Question

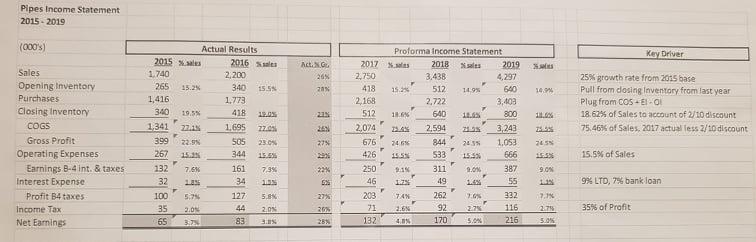

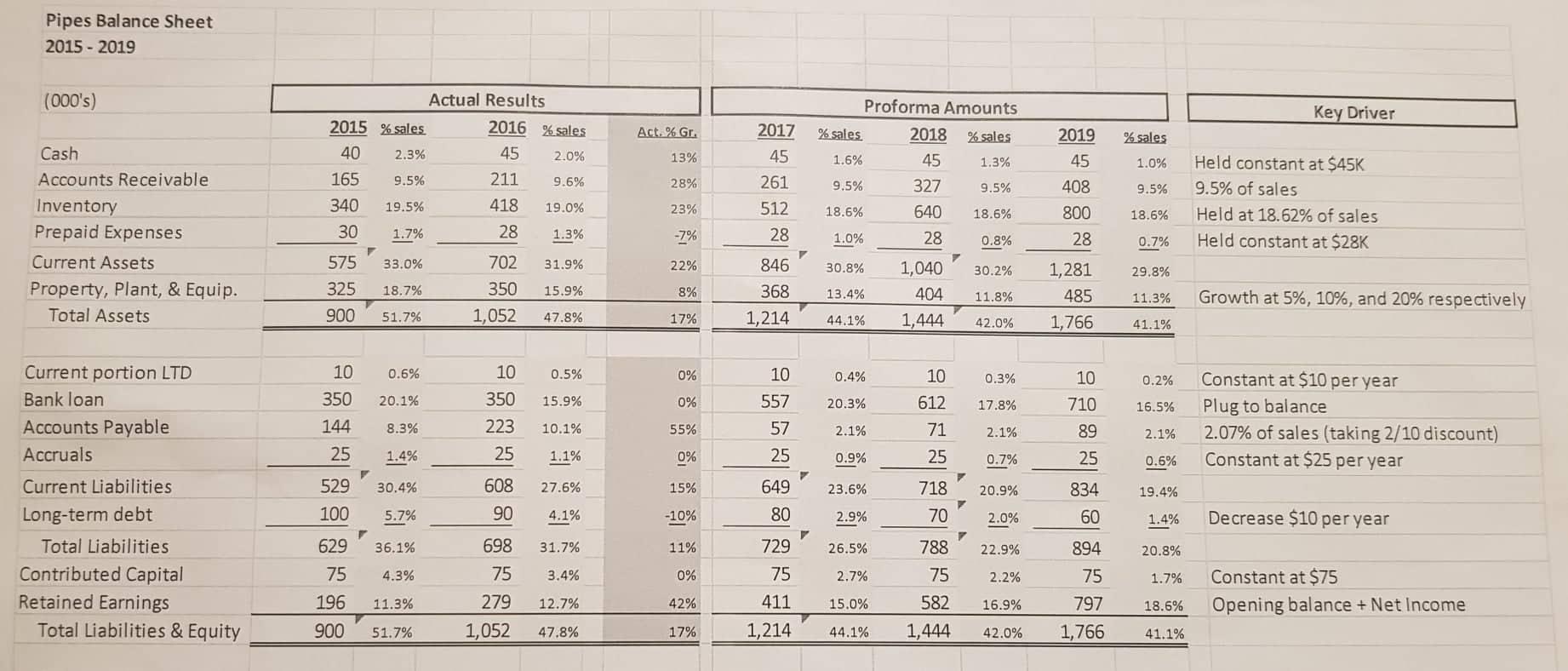

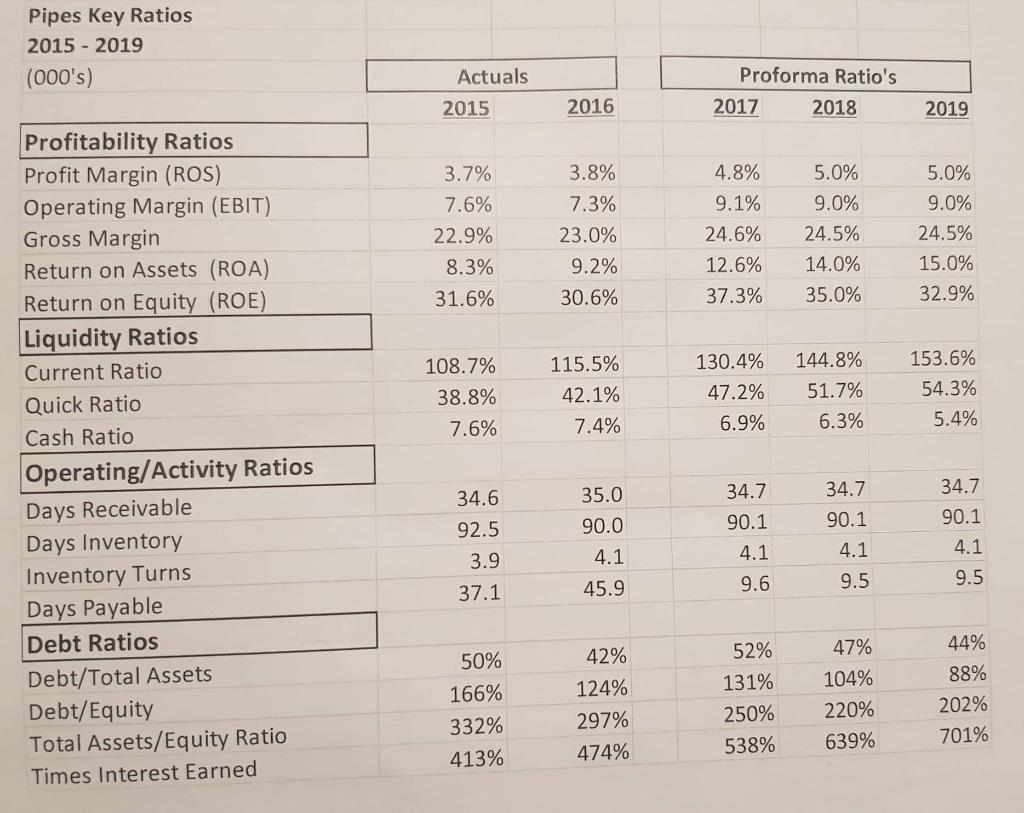

Using the financial information: Proforma Income Statement, Balance Sheet, Statement of Cash Flows, and Key Ratios. Solve these scenarios and how the financial information will

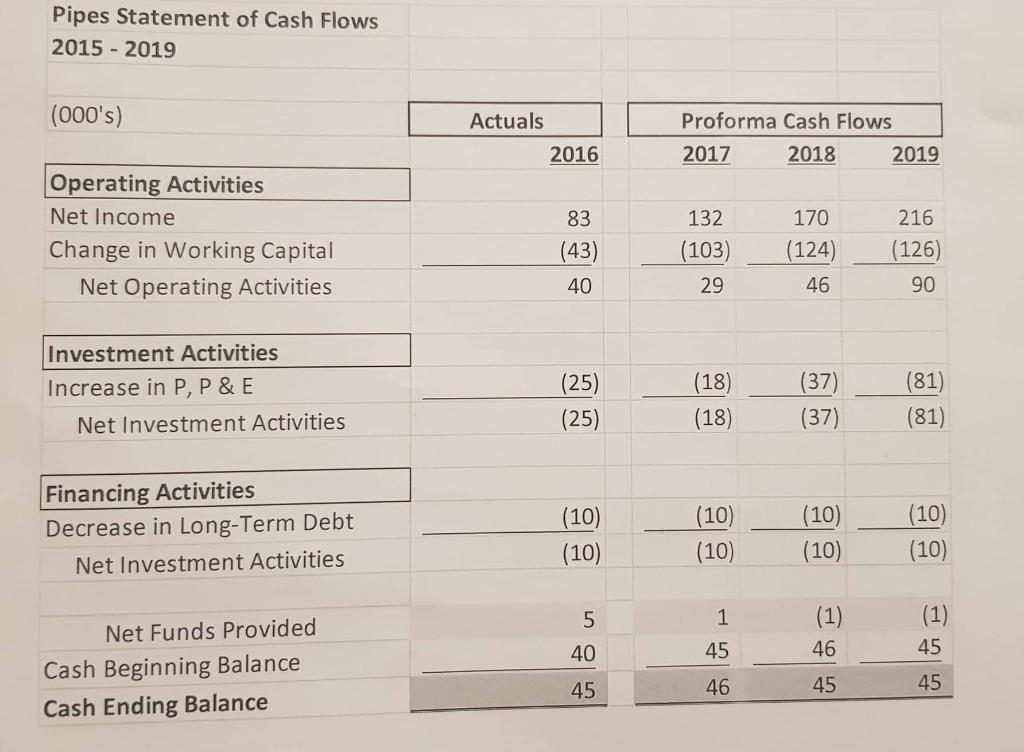

Using the financial information: Proforma Income Statement, Balance Sheet, Statement of Cash Flows, and Key Ratios. Solve these scenarios and how the financial information will change when the following scenario:

a. The Banker of Pipes is only willing to loan the company up to $500K for the years 2017, 2018, and 2019.

No other debt financing is available from any financial institution.

b. You must pull together a set of Proforma statements with the above loan constraints. Additional

constraints:

i. Cash must remain constant at $45K

ii. Prepaid Expenses must remain constant at $28K

iii. Accounts Receivable Days cannot be less than 30 Days

iv. Inventory Days cannot be less than 85 Days

v. Plant, Property and Equipment must grow at least 5% in 2017 and at least 10% in the next two

years

vi. You must keep ROE (Return on Equity) at 30% or higher for all proforma years

vii. As indicated above, the Bank loan is frozen at $500K (you can’t increase Long-term debt and

must pay back $10K per year as stated in the base plan)

viii. You must meet or beat “base proforma” income for all 3 years

c. What are the implications of the plan you have pulled together to meet the above constraints – Please

explain in detail?

d. Write Summarize your findings from the “What if” scenario in a one-page executive summary.

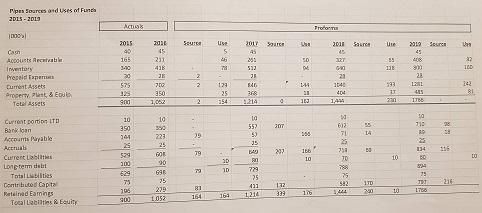

Pipes Sources and Uses of Funds 2015-2019 1000's) Cash Accounts Receivabl Inventory Prepeld Exper Current Assets Property Punt, & Equi Total Assets Current portion LTD Bank loan Accounts Payable Accruali Current Liables Long-term debt TotalLibilities Contributed Capital Retained Earnings Total Liablities & Equity Actuos 2015 40 165 3-40 30 575 325 900 10 350 244 25 529 100 629 75 196 900 2014 45 211 418 28 700 350 1,062 10 350 223 25 605 90 698 25 279 1.052 Source 2 2 2 2. 29 79 79 81 164 Use S 46 78 124 25 154 W 1919 164 2017 45 201 513 38 546 368 1214 10 557 5) 35 140 800 729 25 411 1,214 Source 0 307 207 A 132 339 398 39 M 156 166 10 106 Proform 2018 Sau 45 327 21 1040 404 1,444 10 6123 71 25 731 70 788 75 582 444 55 14 53 130 240 Use 2019 Source 89 118 IT 393 1281 230 10 ***22082 10 45 485 1766 10 710 AP 25 134 75 28 116 Ver 32 100 242 81 LO

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a The financial information will not change because the company will not be able to borrow any more ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started