Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the Estimations and Job Cost Sheet below can you please review the Scheduled of Cost of Goods Manufactured that I completed and let me

Using the Estimations and Job Cost Sheet below can you please review the Scheduled of Cost of Goods Manufactured that I completed and let me know if this is done correctly or not.. Thanks so much.

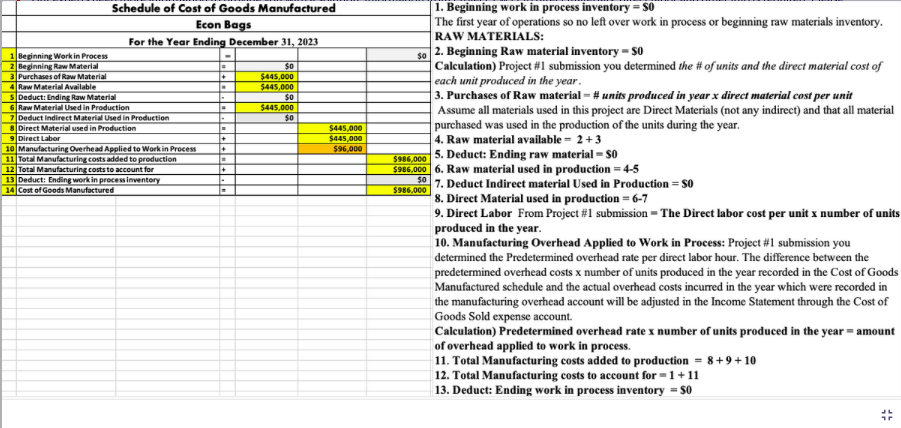

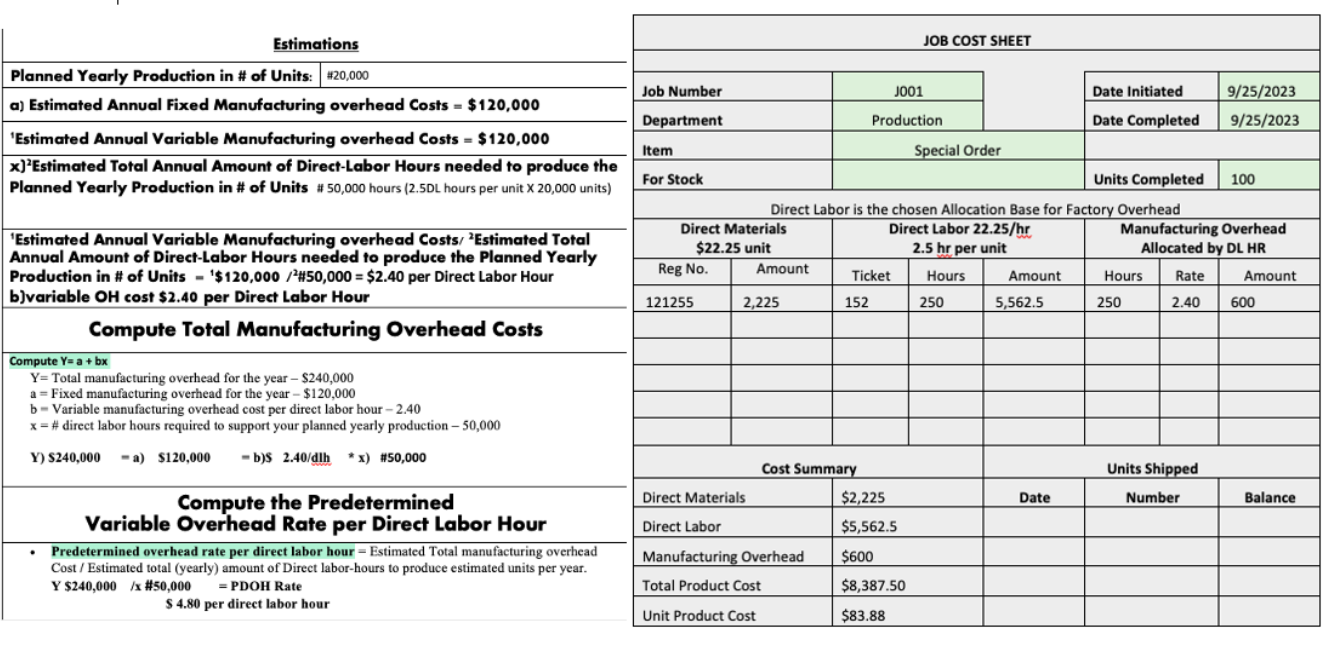

1. Beginning work in process inventory =$0 The first year of operations so no left over work in process or beginning raw materials inventory. RAW MATERIALS: 2. Beginning Raw material inventory =$S0 Calculation) Project \#1 submission you determined the \# of units and the direct material cost of each unit produced in the year. 3. Purchases of Raw material = \# units produced in year x direct material cost per unit Assume all materials used in this project are Direct Materials (not any indirect) and that all material purchased was used in the production of the units during the year. 4. Raw material available =2+3 5. Deduct: Ending raw material =$S0 6. Raw material used in production =45 7. Deduct Indirect material Used in Production =S0 8. Direct Material used in production =67 9. Direct Labor From Project \#1 submission = The Direct labor cost per unit x number of units produced in the year. 10. Manufacturing Overhead Applied to Work in Process: Project \#1 submission you determined the Predetermined overhead rate per direct labor hour. The difference between the predetermined overhead costs x number of units produced in the year recorded in the Cost of Goods Manufactured schedule and the actual overhead costs incurred in the year which were recorded in the manufacturing overhead account will be adjusted in the Income Statement through the Cost of Goods Sold expense account. Calculation) Predetermined overhead rate x number of units produced in the year = amount of overhead applied to work in process. 11. Total Manufacturing costs added to production =8+9+10 12. Total Manufacturing costs to account for =1+11 13. Deduct: Ending work in process inventory =$0 \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline Estimations & \multicolumn{8}{|c|}{ JOB COST SHEET } \\ \hline \begin{tabular}{|l|l|l} Planned Yearly Production in \# of Units: & #20,000 \\ \end{tabular} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Job Number }} & \multicolumn{2}{|c|}{001} & & \multirow{2}{*}{\multicolumn{2}{|c|}{ Date Initiated }} & \\ \hline a) Estimated Annual Fixed Manufacturing overhead Costs = \$120,000 & & & \multirow{2}{*}{\multicolumn{2}{|c|}{ Production }} & & & & 9/25/2023 \\ \hline 'Estimated Annual Variable Manufacturing overhead Costs =$120,000 & \multicolumn{2}{|l|}{ Department } & \multirow{2}{*}{\multicolumn{3}{|c|}{ Special Order }} & \multicolumn{2}{|c|}{ Date Completed } & 9/25/2023 \\ \hline \multirow{3}{*}{x)2EstimatedTotalAnnualAmountofDirect-LaborHoursneededtoproducethePlannedYearlyProductionin#ofUnits#50,000hours(2.5DLhoursperunitX20,000units)} & \multicolumn{2}{|l|}{ Item } & & & & \multirow{2}{*}{\multicolumn{2}{|c|}{ Units Completed }} & \\ \hline & \multicolumn{2}{|l|}{ For Stock } & & & & & & 100 \\ \hline & \multicolumn{8}{|c|}{ Direct Labor is the chosen Allocation Base for Factory Overhead } \\ \hline \multirow{3}{*}{EstimatedAnnualVariableManufacturingoverheadCosts/2EstimatedTotalAnnualAmountofDirect-LaborHoursneededtoproducethePlannedYearlyProductionin#ofUnits=$120,000/2#50,000=$2.40perDirectLaborHourb)variableOHcost$2.40perDirectLaborHour} & \multicolumn{2}{|c|}{DirectMaterials$22.25unit} & \multicolumn{3}{|c|}{DirectLabor22.25/hr2.5hrperunit} & \multicolumn{3}{|c|}{ManufacturingOverheadAllocatedbyDLHR} \\ \hline & Reg No. & Amount & Ticket & Hours & Amount & Hours & Rate & Amount \\ \hline & 121255 & 2,225 & 152 & 250 & 5,562.5 & 250 & 2.40 & 600 \\ \hline \multicolumn{9}{|l|}{ Compute Total Manufacturing Overhead Costs } \\ \hline \\ \hline \multirow{3}{*}{Y=Totalmanufacturingoverheadfortheyear$240,000a=Fixedmanufacturingoverheadfortheyear$120,000b=Variablemanufacturingovertheadcostperdirectlaborhour2.40x=#directlaborhoursrequiredtosupportyourplannedyearlyproduction50,000} & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline Y) $240,000 - a) $120,000-b)S 2.40/ dlh x)#50,000 & \multicolumn{4}{|c|}{ Cost Summary } & \multicolumn{4}{|c|}{ Units Shipped } \\ \hline \multirow{2}{*}{ComputethePredeterminedVariableOverheadRateperDirectLaborHour} & \multicolumn{2}{|c|}{ Direct Materials } & \multicolumn{2}{|l|}{$2,225} & Date & \multicolumn{2}{|c|}{ Number } & Balance \\ \hline & \multicolumn{2}{|l|}{ Direct Labor } & \multicolumn{2}{|l|}{$5,562.5} & & & & \\ \hline -Predeterminedoverheadrateperdirectlaborhour=EstimatedTotalmanufacturingoverheadCost/Estimatedtotal(yearly)amountofDirectlabor-hourstoproduceestimatedunitsperyear. & \multicolumn{2}{|c|}{ Manufacturing Overhead } & $600 & & & & & \\ \hline Y \$240,000 / x#50,000= PDOH Rate & Total Produc & Cost & $8,387.50 & & & & & \\ \hline$4.80 per direct labor hour & Unit Produc & & $83.88 & & & & & \\ \hline \end{tabular}

1. Beginning work in process inventory =$0 The first year of operations so no left over work in process or beginning raw materials inventory. RAW MATERIALS: 2. Beginning Raw material inventory =$S0 Calculation) Project \#1 submission you determined the \# of units and the direct material cost of each unit produced in the year. 3. Purchases of Raw material = \# units produced in year x direct material cost per unit Assume all materials used in this project are Direct Materials (not any indirect) and that all material purchased was used in the production of the units during the year. 4. Raw material available =2+3 5. Deduct: Ending raw material =$S0 6. Raw material used in production =45 7. Deduct Indirect material Used in Production =S0 8. Direct Material used in production =67 9. Direct Labor From Project \#1 submission = The Direct labor cost per unit x number of units produced in the year. 10. Manufacturing Overhead Applied to Work in Process: Project \#1 submission you determined the Predetermined overhead rate per direct labor hour. The difference between the predetermined overhead costs x number of units produced in the year recorded in the Cost of Goods Manufactured schedule and the actual overhead costs incurred in the year which were recorded in the manufacturing overhead account will be adjusted in the Income Statement through the Cost of Goods Sold expense account. Calculation) Predetermined overhead rate x number of units produced in the year = amount of overhead applied to work in process. 11. Total Manufacturing costs added to production =8+9+10 12. Total Manufacturing costs to account for =1+11 13. Deduct: Ending work in process inventory =$0 \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline Estimations & \multicolumn{8}{|c|}{ JOB COST SHEET } \\ \hline \begin{tabular}{|l|l|l} Planned Yearly Production in \# of Units: & #20,000 \\ \end{tabular} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Job Number }} & \multicolumn{2}{|c|}{001} & & \multirow{2}{*}{\multicolumn{2}{|c|}{ Date Initiated }} & \\ \hline a) Estimated Annual Fixed Manufacturing overhead Costs = \$120,000 & & & \multirow{2}{*}{\multicolumn{2}{|c|}{ Production }} & & & & 9/25/2023 \\ \hline 'Estimated Annual Variable Manufacturing overhead Costs =$120,000 & \multicolumn{2}{|l|}{ Department } & \multirow{2}{*}{\multicolumn{3}{|c|}{ Special Order }} & \multicolumn{2}{|c|}{ Date Completed } & 9/25/2023 \\ \hline \multirow{3}{*}{x)2EstimatedTotalAnnualAmountofDirect-LaborHoursneededtoproducethePlannedYearlyProductionin#ofUnits#50,000hours(2.5DLhoursperunitX20,000units)} & \multicolumn{2}{|l|}{ Item } & & & & \multirow{2}{*}{\multicolumn{2}{|c|}{ Units Completed }} & \\ \hline & \multicolumn{2}{|l|}{ For Stock } & & & & & & 100 \\ \hline & \multicolumn{8}{|c|}{ Direct Labor is the chosen Allocation Base for Factory Overhead } \\ \hline \multirow{3}{*}{EstimatedAnnualVariableManufacturingoverheadCosts/2EstimatedTotalAnnualAmountofDirect-LaborHoursneededtoproducethePlannedYearlyProductionin#ofUnits=$120,000/2#50,000=$2.40perDirectLaborHourb)variableOHcost$2.40perDirectLaborHour} & \multicolumn{2}{|c|}{DirectMaterials$22.25unit} & \multicolumn{3}{|c|}{DirectLabor22.25/hr2.5hrperunit} & \multicolumn{3}{|c|}{ManufacturingOverheadAllocatedbyDLHR} \\ \hline & Reg No. & Amount & Ticket & Hours & Amount & Hours & Rate & Amount \\ \hline & 121255 & 2,225 & 152 & 250 & 5,562.5 & 250 & 2.40 & 600 \\ \hline \multicolumn{9}{|l|}{ Compute Total Manufacturing Overhead Costs } \\ \hline \\ \hline \multirow{3}{*}{Y=Totalmanufacturingoverheadfortheyear$240,000a=Fixedmanufacturingoverheadfortheyear$120,000b=Variablemanufacturingovertheadcostperdirectlaborhour2.40x=#directlaborhoursrequiredtosupportyourplannedyearlyproduction50,000} & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline Y) $240,000 - a) $120,000-b)S 2.40/ dlh x)#50,000 & \multicolumn{4}{|c|}{ Cost Summary } & \multicolumn{4}{|c|}{ Units Shipped } \\ \hline \multirow{2}{*}{ComputethePredeterminedVariableOverheadRateperDirectLaborHour} & \multicolumn{2}{|c|}{ Direct Materials } & \multicolumn{2}{|l|}{$2,225} & Date & \multicolumn{2}{|c|}{ Number } & Balance \\ \hline & \multicolumn{2}{|l|}{ Direct Labor } & \multicolumn{2}{|l|}{$5,562.5} & & & & \\ \hline -Predeterminedoverheadrateperdirectlaborhour=EstimatedTotalmanufacturingoverheadCost/Estimatedtotal(yearly)amountofDirectlabor-hourstoproduceestimatedunitsperyear. & \multicolumn{2}{|c|}{ Manufacturing Overhead } & $600 & & & & & \\ \hline Y \$240,000 / x#50,000= PDOH Rate & Total Produc & Cost & $8,387.50 & & & & & \\ \hline$4.80 per direct labor hour & Unit Produc & & $83.88 & & & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started