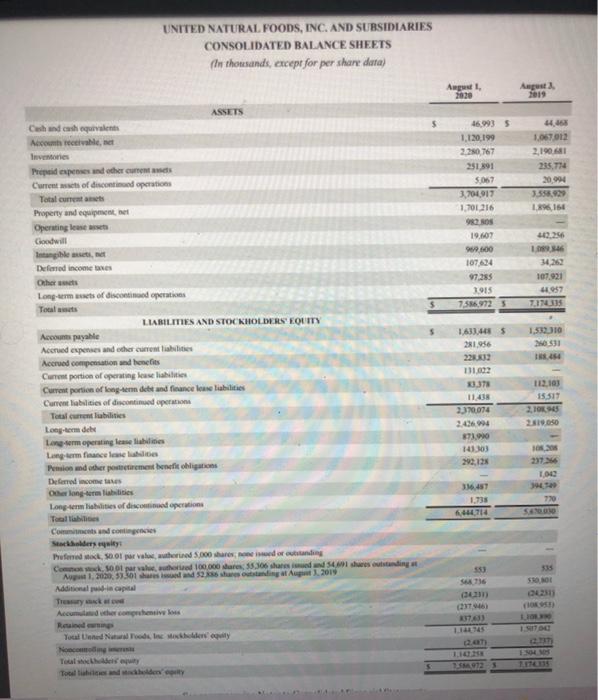

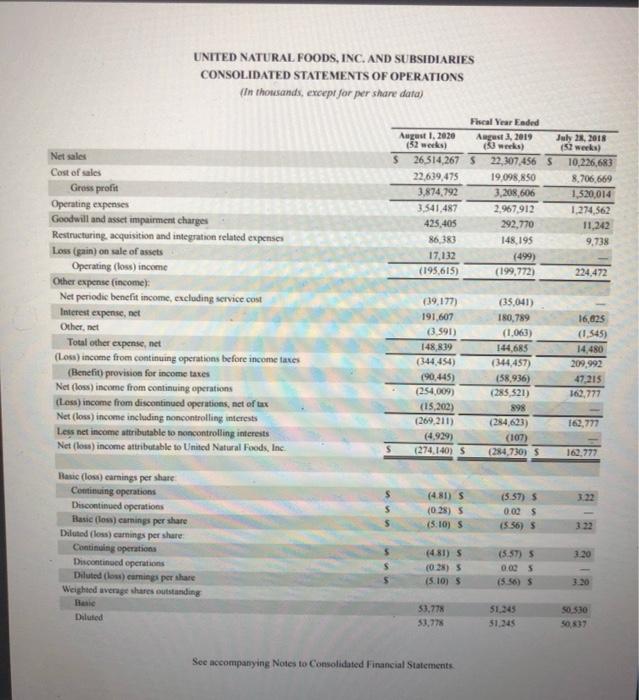

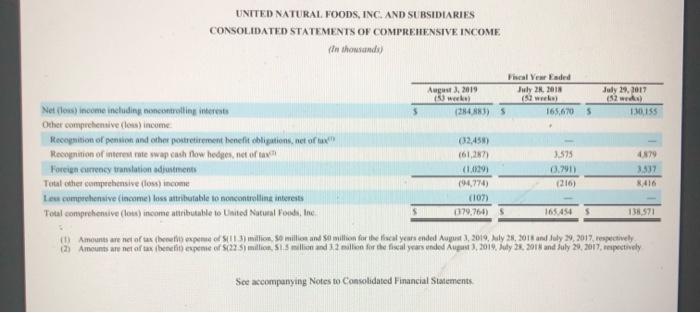

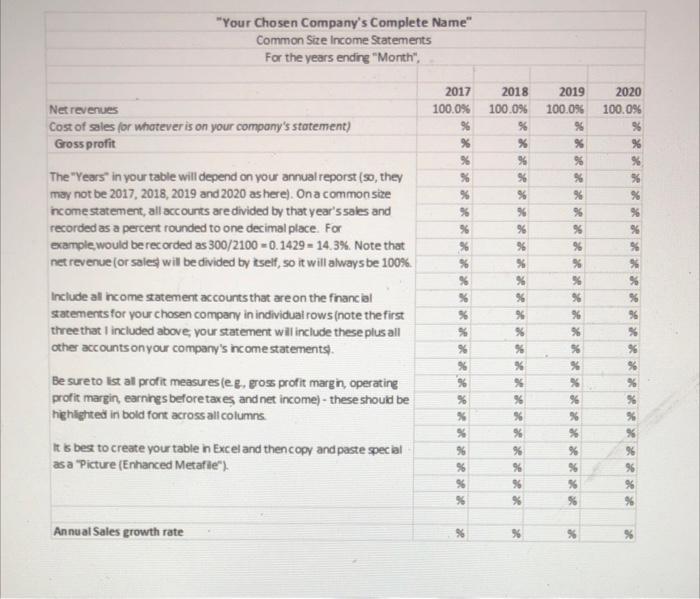

Using the financial statement data in the company's annual reports, create a comprehensive written analysis of the company's financial operations for the four most recent fiscal years. You written report should be structured as follows: o Part I: Construct common size income statements for the four most recent fiscal years (that is why you need the two most recent annual reports). Also include a line listing the annual growth rate in net revenue (or sales) for the four most recent years. Write an analysis of the ratio table you created. For example: What trends do you observe? What appears to be areas of strength or weaknesses? What are any potential areas of significant concern? Anything else? UNITED NATURAL FOODS, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in thousands, except for per share data) August 2020 August 19 44.162 1,067012 2.190.41 235.74 20.994 3.55829 1.896,164 46.9935 1,120,199 2.250 767 251 891 5.067 3,704917 1.701216 98.80 19,607 962.600 107424 97.255 1915 7,586,9725 46.256 46 34.253 107.921 4.957 IN ASSETS Cash and cash equivalent Aceale, et Investors Prepaid expenses and others Current is of discontinued operation Total current Property and equipment Operating Codwill Intangibles, Deferred income ne Other Long-term of discontinuer Tocals LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Acered expenses and other current Accrued compensation and hones Current portion of operating sites Current portion of long-term debt and finance tous liabilities Current liabilities of discontinued operation Totalclities Long-term der Long-term operating lease ai Long-term face leite Pension and other postmest benefit obligations Deferred mom Olong-term hitties Long-term lilities of discomedoperations 1.532310 531 1.63485 281,956 22.12 131.002 3370 11.48 2.370.074 24694 73.00 14.03 292,123 112,103 15511 2. 21 OSO 10 36,457 1.735 770 SO Come contingencies Makara rasily Pufend, so thered 5.000 de ording Como solve the 100.000 53.30 shares and standing 1.200, 33.301 52 gal. 2015 Additional in capital Trek Accued her comprehensive Red Your Une Noodle Mac quy SONO 550 S756 (30 (6) STO 11145 2. Tould Total headsety 9723 Les UNITED NATURAL FOODS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS [In thousands, except for per share data) Fiscal Year Eaded August 1, 2030 August, 2019 July 21, 2018 (52 weeks) (3 werks) (52 weeks) $ 26,314,2675 22.307.456 5 10,226,683 22,639,475 19,098,850 8,706.669 3,874.792 3.208.606 1,520,014 3,541,487 2.967912 1.274,562 425,405 292,770 11,242 86,383 148.195 9,738 17,132 (499) (195,615) (199,772) 224,472 Net sales Cost of sales Gross profit Operating expenses Goodwill and asset impairment charges Restructuring, acquisition and integration related expenses Loss (gain) on sale of assets Operating (los) income Other expense (income Net periodic benefit income, excluding service cost Interest expense, net Othernet Total other expense, net (Low) income from continuing operations before income taxes (Benefit) provision for income taxes Net (loss) income from continuing operations (Loss) income from discontinued operations, net of tax Net (los) income including noncontrolling interests Less net income attributable to noncontrolling interests Net (los) income attributable to United Natural Foods, Ine (19,177) 191 607 (3.591) 148,839 (344,454) (90.445) (254,009) (15,202) (269,211) (4.929) (274.140) S (35,041) 180,789 (1.063) 144,685 (344,457) (58,936) (283,521) 898 (284,623) (107) (284,730) 5 16,625 (1.545) 14.480 209.992 47.215 162.777 162.777 162.777 (481) S (0.28) 5 5:10) (5.57) 5 0.00 $ (556) $ 322 Basic (los) camnings per share Continuing operations Discontinued operations Basic (los) camnings per share Diluted loss carnings per share: Continuing operations Discontinued operations Diluted (los) earnings per share Weighted average shares outstanding Basic Diluted 3.20 (481) (0.38) 5 (5.10) 5 (5.5) 5 0.005 (556) $ 33,778 53.77 51.345 31.345 SO 530 50,837 See accompanying Notes to Consolidated Financial Statements UNITED NATURAL FOODS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME in thousands Fheal Year Ended August 2019 July 21, 2018 July 29, 2017 w ( www (52) Netlos) income including noncontrolling interes 12483) 165,670 5 1.155 Other comprehensive income Recognition of pension and other portretirement benefit obligations, net of (32,453) Recognition of interest rate wap cash flow hedgen niet of taxi (61,217) 3.575 0879 Foreign currency translation adjustments (1,4291 0.791) 3.537 Total other comprehensive oss) income 1944,774) (216) Les comprehensive (Income) loss attributable to noncontrolling interests (107) Total comprehensive (os) income attributable to United Natural Food, Inc 079,764) 165.454 138.571 1) Amounts are net of tax (hetto expect 3 million so million and Soullion for the fiscal years ended uust, 2019. Aly 28, 2018 and July 29, 2017 tively (3) Amounts are net of tax benefits expense of 22 million. Se million and million for the fiscal years unded A). 2019. July 22, 2018 and July 20, 2017, espectively 8,416 See accompanying Notes to Consolidated Financial Statements. *Your Chosen Company's Complete Name" Common Size Income Statements For the years ending "Month". Net revenues 2017 100.0% 96 % % % % 2019 100.0% %6 % % 2020 100.0% % % % 56 Cost of sales for whatever is on your company's statement) Gross profit The "Years" in your table will depend on your annual reporst (so, they may not be 2017, 2018, 2019 and 2020 as here). Ona common size income statement, all accounts are divided by that year's sales and recorded as a percent rounded to one decimal place. For example would be recorded as 300/2100 -0.1429 - 14.3%. Note that net revenue (or sales will be divided by tself, so it will always be 100% * % % % % % % % % % 2018 100.0% % % %% % % % % % % % % % % % % % % % % % % % % Include all come statement accounts that are on the financial statements for your chosen company in individual rows (note the first three that included above your statement will include these plus all other accountsonyour company's come statements Be sure to list al profit measures (eg, gros profit margin operating profit margin, earnings before taxes and net income) - these should be highlighted in bold font across all columns It is best to create your table in Excel and then copy and paste special as a "Picture (Enhanced Metafle") %6 % % % % % % % % % % % % % % % % % % 96 % % % % % % % % % 96 % % % RRRRR RROR RRR RRRRRR % Annual Sales growth rate % % % % Using the financial statement data in the company's annual reports, create a comprehensive written analysis of the company's financial operations for the four most recent fiscal years. You written report should be structured as follows: o Part I: Construct common size income statements for the four most recent fiscal years (that is why you need the two most recent annual reports). Also include a line listing the annual growth rate in net revenue (or sales) for the four most recent years. Write an analysis of the ratio table you created. For example: What trends do you observe? What appears to be areas of strength or weaknesses? What are any potential areas of significant concern? Anything else? UNITED NATURAL FOODS, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in thousands, except for per share data) August 2020 August 19 44.162 1,067012 2.190.41 235.74 20.994 3.55829 1.896,164 46.9935 1,120,199 2.250 767 251 891 5.067 3,704917 1.701216 98.80 19,607 962.600 107424 97.255 1915 7,586,9725 46.256 46 34.253 107.921 4.957 IN ASSETS Cash and cash equivalent Aceale, et Investors Prepaid expenses and others Current is of discontinued operation Total current Property and equipment Operating Codwill Intangibles, Deferred income ne Other Long-term of discontinuer Tocals LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Acered expenses and other current Accrued compensation and hones Current portion of operating sites Current portion of long-term debt and finance tous liabilities Current liabilities of discontinued operation Totalclities Long-term der Long-term operating lease ai Long-term face leite Pension and other postmest benefit obligations Deferred mom Olong-term hitties Long-term lilities of discomedoperations 1.532310 531 1.63485 281,956 22.12 131.002 3370 11.48 2.370.074 24694 73.00 14.03 292,123 112,103 15511 2. 21 OSO 10 36,457 1.735 770 SO Come contingencies Makara rasily Pufend, so thered 5.000 de ording Como solve the 100.000 53.30 shares and standing 1.200, 33.301 52 gal. 2015 Additional in capital Trek Accued her comprehensive Red Your Une Noodle Mac quy SONO 550 S756 (30 (6) STO 11145 2. Tould Total headsety 9723 Les UNITED NATURAL FOODS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS [In thousands, except for per share data) Fiscal Year Eaded August 1, 2030 August, 2019 July 21, 2018 (52 weeks) (3 werks) (52 weeks) $ 26,314,2675 22.307.456 5 10,226,683 22,639,475 19,098,850 8,706.669 3,874.792 3.208.606 1,520,014 3,541,487 2.967912 1.274,562 425,405 292,770 11,242 86,383 148.195 9,738 17,132 (499) (195,615) (199,772) 224,472 Net sales Cost of sales Gross profit Operating expenses Goodwill and asset impairment charges Restructuring, acquisition and integration related expenses Loss (gain) on sale of assets Operating (los) income Other expense (income Net periodic benefit income, excluding service cost Interest expense, net Othernet Total other expense, net (Low) income from continuing operations before income taxes (Benefit) provision for income taxes Net (loss) income from continuing operations (Loss) income from discontinued operations, net of tax Net (los) income including noncontrolling interests Less net income attributable to noncontrolling interests Net (los) income attributable to United Natural Foods, Ine (19,177) 191 607 (3.591) 148,839 (344,454) (90.445) (254,009) (15,202) (269,211) (4.929) (274.140) S (35,041) 180,789 (1.063) 144,685 (344,457) (58,936) (283,521) 898 (284,623) (107) (284,730) 5 16,625 (1.545) 14.480 209.992 47.215 162.777 162.777 162.777 (481) S (0.28) 5 5:10) (5.57) 5 0.00 $ (556) $ 322 Basic (los) camnings per share Continuing operations Discontinued operations Basic (los) camnings per share Diluted loss carnings per share: Continuing operations Discontinued operations Diluted (los) earnings per share Weighted average shares outstanding Basic Diluted 3.20 (481) (0.38) 5 (5.10) 5 (5.5) 5 0.005 (556) $ 33,778 53.77 51.345 31.345 SO 530 50,837 See accompanying Notes to Consolidated Financial Statements UNITED NATURAL FOODS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME in thousands Fheal Year Ended August 2019 July 21, 2018 July 29, 2017 w ( www (52) Netlos) income including noncontrolling interes 12483) 165,670 5 1.155 Other comprehensive income Recognition of pension and other portretirement benefit obligations, net of (32,453) Recognition of interest rate wap cash flow hedgen niet of taxi (61,217) 3.575 0879 Foreign currency translation adjustments (1,4291 0.791) 3.537 Total other comprehensive oss) income 1944,774) (216) Les comprehensive (Income) loss attributable to noncontrolling interests (107) Total comprehensive (os) income attributable to United Natural Food, Inc 079,764) 165.454 138.571 1) Amounts are net of tax (hetto expect 3 million so million and Soullion for the fiscal years ended uust, 2019. Aly 28, 2018 and July 29, 2017 tively (3) Amounts are net of tax benefits expense of 22 million. Se million and million for the fiscal years unded A). 2019. July 22, 2018 and July 20, 2017, espectively 8,416 See accompanying Notes to Consolidated Financial Statements. *Your Chosen Company's Complete Name" Common Size Income Statements For the years ending "Month". Net revenues 2017 100.0% 96 % % % % 2019 100.0% %6 % % 2020 100.0% % % % 56 Cost of sales for whatever is on your company's statement) Gross profit The "Years" in your table will depend on your annual reporst (so, they may not be 2017, 2018, 2019 and 2020 as here). Ona common size income statement, all accounts are divided by that year's sales and recorded as a percent rounded to one decimal place. For example would be recorded as 300/2100 -0.1429 - 14.3%. Note that net revenue (or sales will be divided by tself, so it will always be 100% * % % % % % % % % % 2018 100.0% % % %% % % % % % % % % % % % % % % % % % % % % Include all come statement accounts that are on the financial statements for your chosen company in individual rows (note the first three that included above your statement will include these plus all other accountsonyour company's come statements Be sure to list al profit measures (eg, gros profit margin operating profit margin, earnings before taxes and net income) - these should be highlighted in bold font across all columns It is best to create your table in Excel and then copy and paste special as a "Picture (Enhanced Metafle") %6 % % % % % % % % % % % % % % % % % % 96 % % % % % % % % % 96 % % % RRRRR RROR RRR RRRRRR % Annual Sales growth rate % % % %