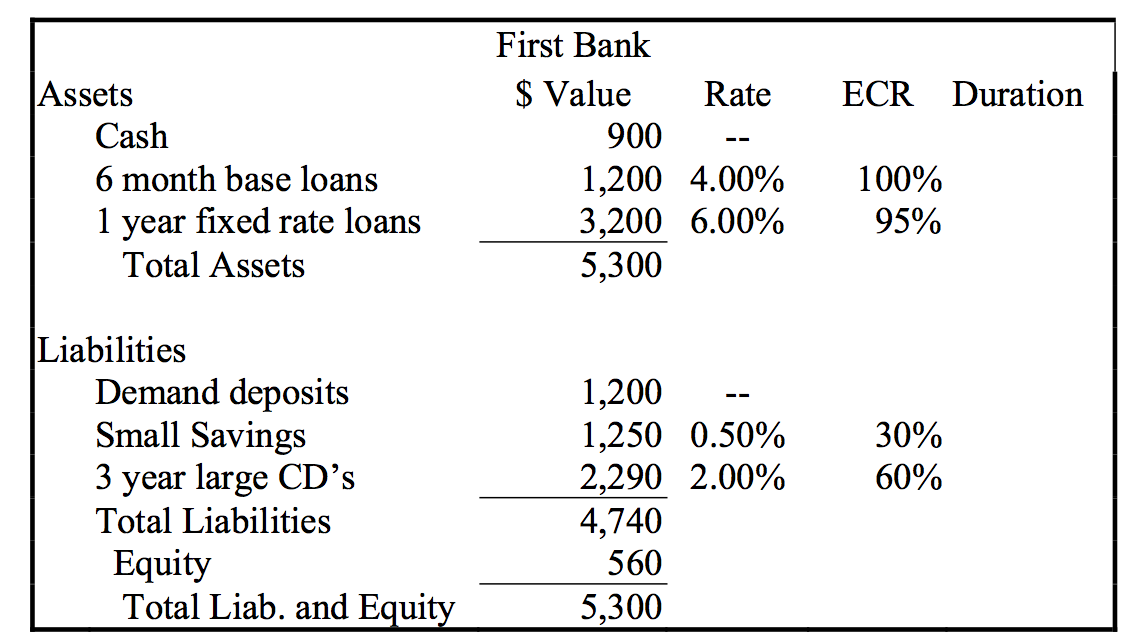

Question: Using the following data for First Bank: a) Calculate the banks static funding GAP over the various time buckets (0-6 months, 6 months - 1

Using the following data for First Bank:

a) Calculate the banks static funding GAP over the various time buckets (0-6

months, 6 months - 1 year, and over 1 year). Consider both the periodic GAP and

the cumulative GAP.

b) Calculate the banks income statement GAP over the various time buckets.

c. Evaluate this banks interest rate risk. Be sure you explain what information is

contained in the static periodic and cumulative GAP and the income statement GAP measures.

First Bank Assets S Value Rate ECR Duration Cash 6 month base loans 1 year fixed rate loans 900 1,200 4.00% 100% 3,200 6.00% 5,300 95% Total Assets Liabilities Demand deposits Small Savings 3 year large CD's Total Liabilities 1,200 1,250 0.50% 2,290 2.00% 4,740 30% 60% 560 5,300 Equity Total Liab. and Equit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts