Answered step by step

Verified Expert Solution

Question

1 Approved Answer

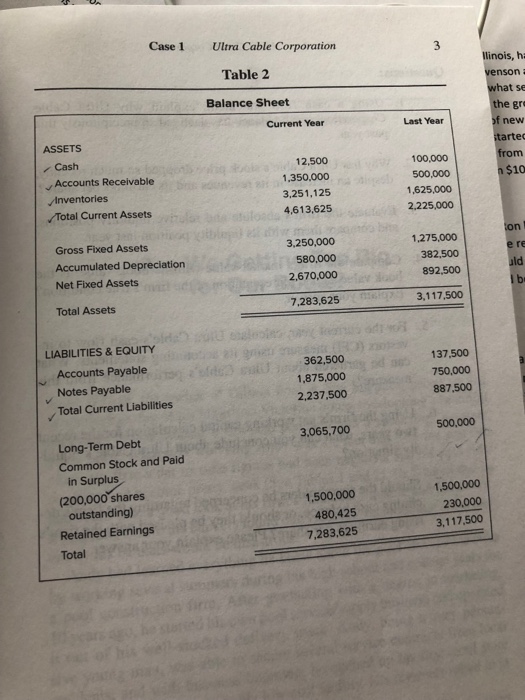

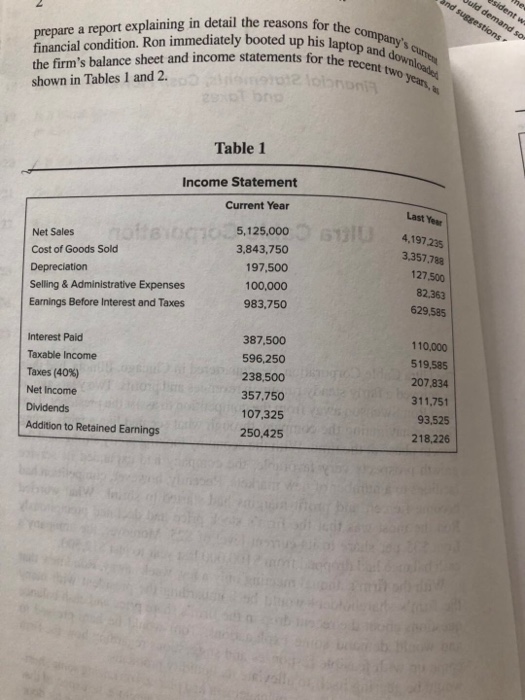

Using the firms net working capital calculation for the recent two years, what can you conclude about ultra cabls liquidity situation ( show your calculation

Using the firms net working capital calculation for the recent two years, what can you conclude about ultra cabls liquidity situation ( show your calculation for NWC). Should the shareholder be concerned regarding the firma declining cash balance or should they be pleased with the firms rising earning per share? Please explain your answer

Using the firms net working capital calculation for the recent two years, what can you conclude about ultra cabls liquidity situation ( show your calculation for NWC). Should the shareholder be concerned regarding the firma declining cash balance or should they be pleased with the firms rising earning per share? Please explain your answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started