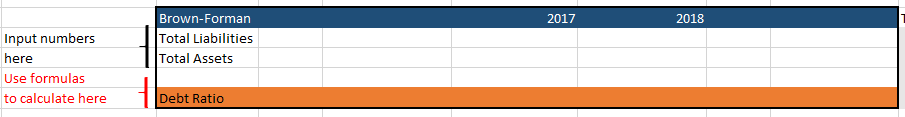

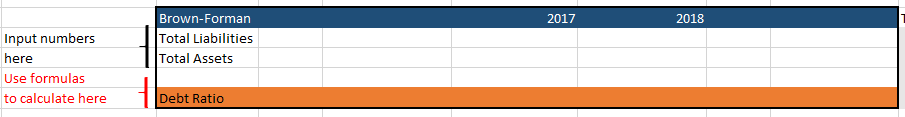

Using the financial statement information that you input into the Income Statement and Balance Sheet tabs, calculate Brown-Forman's return-on-assets for fiscal year 2018

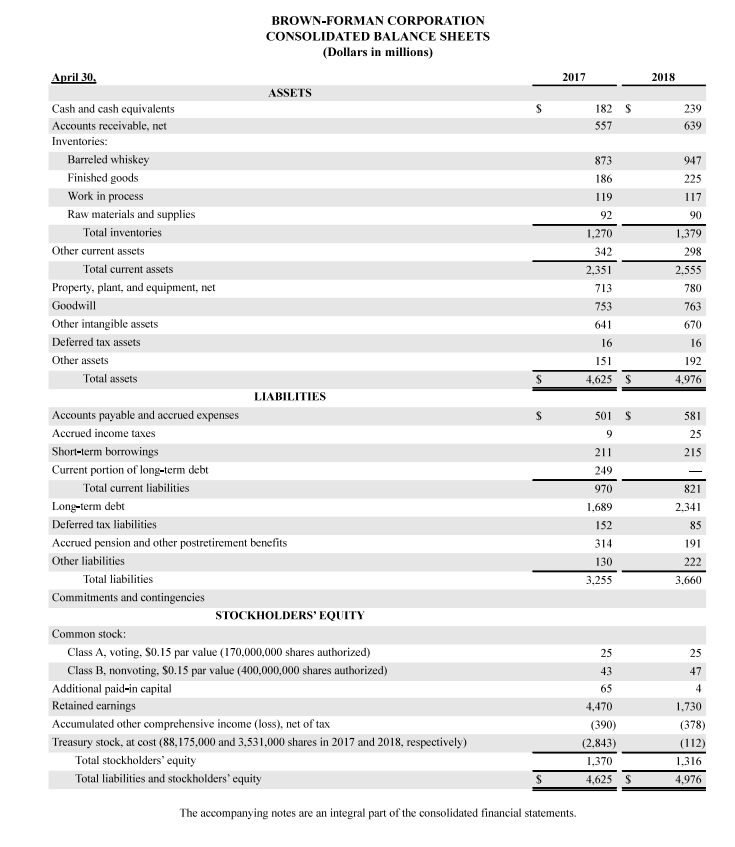

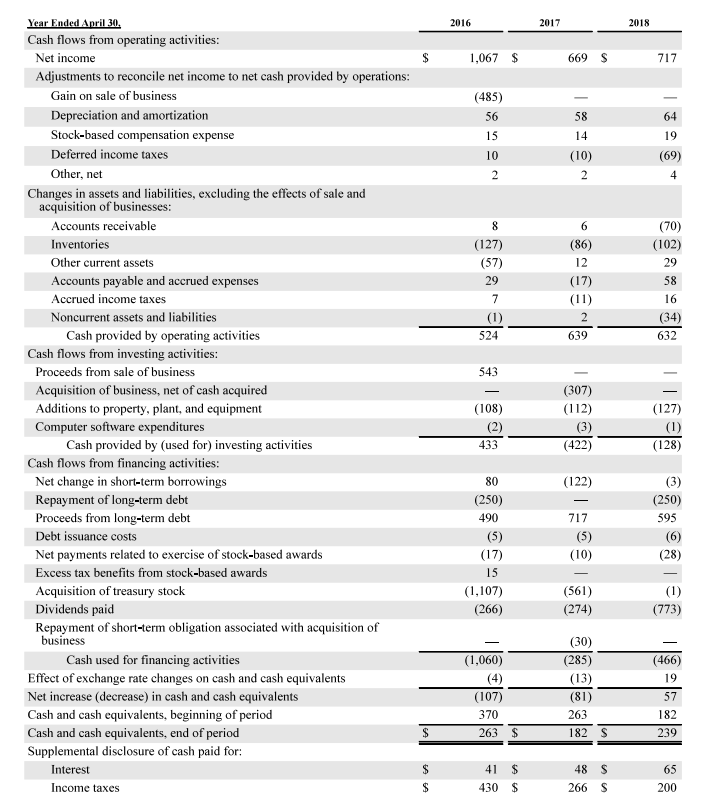

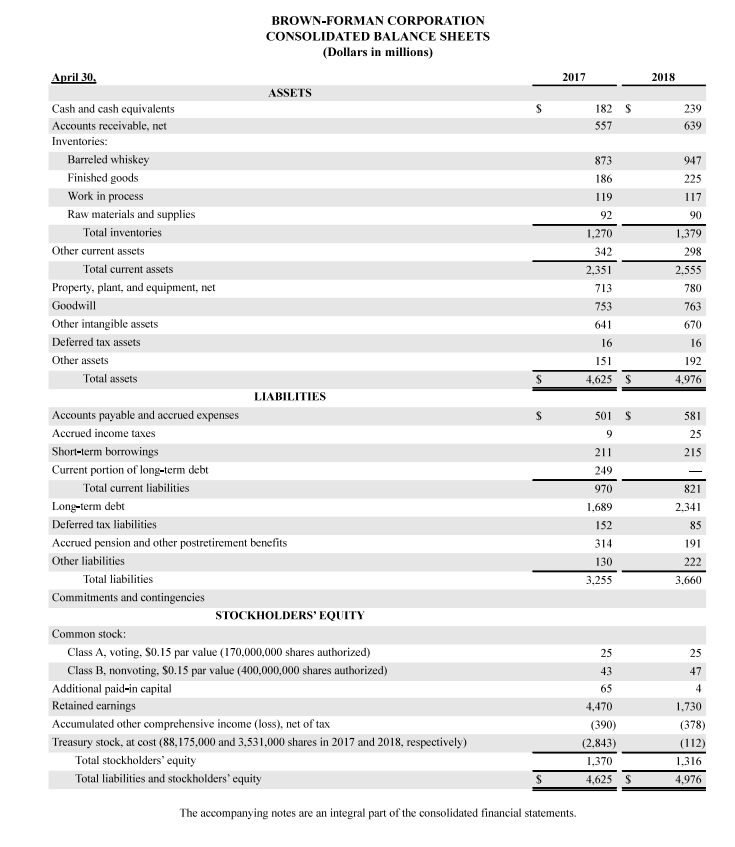

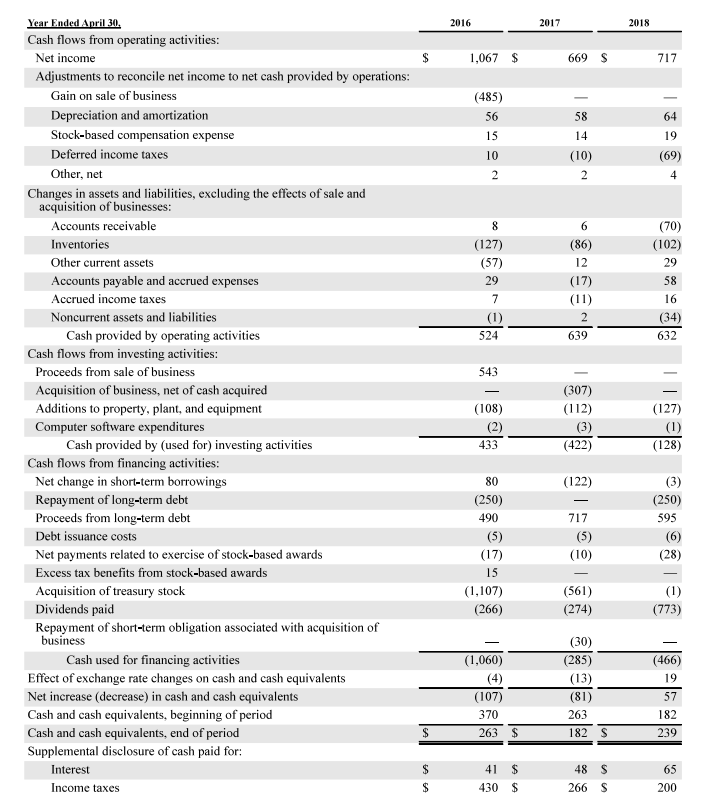

Brown-Forman Total Liabilities Total Assets 2017 Input numbers here Use formulas to calculate here Debt Ratio BROWN-FORMAN CORPORATION CONSOLIDATED BALANCE SHEETS (Dollars in millions) 2017 2018 ASSETS Cash and cash equivalents Accounts receivable, net Inventories 239 639 182 S 557 Barreled whiskey Finished goods Work in process Raw materials and supplies 873 186 947 225 92 Total inventories 1,270 1,379 Other current assets Total current assets Property, plant, and equipment, net Goodwill Other intangible assets Deferred tax assets Other assets 2,351 713 753 641 16 151 2.555 780 763 670 192 4.976 Total assets 4,625 S LIABILITIES able and accrued expenses Accounts pay Accrued income taxes Short-term borrowings Current portion of long-term debt 501 $ 581 25 215 211 249 970 1.689 152 314 130 3,255 Total current liabilities Lon -term debt Deferred tax liabilities Accrued pension and other postretirement benefits Other liabilities 821 2.341 85 191 Total iabilities 3.660 Commitments and contingencies STOCKHOLDERS' EQUITY Common stock: Class A, voting, S0.15 par value (170,000,000 shares authorized) 25 43 65 4,470 (390) (2.843) 1,370 25 47 Class B, nonvoting, $0.15 par value (400,000,000 shares authorized) Additional paid-in capital Retained earnings Accumulated other comprehensive income (loss), net of tax Treasury stock, at cost (88,175,000 and 3,531,000 shares in 2017 and 2018, respectively) 1,730 (378) (112) 1,316 4,976 Total stockholders' equity Total liabilities and stockholders' equity 4,625 S The accompanying notes are an integral part of the consolidated financial statements. 2016 2017 2018 Cash flows from operating activities Net income 1,067 S 669 S Adjustments to reconcile net income to net cash provided by operations: (485) Gain on sale of busineSS Depreciation and amortization Stock-based compensation expense Deferred income taxes Other, net 58 64 15 (10) (69) Changes in assets and liabilities, excluding the effects of sale and acquisition of businesses: Accounts receivable Inventories Other current assets Accounts payable and accrued expenses Accrued income taxes Noncurrent assets and liabilities (70) (102) 29 58 (127) (57) (86) (17) (34) 632 Cash provided by operating activities 524 639 Cash flows from investing activities: Proceeds from sale of business Acquisition of business, net of cash acquired Additions to property, plant, and equipment Computer software expenditures 543 (307) (112) (422) (122) (108) (127) Cash provided by (used for) investing activities 433 (128) Cash flows from financing activities: Net change in short-term borrowings Repayment of long-term debt Proceeds from long-term debt Debt issuance costs Net payments related to exercise of stock-based awards Excess tax benefits from stock-based awards Acquisition of treasury stock Dividends paid Repayment of short-term obligation associated with acquisition of 80 (250) 490 (250) 595 (17) 15 (10) (28) (1,107) (561) (274) (266) (773) (30) (285) business Cash used for financing activities (1,060) Effect of exchange rate changes on cash and cash equivalents Net increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period Supplemental disclosure of cash paid for: (107) 370 263 $ 263 182 S 182 239 Interest Income taxes 430 S 266 S 200