Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the financial statements for the hypothetical company - Big Box Retailer-record the transactions for the year to the financial statement. The financial statements

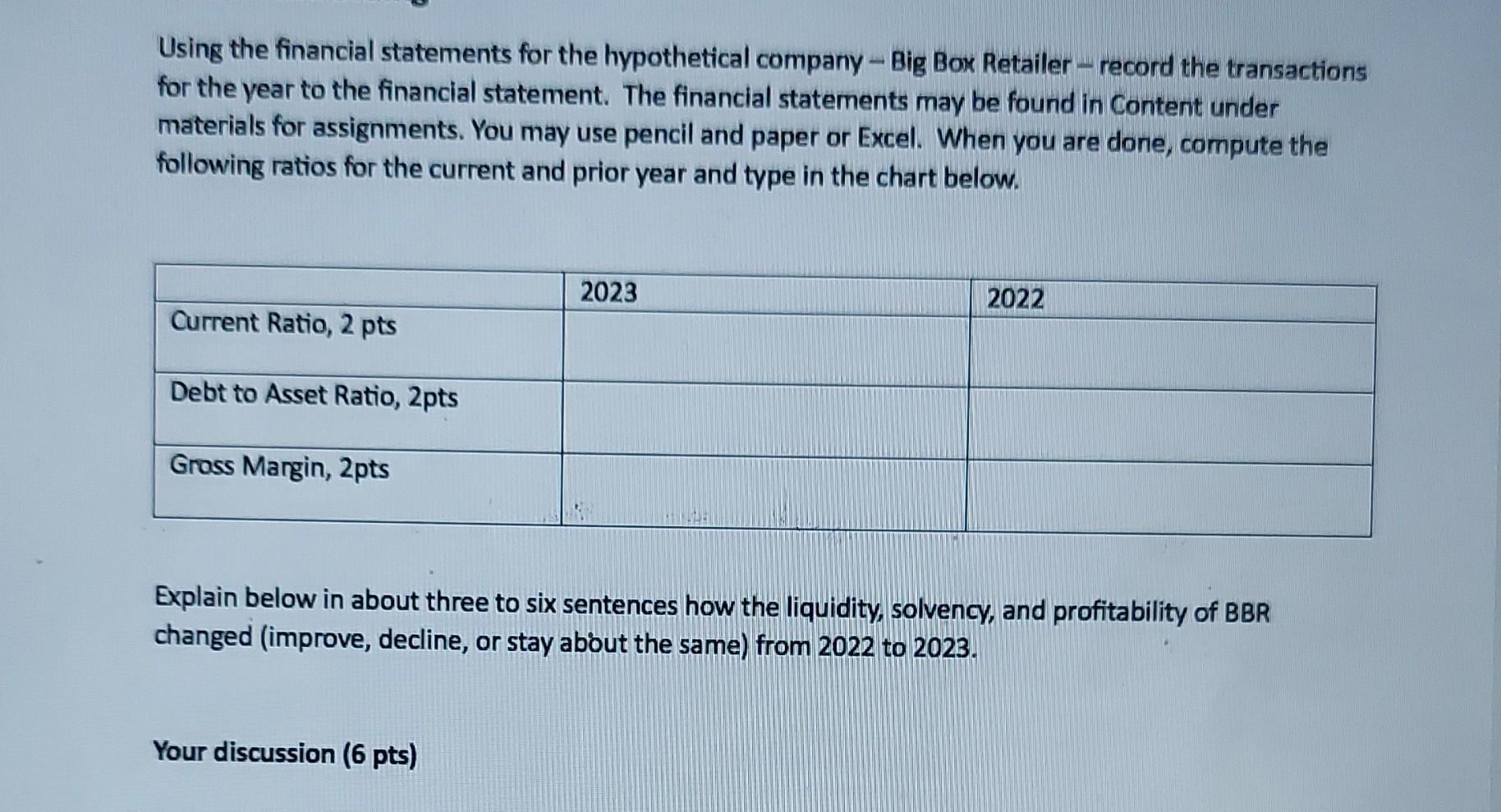

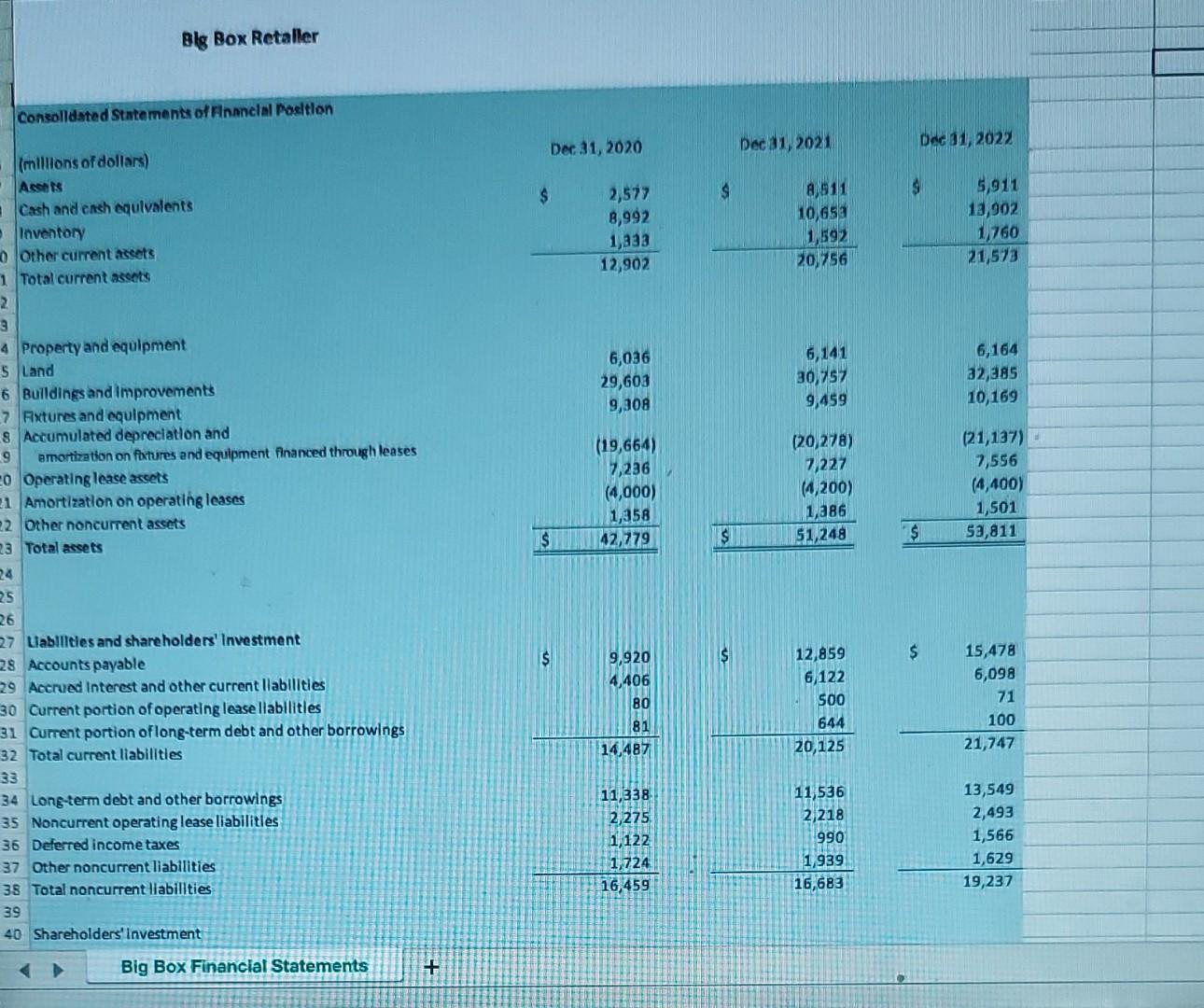

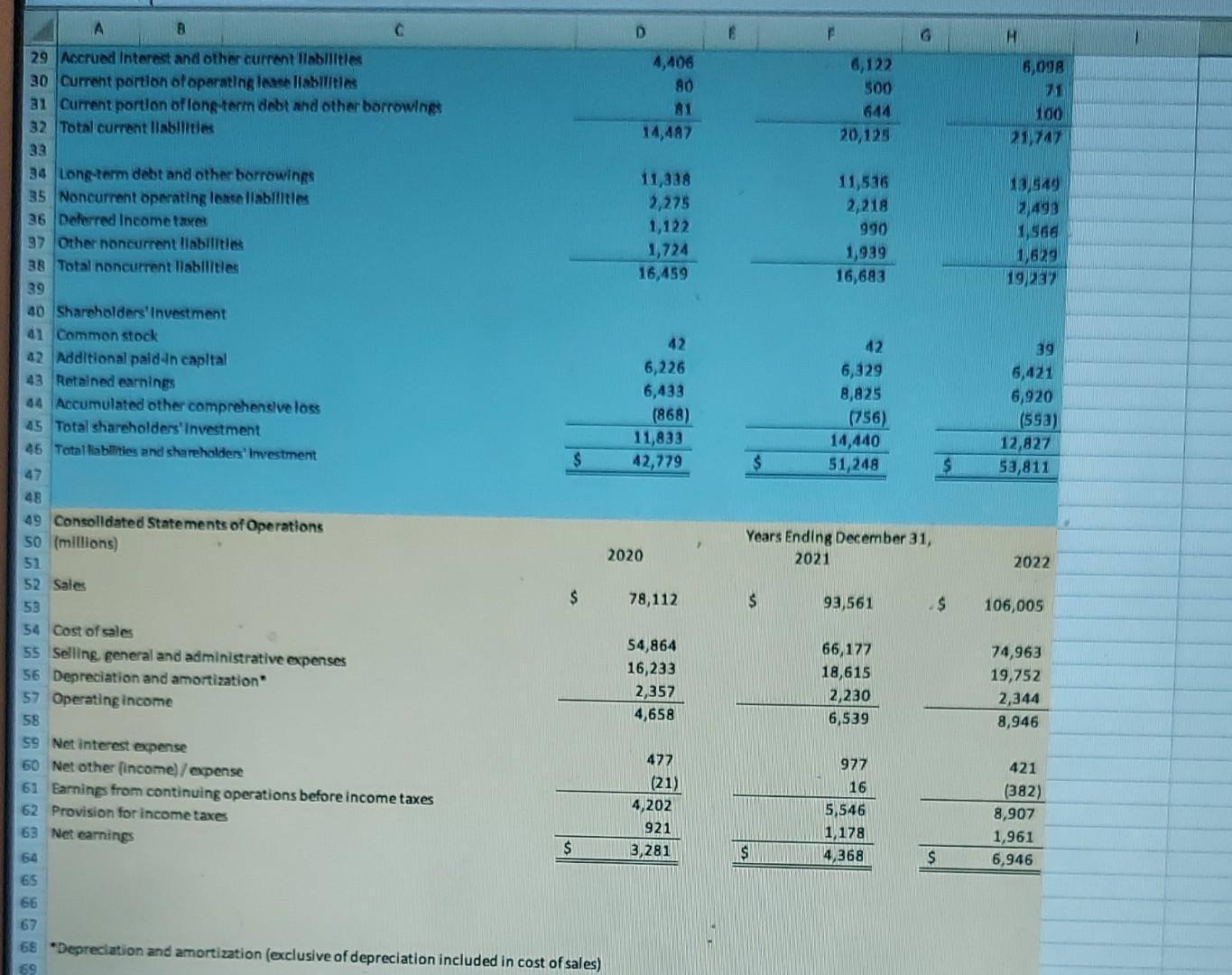

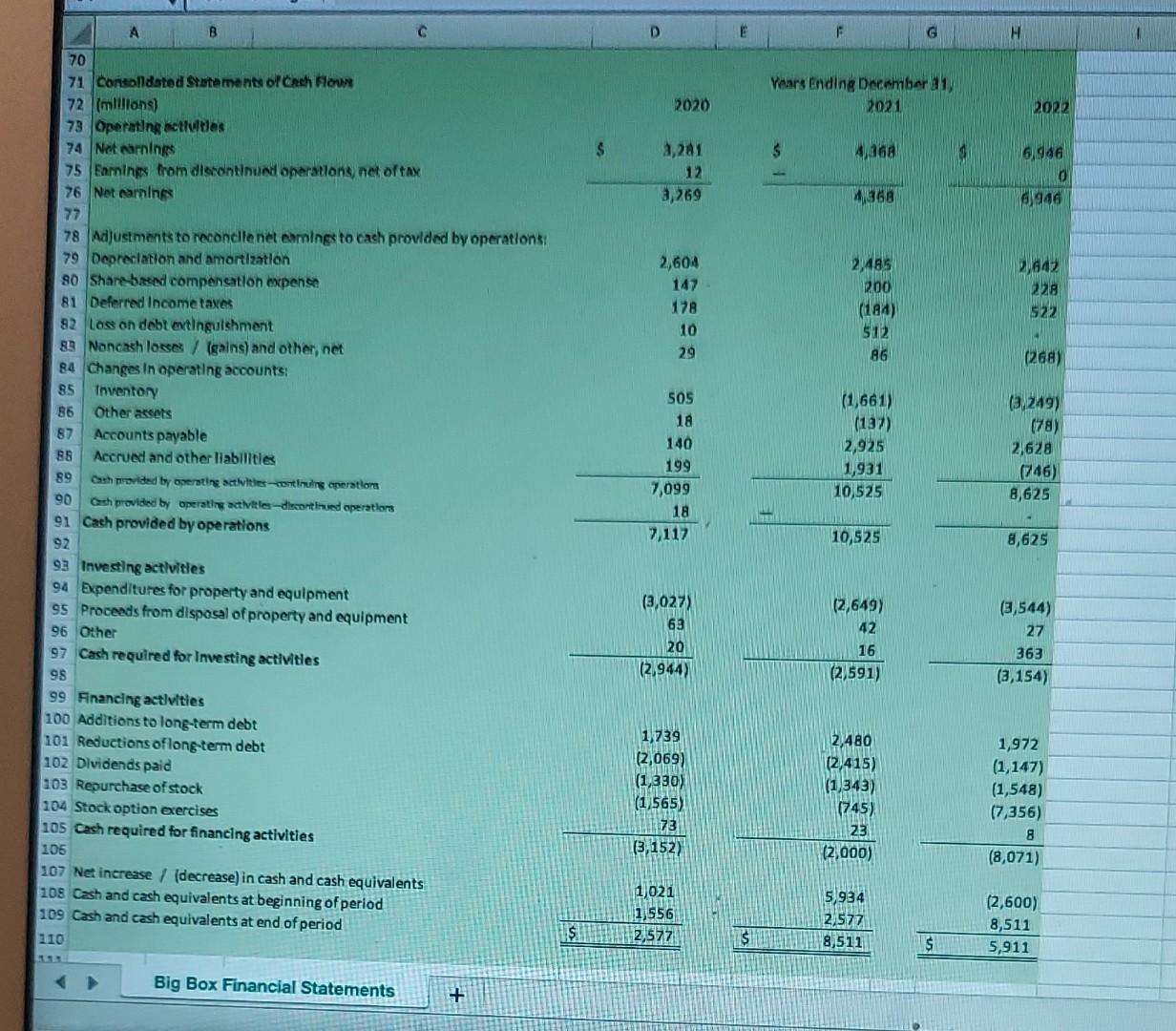

Using the financial statements for the hypothetical company - Big Box Retailer-record the transactions for the year to the financial statement. The financial statements may be found in Content under materials for assignments. You may use pencil and paper or Excel. When you are done, compute the following ratios for the current and prior year and type in the chart below. Current Ratio, 2 pts Debt to Asset Ratio, 2pts Gross Margin, 2pts 2023 Your discussion (6 pts) 2022 Explain below in about three to six sentences how the liquidity, solvency, and profitability of BBR changed (improve, decline, or stay about the same) from 2022 to 2023. Big Box Retaller Consolidated Statements of Financial Position (millions of dollars) Assets Cash and cash equivalents Inventory Other current assets 1 Total current assets 2 3 4 Property and equipment S Land 6 Buildings and improvements 7 Fixtures and equipment 8 Accumulated depreciation and 9 amortization on fixtures and equipment financed through leases 20 Operating lease assets 21 Amortization on operating leases 22 Other noncurrent assets 23 Total assets 24 25 26 27 Liabilities and shareholders' Investment 28 Accounts payable 29 Accrued Interest and other current liabilities 30 Current portion of operating lease llabilities 31 Current portion of long-term debt and other borrowings 32 Total current liabilities 33 34 Long-term debt and other borrowings 35 Noncurrent operating lease liabilities 36 Deferred income taxes 37 Other noncurrent liabilities 38 Total noncurrent liabilities 39 40 Shareholders' investment Big Box Financial Statements + $ $ Dec 31, 2020 $ 2,577 8,992 1,333 12,902 6,036 29,603 9,308 (19,664) 7,236 (4,000) 1,358 42,779 9,920 4,406 80 81 14,487 11,338 2,275 1,122 1,724 16,459 $ $ $ Dec 31, 2021 8,511 10,653 1,592 20,756 6,141 30,757 9,459 (20,278) 7,227 (4,200) 1,386 51,248 12,859 6,122 500 644 20,125 11,536 2,218 990 1,939 16,683 $ $ Dec 31, 2022 $ 5,911 13,902 1,760 21,573 6,164 32,385 10,169 (21,137) 7,556 (4,400) 1,501 53,811 15,478 6,098 71 100 21,747 13,549 2,493 1,566 1,629 19,237 A B 29 Accrued Interest and other current llabilities 30 Current portion of operating lessellabilities 31 Current portion of long-term debt and other borrowings 32 Total current liabilities 33 34 Long-term debt and other borrowings 35 Noncurrent operating lease liabilities 36 Deferred Income taxes 37 Other noncurrent liabilities 38 Total noncurrent liabilities 39 40 Shareholders' Investment 41 Common stock 42 Additional paid-in capital 43 Retained earnings 44 Accumulated other comprehensive loss 45 Total shareholders' Investment 45 Total liabilities and shareholders' Investment 47 48 49 Consolidated Statements of Operations 50 (millions) 51 52 Sales 53 54 Cost of sales 55 Selling, general and administrative expenses 56 Depreciation and amortization" 57 Operating income 58 59 Net interest expense 60 Net other (income)/expense 61 Earnings from continuing operations before income taxes 62 Provision for income taxes 63 Net earnings $ $ $ 64 65 66 67 68 Depreciation and amortization (exclusive of depreciation included in cost of sales) 69 D 4,406 80 81 14,487 11,338 2,275 1,122 1,724 16,459 42 6,226 6,433 2020 (868) 11,833 42,779 78,112 54,864 16,233 2,357 4,658 477 (21) 4,202 921 3,281 E $ $ $ 6,122 500 644 20,125 11,536 2,218 990 1,939 16,683 42 6,329 8,825 (756) Years Ending December 31, 2021 14,440 51,248 93,561 66,177 18,615 2,230 6,539 977 16 5,546 1,178 4,368 $ $ 6,098 71 100 21,747 13,549 2,493 1,566 1,629 19,237 39 6,421 6,920 (553) 12,827 $ 53,811 2022 106,005 74,963 19,752 2,344 **** 8,946 421 (382) 8,907 1,961 6,946 A B 70 71 Consolidated Statements of Cash Flows 72 (millions) 73 Operating activities 74 Net earnings 75 Earnings from discontinued operations, net of tax 76 Net earnings 77 78 Adjustments to reconcile net earnings to cash provided by operations: 79 Depreciation and amortization 80 Share-based compensation expense 81 Deferred Income taxes 82 Loss on debt extinguishment 83 Noncash losses/ (gains) and other, net 84 Changes In operating accounts: 85 Inventory 86 Other assets 87 Accounts payable 88 Accrued and other liabilities 89 90 91 Cash provided by operations 92 Cash provided by operating activities-continuing operations Cash provided by operating activities-discontinued operations 93 Investing activities 94 Expenditures for property and equipment 95 Proceeds from disposal of property and equipment 96 Other 97 Cash required for Investing activities 98 99 Financing activities 100 Additions to long-term debt 101 Reductions of long-term debt 102 Dividends paid 103 Repurchase of stock 104 Stock option exercises 105 Cash required for financing activities 105 C 107 Net increase / (decrease) in cash and cash equivalents 108 Cash and cash equivalents at beginning of period 109 Cash and cash equivalents at end of period 110 Big Box Financial Statements + $ $ D 2020 3,281 12 3,269 2,604 147 178 10 29 505 18 140 199 7,099 18 7,117 (3,027) 63 20 (2,944) 1,739 (2,069) (1,330) (1,565) 73 (3,152) 1,021 1,556 2,577 E $ F Years Ending December 31, 2021 $ 4,368 4,368 2,485 200 (184) 512 86 (1,661) (137) 2,925 1,931 10,525 10,525 (2,649) 42 16 (2,591) 2,480 (2,415) (1,343) (745) 23 (2,000) 5.934 2,577 8,511 $ H 2022 6,946 0 6,946 2,642 228 522 (268) (3,249) (78) 2,628 (746) 8,625 8,625 (3,544) 27 363 (3,154) 1,972 (1,147) (1,548) (7,356) 8 (8,071) (2,600) 8,511 5,911

Step by Step Solution

★★★★★

3.49 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

To compute the ratios well use the data provided in the consolidated financial statements of Big Box Retailer for the years 2022 and 2023 Current Rati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started