Question

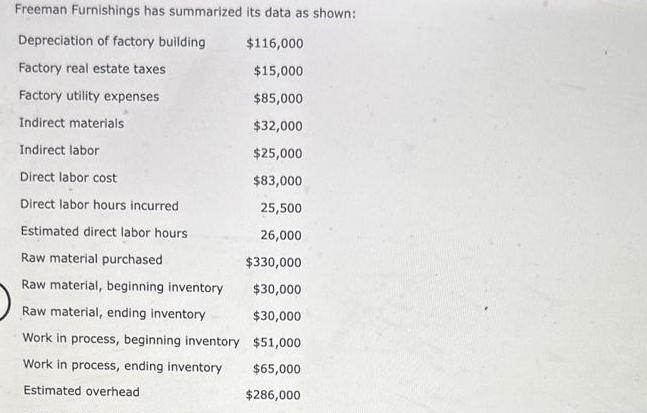

Compute the cost of goods manufactured, assuming that the overhead is allocated based on direct labor hours. Freeman Furnishings has summarized its data as

Compute the cost of goods manufactured, assuming that the overhead is allocated based on direct labor hours. Freeman Furnishings has summarized its data as shown: Depreciation of factory building $116,000 Factory real estate taxes $15,000 Factory utility expenses $85,000 Indirect materials $32,000 Indirect labor $25,000 Direct labor cost $83,000 Direct labor hours incurred 25,500 26,000 $330,000 $30,000 $30,000 $51,000 $65,000 $286,000 Estimated direct labor hours Raw material purchased Raw material, beginning inventory Raw material, ending inventory Work in process, beginning inventory Work in process, ending inventory Estimated overhead

Step by Step Solution

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

The cost of goods manufactured can be calculated using the following formula Cost of goods manufactu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Karen W. Braun, Wendy M. Tietz

4th edition

978-0133428469, 013342846X, 133428370, 978-0133428377

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App