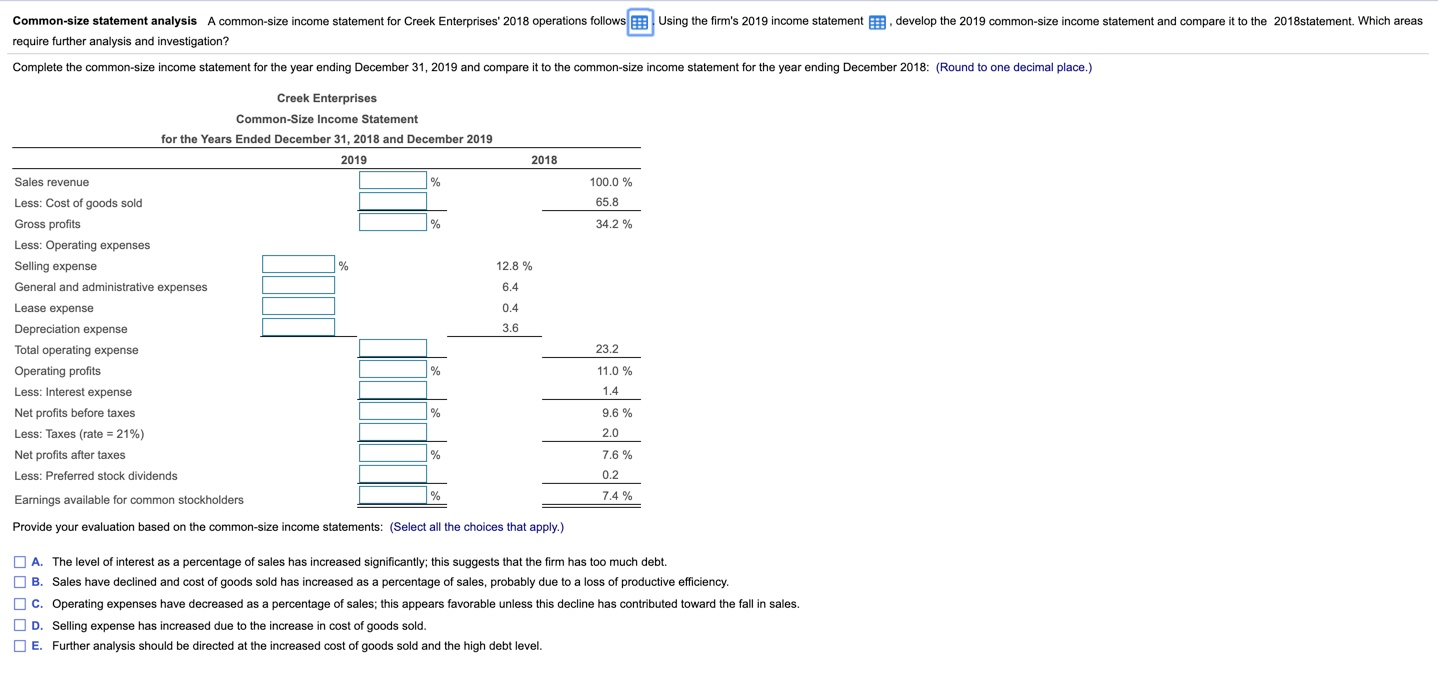

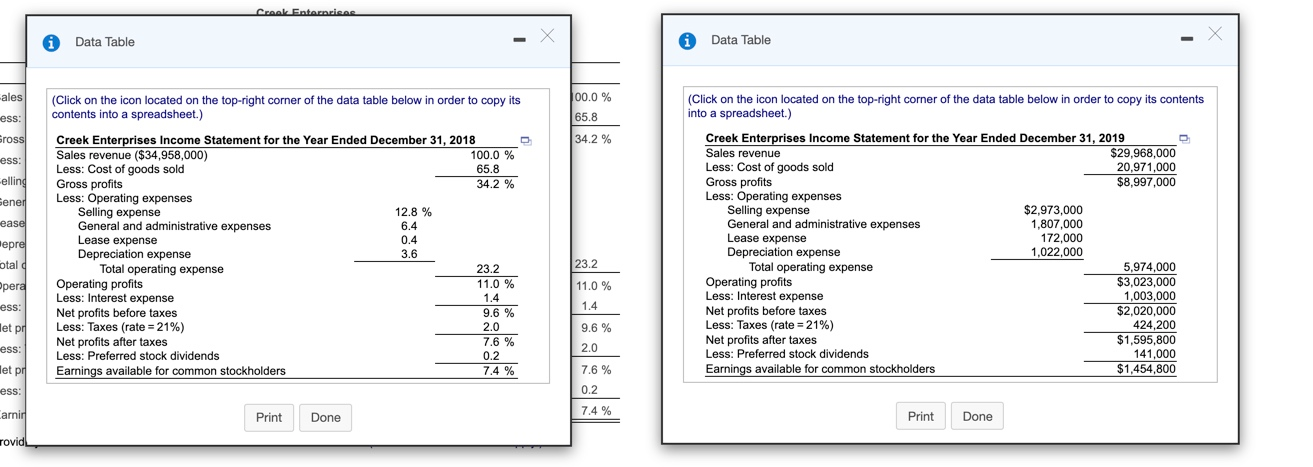

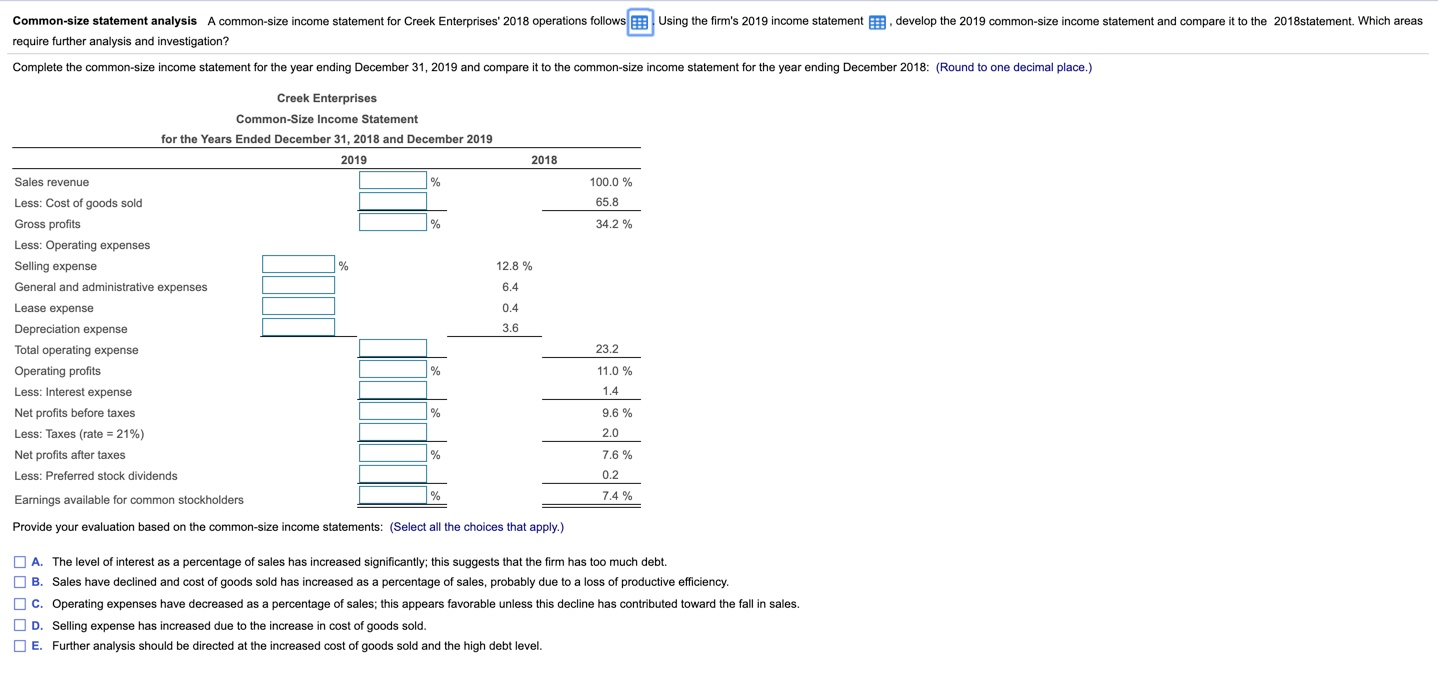

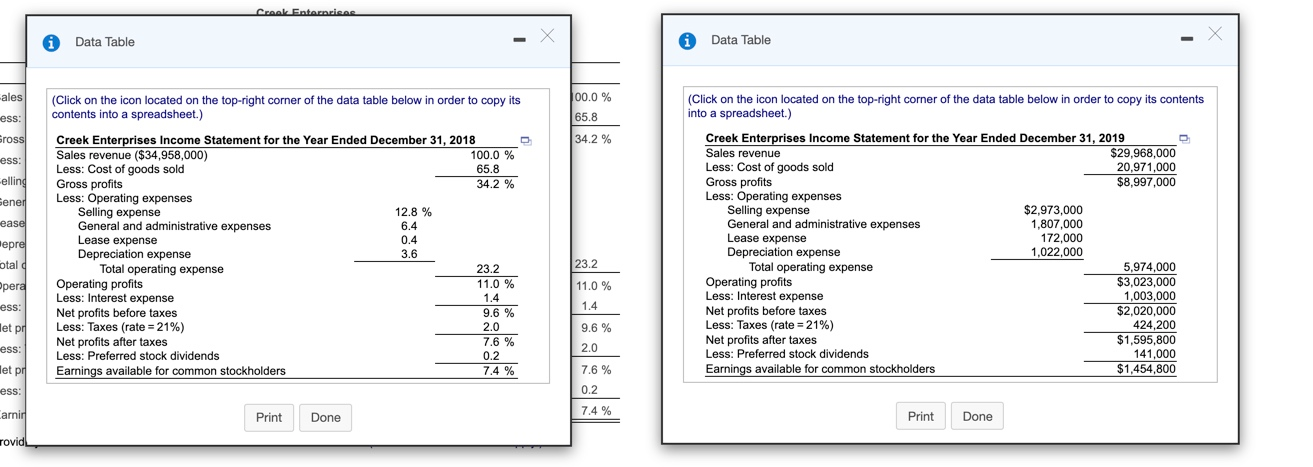

Using the firm's 2019 income statement develop the 2019 common-size income statement and compare it to the 2018statement. Which areas Common-size statement analysis A common-size income statement for Creek Enterprises' 2018 operations follows require further analysis and investigation? Complete the common-size income statement for the year ending December 31, 2019 and compare it to the common-size income statement for the year ending December 2018: (Round to one decimal place.) 2018 Creek Enterprises Common-Size Income Statement for the Years Ended December 31, 2018 and December 2019 2019 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense General and administrative expenses 100.0 % 65.8 34.2% 12.8 % 6.4 0.4 3.6 23.2 Lease expense Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 21%) Net profits after taxes Less: Preferred stock dividends 11.0 % 1.4 9.6 % 2.0 7.6 % 0.2 7.4% Earnings available for common stockholders Provide your evaluation based on the common-size income statements: (Select all the choices that apply.) A. The level of interest as a percentage of sales has increased significantly; this suggests that the firm has too much debt. B. Sales have declined and cost of goods sold has increased as a percentage of sales, probably due to a loss of productive efficiency. C. Operating expenses have decreased as a percentage of sales; this appears favorable unless this decline has contributed toward the fall in sales. D. Selling expense has increased due to the increase in cost of goods sold. E. Further analysis should be directed at the increased cost of goods sold and the high debt level. Crol tersee Data Table i Data Table ales 00.0 % (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) ess: 65.8 Gross 34.2 % ess: -elling Sener ease Hepre otal Opera ess: let pr ess: let pr Creek Enterprises Income Statement for the Year Ended December 31, 2018 Sales revenue ($34,958,000) 100.0 % Less: Cost of goods sold 65.8 Gross profits 34.2 % Less: Operating expenses Selling expense 12.8 % General and administrative expenses 6.4 Lease expense 0.4 Depreciation expense 3.6 Total operating expense 23.2 Operating profits 11.0 % Less: Interest expense Net profits before taxes 9.6 % Less: Taxes (rate=21%) 2.0 Net profits after taxes 7.6 % Less: Preferred stock dividends Earnings available for common stockholders 7.4 % (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Creek Enterprises Income Statement for the Year Ended December 31, 2019 Sales revenue $29,968,000 Less: Cost of goods sold 20,971,000 Gross profits $8,997,000 Less: Operating expenses Selling expense $2,973,000 General and administrative expenses 1,807,000 Lease expense 172,000 Depreciation expense 1,022,000 Total operating expense 5,974,000 Operating profits $3,023,000 Less: Interest expense 1,003,000 Net profits before taxes $2,020,000 Less: Taxes (rate=21%) 424,200 Net profits after taxes $1,595,800 Less: Preferred stock dividends 141,000 Earnings available for common stockholders $1,454,800 23.2 11.0 % 1.4 9.6 % 2.0 0.2 7.6 % 0.2 ess: Carnir 7.4 % Print Done Print Done rovid