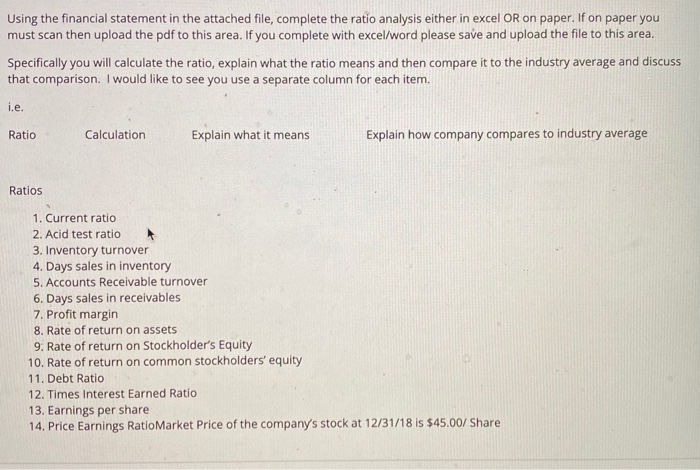

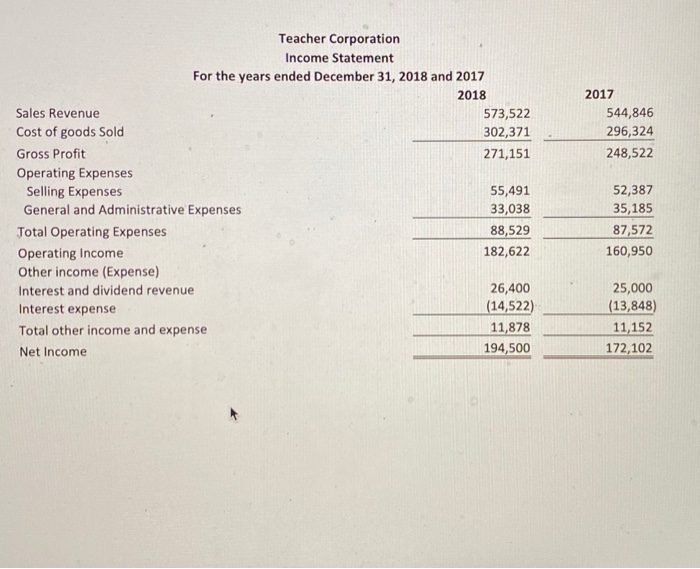

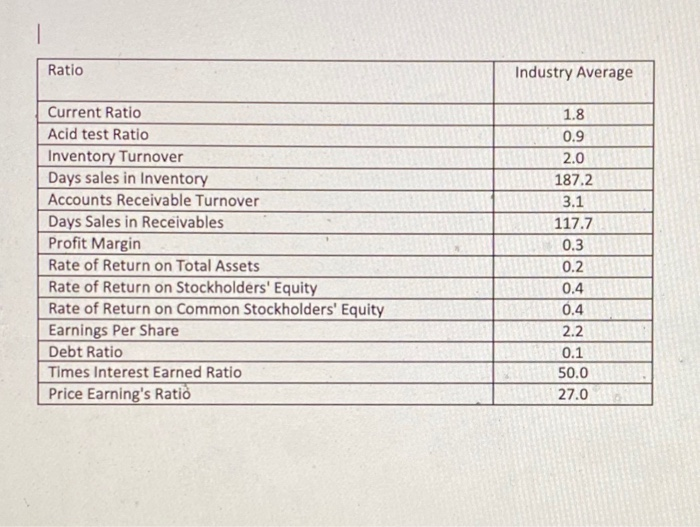

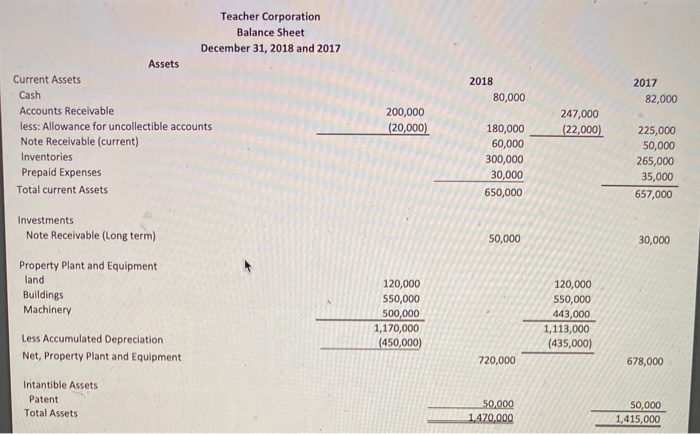

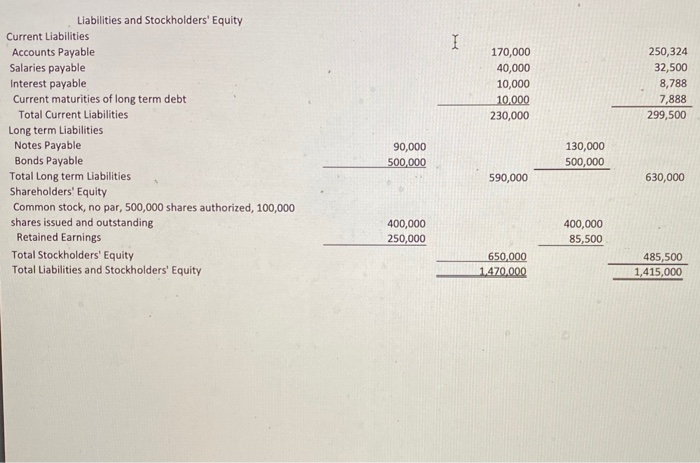

Using the financial statement in the attached file, complete the ratio analysis either in excel OR on paper. If on paper you must scan then upload the pdf to this area. If you complete with excel/Word please save and upload the file to this area. Specifically you will calculate the ratio, explain what the ratio means and then compare it to the industry average and discuss that comparison. I would like to see you use a separate column for each item. i.e. Ratio Calculation Explain what it means Explain how company compares to industry average Ratios 1. Current ratio 2. Acid test ratio 3. Inventory turnover 4. Days sales in inventory 5. Accounts Receivable turnover 6. Days sales in receivables 7. Profit margin 8. Rate of return on assets 9. Rate of return on Stockholder's Equity 10. Rate of return on common stockholders' equity 11. Debt Ratio 12. Times Interest Earned Ratio 13. Earnings per share 14. Price Earnings Ratio Market Price of the company's stock at 12/31/18 is $45.00/ Share 2017 544,846 296,324 248,522 Teacher Corporation Income Statement For the years ended December 31, 2018 and 2017 2018 Sales Revenue 573,522 Cost of goods Sold 302,371 Gross Profit 271,151 Operating Expenses Selling Expenses 55,491 General and Administrative Expenses 33,038 Total Operating Expenses 88,529 Operating Income 182,622 Other income (Expense) Interest and dividend revenue 26,400 Interest expense (14,522) Total other income and expense 11,878 Net Income 194,500 52,387 35,185 87,572 160,950 25,000 (13,848) 11,152 172,102 Ratio Industry Average 1.8 0.9 2.0 Current Ratio Acid test Ratio Inventory Turnover Days sales in Inventory Accounts Receivable Turnover Days Sales in Receivables Profit Margin Rate of Return on Total Assets Rate of Return on Stockholders' Equity Rate of Return on Common Stockholders' Equity Earnings Per Share Debt Ratio Times Interest Earned Ratio Price Earning's Ratio 187.2 3.1 117.7 0.3 0.2 0.4 0.4 2.2 0.1 50.0 27.0 Teacher Corporation Balance Sheet December 31, 2018 and 2017 Assets Current Assets Cash Accounts Receivable less: Allowance for uncollectible accounts Note Receivable (current) Inventories Prepaid Expenses Total current Assets 2018 80,000 2017 82,000 200,000 (20,000) 247,000 (22,000) 180,000 60,000 300,000 30,000 650,000 225,000 50,000 265,000 35,000 657,000 Investments Note Receivable (Long term) 50,000 30,000 Property Plant and Equipment land Buildings Machinery 120,000 550,000 500,000 1,170,000 (450,000) 120,000 550,000 443,000 1,113,000 (435,000) Less Accumulated Depreciation Net, Property Plant and Equipment 720,000 678,000 Intantible Assets Patent Total Assets 50,000 1,470,000 50,000 1,415,000 170,000 40,000 10,000 10,000 230,000 250,324 32,500 8,788 7,888 299,500 Liabilities and Stockholders' Equity Current Liabilities Accounts Payable Salaries payable Interest payable Current maturities of long term debt Total Current Liabilities Long term Liabilities Notes Payable Bonds Payable Total Long term Liabilities Shareholders' Equity Common stock, no par, 500,000 shares authorized, 100,000 shares issued and outstanding Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 90,000 500,000 130,000 500,000 590,000 630,000 400,000 250,000 400,000 85,500 650,000 1.470.000 485,500 1,415,000