Question

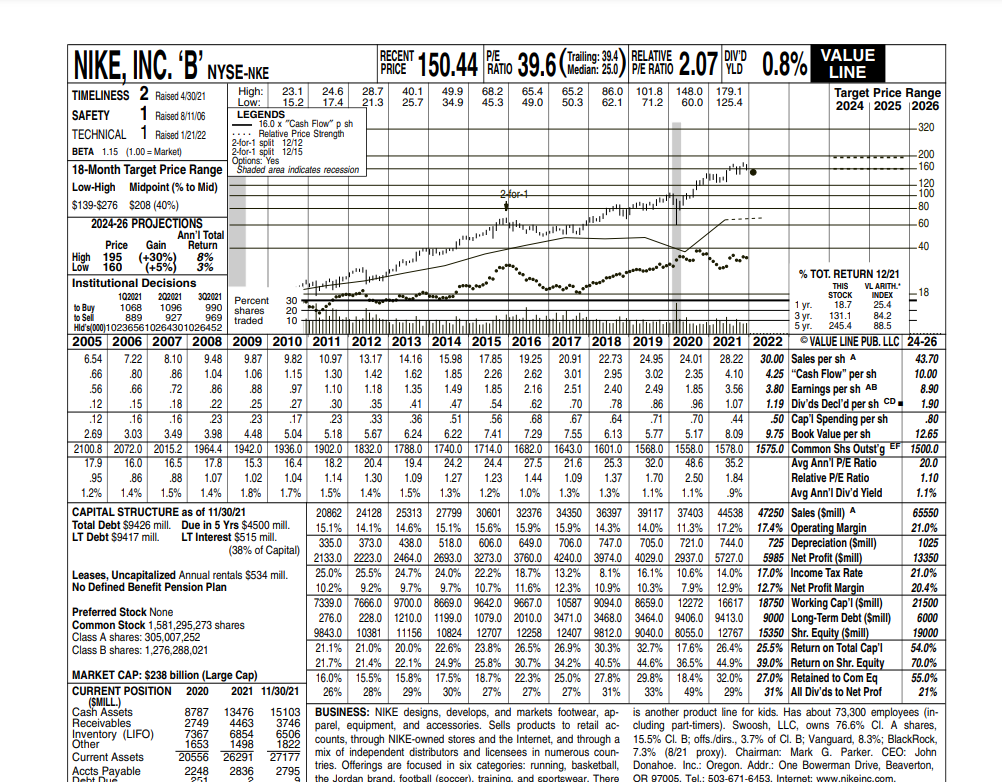

Using the Dividend Discount Model Step 1: Find the discount rate using CAPM model with Treasury bill rate of 4% and a historical market risk

- Using the Dividend Discount Model

Step 1: Find the discount rate using CAPM model with Treasury bill rate of 4% and a historical market risk premium of 7%.

Step 2: Find two growth rates:

- sustainable growth rate, g1

- the geometric average dividend growth rate, g2, using dividends from 2017 2021.

Step 3.

- Estimate P2022 using g1 (where g1 is the sustainable growth rate)

- Estimate P2022 using g2 (g2 is the geometric average dividend growth rate

- Using Residual Income Model (RIM)

Step 1: Let us use the earnings from 2017 2021 to find the arithmetic average earnings growth rate as g3.

Step 2: Use discount rate found from the CAPM (Part (A) Step 1) and g3 (Part (B) Step1), the arithmetic average earnings growth rate, to fine the P2022.

- Using Price Ratio Analysis

Use the average of High and Low prices (see below figures in red for high and low prices) to be the price (P) of each year from 2017 2021 when calculating P/E, P/CFPS, P/Sales.

Following the procedure covered in class to estimate P2022, then fill out the following table. (Note: you also need to submit a copy of the Excel sheet to show how these numbers were calculated. You can copy and paste it into this document before submission)

|

| Earnings | Cash Flow | Sales |

| Five-year average price ratio | Ave P/E

| Ave P/CF

| Ave P/Sales

|

| Current value per share (2021) | EPS2021

| CF2021

| Sales2021

|

| Five-year average growth rate | Ave Earnings growth rate

| Ave CF growth rate

| Ave Sales g rate

|

| Expected share price P2022

|

|

|

|

- Conclusion:

From the Nikes report dated Jan. 21, 2022, the market price was $150.44

Given your answers in the previous questions from Part A-C, do you think Nike is overvalued at its current price of around $150.44 or undervalued? Should you buy or sell Nike?

NIKE, INC. 'B' NYSE-NKE PERCENT 150.44 RATO 39.6 ( hele 9.) SEATINE 2.07 PX 0.8% VALUE 28.7 Options Yes . 4' // 209 INDEX 1 yr. al ..1 PE LINE TIMELINESS 2 Raised 4/30/21 High: : 23.1 24.6 40.1 49.9 68.2 65.4 65.2 86.0 101.8 148.0 179.1 Low: 15.2 17.4 21.3 Target Price Range 25.7 34.9 45.3 49.0 50.3 62.1 71.2 60.0 125.4 SAFETY 1 Raised 8/11/06 LEGENDS 2024 2025 2026 -16.0 x "Cash Flow" p sh TECHNICAL 1 Raised 121/22 .... Relative Price Strength -320 2-for-1 split 12/12 BETA 1.15 (1.00 - Market) 2-for-1 Split 12/15 200 18-Month Target Price Range Shaded area indicates recession 160 Low-High Midpoint (% to Mid) 120 fort 100 $139-$276 $208 (40%) -80 2024-26 PROJECTIONS -60 Ann'l Total Price Gain Return -40 High 195 (+30%) 8% % Low 160 (+5%) 3% Institutional Decisions % TOT. RETURN 12/21 THIS VL ARITH 102021 202021 302021 Percent STOCK 18 30 to Buy 1068 1096 990 shares 18.7 25.4 to Sel 889 927 969 traded 10 HILL 3 yr. 131.1 84.2 Hld's/000102365610264301026452 numi M. omini nominalilimu. 5 yr. 245.4 88.5 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 VALUE LINE PUB. LLC 24-26 6.54 7.22 8.10 9.48 9.87 9.82 10.97 13.17 14.16 15.98 17.85 19.25 20.91 22.73 24.95 24.01 28.22 30.00 Sales per sh A 43.70 .66 .80 .86 1.04 1.06 1.15 1.30 1.42 1.62 1.85 2.26 2.62 3.01 2.95 3.02 2.35 4.10 4.25 "Cash Flow" per sh 10.00 .56 .66 .72 .86 .88 .97 1.10 1.18 1.35 1.49 1.85 2.16 2.51 2.40 2.49 1.85 3.56 3.80 Earnings per sh AB 8.90 .12 .15 .18 .22 25 .27 .30 .35 41 47 .54 .62 .70 .78 .86 .96 1.07 1.19 Div'ds Decl'd per sh CD 1.90 .12 .16 .16 .23 .23 .17 .23 29 .33 36 .51 .56 .68 .67 .64 .71 .70 .44 .50 Cap'l Spending per sh .80 2.69 3.03 3.49 3.98 4.48 5.04 5.18 5.67 6.24 6.22 7.41 7.29 7.55 6.13 5.77 5.17 8.09 9.75 Book Value per sh 12.65 2100.8 2072.0 2015.2 1964.4 1942.0 1936.0 1902.0 1832.0 1788.0 1740.0 1714.0 1682.0 1643.0 1601.0 1568.0 1558.0 1578.0 1575.0 Common Shs Outstg EF 1500.0 17.9 16.0 16.5 17.8 15.3 16.4 18.2 20.4 19.4 24.2 24.4 27.5 21.6 25.3 32.0 48.6 35.2 Avg Ann TPE Ratio 20.0 .95 .86 .88 1.07 1.02 1.04 1.14 1.30 1.09 1.27 1.23 1.44 1.09 1.37 1.70 2.50 1.84 Relative P/E Ratio 1.10 1.2% 1.4% 1.5% 1.4% 1.7% 1.4% 1.5% 1.3% 1.2% 1.0% 1.3% 1.3% 1.1% 1.1% .9% Avg Ann'l Div'd Yield 1.1% CAPITAL STRUCTURE as of 11/30/21 20862 24128 25313 27799 30601 32376 34350 36397 39117 37403 44538 47250 Sales (Smill) A 65550 Total Debt $9426 mill. Due in 5 Yrs $4500 mill. % 15.1% 14.1% 14.6% 15.1% 15.6% 15.9% 15.6% 15.9% 15.9% 14.3% LT Debt $9417 mill. LT Interest $515 mill. 14.0% 11.3% 17.2% 17.4% Operating Margin 21.0% 335.0 373.0 438.0 518.0 606.0 (38% of Capital) 649.0 706.0 747.0 705.0 721.0 744.0 725 Depreciation (Smill) 1025 2133.0 2223.0 2464.0 2693.0 3273.0 3760.0 4240.0 3974.0 4029.0 2937.0 5727.0 5985 Net Profit ($mill) 13350 Leases, Uncapitalized Annual rentals $534 mill. 25.0% 25.5% 24.7% 24.0% 22.2% 18.7% 13.2% 8.1% 16.1% 10.6% 14.0% 17.0% Income Tax Rate 21.0% No Defined Benefit Pension Plan 10.2% 9.2% 9.7% 9.7% 10.7% 11.6% % 12.3% 10.9% 10.3% 7.9% 12.9% 12.7% Net Profit Margin % 20.4% Preferred Stock None 7339.0 7666.0 9700.0 8669.0 9642.0 9667.0 10587 9094.0 8659.0 12272 16617 18750 Working Cap'l (Smill) 21500 Common Stock 1,581,295,273 shares 276.0 228.0 1210.0 1199.0 1079.0 2010.0 3471.0 3468.0 3464.0 9406.0 9413.0 9000 Long-Term Debt (Smill) 6000 Class A shares: 305,007,252 9843.0 10381 1115610824 12707 12258 12407 9812.0 9040.0 8055.0 12767 15350 Shr. Equity (Smill) 19000 Class B shares: 1,276,288,021 21.1% 21.0% 20.0% 22.6% 23.8% 26.5% 26.9% 30.3% 32.7% 17.6% 26.4% 25.5% Return on Total Cap'l 54.0% 21.7% 21.4% 22.1% 24.9% 25.8% 30.7% 34.2% 40.5% 44.6% 36.5% 44.9% 39.0% Return on Shr. Equity MARKET CAP: $238 billion (Large Cap) 70.0% 16.0% 15.5% 15.8% 17.5% 18.7% 22.3% 25.0% 27.8% 25.0% 27.8% 29.8% 18.4% 32.0% 27.0% Retained to Com Eq 55.0% CURRENT POSITION 2020 2021 11/30/21 26% 28% 29% 30% 27% 27% 27% 31% 33% 49% (SMILL.) 29% 31% All Div'ds to Net Prof 21% Cash Assets 8787 13476 15103 BUSINESS: NIKE designs, develops, and markets footwear, ap- is another product line for kids. Has about 73,300 employees (in- Receivables 2749 4463 3746 parel, equipment, and accessories. Sells products to retail ac- cluding part-timers). Swoosh, LLC, owns 76.6% CI A shares, Inventory (LIFO) 7367 , . 6854 , . Other 1653 1498 1822 counts, through NIKE-owned stores and the Internet, and through a 15.5% CI. B; offs./dirs., 3.7% of Cl. B; Vanguard, 8.3%; BlackRock, Current Assets 20556 26291 27177 mix of independent distributors and licensees in numerous coun- 7.3% (8/21 proxy). Chairman: Mark G. Parker. CEO: John Accts Payable 2248 2836 2795 tries. Offerings are focused in six categories: running, basketball, Donahoe. Inc.: Oregon. Addr.: One Bowerman Drive, Beaverton, code the Jordan brand, football (soccer), training, and sportswear. There OR 97005. Tel. 503-671-6153. Internet: www.nikein.com 1.8% 1.5% 6506 Deht Due 291 9 NIKE, INC. 'B' NYSE-NKE PERCENT 150.44 RATO 39.6 ( hele 9.) SEATINE 2.07 PX 0.8% VALUE 28.7 Options Yes . 4' // 209 INDEX 1 yr. al ..1 PE LINE TIMELINESS 2 Raised 4/30/21 High: : 23.1 24.6 40.1 49.9 68.2 65.4 65.2 86.0 101.8 148.0 179.1 Low: 15.2 17.4 21.3 Target Price Range 25.7 34.9 45.3 49.0 50.3 62.1 71.2 60.0 125.4 SAFETY 1 Raised 8/11/06 LEGENDS 2024 2025 2026 -16.0 x "Cash Flow" p sh TECHNICAL 1 Raised 121/22 .... Relative Price Strength -320 2-for-1 split 12/12 BETA 1.15 (1.00 - Market) 2-for-1 Split 12/15 200 18-Month Target Price Range Shaded area indicates recession 160 Low-High Midpoint (% to Mid) 120 fort 100 $139-$276 $208 (40%) -80 2024-26 PROJECTIONS -60 Ann'l Total Price Gain Return -40 High 195 (+30%) 8% % Low 160 (+5%) 3% Institutional Decisions % TOT. RETURN 12/21 THIS VL ARITH 102021 202021 302021 Percent STOCK 18 30 to Buy 1068 1096 990 shares 18.7 25.4 to Sel 889 927 969 traded 10 HILL 3 yr. 131.1 84.2 Hld's/000102365610264301026452 numi M. omini nominalilimu. 5 yr. 245.4 88.5 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 VALUE LINE PUB. LLC 24-26 6.54 7.22 8.10 9.48 9.87 9.82 10.97 13.17 14.16 15.98 17.85 19.25 20.91 22.73 24.95 24.01 28.22 30.00 Sales per sh A 43.70 .66 .80 .86 1.04 1.06 1.15 1.30 1.42 1.62 1.85 2.26 2.62 3.01 2.95 3.02 2.35 4.10 4.25 "Cash Flow" per sh 10.00 .56 .66 .72 .86 .88 .97 1.10 1.18 1.35 1.49 1.85 2.16 2.51 2.40 2.49 1.85 3.56 3.80 Earnings per sh AB 8.90 .12 .15 .18 .22 25 .27 .30 .35 41 47 .54 .62 .70 .78 .86 .96 1.07 1.19 Div'ds Decl'd per sh CD 1.90 .12 .16 .16 .23 .23 .17 .23 29 .33 36 .51 .56 .68 .67 .64 .71 .70 .44 .50 Cap'l Spending per sh .80 2.69 3.03 3.49 3.98 4.48 5.04 5.18 5.67 6.24 6.22 7.41 7.29 7.55 6.13 5.77 5.17 8.09 9.75 Book Value per sh 12.65 2100.8 2072.0 2015.2 1964.4 1942.0 1936.0 1902.0 1832.0 1788.0 1740.0 1714.0 1682.0 1643.0 1601.0 1568.0 1558.0 1578.0 1575.0 Common Shs Outstg EF 1500.0 17.9 16.0 16.5 17.8 15.3 16.4 18.2 20.4 19.4 24.2 24.4 27.5 21.6 25.3 32.0 48.6 35.2 Avg Ann TPE Ratio 20.0 .95 .86 .88 1.07 1.02 1.04 1.14 1.30 1.09 1.27 1.23 1.44 1.09 1.37 1.70 2.50 1.84 Relative P/E Ratio 1.10 1.2% 1.4% 1.5% 1.4% 1.7% 1.4% 1.5% 1.3% 1.2% 1.0% 1.3% 1.3% 1.1% 1.1% .9% Avg Ann'l Div'd Yield 1.1% CAPITAL STRUCTURE as of 11/30/21 20862 24128 25313 27799 30601 32376 34350 36397 39117 37403 44538 47250 Sales (Smill) A 65550 Total Debt $9426 mill. Due in 5 Yrs $4500 mill. % 15.1% 14.1% 14.6% 15.1% 15.6% 15.9% 15.6% 15.9% 15.9% 14.3% LT Debt $9417 mill. LT Interest $515 mill. 14.0% 11.3% 17.2% 17.4% Operating Margin 21.0% 335.0 373.0 438.0 518.0 606.0 (38% of Capital) 649.0 706.0 747.0 705.0 721.0 744.0 725 Depreciation (Smill) 1025 2133.0 2223.0 2464.0 2693.0 3273.0 3760.0 4240.0 3974.0 4029.0 2937.0 5727.0 5985 Net Profit ($mill) 13350 Leases, Uncapitalized Annual rentals $534 mill. 25.0% 25.5% 24.7% 24.0% 22.2% 18.7% 13.2% 8.1% 16.1% 10.6% 14.0% 17.0% Income Tax Rate 21.0% No Defined Benefit Pension Plan 10.2% 9.2% 9.7% 9.7% 10.7% 11.6% % 12.3% 10.9% 10.3% 7.9% 12.9% 12.7% Net Profit Margin % 20.4% Preferred Stock None 7339.0 7666.0 9700.0 8669.0 9642.0 9667.0 10587 9094.0 8659.0 12272 16617 18750 Working Cap'l (Smill) 21500 Common Stock 1,581,295,273 shares 276.0 228.0 1210.0 1199.0 1079.0 2010.0 3471.0 3468.0 3464.0 9406.0 9413.0 9000 Long-Term Debt (Smill) 6000 Class A shares: 305,007,252 9843.0 10381 1115610824 12707 12258 12407 9812.0 9040.0 8055.0 12767 15350 Shr. Equity (Smill) 19000 Class B shares: 1,276,288,021 21.1% 21.0% 20.0% 22.6% 23.8% 26.5% 26.9% 30.3% 32.7% 17.6% 26.4% 25.5% Return on Total Cap'l 54.0% 21.7% 21.4% 22.1% 24.9% 25.8% 30.7% 34.2% 40.5% 44.6% 36.5% 44.9% 39.0% Return on Shr. Equity MARKET CAP: $238 billion (Large Cap) 70.0% 16.0% 15.5% 15.8% 17.5% 18.7% 22.3% 25.0% 27.8% 25.0% 27.8% 29.8% 18.4% 32.0% 27.0% Retained to Com Eq 55.0% CURRENT POSITION 2020 2021 11/30/21 26% 28% 29% 30% 27% 27% 27% 31% 33% 49% (SMILL.) 29% 31% All Div'ds to Net Prof 21% Cash Assets 8787 13476 15103 BUSINESS: NIKE designs, develops, and markets footwear, ap- is another product line for kids. Has about 73,300 employees (in- Receivables 2749 4463 3746 parel, equipment, and accessories. Sells products to retail ac- cluding part-timers). Swoosh, LLC, owns 76.6% CI A shares, Inventory (LIFO) 7367 , . 6854 , . Other 1653 1498 1822 counts, through NIKE-owned stores and the Internet, and through a 15.5% CI. B; offs./dirs., 3.7% of Cl. B; Vanguard, 8.3%; BlackRock, Current Assets 20556 26291 27177 mix of independent distributors and licensees in numerous coun- 7.3% (8/21 proxy). Chairman: Mark G. Parker. CEO: John Accts Payable 2248 2836 2795 tries. Offerings are focused in six categories: running, basketball, Donahoe. Inc.: Oregon. Addr.: One Bowerman Drive, Beaverton, code the Jordan brand, football (soccer), training, and sportswear. There OR 97005. Tel. 503-671-6153. Internet: www.nikein.com 1.8% 1.5% 6506 Deht Due 291 9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started