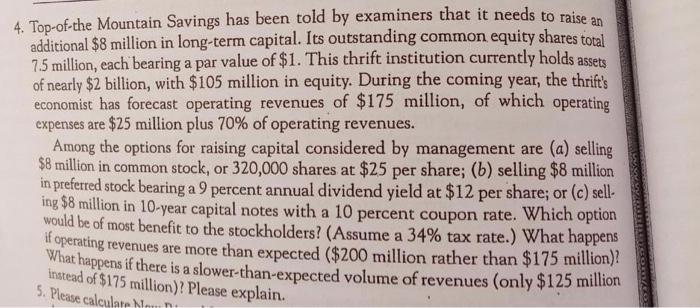

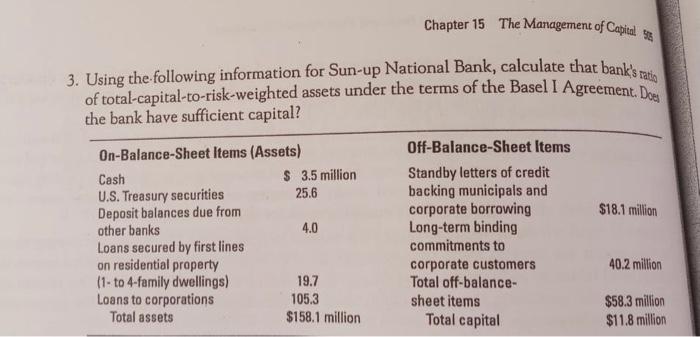

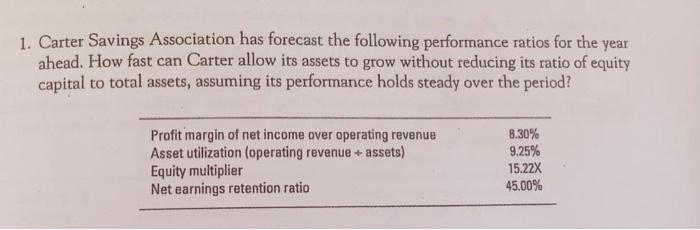

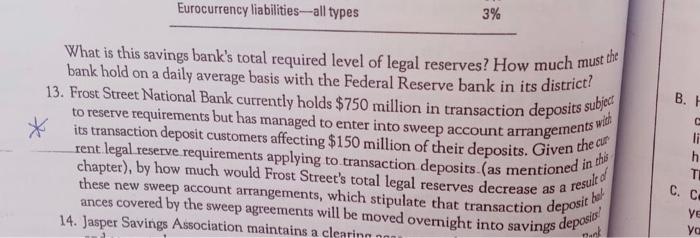

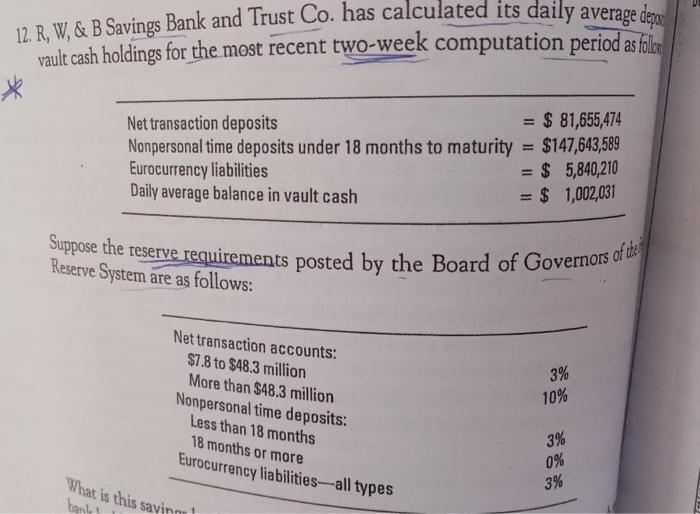

4. Top-of-the Mountain Savings has been told by examiners that it needs to raise an additional $8 million in long-term capital. Its outstanding common equity shares total 7.5 million, each bearing a par value of $1. This thrift institution currently holds assets of nearly $2 billion, with $ 105 million in equity. During the coming year, the thrift's economist has forecast operating revenues of $175 million, of which operating expenses are $25 million plus 70% of operating revenues. Among the options for raising capital considered by management are (a) selling $8 million in common stock, or 320,000 shares at $25 per share; (b) selling $8 million in preferred stock bearing a 9 percent annual dividend yield at $12 per share; or (c) sell- ing $8 million in 10-year capital notes with a 10 percent coupon rate. Which option would be of most benefit to the stockholders? (Assume a 34% tax rate.) What happens if operating revenues are more than expected ($200 million rather than $175 million)? What happens if there is a slower-than-expected volume of revenues (only $125 million instead of $175 million)? Please explain. 5. Please calculate Now Chapter 15 The Management of Capital 143 3. Using the following information for Sun-up National Bank, calculate that bank's ratio of total-capital-to-risk-weighted assets under the terms of the Basel I Agreement. Dog the bank have sufficient capital? $18.1 million On-Balance-Sheet Items (Assets) Cash $ 3.5 million U.S. Treasury securities 25.6 Deposit balances due from other banks 4.0 Loans secured by first lines on residential property (1- to 4-family dwellings) 19.7 Loans to corporations Total assets $158.1 million Off-Balance-Sheet Items Standby letters of credit backing municipals and corporate borrowing Long-term binding commitments to corporate customers Total off-balance- sheet items Total capital 40.2 million 105.3 $58.3 million $11.8 million 1. Carter Savings Association has forecast the following performance ratios for the year ahead. How fast can Carter allow its assets to grow without reducing its ratio of equity capital to total assets, assuming its performance holds steady over the period? Profit margin of net income over operating revenue Asset utilization (operating revenue + assets) Equity multiplier Net earnings retention ratio 8.30% 9.25% 15.22X 45.00% Eurocurrency liabilities--all types 3% B. H What is this savings bank's total required level of legal reserves? How much must the bank hold on a daily average basis with the Federal Reserve bank in its district? 13. Frost Street National Bank currently holds $750 million in transaction deposits subject its transaction deposit customers affecting $150 million of their deposits. Given the cur rent legal reserve requirements applying to transaction deposits (as mentioned in the chapter), by how much would Frost Street's total legal reserves decrease as a these new sweep account arrangements, which stipulate that transaction deposit ances covered by the sweep agreements will be moved overnight into savings depasi 14. Jasper Savings Association maintains a clearinn UEF resule d' hel C. C. ye ya mark 12. R, W, & B Savings Bank and Trust Co. has calculated its daily average depos vault cash holdings for the most recent two-week computation period as folce Net transaction deposits = $ 81,655,474 Nonpersonal time deposits under 18 months to maturity = $147,643,589 Eurocurrency liabilities = $ 5,840,210 Daily average balance in vault cash = $ 1,002,031 Suppose the reserve requirements posted by the Board of Governors of the Reserve System are as follows: Net transaction accounts: $7.8 to $48.3 million More than $48.3 million Nonpersonal time deposits: Less than 18 months 18 months or more Eurocurrency liabilities--all types 3% 10% 3% 0% 3% What is this savinnu bank