using the financial information how would you answer a-e

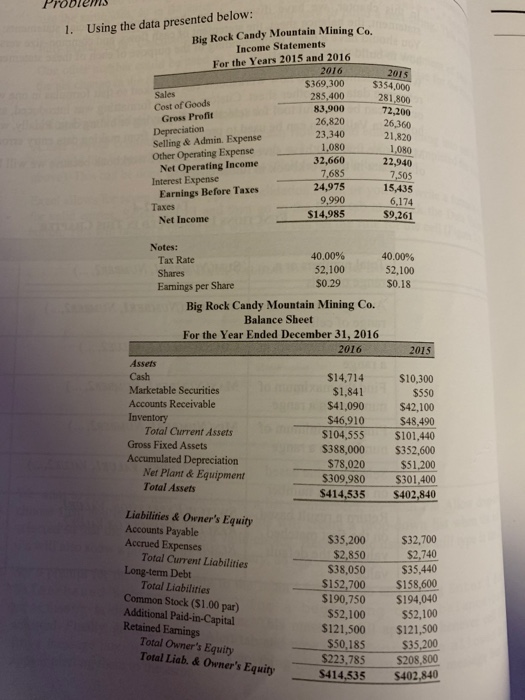

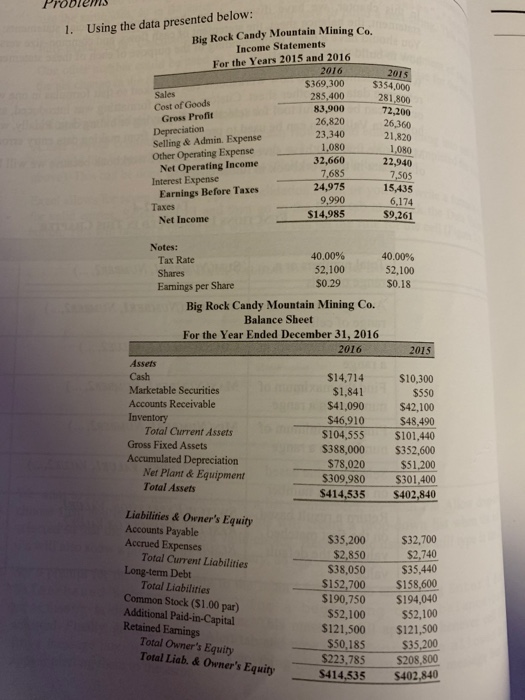

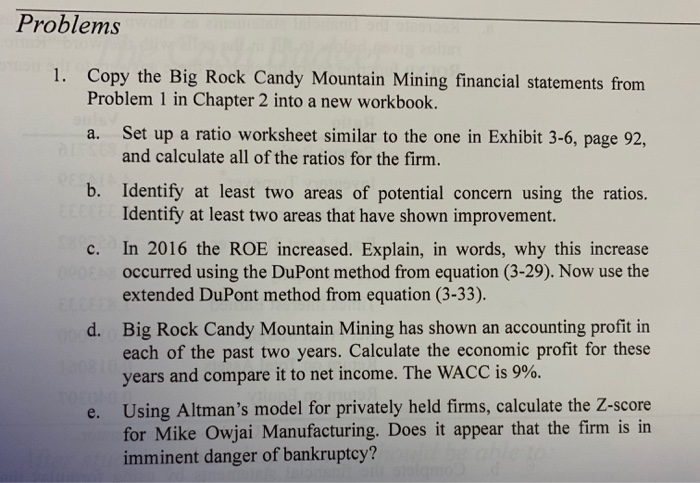

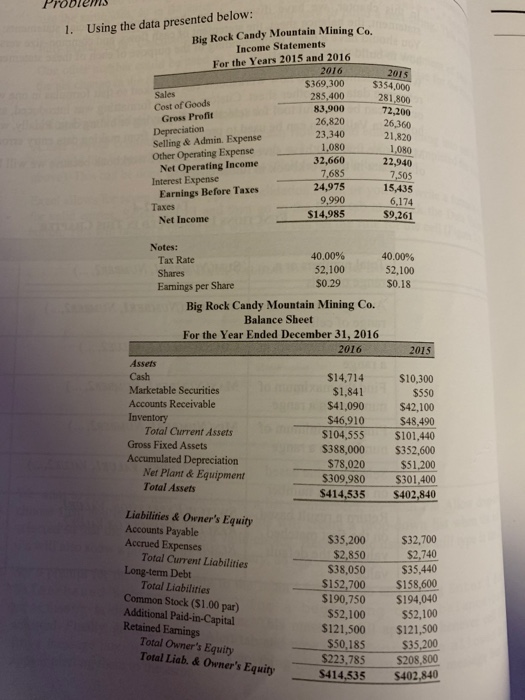

Problems 1. Using the data presented below: Big Rock Candy Mountain Mining Co Income Statements For the Years 2015 and 2016 2016 $369,300 Sales Cost of Goods 285,400 Gross Profit 83,900 Depreciation 26,820 Selling & Admin. Expense 23,340 Other Operating Expense 1,080 Net Operating Income 32,660 Interest Expense 7,685 Earnings Before Taxes 24,975 Taxes 9,990 Net Income $14,985 2015 $354,000 281,800 72,200 26,360 21.820 1,080 22,940 7,505 15,435 6.174 $9,261 52,100 40.00% 52,100 $0.18 2015 Notes: Tax Rate 40.00% Shares Eamings per Share $0.29 Big Rock Candy Mountain Mining Co. Balance Sheet For the Year Ended December 31, 2016 2016 Assets Cash $14,714 Marketable Securities $1,841 Accounts Receivable $41,090 Inventory $46,910 Total Current Assets $104,555 Gross Fixed Assets $388,000 Accumulated Depreciation $78,020 Net Plant & Equipment $309.980 Total Assets $414,535 $10,300 $550 $42,100 $48.490 S101,440 $352,600 $51,200 $301,400 S402,840 Liabilities & Owner's Equity Accounts Payable Accrued Expenses Total Current Liabilities Long-term Debt Total Liabilities Common Stock (51.00 par) Additional Paid-in-Capital Retained Earnings Total Owner's Equity Total Liab. & Owner's Equity $35,200 $2,850 $38,050 $152,700 $190,750 $52,100 $121,500 $50,185 $223,785 S414,535 $32,700 $2,740 $35,440 $158.600 $194,040 $52,100 $121,500 $35,200 $208,800 5402,840 Problems 1. Copy the Big Rock Candy Mountain Mining financial statements from Problem 1 in Chapter 2 into a new workbook. a. Set up a ratio worksheet similar to the one in Exhibit 3-6, page 92, and calculate all of the ratios for the firm. b. Identify at least two areas of potential concern using the ratios. Identify at least two areas that have shown improvement. c. In 2016 the ROE increased. Explain, in words, why this increase occurred using the DuPont method from equation (3-29). Now use the extended DuPont method from equation (3-33). d. Big Rock Candy Mountain Mining has shown an accounting profit in each of the past two years. Calculate the economic profit for these years and compare it to net income. The WACC is 9%. e. Using Altman's model for privately held firms, calculate the Z-score for Mike Owjai Manufacturing. Does it appear that the firm is in imminent danger of bankruptcy? Problems 1. Using the data presented below: Big Rock Candy Mountain Mining Co Income Statements For the Years 2015 and 2016 2016 $369,300 Sales Cost of Goods 285,400 Gross Profit 83,900 Depreciation 26,820 Selling & Admin. Expense 23,340 Other Operating Expense 1,080 Net Operating Income 32,660 Interest Expense 7,685 Earnings Before Taxes 24,975 Taxes 9,990 Net Income $14,985 2015 $354,000 281,800 72,200 26,360 21.820 1,080 22,940 7,505 15,435 6.174 $9,261 52,100 40.00% 52,100 $0.18 2015 Notes: Tax Rate 40.00% Shares Eamings per Share $0.29 Big Rock Candy Mountain Mining Co. Balance Sheet For the Year Ended December 31, 2016 2016 Assets Cash $14,714 Marketable Securities $1,841 Accounts Receivable $41,090 Inventory $46,910 Total Current Assets $104,555 Gross Fixed Assets $388,000 Accumulated Depreciation $78,020 Net Plant & Equipment $309.980 Total Assets $414,535 $10,300 $550 $42,100 $48.490 S101,440 $352,600 $51,200 $301,400 S402,840 Liabilities & Owner's Equity Accounts Payable Accrued Expenses Total Current Liabilities Long-term Debt Total Liabilities Common Stock (51.00 par) Additional Paid-in-Capital Retained Earnings Total Owner's Equity Total Liab. & Owner's Equity $35,200 $2,850 $38,050 $152,700 $190,750 $52,100 $121,500 $50,185 $223,785 S414,535 $32,700 $2,740 $35,440 $158.600 $194,040 $52,100 $121,500 $35,200 $208,800 5402,840 Problems 1. Copy the Big Rock Candy Mountain Mining financial statements from Problem 1 in Chapter 2 into a new workbook. a. Set up a ratio worksheet similar to the one in Exhibit 3-6, page 92, and calculate all of the ratios for the firm. b. Identify at least two areas of potential concern using the ratios. Identify at least two areas that have shown improvement. c. In 2016 the ROE increased. Explain, in words, why this increase occurred using the DuPont method from equation (3-29). Now use the extended DuPont method from equation (3-33). d. Big Rock Candy Mountain Mining has shown an accounting profit in each of the past two years. Calculate the economic profit for these years and compare it to net income. The WACC is 9%. e. Using Altman's model for privately held firms, calculate the Z-score for Mike Owjai Manufacturing. Does it appear that the firm is in imminent danger of bankruptcy