Answered step by step

Verified Expert Solution

Question

1 Approved Answer

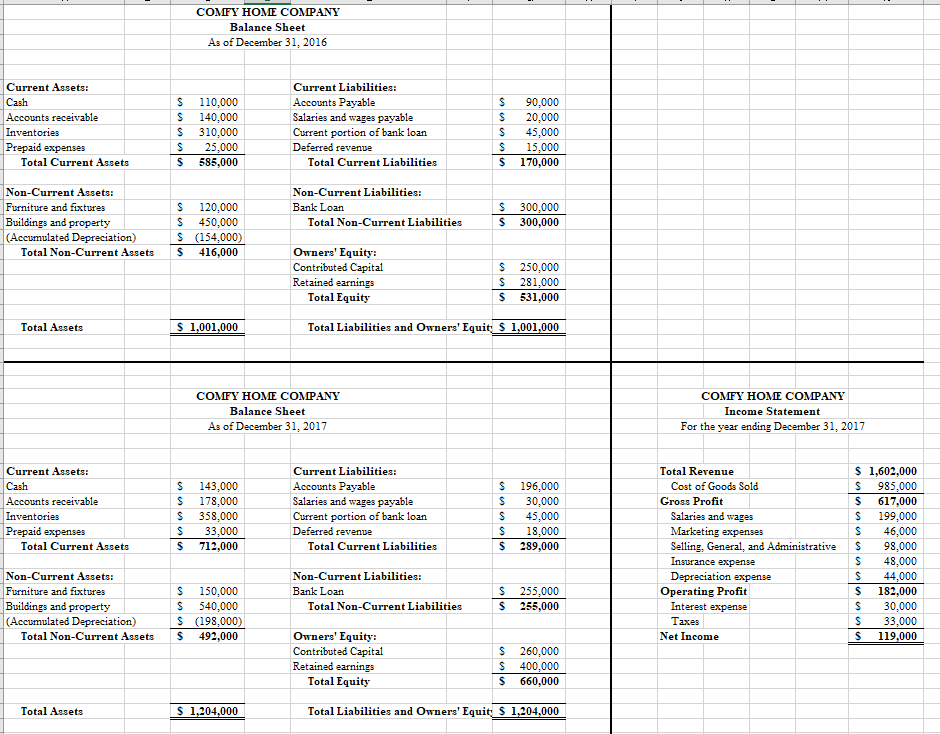

Using the financial statements provided, please prepare a Statement of Cash Flows for Comfy Home as of December 31, 2017, to answer questions 1-3. Note

Using the financial statements provided, please prepare a Statement of Cash Flows for Comfy Home as of December 31, 2017, to answer questions 1-3. Note that in 2017, Comfy Home paid for all purchases of long-term fixed assets with cash. The company did not take out any new loans, but paid off part of an existing loan with cash. What is Comfy Homes net cash from financing activities?

COMFY HOME COMPANY Balance Sheet As of December 31, 2016 Current Assets: Cash Accounts receivable Inventories Prepaid expenses Total Current Assets $ $ $ $ $ 110,000 140,000 310,000 25,000 585,000 Current Liabilities: Accounts Payable Salaries and wages payable Current portion of bank loan Deferred revenue Total Current Liabilities lo S 90,000 S 20,000 45,000 15,000 $ 170,000 Non-Current Assets: Furniture and fixtures Buildings and property (Accumulated Depreciation) Total Non-Current Assets Non-Current Liabilities: Bank Loan Total Non-Current Liabilities S $ $ 120,000 $ 450,000 $ (154,000) $ 416,000 300,000 300,000 Owners' Equity: Contributed Capital Retained earnings Total Equity S 250,000 S 281,000 $ 531,000 Total Assets $ 1,001,000 Total Liabilities and Owners' Equit $ 1,001,000 COMFY HOME COMPANY Balance Sheet As of December 31, 2017 COMFY HOME COMPANY Income Statement For the year ending December 31, 2017 Current Assets: Cash Accounts receivable Inventories Prepaid expenses Total Current Assets $ $ S $ $ 143,000 178,000 358,000 33,000 712,000 Current Liabilities: Accounts Payable Salaries and wages payable Current portion of bank loan Deferred revenue Total Current Liabilities $ 196,000 S 30,000 $ 45,000 S 18,000 $ 289,000 Total Revenue Cost of Goods Sold Gross Profit Salaries and wages Marketing expenses Selling, General, and Administrative Insurance expense Depreciation expense Operating Profit Interest expense Taxes Net Income $ 1,602,000 S 985,000 $ 617,000 $ 199,000 S 46,000 S 98,000 S 48,000 S 44,000 S 182,000 S 30,000 S 33,000 $ 119,000 Non-Current Assets: Furniture and fixtures Buildings and property (Accumulated Depreciation) Total Non-Current Assets Non-Current Liabilities: Bank Loan Total Non-Current Liabilities $ 150,000 S 540,000 $ (198,000) $ 492,000 S 255,000 $ 255,000 Owners' Equity: Contributed Capital Retained earnings Total Equity $ 260,000 $ 400,000 $ 660,000 Total Assets $ 1,204.000 Total Liabilities and Owners' Equit $ 1,204,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started