Answered step by step

Verified Expert Solution

Question

1 Approved Answer

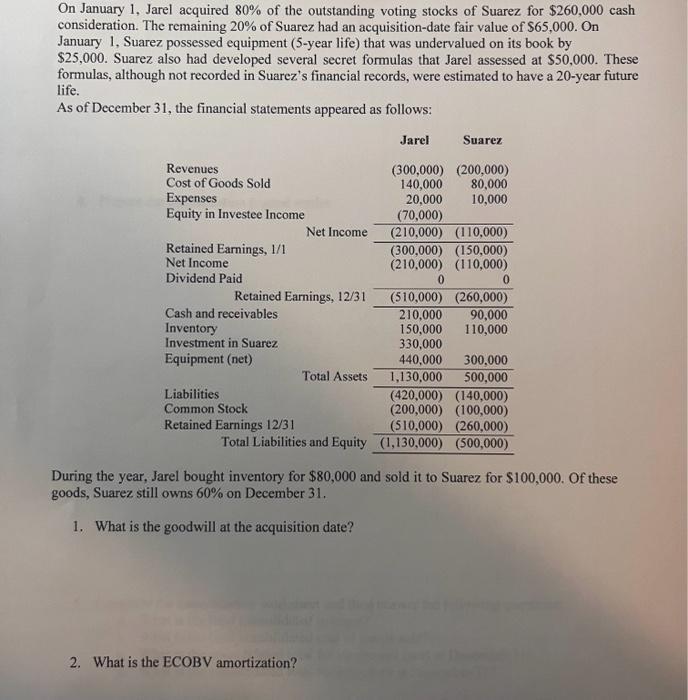

On January 1, Jarel acquired 80% of the outstanding voting stocks of Suarez for $260,000 cash consideration. The remaining 20% of Suarez had an

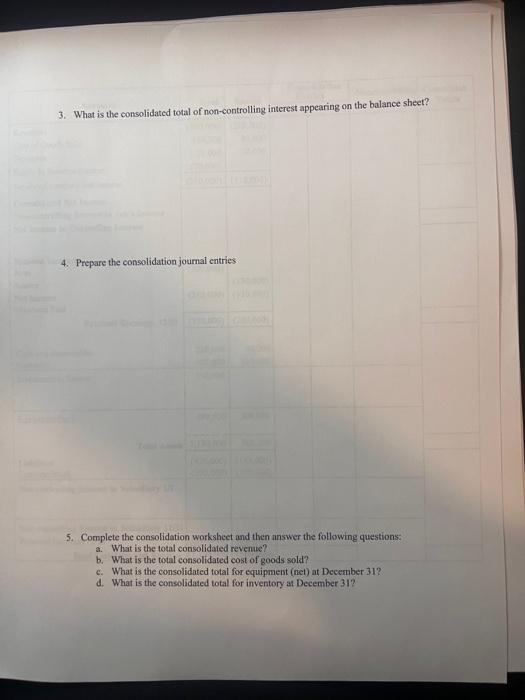

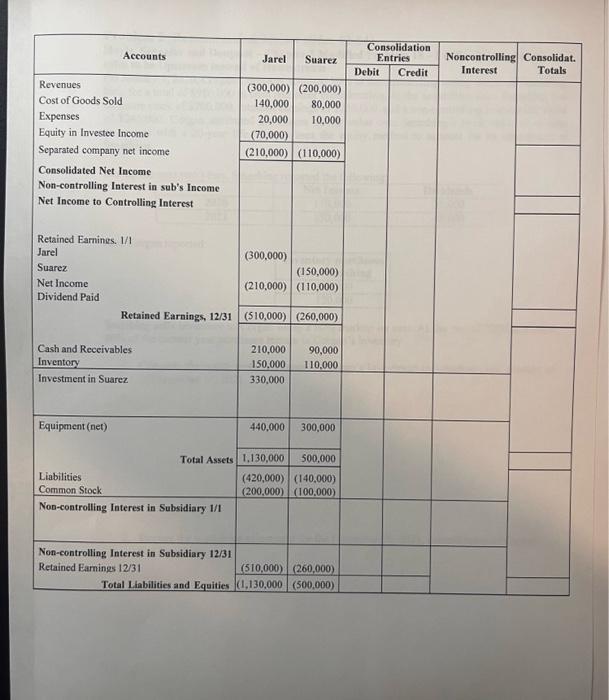

On January 1, Jarel acquired 80% of the outstanding voting stocks of Suarez for $260,000 cash consideration. The remaining 20% of Suarez had an acquisition-date fair value of $65,000. On January 1, Suarez possessed equipment (5-year life) that was undervalued on its book by $25,000. Suarez also had developed several secret formulas that Jarel assessed at $50,000. These formulas, although not recorded in Suarez's financial records, were estimated to have a 20-year future life. As of December 31, the financial statements appeared as follows: Revenues Cost of Goods Sold Expenses Jarel Suarez (300,000) (200,000) 140,000 80,000 20,000 10,000 Equity in Investee Income (70,000) Net Income (210,000) (110,000) Retained Earnings, 1/1 (300,000) (150,000) Net Income (210,000) (110,000) Dividend Paid 0 0 Retained Earnings, 12/31 (510,000) (260,000) Cash and receivables 210,000 90,000 Inventory 150,000 110,000 Investment in Suarez 330,000 Equipment (net) 440,000 300,000 Total Assets 1,130,000 500,000 Liabilities (420,000) (140,000) Common Stock (200,000) (100,000) Retained Earnings 12/31 (510,000) (260,000) Total Liabilities and Equity (1,130,000) (500,000) During the year, Jarel bought inventory for $80,000 and sold it to Suarez for $100,000. Of these goods, Suarez still owns 60% on December 31. 1. What is the goodwill at the acquisition date? 2. What is the ECOBV amortization? 3. What is the consolidated total of non-controlling interest appearing on the balance sheet? 4. Prepare the consolidation journal entries. 5. Complete the consolidation worksheet and then answer the following questions: a. What is the total consolidated revenue? b. What is the total consolidated cost of goods sold? c. What is the consolidated total for equipment (net) at December 31? d. What is the consolidated total for inventory at December 317 Revenues Cost of Goods Sold Accounts Jarel Suarez (300,000) (200,000) Consolidation Entries Debit Credit 140,000 80,000 Expenses Equity in Investee Income Separated company net income Consolidated Net Income Non-controlling Interest in sub's Income Net Income to Controlling Interest 20,000 10,000 (70,000) (210,000) (110,000) Retained Earnings. 1/1 Jarel Suarez Net Income Dividend Paid (300,000) (150,000) (210,000) (110,000) Retained Earnings, 12/31 (510,000) (260,000) Cash and Receivables Inventory Investment in Suarez 210,000 90,000 150,000 110,000 330,000 Equipment (net) 440,000 300,000 Total Assets 1,130,000 500,000 Liabilities (420,000) (140,000) Common Stock (200,000) (100,000) Non-controlling Interest in Subsidiary 1/1 Non-controlling Interest in Subsidiary 12/31 Retained Earnings 12/31 (510,000) (260,000) Total Liabilities and Equities (1,130,000 (500,000) Noncontrolling Consolidat. Interest Totals

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 Goodwill at acquisition date Consideration paid by Jarel 260000 Fair value of NCI 65000 Total fair ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started