Midas Manufacturing produces a variety of carbonated drinks for the domestic market. Non-carbonated drinks and their link to healthier living has been identified by the

Midas Manufacturing produces a variety of carbonated drinks for the domestic market. Non-carbonated drinks and their link to healthier living has been identified by the management of Midas as one of the possible reasons for a loss of sales in recent years.

The management of the company is looking to introduce a fruit juice line to appeal to health-conscious consumers. It is believed that revenue from sales of carbonated drinks will decrease by 10% in the next year, but management wants to increase profits during the remainder of the year. Management has asked the accounting team to include the budget value of the new opportunity to manufacture and sell the fruit juices in the next budget.

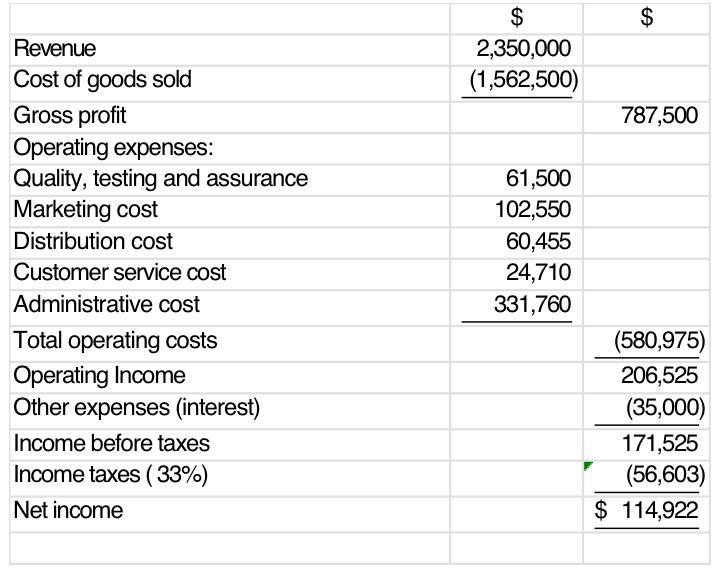

The most recent profit and loss statement, before incorporating the new product line, is given below:

Additional information for existing production:

A major distributor filed for bankruptcy which will cause sales and related variable costs of goods sold to decrease by 20%. The fixed manufacturing overhead will not be affected by this reduction in sales.

Management plans to increase the price of the existing product by 5% in the coming year.

The direct material is 30% of the sales revenue. There will be a 6% reduction in material cost due to removal of trade barriers.

Direct labour which is 30% of cost of goods sold will decrease by 10%.

The manufacturing overhead is 40% variable and 60% fixed. A new automated system will result in a 12% decrease in the variable manufacturing overheads due two efficiency improvements

Quality, testing and assurance is a key cost and will increase by 20% due to the additional production.

Marketing cost and interest expense will also increase by 12% and 6% respectively due to the new product line.

The operating expense will be reduced as follows:

Customer service cost by 2.5%

Distribution cost by 3.5%

Administrative cost by 4%.

The projected information for the new product line is as follows:

Budgeted sales units (cases) | 3,000 |

Budgeted selling price per unit | $100 |

Average cost of fruits per case | $35 |

Labour cost per case of fruits | $22 |

Fixed manufacturing costs per batch | $3,400 |

Number of cases per batch | 200 |

Miscellaneous shipping, brokerage and transportation costs | 15% |

REQUIRED:

Using Microsoft Excel and the format given in the question, prepare the budgeted profit and loss statement for Midas Manufacturing, considering the costing adjustments for the existing products and estimates for the new product line.

Revenue Cost of goods sold Gross profit Operating expenses: Quality, testing and assurance Marketing cost Distribution cost Customer service cost Administrative cost Total operating costs Operating Income Other expenses (interest) Income before taxes Income taxes (33%) Net income $ 2,350,000 (1,562,500) 61,500 102,550 60,455 24,710 331,760 $ 787,500 (580,975) 206,525 (35,000) 171,525 (56,603) $ 114,922

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started