Answered step by step

Verified Expert Solution

Question

1 Approved Answer

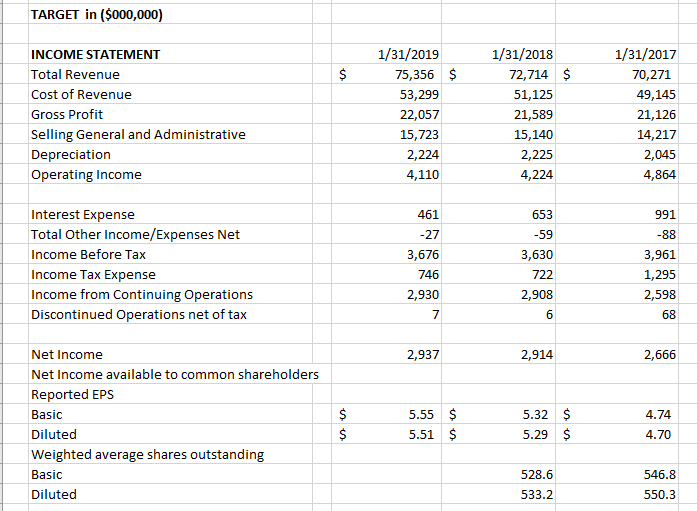

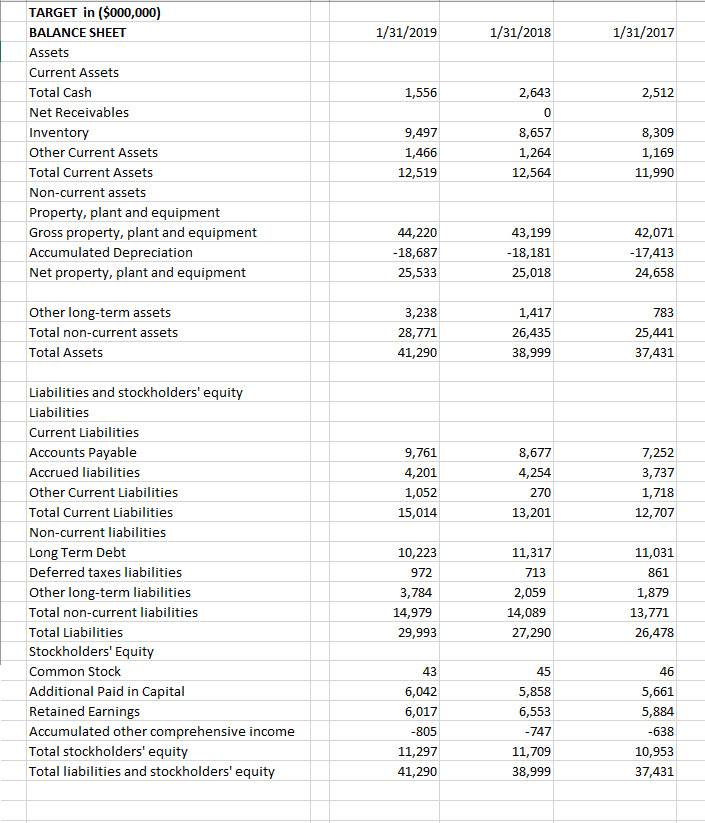

Using the DuPont Multiplier Model to analyze and compare financial performance Target Analysis: Please do excel work and show calculations in details 1/31/2019 1/31/2018 1/31/2017

Using the DuPont Multiplier Model to analyze and compare financial performance

Target Analysis: Please do excel work and show calculations in details

|

| 1/31/2019 | 1/31/2018 | 1/31/2017 |

| Profit Margin |

|

|

|

| Total Asset Turnover |

|

|

|

| Return on Assets |

|

|

|

| Equity Multiplier |

|

|

|

| Return on Equity |

|

|

|

Explain in terms of the Dupont Model Targets Performance over the last 3 years. Pay attention to which Ratios added to or detracted from Targets performance changes over the 3 years.

TARGET in ($000,000) $ $ INCOME STATEMENT Total Revenue Cost of Revenue Gross Profit Selling General and Administrative Depreciation Operating Income 1/31/2019 75,356 53,299 22,057 15,723 2,224 4,110 1/31/2018 72,714 51,125 21,589 15,140 2,225 4,224 1/31/2017 70,271 49,145 21,126 14,217 2,045 4,864 653 -59 Interest Expense Total Other Income/Expenses Net Income Before Tax Income Tax Expense Income from Continuing Operations Discontinued Operations net of tax 461 -27 3,676 746 2,930 3,630 722 2,908 991 -88 3,961 1,295 2,598 68 2,937 2,914 2,666 Net Income Net Income available to common shareholders Reported EPS Basic Diluted Weighted average shares outstanding Basic Diluted 5.55 5.51 $ $ 5.32 $ 5.29 $ 4.74 4.70 528.6 533.2 546.8 550.3 1/31/2019 1/31/2018 1/31/2017 1,556 2,512 TARGET in ($000,000) BALANCE SHEET Assets Current Assets Total Cash Net Receivables Inventory Other Current Assets Total Current Assets Non-current assets Property, plant and equipment Gross property, plant and equipment Accumulated Depreciation Net property, plant and equipment 9,497 1,466 12,519 2,643 0 8,657 1,264 12,564 8,309 1,169 11,990 44,220 -18,687 25,533 43,199 -18,181 25,018 42,071 -17,413 24,658 Other long-term assets Total non-current assets Total Assets 3,238 28,771 41,290 1,417 26,435 38,999 783 25,441 37,431 8,677 9,761 4,201 1,052 15,014 4,254 270 13,201 7,252 3,737 1,718 12,707 Liabilities and stockholders' equity Liabilities Current Liabilities Accounts Payable Accrued liabilities Other Current Liabilities Total Current Liabilities Non-current liabilities Long Term Debt Deferred taxes liabilities Other long-term liabilities Total non-current liabilities Total Liabilities Stockholders' Equity Common Stock Additional Paid in Capital Retained Earnings Accumulated other comprehensive income Total stockholders' equity Total liabilities and stockholders' equity 10,223 972 3,784 14,979 29,993 11,317 713 2,059 14,089 27,290 11,031 861 1,879 13,771 26,478 45 46 43 6,042 6,017 -805 11,297 41,290 5,858 6,553 -747 11,709 38,999 5,661 5,884 -638 10,953 37,431Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started