Answered step by step

Verified Expert Solution

Question

1 Approved Answer

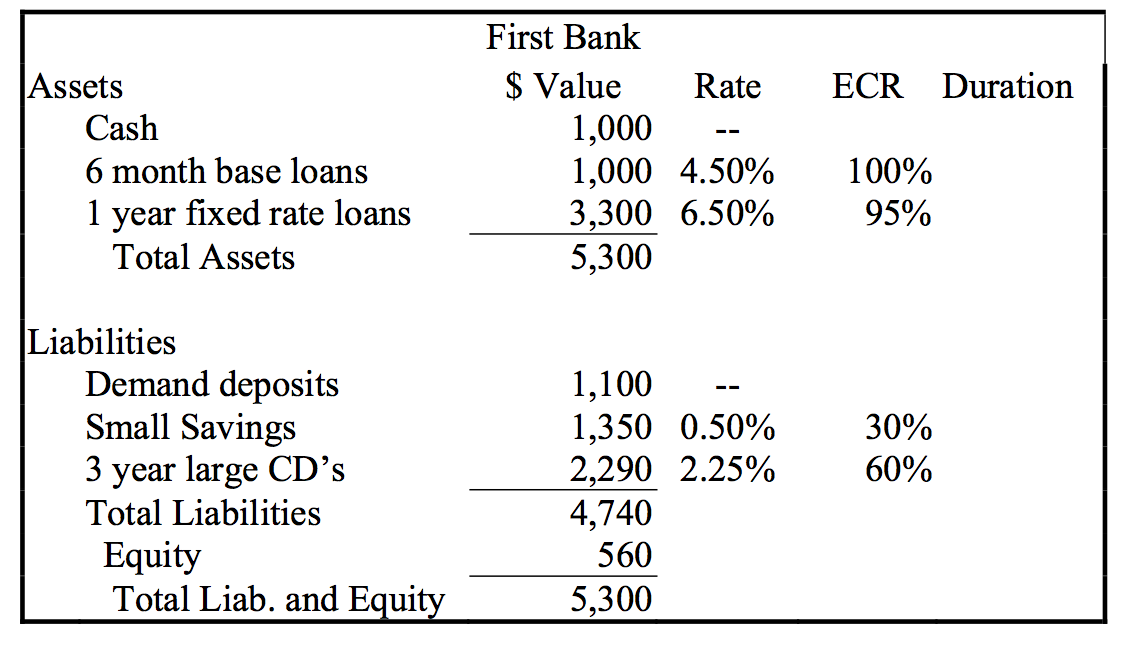

Using the following data for First Bank: a)Calculate the banks DGAP. b)Specifically what does this DGAP mean to the bank? c)If rates increase by 1%,

Using the following data for First Bank:

a)Calculate the banks DGAP.

b)Specifically what does this DGAP mean to the bank?

c)If rates increase by 1%, what will be the approximate change in the banks market value of equity position? Explain.

d)If interest rates increase by 2 or 3 percent over the next six months, how might this effect the banks DGAP position? How might your answer to part c change? In particular, which assets or liabilities, if any, would be affected and how would they be affected?

First Bank Assets $ Value Rate ECR Duration Cash 6 month base loans 1 year fixed rate loans 1,000 1,000 4.50% 100% 3,300 6.50% 5,300 95% Total Assets Liabilities Demand deposits Small Savings 3 year large CD's Total Liabilities 1,100-- 1,350 0.50% 2,290 2.25% 4,740 30% 60% 560 5,300 Equity uitvStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started