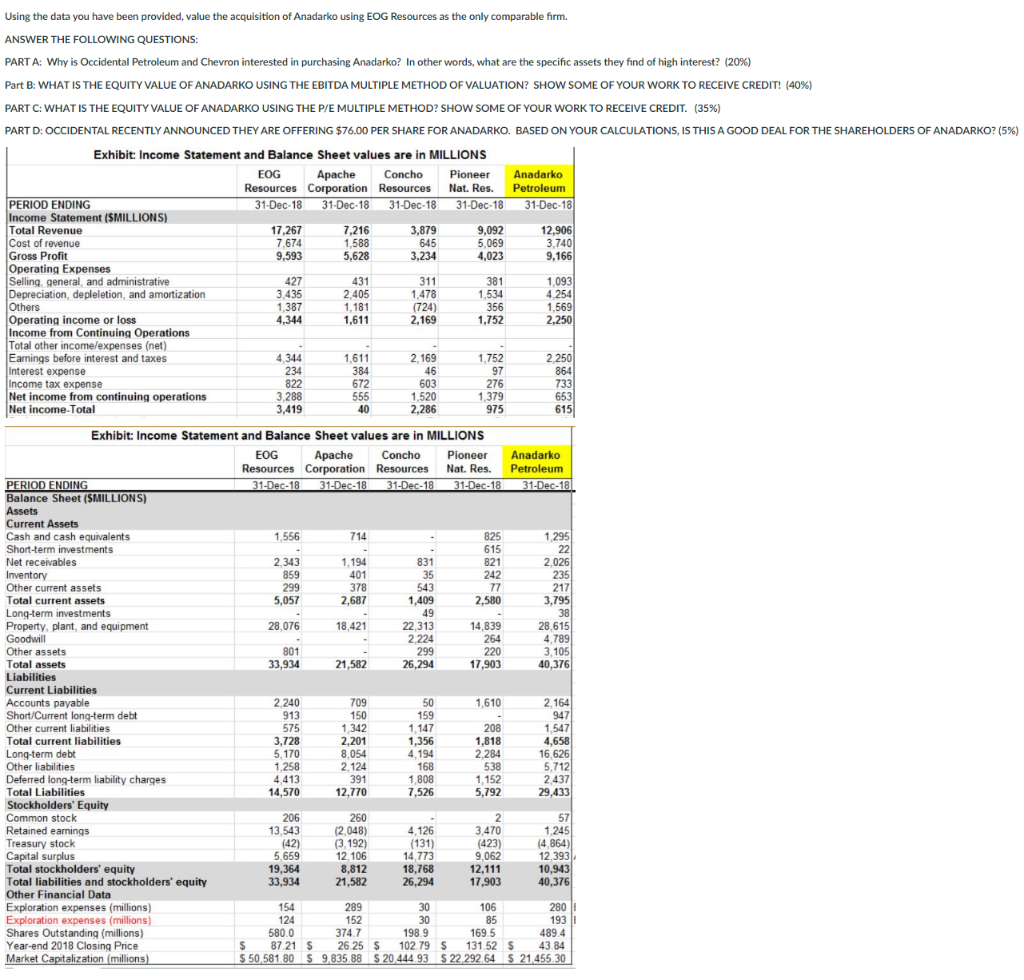

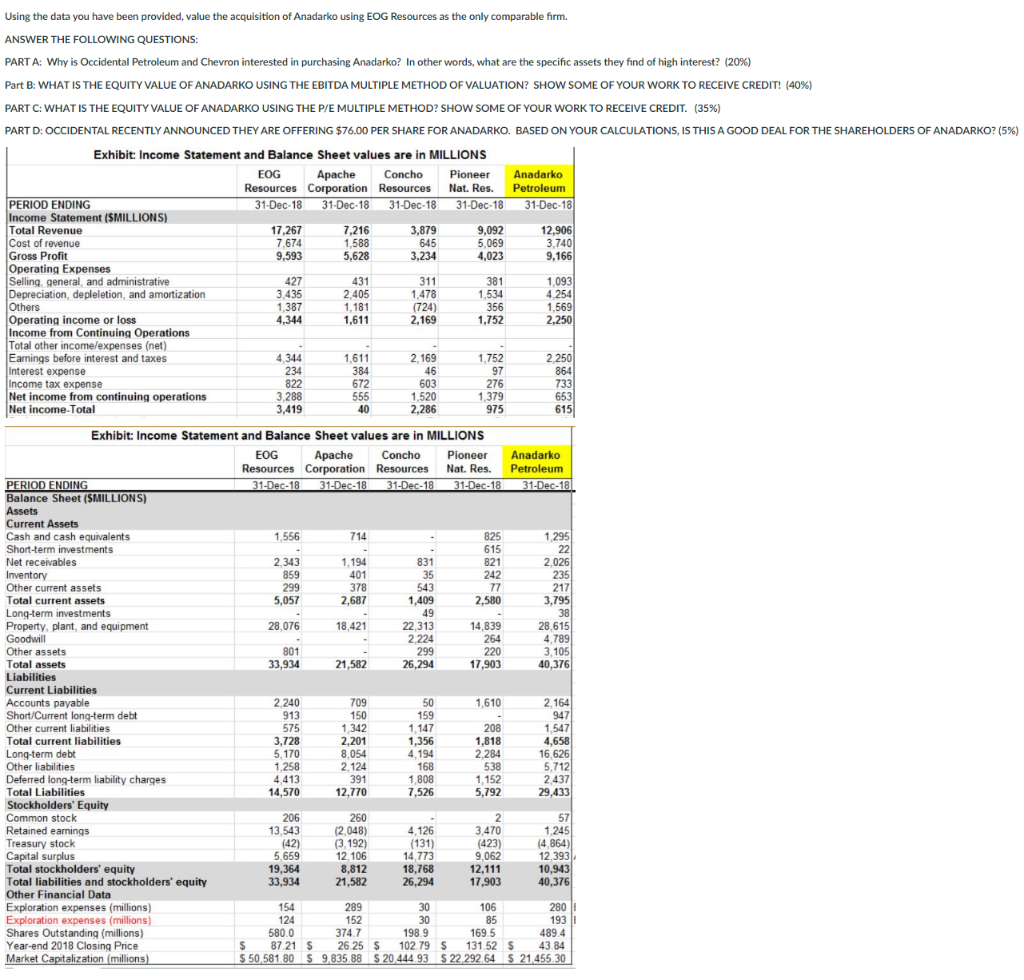

Using the data you have been provided, value the acquisition of Anadarko using EOG Resources as the only comparable firm. ANSWER THE FOLLOWING QUESTIONS: PART A: Why is Occidental Petroleum and Chevron interested in purchasing Anadarko? In other words, what are the specific assets they find of high interest? (20%) Part B: WHAT IS THE EQUITY VALUE OF ANADARKO USING THE EBITDA MULTIPLE METHOD OF VALUATION? SHOW SOME OF YOUR WORK TO RECEIVE CREDIT! (40%) %) PART C: WHAT IS THE EQUITY VALUE OF ANADARKO USING THE P/E MULTIPLE METHOD? SHOW SOME OF YOUR WORK TO RECEIVE CREDIT. (35%) /E . (% PART D: OCCIDENTAL RECENTLY ANNOUNCED THEY ARE OFFERING $76.00 PER SHARE FOR ANADARKO. BASED ON YOUR CALCULATIONS, IS THIS A GOOD DEAL FOR THE SHAREHOLDERS OF ANADARKO? (5%) Exhibit: Income Statement and Balance Sheet values are in MILLIONS EOG Apache Concho Pioneer Anadarko Resources Corporation Resources Nat. Res. Petroleum PERIOD ENDING 31-Dec-18 31-Dec-18 31-Dec-18 31-Dec-18 31-Dec-18 Income Statement (SMILLIONS) Total Revenue 17,267 7,216 3,879 9,092 12,906 Cost of revenue 7.674 1,588 645 5,069 3.7401 Gross Profit 9,593 5,628 3,234 4,023 9,166 Operating Expenses Selling, general, and administrative 427 431 311 381 1,093 Depreciation, de pleletion, and amortization 3,435 2.405 1,478 1,534 4.254 Others 1,387 1,181 (724) 356 1,569 Operating income or loss 4,344 1,611 2,169 1,752 2,250 Income from Continuing Operations Total other income/expenses (net) Earnings before interest and taxes 4,344 1,611 2.169 1,752 2.250) Interest expense 234 384 46 97 864 Income tax expense 822 672 603 276 733 Net income from continuing operations 3.288 555 1,520 1,379 653 Net income Total 3,419 40 2,286 975 615 Pioneer Exhibit: Income Statement and Balance Sheet values are in MILLIONS EOG Apache Concho Anadarko Resources Corporation Resources Nat. Res. Petroleum PERIOD ENDING 31-Dec-18 31-Dec-18 31-Dec-18 31-Dec-18 31-Dec-18 Balance Sheet (SMILLIONS) Assets Current Assets Cash and cash equivalents 1,556 714 825 1.295 Short-term investments 615 22 Net receivables 2,343 1.194 831 821 2.026 Inventory 859 401 35 242 235 Other current assets 299 378 543 77 217 Total current assets 5,057 2,687 1,409 2,580 3,795 Long-term investments 49 38 Property, plant, and equipment 28,076 18,421 22 313 14,839 28,615 Goodwill 2.224 264 4.789 Other assets 801 299 220 3,105 Total assets 33,934 21,582 26,294 17,903 40,376 Liabilities Current Liabilities Accounts payable 2.240 709 50 1,610 2. 164 Short/Current long-term debt 913 150 159 947 Other current liabilities 575 1,342 1,147 208 1,547 Total current liabilities 3,728 2,201 1,356 1,818 4,658 Long-term debt 5,170 8,054 4.194 2.284 16,626 Other liabilities 1,258 2. 124 168 538 5,712 Deferred long-term liability charges 4.413 391 1,808 1,152 2.437 Total Liabilities 14,570 12.770 7,526 5,792 29,433 Stockholders' Equity Common stock 206 260 2 57 Retained earnings 13,543 (2,048) 4 126 3.470 1.245 Treasury stock (42) (3.192) (131) (423) (4 864) Capital surplus 5,659 12 106 14,773 9,062 12,393 Total stockholders' equity 19,364 8,812 18,768 12,111 10,943 Total liabilities and stockholders' equity 33,934 21,582 26,294 17,903 40,376 Other Financial Data Exploration expenses (millions) 154 289 30 106 2800 Exploration expenses (millions) 124 152 30 85 1931 Shares Outstanding (millions) 580.0 374.7 198.9 169.5 489.4 Year-end 2018 Closing Price $ 87.21 $ 26.25 S 102.79 S 131.52 $ 43.84 Market Capitalization millions) $ 50.581.80 $ 9.835.88 $ 20 444.93 $ 22 292.64 $ 21.455.30 Using the data you have been provided, value the acquisition of Anadarko using EOG Resources as the only comparable firm. ANSWER THE FOLLOWING QUESTIONS: PART A: Why is Occidental Petroleum and Chevron interested in purchasing Anadarko? In other words, what are the specific assets they find of high interest? (20%) Part B: WHAT IS THE EQUITY VALUE OF ANADARKO USING THE EBITDA MULTIPLE METHOD OF VALUATION? SHOW SOME OF YOUR WORK TO RECEIVE CREDIT! (40%) %) PART C: WHAT IS THE EQUITY VALUE OF ANADARKO USING THE P/E MULTIPLE METHOD? SHOW SOME OF YOUR WORK TO RECEIVE CREDIT. (35%) /E . (% PART D: OCCIDENTAL RECENTLY ANNOUNCED THEY ARE OFFERING $76.00 PER SHARE FOR ANADARKO. BASED ON YOUR CALCULATIONS, IS THIS A GOOD DEAL FOR THE SHAREHOLDERS OF ANADARKO? (5%) Exhibit: Income Statement and Balance Sheet values are in MILLIONS EOG Apache Concho Pioneer Anadarko Resources Corporation Resources Nat. Res. Petroleum PERIOD ENDING 31-Dec-18 31-Dec-18 31-Dec-18 31-Dec-18 31-Dec-18 Income Statement (SMILLIONS) Total Revenue 17,267 7,216 3,879 9,092 12,906 Cost of revenue 7.674 1,588 645 5,069 3.7401 Gross Profit 9,593 5,628 3,234 4,023 9,166 Operating Expenses Selling, general, and administrative 427 431 311 381 1,093 Depreciation, de pleletion, and amortization 3,435 2.405 1,478 1,534 4.254 Others 1,387 1,181 (724) 356 1,569 Operating income or loss 4,344 1,611 2,169 1,752 2,250 Income from Continuing Operations Total other income/expenses (net) Earnings before interest and taxes 4,344 1,611 2.169 1,752 2.250) Interest expense 234 384 46 97 864 Income tax expense 822 672 603 276 733 Net income from continuing operations 3.288 555 1,520 1,379 653 Net income Total 3,419 40 2,286 975 615 Pioneer Exhibit: Income Statement and Balance Sheet values are in MILLIONS EOG Apache Concho Anadarko Resources Corporation Resources Nat. Res. Petroleum PERIOD ENDING 31-Dec-18 31-Dec-18 31-Dec-18 31-Dec-18 31-Dec-18 Balance Sheet (SMILLIONS) Assets Current Assets Cash and cash equivalents 1,556 714 825 1.295 Short-term investments 615 22 Net receivables 2,343 1.194 831 821 2.026 Inventory 859 401 35 242 235 Other current assets 299 378 543 77 217 Total current assets 5,057 2,687 1,409 2,580 3,795 Long-term investments 49 38 Property, plant, and equipment 28,076 18,421 22 313 14,839 28,615 Goodwill 2.224 264 4.789 Other assets 801 299 220 3,105 Total assets 33,934 21,582 26,294 17,903 40,376 Liabilities Current Liabilities Accounts payable 2.240 709 50 1,610 2. 164 Short/Current long-term debt 913 150 159 947 Other current liabilities 575 1,342 1,147 208 1,547 Total current liabilities 3,728 2,201 1,356 1,818 4,658 Long-term debt 5,170 8,054 4.194 2.284 16,626 Other liabilities 1,258 2. 124 168 538 5,712 Deferred long-term liability charges 4.413 391 1,808 1,152 2.437 Total Liabilities 14,570 12.770 7,526 5,792 29,433 Stockholders' Equity Common stock 206 260 2 57 Retained earnings 13,543 (2,048) 4 126 3.470 1.245 Treasury stock (42) (3.192) (131) (423) (4 864) Capital surplus 5,659 12 106 14,773 9,062 12,393 Total stockholders' equity 19,364 8,812 18,768 12,111 10,943 Total liabilities and stockholders' equity 33,934 21,582 26,294 17,903 40,376 Other Financial Data Exploration expenses (millions) 154 289 30 106 2800 Exploration expenses (millions) 124 152 30 85 1931 Shares Outstanding (millions) 580.0 374.7 198.9 169.5 489.4 Year-end 2018 Closing Price $ 87.21 $ 26.25 S 102.79 S 131.52 $ 43.84 Market Capitalization millions) $ 50.581.80 $ 9.835.88 $ 20 444.93 $ 22 292.64 $ 21.455.30