Question

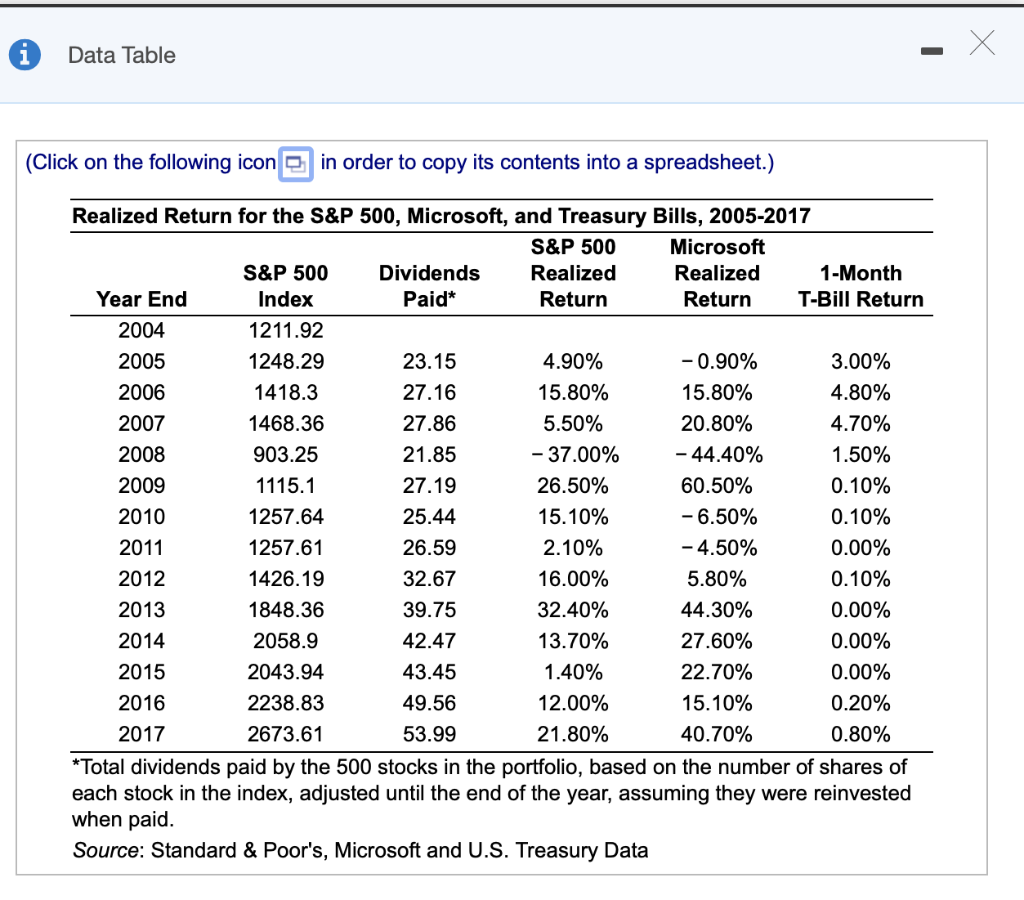

Using the data in the table below a. What was the average dividend yield for the S&P 500 from 2005-2017? The average dividend yield is

Using the data in the table below

a. What was the average dividend yield for the S&P 500 from 2005-2017?

The average dividend yield is ............%. (Round to two decimal places.)

b. What was the volatility of the dividend yield?

The volatility of the dividend yield is the square root of the variance of dividend yields .............%.(Round to two decimal places.)

c. What was the average annual return of the S&P 500 from 2005-2017 excluding dividends (i.e., from capital gains only)?

The average annual return is ............%.(Round to two decimal places.)

d. What was the volatility of the S&P 500 returns from capital gains?

Annual volatility of returns is the square root of the variance of returns............%.(Round to two decimal places.)

e. Were dividends or capital gains a more important component of the S&P 500's average returns during this period? Which were the more important source of volatility?(Select one)

(dividend..... or ......capital gains) were more important for returns and volatility.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started