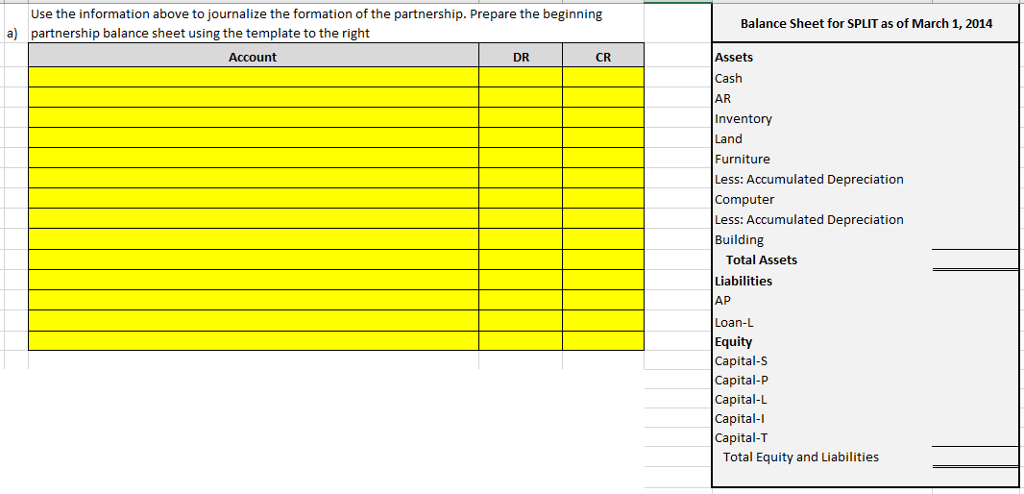

a) Use the information above to journalize the formation of the partnership. Prepare the beginning partnership balance sheet using the template below

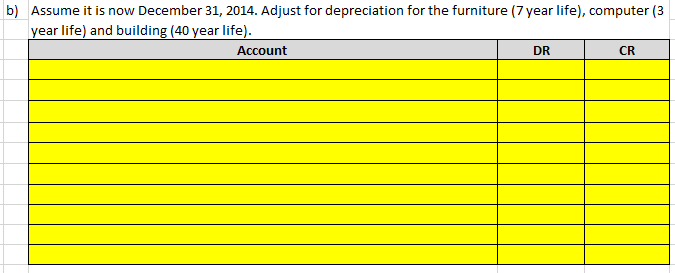

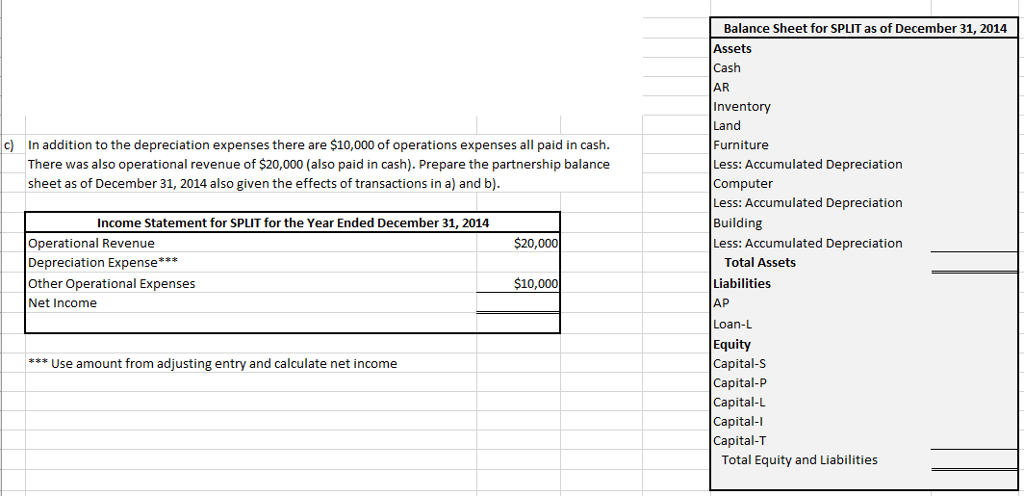

b) Assume it is now December 31, 2014. Adjust for depreciation for the furniture (7 year life), computer (3 year life) and building (40 year life).

c) In addition to the depreciation expenses there are $10,000 of operations expenses all paid in cash. There was also operational revenue of $20,000 (also paid in cash). Prepare the partnership balance sheet as of December 31, 2014 also given the effects of transactions in a) and b).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started